After the initial drama of 2016, a calm of sorts has settled the waves in financial markets, producing a series of ranging behaviors across the investment landscape. The highly anticipated Fed liftoff for interest rate normalization finally took place. The chaos surrounding China, its equity markets, and its attempt at a soft economic landing has subsided. Financial markets have even tolerated the latest theatrics emanating from Europe and its central banker extraordinaire, the one and only Mario Draghi, while yawning at Yellen and the inability of her Fed governors to speak with one voice.

When the Fed minutes of its last meeting were published this past Thursday, investors breathed a sigh of relief and rushed back into risk-based securities, as if their very lives depended on it. Wall Street loves cheap money, despises hawkish tones from the Fed, and abhors uncertainty. When Janet Yellen’s recent public remarks contradicted those from other Fed members on the speaking tour, there were shouts of “flip-flopper” and “back-tracker” and, perhaps, a few more unprintable descriptive expletives. Pick your own metaphor, but the kindest thing to say is that we are in a period of transition. The Fed had wanted four rate adjustments in 2016. The guess now is a mere two.

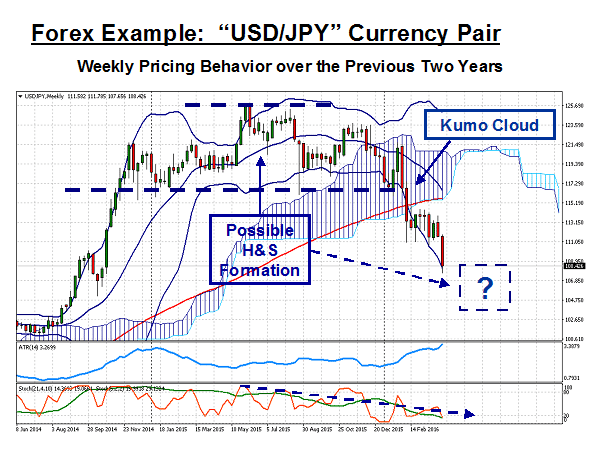

And so, the doves were released once more, and the hawks were confined to their respective cages. Stocks managed a mild recovery, but major currency pairs continued to fluctuate within tight boundaries, except for anything associated with the Yen. Of all the places to observe contrary-ism, Japan was the last nation on anyone’s list. Japan had started the currency wars in late 2012, incurring the wrath of the IMF and other G7 officials at the time. It then compounded the issue in mid 2014, when it embarked on a new round of qualitative and quantitative easing (QQE). The chart below tells the story:

We had reported, “The initial QE expansion announced by BOJ Governor Haruhiko Kuroda in late 2012 was just one prong in a multi-phased program proposed within “Abe-nomics”. Officials were soon celebrating their efforts when first-quarter GDP in 2013 grew 5.9% Y-O-Y, but, unfortunately, results thereafter have been tepid, at best. A raise in the national sales tax from 5% to 8% in April of this year only made matters worse. The world has now been patiently waiting for a new consensus to form within Japan.”

It took two years for a new consensus to form. The “USD/JPY” pair had risen from 80 to 100 over the period, but exports had not improved materially, and the domestic economy remained stuck in low gear. The above chart picks up where the first QE program suddenly morphed into QQE. Analysts had been expecting more easing from the BOJ, but markets were still surprised when Kuroda announced a new round of stimulus measures, ostensibly to boost exports, inflation, and domestic GDP growth.

The Yen subsequently weakened to 110, but no one accepted this level as enough to impact lagging exports. The BOJ is known for working behind the scenes, often intervening in the currency market or tweaking QQE parameters to hone in on its selected targets. Technical analysis put that figure as somewhere between 120 and 125, if the export trade was ever to respond to a weaker Yen. The “USD/JPY” pair did peak just above 125, while maintaining support at 120.

What are the technical indicators telling us about the Yen’s future prospects?

The “USD/JPY” currency pair is often the source for technical textbook discussions because it typically moves in a very orderly fashion. Suggestive patterns tend to produce the expected results more often than not and certainly at higher percentages than for other forex pairs. Whether it has something to do with the Japanese culture or the propensity of the BOJ to intervene in the market is open for debate, but at the end of the day, the benefit of orderly price transitions provides an opportunity that most traders seize on a moment’s notice.

Long-term charts, like the weekly one above, can be a treasure trove of technical bits of tradable information. Over the last two years, a possible “Head & Shoulders” formation remarkably came into being. Newcomers to forex are often counseled to avoid seeing an “H&S” pattern in every chart they review. It is easy to do, but in this case, even over such an extended period, the popular pattern has behaved according to applicable rules. If you place the “Neckline” at 117, as above, then you would expect the recent fall to 108. But you could also set the “Neckline” at 113 or even to a lower support level, which would suggest that the Yen has more appreciation in the cards, perhaps, down to 100.

What do the other indicators suggest? Recent price action penetrated the 100-EMA red line and the lower boundary of the blue Kumo Cloud, an indicator that actually originated in Japan. Such a move usually implies that there is more downward pricing action to come. Whether it will be to the 100 level is open for speculation, since the BOJ may not tolerate too strong a strengthening while the Japanese economy is suffering. The ascending ATR and downward sloping Stochastic indicators suggest more Yen appreciation, as well. This long-term trend actually began back in 2011. The 38.2 and 50 Fibonacci levels from that point forward would predict support levels at 107 and 101, respectively. If the 107 level is penetrated in a forceful way, then the trend will continue.

