Any discussion on how to count pips on MT4 before talking about MT4 itself is putting the cart before the horse. Many writers make that cardinal error; that’s not us. Indeed, MT4 is a spearhead in facilitating smooth and seamless forex trading as platform brokers far and wide use as servers for their clients (i.e., forex traders). The MT4 originator MetaQuotes Software licenses the platform – full name MetaTrader 4 – to brokerage companies and has been doing so since 2005.

Like most people ask for Vaseline when buying petroleum jelly, forex traders demand MT4 when choosing a trading platform. In short, in both cases, the brand names are generic with the product. And for a good reason: MT4 is flexible, easy to use, and has the infrastructure for traders to integrate with multiple trading indicators to help performance and trend predictability. In this article, we are focusing on a vital element of MT4 trading – Pips. As we cover the two methods of calculating pips on MT4, you will see that calculating profits or losses on trades is a fast and seamless exercise by taking advantage of default formats in the software.

What is a Pip?

We must answer with a question as a start: What is a trader’s single-minded focus in trading a currency pair for profit? Answer – Price movement (PM). So, that said, where does Pip come into the picture? It lies at the core of measuring PM. Indeed, Pip is an acronym for “Point in percentage”, and one Pip represents the smallest distance price can move up or down. In other words, Pip is the unit of measurement applied to any exchange rate movement between two currencies.

So, how tiny is a single Pip in a world with infinitesimal fractions?

- Most currencies reflect prices to four decimal points (although five decimal points are creeping in frequently).

- Thus, a Pip drops to the fourth decimal point as a ‘1’ In other words, a Pip = 0.0001 =1/100 of 1%, frequently referred to as one basis point.

The exception to the above is any trade where YEN is in the pair, in which case a Pip is 0.01 (two decimal points, or 1%).

So, now we know that a Pip is a percentage factor, how do we allocate a currency value to it? After all, when we calculate profits and losses, it hits our pocket. The best way of explaining this is with examples, keeping the definition of a Pip above in mind.

Traders traditionally reference Pips to express their gains or losses. For instance, you’ll often hear comments like, “I made 20 Pips on that Pound USD trade” in trading circles, which immediately tells us the transaction yielded a gain of 20 x 0.0001 = 0.0020 = 2/10 of a per cent = 1/5th of 1%. However, the latter is only half the story. We want to know in money terms what the trader made.

Let’s stay with our 20 Pip gain trader and progress the trade metrics further. The first thing we do in this currency pair trade is look at the official pairing GBP/USD – where GBP (Pound Sterling) is the base currency, and USD (the US Dollar) is the quote currency (more on this below).

We discover that the trader in question transacted 100,000 in GBP/USD pairing that started at an exchange rate of 1.3147.

- In other words, it took USD131,470 to open the trade, converted to 100,000 GBP.

- When the trade closed, the exchange rate had increased to 1.3167 – thus, the 20 Pips we heard the trader commenting about above appeared (i.e., 1,3167 – 1.3142 = 20).

- That means, at the close, the trader exchanged the GBP100,000 back into USD but at the new exchange rate of 1.3167 = 100,000 x 1.3167 = USD131,670 = USD200 profit (i.e., USD131,670 – starting capital of USD131,470 = USD200).

- Therefore, we know 20 Pips = USD200 (or USD10 a Pip)

Another way of looking at this is as follows:

- Twenty Pips = 0.002. So, In other words, taking the base currency (GBP100,000) x 0.0020 = USD200.

- Therefore, each Pip yielded USD200/20 = USD10.

- And 10 is 0.0001 of 100,000, which circles back to the exact percentage of a Pip as explained above.

- Thus, deriving the value of one Pip in monetary terms connects to our example above, where: The Base currency investment (GBP100,000 ) x 0.0001 = 10 units of the Quote currency (USD).

- It’s easy to see that if the trade above had been 1000,000 GBP Base currency, then the value of a Pip in USD (the Quote currency) = USD100; 500,000 GBP = USD50 per Pip, and so on.

Please note, if neither of the currencies in the pair traded was in the trader’s domicile currency (i.e., where he lives), he still has to convert the funds returned on closing back to the latter. So, in our example, say the trader was Australian, we can presume that the initial currency funding all trades is AUD. Therefore, the trader must still convert the USD 131,670 back to AUD (which may have changed over the transaction period). As a result, traders prefer to have at least one currency in the pair as the domicile currency to avoid a triangular conversion.

How to Count Pips on MT4

There are various methods for calculating pips on MT4. In a nutshell, it involves measuring the distance between points on a chart in Pip terms.

Method #1:

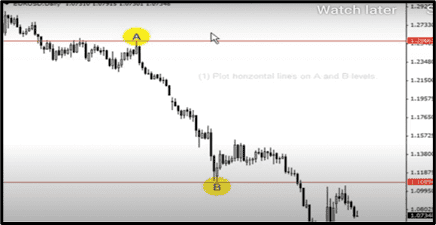

The image below is a price chart for EUR/USD trades.

- The trader in this example is interested in two points (A and B) for a Pip calculation. So, we draw a horizontal line on each level.

- Next, the distance between these two horizontal lines is easy to calculate. MT4 provides an integrated calculator (see below) where you copy, paste, and subtract the values of the two points. However, you could do it with an outside calculator just as quickly. We are assuming the latter for the rest of the explanation.

It’s quite simple; we deduct the value of one from the other:

- 2566 – 1.1089 = 0.1477

- Now we know from our explanation above that one Pip = 0.0001

- Therefore, to calculate the number of Pips in 0.1477, we divide it by 0.0001 (or multiply by 10,000).

- Thus, 0.1477/0.0001 = 1477 pips.

Note in this case, the currency values went to five decimals points. Therefore, we suggest either ignoring the 5th decimal in both values or dividing the answer with the 5th decimal included in the calculation (i.e., 14765) by 10 to align with our standard Pip format of four decimal points.

Method #2:

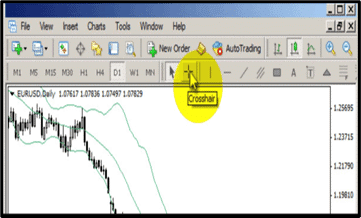

Please go to the “Crosshair” tool on the Line Studies toolbar at the top of the MT4 chart (see below):

- Just click on it, and the mouse crosshair cursor will appear.

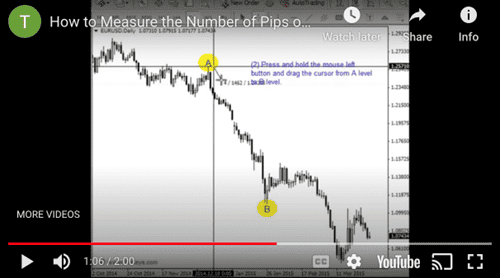

- Move the crosshair to any one of the two points you want to measure, as shown below:

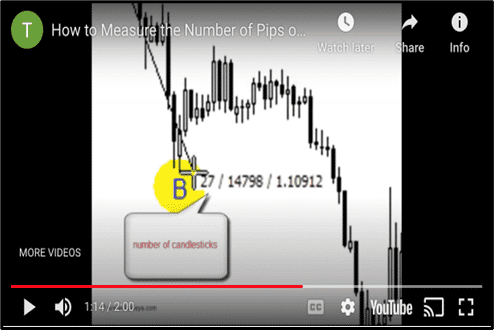

- From there, press down the mouse’s left button and drag the crosshair (cursor) to the second point in the calculation, as demonstrated below.

- Three numbers appear at the side of the cursor, as seen above:

- The first number (i.e., 27) = the number of candlesticks (bars) between your first and second points (i.e., time units).

- The second number is the distance of the two price levels, A and B, in pips (but only after you divide by ten because the currency pair, in this case, is showing as five decimals on the platform). Note – if the platform is functioning on four decimal points, the middle number above would have been 1480 – the accurate Pip reading.

- The third number indicates the price level where the cursor rests.

Conclusion

Well, there you have it, a comprehensive Pip overview. Translating Pips to monetary values is arguably the most complicated aspect, but MT4’s in-built tools to calculate Pips are relatively straightforward. Use Pip calculations when setting stop losses as well. They are a crucial aspect of sensible trading.

Related Articles

- How To Use Expert Advisors in MT4

- How to Set Stop-Loss and Take-Profit in MT4

- How to Open a Live Account in MetaTrader 4

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.