Forex indicators, one day you swear by them, and the next day you swear at them! Can’t seem to live without them, but you can’t kill them either! How could we trade foreign exchange without technical analysis? Indicators can be fickle friends at times, but it is up to the user to understand what works best when, how to set parameters effectively, and if more than one indicator is necessary to confirm a trend or signal the beginning of new price behavior. With all the advances in the physical sciences, one would think that the universal laws that dictate the predictable effects of natural forces could be applied to currency market dynamics. Has this idea ever been investigated? Let’s take a look at the best forex indicators that can be a valuable tool within trading.

Physical sciences and mathematics have been used before

The physical sciences literally escalated when Newton published his historical treatise describing the major forces of nature. In order to reach his conclusions, he actually had to invent calculus in the process. He was a bit of a recluse, living on a farm far from plague-infested cities, but he finally did make his discoveries known, and the world has been different ever since. Even Einstein and his cohorts looked to mathematics for hints in developing their various theories. Financial “scientists”, if you will, have been vigilant searching for pointers from their math textbooks to unravel the dynamics of market forces and determine if they also follow similar natural laws.

The Elliot Wave Principle

The most notable outcome for associating natural laws with predicting market behavior was the Elliott Wave Principle. Ralph Elliott, an accountant, spent an exhaustive amount of his time studying the movements of the Dow Jones Industrial Average. He discovered that the ever-changing stock market actually reflected basic harmonic waves found in nature, which provided a foundation for his rational analysis to follow. He further postulated that price behavior in financial markets is repetitive in nature, not necessarily in constant time periods or wave amplitude, but with enough predictability to be of value.

Outside of his primary wave theory, Elliott is perhaps better known for his observation that wave patterns of the same degree tend to correlate by specific ratios depicted as in a Fibonacci sequence, a famous mathematical series named for its Italian creator who was actually studying the predictable growth rates of rabbit populations. Adding two previous numbers together to get a third, and so forth produces the famous series:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, ……………

The “ratios” are computed by dividing a term by the term that follows, and then the next by the next, etc. The pertinent ratios eventually result in irrational numbers, but the key ones are 0.618, 0.382 and 0.236. The first ratio, 0.618, is commonly referred to as the “Golden Ratio” and has been revered by artists and scientists alike. There is a reason why an “8X5” picture looks pleasing to the eye. Elliott demonstrated that in both his impulse and corrective waves, predictable reversal points occurred at 61.8%, 38.2% and 23.5%. The theory has evolved as a powerful tool for traders to forecast highly effective entry and exit points for trends in the currency markets.

Fibonacci ratios can be seen everywhere

Fibonacci ratios have also been detected in various forms throughout the natural world, from seashells to the form of spiral galaxies. On an atomic level, the double helix of the DNA molecule, the building block of all forms of life, displays precise Fibonacci geometry. Even our bodies exhibit branching patterns in our blood vessels and bronchial tubes that abide by the Golden Ratio. More curious is that these ratios appear in nearly every natural form of growth, as well as in computer generated “fractals” in the emerging field of chaos theory.

Chaotic systems and fractal geometry

Chaotic systems tend to reflect a related organization within their turbulence of swirls and eddies. Their final behavior depends critically on the conditions that exist initially, and when charted by computers, geometric patterns with a high degree of order emerge. Financial “scientists” were quick to study chaos theory and its fractal geometry, but despite much effort, very little in practical applications emerged. However, there was one engineer/programmer who was able to develop a fractal-type indicator.

Hans Hannula introduced his Polarized Fractal Efficiency (PFE) indicator in 1994.

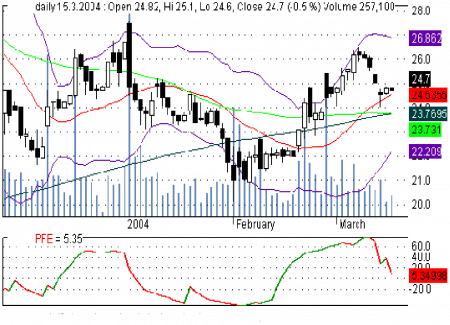

The PFE measures the efficiency of price movements from point to point. When a price moves a short distance to the next point, it is deemed efficient by the measure. The more “squiggly” the movement, the less efficient it is. High and low readings revolve about a mean of zero. The “insight” relates to a maximum or minimum reading indicating the end of a major trend. The “uniqueness” of the measure is that a “hooking” pattern is often displayed before a “max” is reached as below “March” above. Traders are advised to hold onto the trade before the subsequent exit point.

Trading literature also suggests that various markets have specific maximums and minimums, perhaps another correlation to some natural law or ratio. However, the PFE is not a leading indicator like the Fractal Dimension Index. The calculation methodology is complex, but it is still based on past price behavior. Traders are advised to use this measure with another indicator, perhaps a moving average, and to employ trailing stops. The indicator may not be readily available on most trading platforms, but the customized code for Meta 4 can be accessed on the Internet.

Conclusion

Today’s most popular indicators have stood the test of time as reliable tools that are not perfect, but do provide the consistency that traders desire. New age physics and math may hold clues for new indicators that have natural universal laws as their primary foundation. While market forces are as much about natural forces as they are about human psychology, the jury is still out as to whether new age indicators can really deliver a competitive advantage. As with any indicator, the “beauty” is in the “eye” of the trader and their ability to fine tune respective parameters to provide the consistent signals that they require.

Read more about Fibonacci ratios here.

Learn more about a number of indicators here.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.