What are the basic fundamental forces that are driving this pricing behavior?

Technical analysis can point the way, based on previous pricing behavior, but in order to forecast results over the next few weeks, we have to look to the fundamental forces at work in the background. The “USD/JPY” pair is the most heavily traded Yen cross, and its movements are typically very structured, almost boring to a degree. After the introduction of “Abe-nomics”, however, the Yen has been anything but plodding along a boring path. In the past ten weeks, the Yen has improved more than 10%, a move that is quite extraordinary. More strength will not be good for the export trade in Japan.

What is going on behind the numbers from a fundamental perspective? When the Fed began to back off its plan to methodically hike interest rates four times in 2016, forex markets went into turmoil, as global capital searched for a new safe haven. This avalanche of new carry-trade positions, using the Yen as its “Base” currency, created the buying pressure for Yen appreciation. The BOJ’s recent move to use negative interest rates to stem the tide did not work. Other central banks in Europe and Asia were also moving forward with QE programs, basically negating any actions by the BOJ to weaken the Yen. Deflation has to be dealt with, and more QE has failed to deliver.

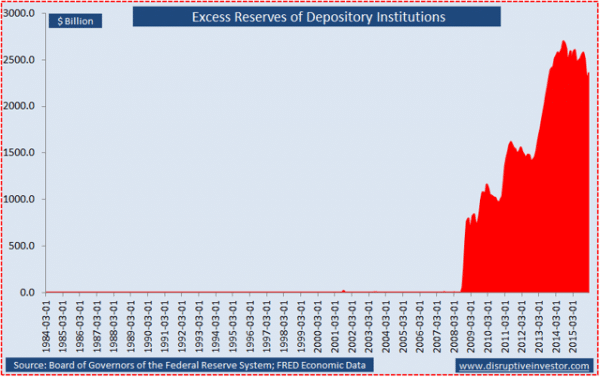

Expanding the money supply and flooding national banks with more liquidity is supposed to lead to more investment, more employment, more economic activity, and then inflation, according to every central banking policy manual on the planet. Why is this basic premise not working in Japan, or anywhere else for that matter? In the U.S. market, we know from the diagram below that banks have been overly conservative after the financial crisis of 2008, and, as a result, they have hoarded cash to the tune of $2.5 trillion. We can only postulate that banks in other markets have hoarded cash, as well.

What can we expect to happen next?

Japanese officials have been out in force, trying their best to weaken the Yen by words alone. Prime Minister Abe has been interviewed by the Wall Street Journal on the topic. BOJ Governor Kuroda and his associates have emphasized that recent moves are “undesirable” or “one-sided”. Mr. Abe went so far as to say, “Whatever the circumstances, we must definitely avoid competitive devaluation, and I think we should refrain from arbitrary intervention in currency markets. Stability is always an important factor for the economy.”

Other officials have remarked that, “We are watching moves with a sense of tension,” and that, “We will take necessary steps in accordance with circumstances.” Analysts, however, believe that the BOJ has exhausted every tool in its toolbox. Intervention in isolation is viewed as a lost cause at the moment. Jawboning rhetoric may be the only acceptable course under these “one-sided circumstances.”

Another issue is that a G7 summit is scheduled for May in Japan. As the host country, local officials do not want an embarrassing repeat of the meeting some years back when Abe-nomics was introduced. The screams of “currency wars” still reverberate within the halls of the BOJ. The IMF and a host of others censured Japanese officials for their blatant actions to devaluate the Yen. Awkwardness is to be avoided at all costs, the real reason why Abe was so adamant in his recent comments to the Wall Street Journal.

For the time being, the probable course will most likely be to sit and wait out the current turbulence. Economy Minister Nobuteru Ishihara is on the record as believing that recent movements are only temporary aberrations caused by speculators. Once the market accepts that nothing has fundamentally changed, shorting the Yen strength will become a popular trading strategy, and the BOJ can stand pat, suppressing any strong desires to intervene at the moment. Some observers, however, expect the BOJ to act and act quickly. The use of “one-sided” in several public comments has been a precursor for previous intervention actions.

Concluding Remarks

Will the Yen move up or down in the near term? The general consensus of analysts follows these recent comments in the press: “The yen is quite literally out of control and there seems to be nothing the Bank of Japan can do to tame it… Some believe that the BOJ will let the recent move play out before considering any action. In any case, it will likely be a while before the BOJ could justify another currency intervention on USD/JPY.”

For now, we expect Japanese officials to continue their “jawboning” rhetoric to weaken the Yen. The BOJ will methodically study the data, review external fundamental forces at play, and then attempt to form a consensus amongst themselves for a plan to move forward. This likely historical scenario suggests that the Yen will range for a bit before moving decisively in one direction, the point being to wait for the new trend to develop and then to jump onboard for all it is worth. Patience will then be rewarded.

See all forex news

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk