Banking foreign exchange departments are always in a state of flux, when it comes to forecasting the next month, let alone the next quarter. When it comes to the next year, then a more determined effort usually produces a consensus view of how they expect the global economy to evolve over the next calendar year. This “narrative” becomes the cornerstone for monthly updates of major pairing exchange rates for as much as two years forward.

Are these forecasts an accurate guidepost for the future? Generally “yes”, and more than likely “no”. The basic narrative is always filled with caveats, dealing with “unknown unknowns” and what are sometimes called Geopolitical Wildcards. There are truly far too many moving parts that can render any prediction to be off by plus or minus a significant number, often in double digits. Accountability for variances is rarely discussed, since everyone in the industry knows that it is near impossible to forecast with any degree of accuracy our major exchange rate pairings, if only for a week in time. Too much can happen to throw things off, but the “narrative” allows for a much needed line in the sand.

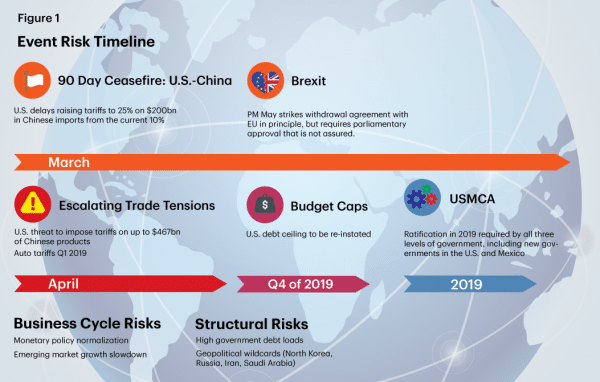

Where do we start? Typically, a group will develop a risk assessment of the near-term future, outlining a timeline of expected events, such as what the folks at TD Economics produced in the graphic below:

The 90-day ceasefire of tariff war tensions between the U.S. and China has provided a brief respite from the daily beat of battle drums in the background, but it, after all, is only for ninety days. Brexit has a similar deadline at the end of March that is quickly approaching, and even thought there was great fanfare after a new NAFTA agreement was negotiated (the name now is “USMCA”), the governments for each of the three countries (United States, Canada, and Mexico) must ratify the new deal.

Tariff war tensions may have been dampened, but we still must remember that, “The U.S. administration taxed imports on a broad range of products, from solar panels and washing machines, to steel and aluminum, to $250bn of Chinese products.” China also countered, but 2018 witnessed many other disturbing events that will not go away in 2019. Capital flight from emerging countries was just one of those issues. Central banks have expended their monetary policy ammunition such the G7 bankers are now less supportive of struggling economies. The message: Sink or swim on your own accord.

The trail of logic then settles upon three basic categories of risk: 1) Event Risk (Trade, Brexit, U.S. Government finances, and USMCA); 2) Business Cycle Risks (Monetary Policy Normalization and Emerging Market Malaise); and 3) Structural Risks (High government debt loads and Geopolitical Wildcards). Politicians may appear to be working towards acceptable resolutions for each event item, but the jury is still out. No consensus has formed. Tensions have not abated, and timelines are shorter day by day.

How will Event Risk impact outcomes for 2019?

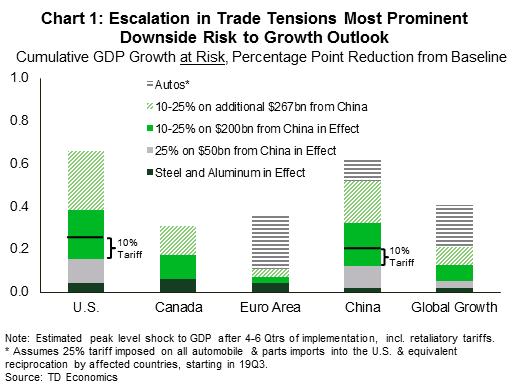

The event item, which could have the greatest impact on the coming year, is decidedly the uncertainty of how trade negotiations will proceed in several quarters. The Toronto Dominion staffers prepared the following chart to delineate the potential impact of each layer of pending discussions, as well as the impact on GDP growth for items that are already in effect:

The downside drag on international GDP growth is shown to be as high as 0.4% for the year. The ceasefire was a welcomed event, but the concessions made public were more than likely the easier points of common interest. One reporter opined that, “These token promises do little to assuage a U.S. administration that seeks to address heavy-hitting issues related to intellectual property protection, coerced technology transfer, government subsidies, and non-trade issues such as cyber espionage. As such, the 90-day ceasefire does not dismiss the threat of eventual tariff escalation in the New Year.”

Tensions do not stop with China. U.S. officials are also not happy with trade deficits resulting from the auto industry with Europe and Japan and possibly Canada. While discord in this arena will not bring on a recession, financial markets are edgy when any deal gets thrown on the negotiation table.

What about Brexit and USMCA? As for the former, “A withdrawal agreement has been reached between the UK and the EU in principle, but still awaits parliamentary approval from the UK and EU. Recent events however, suggest the process is far from over. A no-deal or hard Brexit could severely reduce UK economic activity after the March 2019 deadline.“ And so, we wait again.

A newly elected Congress, with Democrats now in charge of the House, will begin the year in the U.S. The new USMCA agreement will require ratification from this new group, as well as by Mexico and Canada. Another anxious waiting game is coming. No one is forecasting a game-changer issue in the shadows, but nerves are on edge.

Lastly, we have government finances to consider. After ten years of supportive fiscal policies, G7 governments must get their financial houses in order once more. Global debt levels are exceedingly high, not a good thing when escalating interest rates are a given. In the U.S., the Trump administration will have to deal with a divided Congress. Debt-ceiling debates will ensue over budget caps and allocations. More tension awaits everyone.

How will Business Cycle Risk impact outcomes for 2019?

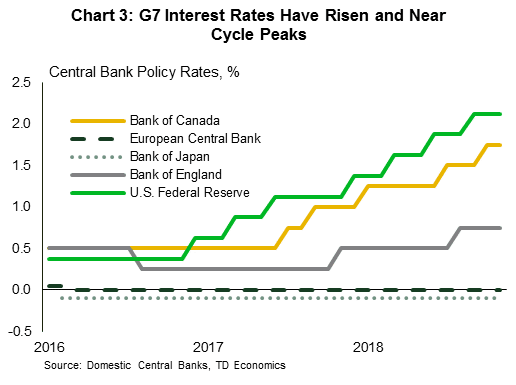

Monetary policy normalization looms large on the horizon. The Fed is leading the charge, but the debate will be over how high interest rates should peak and will the Fed get it right. Expect market volatility over this issue. And, as TD notes, “Similarly, the Fed’s peers in Canada, UK, Euro Area, and Japan are reevaluating their outlooks. With some exceptions (ECB, Bank of Japan), the liftoff in global interest rates has occurred. They too must walk the line between market anxiety and the risk of committing a policy error. This will keep central banks in cautious mode in terms of language and the speed of rate adjustments.”

Capital outflows from emerging market countries have moderated of late, but rising interest rates and the issue of debt sustainability will certainly hamper growth in this sector. As contagion fears spread from Turkey and Argentina, countries like Brazil and India come into immediate focus, but the proverbial elephant in the room is China. If growth materially decelerates in the Middle Kingdom, then the entire global growth picture takes on a paler sheen. China and India currently comprise 26% of economic growth on a global basis. Tariffs could darken the view, too, but a weakening USD could allow emerging markets to achieve positive gains a few quarters out.

How will Structural Risk impact outcomes for 2019?

Government debt loads and sustainability are structural issues that will not go away anytime soon. Government spending to boost economic growth followed the Great Recession. Monetary solutions had been expended, such that debt was the only remaining tool. Short-term gains, however, have long-term consequences, when debt is at hand. A near-zero interest rate environment has also enabled many business ventures to proceed that may not have been economically sound. Interest rates are now climbing on a global basis, as central bank normalization cautiously moves forward. Central bank policy rates have been moving upward, as this chart illustrates:

If we could stop here, it would be nice, but geopolitical wildcards have a way of stirring the pot unexpectedly. Where are potential wildcards lurking? TD states: “Examples include threats of a North Korean nuclear missile launch, Russian aggression within and beyond Ukraine into Eastern Europe and the Baltics, a war with Iran, and the end of the Saudi alliance with the U.S., which could result in a positive oil price shock. Should any one of these, in their extreme, be realized, all bets are off that the current outlook remains in play.”

How could these risks impact market volatility and the U.S. Dollar in 2019?

With so many moving parts at play and a list of potential wildcards, financial markets will have an anxious time dealing with uncertainty over the months to come. Investors have stashed capital around the global like never before in search of illusive high returns. These returns evaporate when exchange rates depreciate, which happened recently in Turkey and Argentina. Yes, markets have been calming of late, but the action discussed above is waiting in the wings. Expect capital flows to go into a higher gear in 2019.

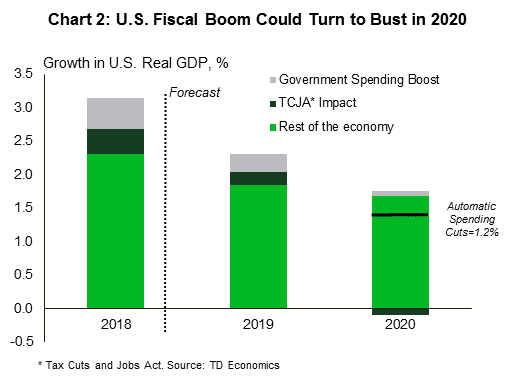

What about the U.S. Dollar? The Almighty Dollar surged in the latter part of 2018, due in part to the emerging market crisis and the fact that the U.S. economy was well ahead of other G7 countries. The “Safe Haven” status of dollar denominated securities cannot be overstated, but at some point, long-dollar trading positions must unwind. A slowing economy, as predicted by the TD economists in the chart below, will initiate the reversal:

TD is not alone in this opinion. Reuter’s recently conducted a survey “of more than 60 currency analysts, taken from Nov. 28 to Dec. 5.” According to Reuters: “The dollar, which has enjoyed an unrivalled surge against its peers this year, will be undermined in 2019 on increasing concerns about slowing U.S. economic growth.” The USD index now sits at 96.9, but the survey group forecasts a 91.9 reading by the end of 2019, a 5% drop, thereby giving back 2018 gains.

Concluding Remarks

One major global bank, Toronto Dominion, has spoken, regarding its take on risks that could impact the global economy in 2019. Others will soon join the fray, and we will eventually see an overall consensus narrative emerge for the coming year. Yes, opinions will vary from the global banking elite, but as we move forward, adjustments will be made. The new resulting storyline may be short lived, too, but we will have an acceptable basis from which to evaluate how 2019 plays out versus this constantly moving guidepost.

No one is forecasting a recession in the next twelve months, but a global slowdown is the primary assumption. Several markets may have already experienced negative growth, and, undoubtedly, a few more underperformers will follow. As we move through the coming year, various recession models will also be updated as new data points pour in, but uncertainty does breed volatility, and with it comes opportunity in the trading arena. With these thoughts as an initial backdrop, you, too, can begin to formulate your own narrative for the year ahead, adapting as you go along, just as with major banking forex departments.

To be forewarned is to be forearmed!

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk