All forex traders ask themselves When to take profit when scalping forex but many beginner traders get caught up in the excitement of placing their first trade and rush into executing their trade orders. Often, little attention is given to where a profit target and stop-loss order should be positioned.

All successful traders have a solid trading plan. Stick to the process and you stack the odds of making consistent returns in your favour. Knowing where to take profit while managing your risk is a crucial part of trading.

The purpose of this article is to discuss various ways to take profit when scalping in forex while managing your risk appropriately.

The Benefits of Setting a Take-Profit Level

Trading has one common goal in mind: to make money.

Setting a take-profit level allows you to bank your profits on any given trade, and it should be seen as the potential reward you will get for taking the risk in the first place.

Knowing where to place your take-profit level, even before you enter a trade, allows you to calculate your risk/reward ratio. The same goes for your stop loss, which determines the potential loss or risk on a trade.

Ideally, all trades should offer a reward potential that outweighs the risk. For example, let’s say that a scalping strategy averages 11 pips on the winning trades, while the losing trades average 6 pips. For this strategy to remain profitable, it needs to win 40% of the trades taken (minus the cost of the spread) to produce an overall profit.

Setting a take-profit order when scalping is one thing, but knowing where to place it can be determined using various methods, which we will look at in the next section of this article.

Where to Set Take-Profit Levels When Scalping Forex

There are various methods that can be used to establish a take-profit level when scalping the forex market.

Image for illustration purposes only

One of the simplest methods to determine your take-profit level is to use a fixed risk vs. reward ratio.

The chart example above shows the EUR/USD forex pair on a 1-minute timeframe, which is a popular scalping timeframe to use.

To use a fixed risk/reward ratio to set your take-profit order, you would first need to know where your stop loss needs to be placed. The example above assumes that a short entry was taken below the red arrow pointing downwards and that a stop loss was placed a few pips above the preceding green candlestick.

With this example, the take-profit level was determined by doubling the distance from the entry order to the stop loss in pips and projecting it lower (in the case of a short position).

This example offered double the reward versus the risk taken on the trade. Some scalpers might prefer to increase their reward potential by a larger ratio, but this example was intended to simply show you what the fixed risk/reward ratio is and how it is calculated.

Image for illustration purposes only

Fibonacci extension ratios are another common tool used by scalpers to forecast where price might move towards during a trending environment and where potential support or resistance might step in.

Profit taking often occurs at Fibonacci extension levels, which makes it an excellent tool to decide where you might want to place your take-profit orders.

The chart image above shows how the Fibonacci extension levels were drawn by selecting three anchor points on a chart (labelled A, B and C) and how extension ratios were projected lower.

During strong trending conditions, a market will typically reach the 138.2%, 161.8%, 178.6% and 200% extensions or higher.

Assuming that the sell and stop-loss orders were placed at the same levels as the previous fixed ratio method, with this method, a take-profit order could have been placed at either of the above-mentioned extension ratios while still offering a decent risk/reward ratio.

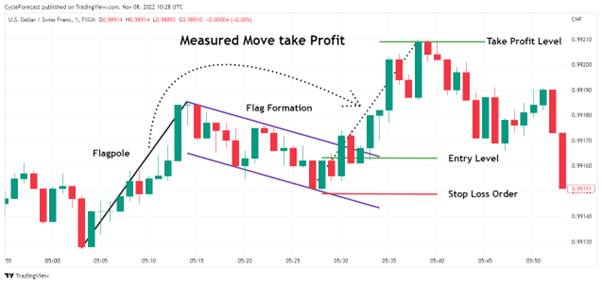

Image for illustration purposes only

Our final method for selecting a take-profit level is called the measured move technique, which is typically used with chart patterns.

Scalping strategies rely heavily on technical analysis methods such as chart patterns. The chart image above shows a very popular pattern called the flag pattern that formed on the 1-minute scalping timeframe.

Scalpers who follow this pattern will generally enter at the lower part of the flag formation and use the same height as the ‘flagpole’ part of the pattern and project it higher (in this case, during a bullish setup) to determine their take-profit level.

The target objective therefore uses the same ‘measured move’ of one of the pattern parts – in this case, the flagpole, which is where the term measured move comes from.

How to Set a Take-Profit Level

Now that we have discussed various methods that can be used to select your take-profit level, we will quickly take a look at the procedures for setting the various orders on your trading platform.

The first step is to open your order panel – you will need to select and fill in various fields before you execute a trade position.

Secondly, you will need to decide whether you are going to buy or sell the market and make your selection.

Thirdly, you will need to select the correct type of entry order (i.e., market order, limit order or stop order).

The fourth step requires you to enter the actual price at which you want to enter and the position size.

The fifth step is where you need to ‘attach’ your take-profit and stop-loss orders. This can generally be done by either entering the price at which you want to place these orders, or the number of pips. Attaching your take-profit and stop-loss orders in this way will ensure that they are automatically placed when your entry order is executed.

Once all of your selections have been made, proceed to the final sixth step and submit the entire trade order.

When your order has been accepted and executed, most trading platforms will display the actual orders on your chart. The image above shows an example of an open position with the take-profit level above the entry level and a stop-loss order below the entry level.

Note: the order placement procedure above might look different on other platforms, but the actual selection of the required inputs should be the same.

An Example of a Scalping Forex Trade

What follows is a simple 1-minute scalping strategy using one indicator and either one of two take-profit methods.

Image for illustration purposes only

With this scalping strategy, the Bollinger bands indicator was applied to the 1-minute timeframe of the GBP/USD using the 20-period, 2-standard deviation settings on the day that the European session commenced.

The upper and lower blue lines are the Bollinger bands, and the orange line that runs in the middle is a simple moving average that by default forms part of the indicator.

Bollinger bands expand during trending phases and contract during consolidation phases. Price also tends to revert to the simple moving average, or the opposite side of the Bollinger bands, after either side of the Bollinger bands is reached or breached.

This reversion in price behaviour at the extreme ends of the Bollinger bands is what traders look for when using this indicator to scalp the forex market.

Prior to the start of the European trading session, the GBP/USD was creating lower lows (LL) and lower highs (LH), meaning that the main trend was bearish and that only sell setups were taken.

Sell setups using this strategy occur as follows:

- Wait for a candlestick to close above the upper 2-standard deviation Bollinger band.

- Wait for a bearish candlestick to cross back below the upper Bollinger band.

As soon as a bearish 1-minute candlestick closes below the upper Bollinger band, a short entry can be taken with a stop loss 2-3 pips above the most recent swing high.

Image for illustration purposes only

This brings us to our first proposed take-profit method, which is dynamic in nature – meaning that the take-profit level can change as the lower Bollinger bands expand or contract.

The entry example that occurred in the middle of the chart shows how price exited the upper Bollinger band a couple of times, but only after the second time did a red candlestick close back below the upper band.

A sell order was then placed below that red candlestick and a stop-loss order above the most recent swing high.

With the dynamic take-profit method, the trade position can be closed once price touches the opposite band – in this case, the lower Bollinger band. The take-profit level is therefore not set beforehand (when the trade position is opened), but profit is only taken when price reaches the lower band.

Image for illustration purposes only

The second take-profit method with this strategy is the fixed risk/reward ratio method that we discussed earlier.

This method relies on the same entry procedure as before, with the only difference being that the take-profit level is simply double that of the initial risk.

A scalper should always calculate the distance from the intended entry level to the lower Bollinger band before an entry is taken. This is to ensure that the target level has a favourable risk vs. reward ratio. Some setups might not offer enough distance toward these lines to make the risk vs. reward potential worth it.

The Best Brokers for Scalping Forex

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Conclusion

How to quickly take profit when scalping in forex is a crucial consideration when it comes to this fast-paced trading style.

The methods that we discussed in this article all made use of common techniques to determine take-profit levels and will hopefully function as a reliable guide to help you with your own trading.

People Also Read

- Chart Patterns Scalping Strategy

- What is the Relative Strength Index?

- Fibonacci Retracements and Projections

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.