Analysts coming up with wildly different valuations of tech-stocks is nothing new. As current share prices are based on potential future earnings, it’s easy to discount or alternatively overrate new products the firms claim to have in their pipeline.

The Covid-19 lockdown has had the effect of condensing years of societal change into months. The increased amounts of home-working and home-leisure brought potential future earnings growth forward, with the paradigm shift lifting the sector as a whole.

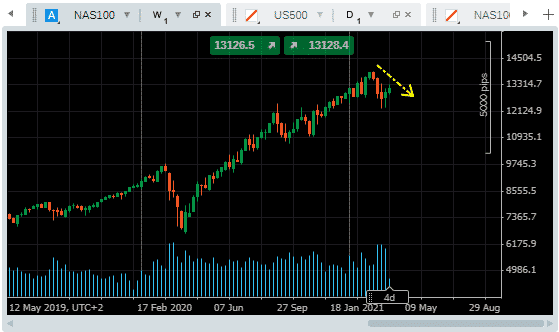

The question being increasingly asked is whether all tech firms justify their new price levels and if the Tech bubble could be about to burst. Since posting an all-time high of 13906 on the 16th of February, the Nasdaq 100 index has lost ground and at times at a 12% discount to those giddy price levels.

Nasdaq 100 index – Weekly Candles

Source: Pepperstone

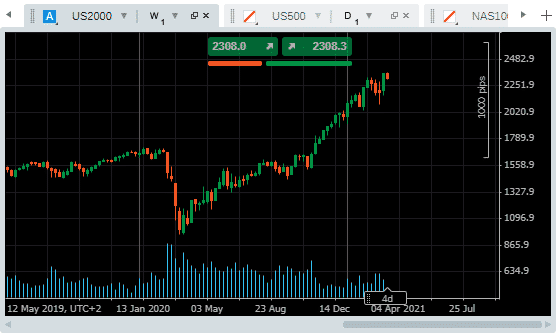

The returns to investors have been staggering but the consolidating price action is particularly concerning compared to the Russell 2000 index. That benchmark, which comprises smaller, main-stream firms, focuses on the domestic US economy.

Russell 2000 index – Weekly Candles

Source: Pepperstone

The Russell 2000 index, which includes lower-profile stocks such as Addus Homecare Corp, is outstripping the one containing Intel, Google and Tesla. The Russell 2000 all-time high of 2,367 was posted only two days ago, on Monday the 15th of March.

The Pin Which Could Burst the Tech Bubble

The potential for inflationary pressure picking up has led to US Treasury yields spiking. That has alarmed tech investors. The consensus that growth stocks underperform in an inflationary environment has given many investors the jitters. With Jerome Powell due to give his next statement on US interest rate policy on Wednesday, all eyes are on what he might, or might not, say.

If he reveals tackling inflationary pressure is being given higher priority, then interest rate rises and tapering back of liquidity could happen sooner rather than later.

For some, the mood has shifted from gradually scaling out of Tech-stocks and actively betting against them. This week, Lansdowne Partners fund manager Per Lekander told CNBC that he thinks Tesla is in a bubble and that he’s short on Elon Musk’s firm.

The market is full of traders who shorted Tesla and lost but if the flagship stock took a reality check, it would have repercussions for tech stocks in general.

USDJPY and the Fed

Another way to play the upcoming announcement from the US Fed is USDJPY. This article from Monday highlighted how the rising wedge pattern was due to run out of room before Powell’s statement on rates. The risk of price being forced out of the wedge ‘early’ but giving a false signal appears to have materialised.

USDJPY – 1h Candles – Stand by your guns?

Source: Pepperstone

The break to the downside saw price reach as low as 108.785 but short-sellers who got in too late will now be nursing losses. Price has returned to above 109 and looks set to wait for the news on US rates before finding genuine momentum.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk