We are half way into February, but the jury is still out as far as what the next twelve months might bring. Uncertainty surrounds President Trump’s entreaties of better days to come, but rhetoric and Executive Orders do not a great economy make. Euphoria may still grip equity markets in the U.S., but stock values have appreciated far in excess of nominal GDP rates of growth. Experts, including a former chairman of the Fed to investing legends of yore, continue to have mixed views on the year in progress, but the U.S. Dollar long trade remains popular. When should one plan on shorting the USD?

Central bank policy divergence continues to be the primary fundamental in town. Janet Yellen spoke to Congress this week, and she sees no reason for not continuing with the Fed’s interest rate normalization plans. The greenback has been on a run for the past two weeks, rising in ten straight sessions from an index value of 99 to nearly 102, before dropping back to 100.5. Trump and his advisors have tried their best to jawbone the value downward with only temporary success, but the success of his programs is dependent upon a weaker Dollar. What will it take for the greenback to fall from grace?

Read more forex market news

This question is reverberating through the hallways of every banking foreign exchange department as we speak, not to mention hedge fund trading rooms and even down to individual traders like ourselves. The USD is hovering over 100 and has been bouncing around in that space for longer than one can recall for decades. Every fundamental known to man suggests that it has to continue upward, once the Fed keeps hiking rates in line with its long-term goals. Having made this remark, we have to add that the Street is not so sure. Most analysts are looking beyond the Fed’s March meeting and out to the June meeting for another lift off, no matter what Yellen has intimated to Congress.

What is Ben Bernanke’s take on the road ahead?

Ben Bernanke served as the Chairman of the Fed from 2006 through 2014, when he handed over the reigns to Janet Yellen. He was instrumental during the financial crisis in preventing the collapse of the global economy and has been acclaimed as the architect of the central banking policy that followed to ensure a gradual recovery from those perilous times. Regulators and central bankers around the world tend to follow the lead of their U.S. compatriots, which have the resources to develop the best strategies when the financial marketplace is in disarray and requires a calm and studied response.

Mr. Bernanke recently spoke to a gathering of certified financial analysts and shared his insights on the road ahead. President Trump had already been in office for two weeks, the Dow Jones had breached an historic 20,000 level, and one of Trump’s advisors had talked down the Dollar by claiming it was “grossly overvalued” relative to the Euro. The anticipation within the room of nearly one thousand attendees was palpable. What insights could this “insider” share about the current economic situation?

Bernanke chose to be upbeat, not expressing concern over the changes to come or how things may play out. His comments focused on these four areas:

1) Ben actually believes that the U.S. economy has more “room to run”. He alluded to the 15 million jobs that have been added since 2010, as one indication that steady growth has been a mainstay, even though we may still feel a few “aftershocks” from the crisis in 2008. Inflation remains in check, but he made no mention of what may come, when and if Trump adds stimulus;

2) Ben also noted why and how Trump was able to win the election. Trump identified and tapped into the public’s dissatisfaction and the “fundamental problems that have been festering. Globalization-related disruptions and low economic productivity have left many with a pervasive sense that they have been left behind in the aftermath of the financial crisis.” Any attempt to fix these problems should be viewed as a positive;

3) Bernanke is not that sure that “the people who feel left behind” will benefit from the new administration’s actions to come. He does not see a Congress that will buy into infrastructure spending. Trump has also sent a cold chill through international trade and the healthcare industry. Ben’s counsel is to, “Wait and see what happens before we anticipate a boom in the economy.”

4) Lastly, former Fed Chairman Bernanke did not see any signs that a recession was imminent. Even with the uncertainty that has accompanied Trump and his team, Ben stated that, “The potential for a recession has not changed.” He did finish, however, with a caveat that understanding the economy is one thing, but accurately forecasting it is quite another. Shifts can occur swiftly, without warning, such that we all should be prepared for any outcome.

How do other legendary investors see the next twelve months playing out?

Ben Bernanke’s voice is but one in the wilderness, but a few other courageous souls with reputations to match have also come forward, hopefully, to remove a bit of the fog on today’s economic landscape. Some of the names to follow may not be familiar in your household, but each is held in high esteem by current gurus in the investment community. Their insights help to put Ben’s comments into an overall context:

- Charles Gave, Louis-Vincent Gave, and Anatole Kaletsky: “It all depends on what happens to return on invested capital. Whether the US dollar rises or falls will be the primary driver of performance for almost any asset class in 2017. And behind that question of the dollar lies the broader outlook for the US economy; specifically, can President Trump manage to raise ROIC in the US?”

- David Rosenberg: “The economy isn’t that strong, and anyone who thinks one man can reverse, on his own, the structural forces that led to the multi-year disinflation trend-and I’m talking about excessive debt, globalization, aging demographics, and technology-needs to go back to economics school right away.”

- Christopher Wood: “Extreme skepticism is warranted on the hopes currently being invested in the powers of fiscal easing and related infrastructure spending even if it is assumed that a Republican-controlled Congress, containing many fiscal conservatives, is really willing to sign up to The Donald’s spending plans.”

It seems that a bit of skepticism is beginning to enter the ranks of those in the know.

What are a few troubling facts that persist and will not go away anytime soon?

Uncertainty is one thing, but the desire to unravel the puzzle is pushing analysts to new extremes. The search is on for the most telling charts that will shed light on the darkness presently at hand. One researcher took issue with the possible bubble that exists in the S&P 500 index of securities. Yes, the real growth in the index has outpaced by double-digits real GDP growth, a concern of many, but optimists quickly cite the reasons as accommodative central bank policy, low interest rates, and various quantitative easing programs.

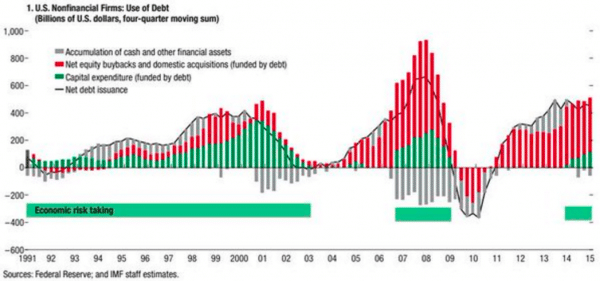

Cheap money has flowed into many corridors, but primarily equity valuations. The real concern, however, is what have corporations done with this cheap money? The objective of central bankers is that these funds would be invested in capital expenditures, a form of economic risk taking that creates jobs in the process. Unfortunately, U.S. corporate leaders have chosen anything but this objective. Stock buybacks and M&A philandering have dominated the scene since 2003. More cheap money may only lead to similar outcomes, not the other way around.

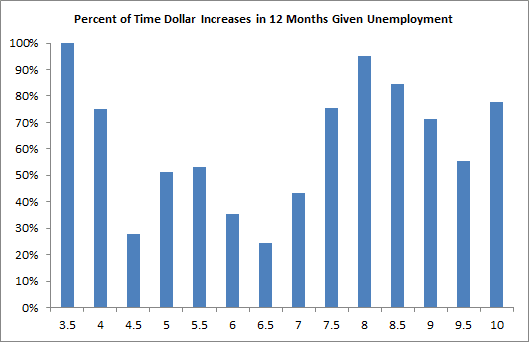

Another researcher took the time to analyze the last forty years of data related to unemployment levels and how the U.S. Dollar reacted in the twelve months that followed. His analysis produced the following diagram:

You might find this presentation difficult to interpret, but, according to its author, the high end of the scale, from 7.5 to 10, is where the government often intervenes with stimulus programs that produce widespread growth, leading to foreign investment that pumps up the Dollar’s value. On the low end, from 3.5 to 4, the economy is going full bore, which also results in increased capital flows and, thereby, an appreciating greenback.

The area from 4.5% to 7% is problematic. He terms this region “the transition zone”. The Dollar depreciates due to uncertainty or because the economy is gradually shifting from growth mode to recession. Bernanke may not see recessionary forces in his headlights, but the possibility does exist. Even Ben admits that a sudden shift in the economic weather could send headwinds our way. In a word, a few experts have simply stated that our economy is “sputtering”. If we truly are in this “transition zone”, then there is a 70% chance that the U.S. Dollar will fall in the next twelve months.

What are the implications for the U.S. Dollar and carry trade positions?

After reviewing the prevailing arguments for where the USD is headed, one disgruntled trader screamed in his headline article, “Why Aren’t You Short The Dollar Yet?” The most crowded trade on Wall Street may still be the “Long Dollar” trade, but it does not take a genius to note the change in capital flows since the first of January. The Yen has prospered, perhaps, due to its “base” status in carry-trade positions. Commodity currencies have also appreciated dramatically versus the USD. The Aussie, the Kiwi, and the Loonie have popped for as many as 300 to 600 pips apiece.

Concluding Remarks

What’s next? Experts remain mixed on what the economic future may hold, but much of the confusion has to do with what the U.S. Dollar will do and how Trump’s policies might jerk the global chain, so to speak. This pundit reflects the increasing skepticism that is growing: “While promises of great action have been made by the new administration, so far there has been none. All we have gotten is a nonstop cavalcade of photo ops. In the meantime, there has been a daily drumbeat of tweets on immigration and trade wars, which are fundamentally negative for the economy and for shares.”

The metaphor that best describes the present situation is that we are on a roller coaster that is slowly ratcheting up the steep climb that precedes the long ride down, and there will be a ride to remember, filled with volatility and herks and jerks along the way. Be ready to pick your moments and enjoy the thrills that come your way. Stay cautious!

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk