There is a subtle shift occurring within the crypto-verse. While Bitcoin continues to excel, blasting through resistance and ascending once more into 5-digit status, altcoins as a group are being left in the dust. In the past, the leading digital currency would gracefully hand over the baton, so to speak, while it consolidated its winnings, and then a rally would take place in the riskier programs in Crypto-Land. Such has not been the case of late. This correlation has broken down. An altcoin rally is nowhere to be seen.

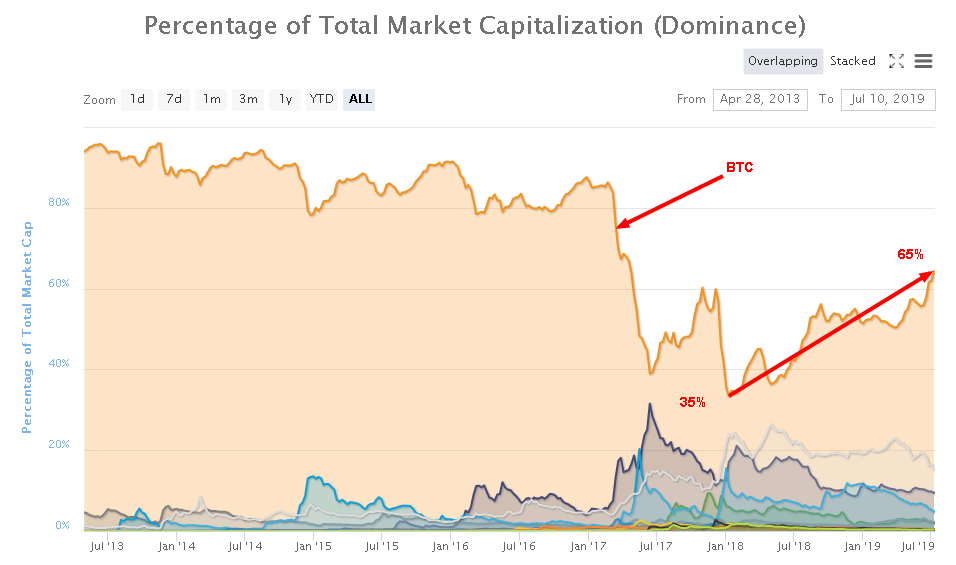

Something has obviously changed in the background of crypto demographics, as Bitcoin has now reached a 65% plateau, after having dipped as low as 35% back in January of 2018. 2017 was the heyday for alternative token development programs. Anyone with a logical whitepaper and the wherewithal to put together a convincing Initial Coin Offering (ICO) campaign could have uninformed investors throw money at them and lots of it. It was very reminiscent of the early Internet age, but a possible reckoning is now in order.

The above chart, courtesy of Coinmarketcap.com, tells the story. From early 2018, Bitcoin has gradually recovered lost ground at the expense of its altcoin brethren, but as one reviews the journey, there were several periods where Bitcoin actually pulled back. During those brief periods, altcoins got a chance to play “catch up”, if you will, an indication that the tolerance for risk had expanded within the investment community.

A report from Binance Research, the analytical support department attached to the Binance crypto exchange, for the second quarter was the first evidence that the recent surge in Bitcoin fortunes might be breaking previous correlations. As reporters noted: “Second quarter data reflected a correlation coefficient of 0.61, as opposed to a 0.73 figure for the first quarter. Analysts attribute this drop to a supposed “culling of the herd”, as the market evaluates various “use cases” in a survival of the fittest scenario.”

It may be too soon to make such a broad-based interpretation of just one quarter’s worth of data, but the report soon resurrected an age-old debate in the crypto industry – Are current crypto tokens overpriced, and is an “asset bubble” about to burst? Many of the leading and most well respected analysts and traders within the crypto realm have come forward to express their current opinions on the topic. The simple verdict at this time is that, while the “majors” may be in a world of their own, the multitude of other coin programs are quickly falling into two classes – the ones with strong fundamentals and the ones that are weak and somewhat questionable.

By the latest count on Coinmarketcap.com, there are over 2,300 token programs in existence. Many are not traded, refusing to pay over the exorbitant fees charged by an exchange for that privilege. These programs do have investors, however, and time is running out for these programs to prove their “use cases” in the marketplace.

These programs may not get the chance to defend themselves. Per one report: “Peter Brandt, a notable commodities and crypto analyst, is one, who favors the argument that a “bifurcation” may continue. He has quipped that: “Crypto maniacs, who believe altcoins will benefit from bull runs in Bitcoin… may be very disappointed.” He also compares the present situation to when the “dot.com bust” occurred back at the turn of the millennium. Companies of real value went on to achieve wonderful things, but the “alt-coms” of the time, as he called them, suffered greatly and died out.”

Brandt has since been interviewed again by Cointelegraph and doubled down on his opinion: “I believe that the advance in late 2017 and early 2018 in altcoins will prove to be bubbles. I am of the firm belief that 95% of alt-coins will eventually be worthless and that BTC will occupy 80% to 90% of the total market cap of cryptocurrencies. No doubt several of the altcoins and macro-cap coins will find utility in specialized niches. It remains to be seen which coins these will be.”

These are pretty strong words, but if we step back for a moment and review studies of the innovation cycle, what is transpiring is actually fairly predictable. The Internet is but one example. There are several others, but the key takeaway is that the market will sort out winners from losers. Hester Peirce, one of many SEC commissioners and who is also affectionately referred to as “Crypto Mom”, has noted that: “I don’t know whether this product or another exchange-traded product would be good for investors, but I think investors can make that decision better than I can. Sometimes things that [require fighting for] make it to market and they fall, and that’s the way it is, but that’s the market’s decision.” It appears that investors are now becoming more discriminating.

Has an “asset bubble” formed in Crypto-Land and are altcoin programs at risk?

These questions have been asked and debated for the past five years. It is interesting to note that the austere Financial Times actually pontificated way back in 2014 that: “We’re going to stick our neck out at this stage and call this the end of Bitcoin.” It, of course, was not the death knell for Bitcoin or for other token programs at the time. The mania that occurred in 2017 did create a “bubble” that did result in a crash in valuations, termed Crypto Winter by the media, but Bitcoin and other cryptos have recovered to a degree.

Fast forward to 2019, and the crypto universe is very different than it was two years past. Per Scott Melker, a trader at Texas West Capital: “I know it’s cliché to say that ‘this time is different,’ but the evidence seems to support this belief. The recent increase has been fueled by institutional investors; retail has only started to pay attention in the past week, when the price advanced to nearly $14,000. During the last bull run, average people were already interested long before the price reached $10,000. The mania has not set in this time.”

As for the “bubble” nature of present valuations, Josh Rager, a crypto analyst with a large following on social media, explained: “The cryptocurrency market as a whole isn’t a ‘bubble’ but I do believe we saw a bubble with ICOs and crypto assets not backed by solid fundamentals. In 2017 all you had to do is put together a small team, build a website and have a white paper to be considered a potentially valuable company. But as we saw, the majority of these companies ‘run out of funds’ by the end of 2018 and their assets were dumped on exchanges.”

Glen Goodman, a former reporter for the BBC and ITV, expressed similar sentiments: “Crypto markets are largely driven by speculation but that doesn’t mean they’re currently in a ‘bubble’. Classic speculative bubbles are characterised by euphoria and the mass-involvement of ordinary people who believe they will soon become rich. We saw that phenomenon in late 2017. […] I sold my crypto holdings shortly after, and waited for the bubble to fully deflate, which took about a year.”

Max Keiser, an American broadcaster and Bitcoin cheerleader, jokingly puts Bitcoin within a larger context and refutes the idea that it is a formidable “bubble”: “Bitcoin is virtually the only financial asset ‘not’ in a bubble. Sovereign bonds are in multi-hundred year bubbles. The USD and various fiat money are in historic bubbles. Stock markets are in bubbles. Most property is also in a bubble. Gold and gold mining stocks are undervalued and good places to invest, but their upside is limited as compared to Bitcoin.”

But what about altcoins? Keiser also believes that: “Look, the dominance index is at 60% again, and it’s going back to 80% or 90%. Because that’s the only logical place for anyone who wants to be in crypto to be. But the short answer is, in my view, the altcoin phenomenon is finished.” It may take a few years before the “finished” moniker will apply, but there is definitely a shift of sorts taking place in the minds of investors.

On this topic, Max Keiser is of a mind that: “In ten years we’ll see Bitcoin, and a bunch of coins that don’t exist now; the new crop of seedlings that start with promise, then fade away.” Glen Goodman echoes the same general presumption: “In ten years, most of the cryptocurrencies we know and love will probably be in the crypto graveyard.”

Concluding Remarks

Subtle changes are taking place in the crypto universe, ones that will certainly reshape the industry in the years down the road. A.T. Kearney, a top ranked global management consulting firm, first saw the handwriting on the wall back in last December: “By the end of 2019, Bitcoin will reclaim nearly two-thirds of the crypto-market capitalization as altcoins lose their luster because of growing risk aversion among cryptocurrency investors.”

Bitcoin may continue down its domination path, and it may even morph into something else or be supplanted by a more capable competitor down the road. Does anyone remember AOL? Change will come, but it will surely impact smaller altcoin programs where fundamentals are suspect or where the market does not place value on the applications that areforthcoming. Such is the nature of innovation. Prepare accordingly.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk