After maintaining a negative interest rate policy for eight years, the Bank of Japan (BoJ) has shifted gears by raising the benchmark interest rate into a positive range of 0% to 0.1%. This move marks a historical pivot for the central bank, as it represents the first rate increase by the BoJ in 17 years.

Despite markets having partially priced in the possibility of a rate hike with a 44% expectation, the actual decision on the increase still managed to cause a stir. The precursors to the BoJ’s decision had not gone unnoticed, with Nikkei Asia pre-emptively leaking the potential move – a move that now validates the publication as a credible prognosticator of the BoJ’s recent policy shifts.

In tandem with the interest rate adjustment, the BoJ also decided to abolish the official target for the 10-year Japanese government bonds (JGBs). However, the central bank assured that it would maintain its JGB purchases at levels similar to those preceding the policy change, intending to continue supporting the bond market.

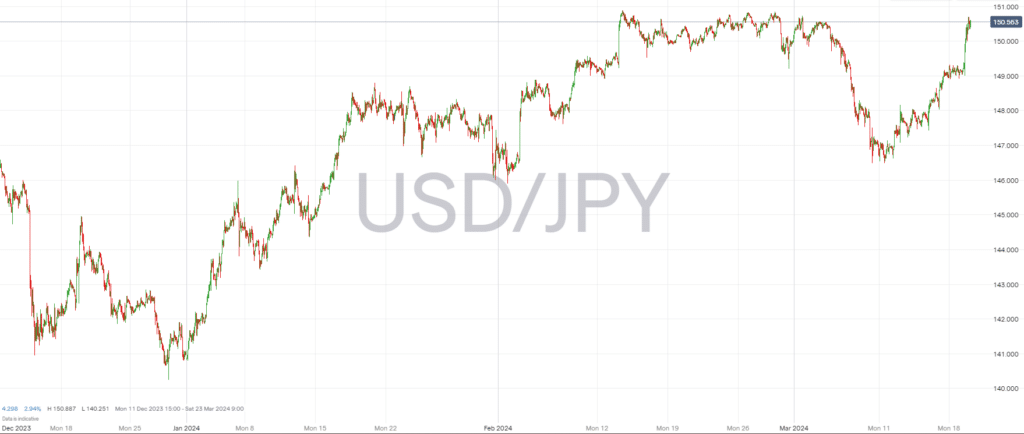

Following the announcement, an immediate side effect was recorded as yields took a further dip, which surprisingly had a detrimental effect on the Japanese yen. The currency experienced a depreciation, with the USD/JPY extending gains and climbing back above the 150.00 level – an affirmation of the US dollar’s continued strength.

Interestingly, the uptick in the USD/JPY came despite the BoJ not offering clear forward guidance regarding future rate hikes. Market sentiment suggests that this lack of indication, especially in a low volatility environment, could be a contributing factor to the yen’s woes. Furthermore, speculation over the timing of a rate cut by the US Federal Reserve has shifted towards July, following firmer-than-expected inflation data and concerns over escalating energy prices.

Governor Ueda of the Bank of Japan has expressed a cautious stance on the matter of subsequent rate hikes, stating that future increases will be contingent on prevailing economic conditions. Investors and analysts will be looking forward to the central bank’s April forecasts for further clarity.

Technical analysis of the USD/JPY daily chart points to a definitive bullish trend as the pair has ascended above the significant 150 level. If this upward trajectory persists, with the US dollar’s momentum acting as a tailwind, there might be scope for the currency pair to test a resistance level near 151.90.

The Bank of Japan’s departure from negative rates reflects a global monetary policy reorientation as central banks worldwide adjust to shifting economic landscapes. However, with mixed signals and a careful approach to future policy decisions, the BoJ’s nuanced path forward underlines its attentiveness to both the domestic economic recovery and the complex interplay of global markets.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk