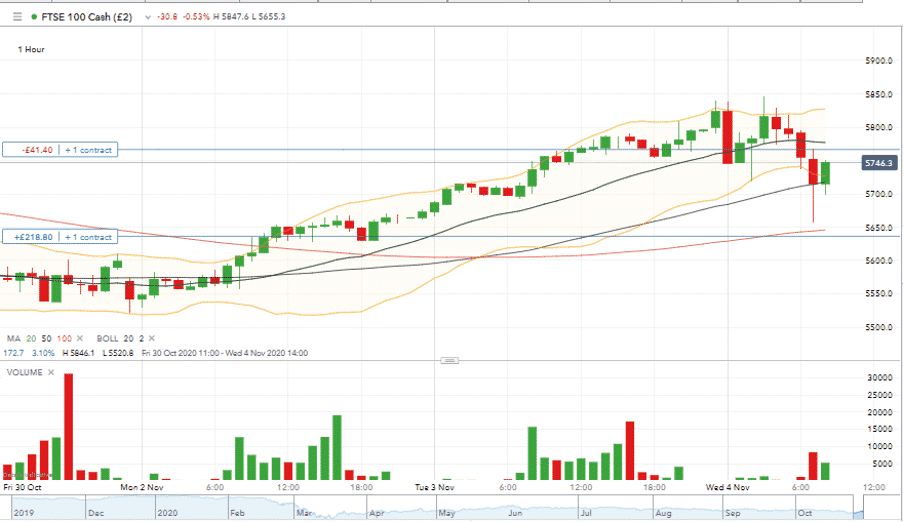

European markets open on Wednesday with one thing on their mind, the US presidential election. Prices had already factored in the ‘known, unknown’ that the result might not be confirmed for days or even weeks.

Wednesday’s early trading saw risk being taken off trading books as an added element of uncertainty was factored into the equation. The predicted victory procession of Joe Biden stalled as early counting indicated that President Donald Trump picked up votes many didn’t think he would.

Source: IG

Monday and Tuesday’s trading now potentially looks like a relief rally retracement of a COVID based sell-off or a chance to buy the dips and benefit from the traditional ‘risk-on’ reaction to a US presidential election being over.

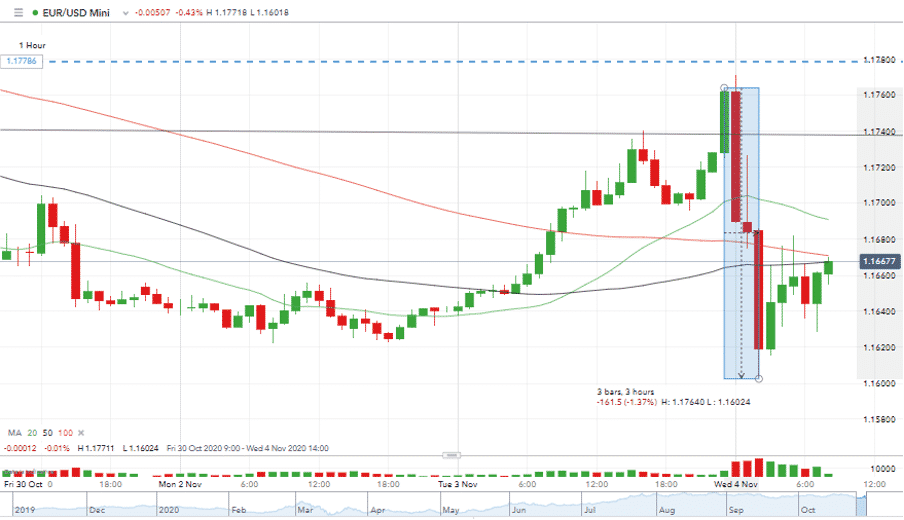

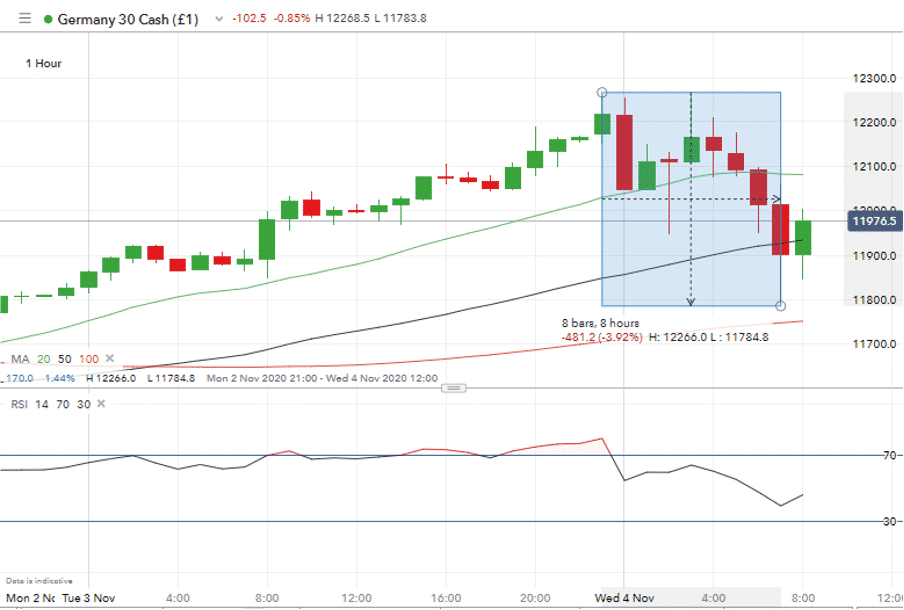

Risk-Off or Profit Taking – Tuesday’s highs to Wednesday morning’s lows

- EURUSD –1.37%

- GBPUSD –1.66%

- German DAX Index –3.92%

- Bitcoin –3.79%

Source: IG

The Forex Traders’ analysts correctly predicted the potential for market strength in the first part of the week. The strategy, based on gold holding its tight trading range picked up on the market’s reaction to several days of being over-sold. It still offers trade exit points that will return a profit and the neck-and-neck status of the US election race is a new element to be considered.

Donald Trump’s claims that he would challenge any result in the courts looked like sabre-rattling when the margin between the candidates was several percentage points. If the race turns out to be as tight as it looks on Wednesday morning, then all bets will be off.

Don’t forget, that both the 2016 and 2012 election results were challenged for some time by the losing side.

Using Forex to Trade the US Presidential vote

One way of trading the outcome of the race is through EURUSD. Strength in USD being traditionally seen as the ‘risk-off’ approach to the pair. Although EURUSD also has some exposure to the Brexit situation, it is less correlated to Brussels-London negotiations than GBPUSD.

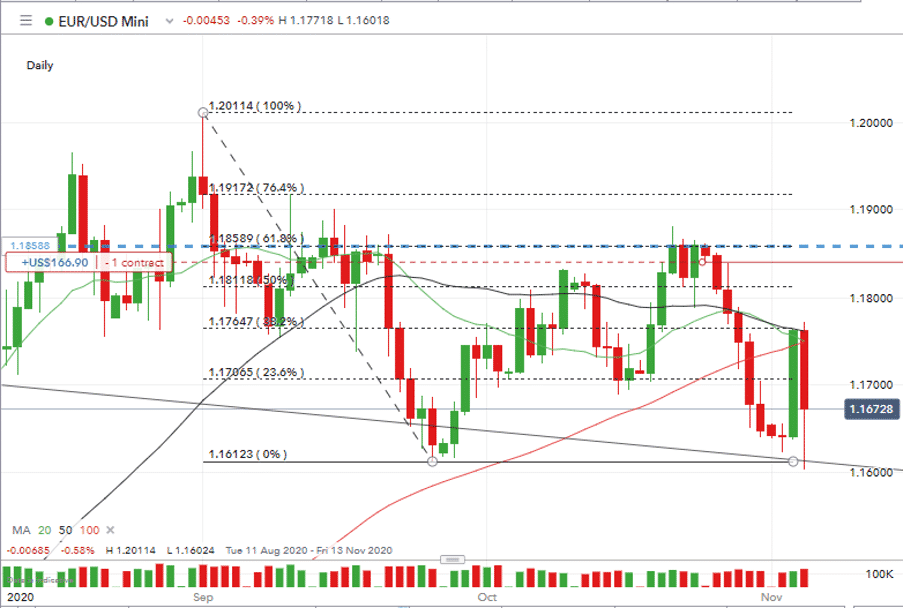

Key resistance and bearish invalidation are found at the 1.1859 level. That is some way higher than Wednesday’s prices but no scenarios can be discounted at this stage. This price level is marked by several technical features including October’s closing high and the 61.8% Fib retracement of September’s price action.

Source: IG

There are several long upper wicks on daily candles, highlighting that on several occasions price has attempted to close above that level but ultimately failed.

As considerable as they are, the obstacles at the 1.859 level are some way off current price levels. If EURUSD does rally on the back of US political news, it has a relatively clear run until it gets there.

The lower end of the EURUSD range finds the September low at 1.16123 currently coming into play. Intra-day trading on Wednesday has already tested that level only to bounce back off the Daily 50 SMA.

The upper and lower end of the EURUSD trading range is occupied by significant technical resistance and support. That opens the door to trading; however, the political noise and volatility could lead to price whipsawing within that range. It would require a degree of patience because there is little benefit from jumping in too early when price is so dependent on the soundbites of the candidates. Stop-losses would be placed just outside the range.

Risk Statement: Trading Financial Markets on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk