Before we get into the ins and outs of leveraging MT4, many may not know what the latter stands for. Indeed, MetaTrader 4 (MT4) is the generic term used to signify that electronic trading platforms are in the mix for forex traders involved in speculative transactions. Developed by MetaQuotes Software and released in 2005, it’s a software configuration built around Microsoft Windows (for application purposes) and licensed to foreign exchange brokers that promote themselves as one-stop trading systems. It allows brokers to deliver MT4 as a server to their clients, relying on the technology to stream charts and prices, establish trades (buying and selling), and manage their accounts within personal risk capacities. In addition, many brokers have adapted their MT4 platforms to embrace macOS, thus extending the usage significantly.

What Has MT4 Got to Do With Leveraging?

Leveraging is loan funding facilitated by the selected broker added to the trader’s equity (investment) as they enter MT4 to establish forex positions. Indeed, trading with reliance on brokers’ loans – many times the trader’s equity – goes together like paper and a pen or macaroni and cheese. Three vital questions arise:

- What precisely does ‘many times’ mean?

- How do I access leveraging facilities?

- What’s the catch?

Context and Background

We’re going to answer questions 1 and 3 above with one response, as follows:

As leveraging enters the picture in MT4, so does risk alongside crucial profit or loss considerations. Here’s a simple case study to demonstrate. It revolves around Trader X, who successfully applies for and trades with $100 leverage for every $1 of his own funding.

It’s all well and good at the start. Trader X gets excited as he sees his $10,000 equity leap to $1,010,000 before venturing into a volatile forex scenario. It’s what happens afterwards that can rattle one’s composure. Why? Because, in a nutshell, heavy borrowing versus equity has a multiplier effect.

- For example, Trader X earns $1,000 profit from positions using the $1m+ at his disposal – not even one-tenth of 1% of the total capital value. Yet on the $10,000 equity stake, it’s an impressive 10%.

- Velocity is also in the equation. In forex markets, multiple trades in minutes are routine, so the $1,000 referred to above represents an hour’s earnings for Trader X. So, it’s easy to see the lure of leveraging with returns like this (i.e., thousands of per cent annualised).

- Conversely, the next day Trader X, operating with more boldness, suffers 10 poor trades, each losing $500. The loss of $5,000 is only around half of 1% of the total money deployed, but it completely wipes out 50% of his starting equity.

Thus, the case study above shows the multiplier effect on both sides of the P&L. Moreover, when things go wrong, as they did in one part of this case, the broker will undoubtedly call for Trader X to replace the lost investment – failing which, it will freeze the account. The latter are margin calls (MCs), signifying that there’s no free lunch when someone opens the gates and releases multiple times what you inject into the trading arena. In other words, rules and protocols determine the ratio that your equity must maintain for the broker to lend you money.

The takeaway is that leveraging is a two-edged multiplier sword that can yield outsized profits for savvy traders and pop bubbles of those inexperienced or overborrowing. So, even though this article may appear to be about how to increase leverage on MT4, the crucial decision is what leverage ratio makes sense to keep your forex trading on an even keel. Therefore, ‘how to change leverage on MT4’ is more to the point because you may want to decrease it from 1/100 to 1/20 (or lower) for a more robust risk profile. The driving considerations are:

- Your risk tolerance.

- The trading strategy you adopt.

- Your experience level.

How Do I Get to a Leverage Ratio for MetaTrading That Makes Sense?

Be aware that you may encounter brokers offering equity/loan ratios of 1/100, 1/200 and 1/500, but this doesn’t mean diving into unchartered waters – venturing forth where angels fear to tread. MCs are ruthless, the ugly side of trading, so think twice, three times, more – as long as it takes to calculate leverage ratios that fit your comfort zone.

One thought should remain embedded from end to end when MT4 leveraging. The house is always watching you to ensure that no borrowed money is irrecoverable. Traders frequently lose sight of leverage rule stringency, side-tracked by the earnings potential that loan multiples offer. Nonetheless, there’s a fine line between a trading winning streak and dipping into the MC range. The instant that your equity looks too thin, count on an MC coming your way.

So, as a novice, we advise starting with 1/10 or 1/20 and moving it up as you grow more confident. Conversely, high-risk lovers with adequate skills can experiment with 1/500, possibly even with 1/1000, knowing that the equity wipe-out effect energises as the ratio escalates. Therefore, ask yourself the price you’re willing to pay when you trade with borrowed funds.

That said, adjusting leverage on MetaTrader 4 depends on your broker. MetaQuotes sets a default leverage when delivering the software to brokers (i.e., the MT4 servers). From there, it’s up to the platforms to create flexibility. They do so via settings on their web portals to move leverage up and down.

Every Broker Is Different

The only latitude for adjustment is on your broker’s portal. However, before navigating the latter, you should understand some specific fundamental parameters of leveraging MT4, as follows:

- Leverage regulation is not the same for all countries. For example, the limits for retail traders by jurisdiction are as follows:

- Europe – 1/30.

- US – 1/50. Seasoned pros can apply for higher ratios.

- Offshore locations – 1/500.

- For many brokers, leverage requests away from the default ratio work only for live accounts. Still, some allow demo accounts to access it.

- Leverage limits vary significantly from one broker to the next. If they are too narrow for your level of sophistication, it’s better to move on to another.

- Leveraging varies depending on the type of trading. Therefore, don’t stop at (2) above. Find out the leveraging protocols for your trading methodologies. Brokerages determine leverage allotments based on:

- The security categories traded.

- The positions one takes.

- Typically, you can select leverage when opening a new account. How? Via quite a simple process, though explaining it is a little complicated. Why? Because every broker functions its online platforms with different navigation configurations. Still, in general terms, if the default leverage doesn’t suit you, you can alter it as follows:

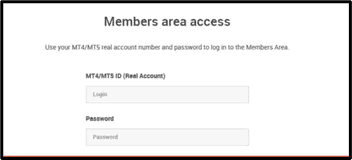

Log into your account (see below):

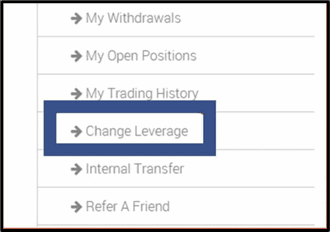

Somewhere on the emerging page should be a button for ‘Actions’. Hover the mouse over it, and ‘Change Leverage’ should pop up with other options (see below):

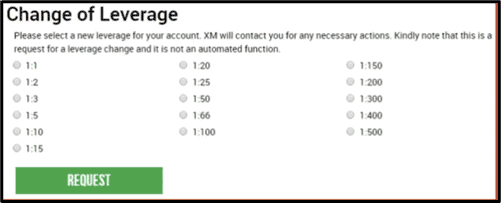

Click on ‘Change Leverage’ and expect to see a table something like the image below:

Select the new ratio. In this instance (and with most brokers), the site accepts the request subject to measuring it against allowable protocols. Thus, the leverage-changing process explained above is not routinely as simple as clicking on a table (though, in some cases, it works). Indeed, it can be a little frustrating and bureaucratic. However, stay patient, take it step by step, and a suitable leverage ratio will come your way. It may not be as high as you would like, but accept that the broker knows a thing or two about risk, and the final decision is in your best interests.

Related Articles

- The Best MT4 Forex Brokers

- How to Set Stop-Loss and Take-Profit in MT4

- How to Use the MetaTrader4 Forex Trading Platform

Conclusion

The mechanics of accessing leverage are the least important aspect of the process. Zoning in on the appropriate leveraging level is priority one, two and three. Our advice is to start small and gradually pick up the pace. Remember that forex markets are volatile, no matter which pairs you transact. Finally, containing the leveraging risk is one thing – adding unnecessary market risk can be too much to bear. Therefore, our most vital caveat to make your equity and the leverage behind it stretch as far as possible is this: always trade with stop losses, and stick with high liquidity trades. With the bank’s money on the table, it’s the only system that works.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.