Using risk-reward techniques in forex trading is one of the easiest ways to instil greater discipline into your strategies. The principles are simple to follow and introduce aspects of money management as well as whether the price of a currency pair will go up or down. If followed, risk-reward techniques can help you trade more professionally and guide you to book trades in position sizes that optimise your investment returns.

What is the risk-reward ratio?

Applying the risk-reward ratio to trading decisions involves quantifying the anticipated loss on a trade and comparing this to the trade’s potential profit. It works on the principle that when entering into a trade, you cannot be sure if it will be a winning or losing one, but using stop loss and take profit instructions allows you to determine what the potential risk or returns are likely to be.

To perform a risk-reward forex ratio calculation on a trade, you can simply calculate the number of pips from your entry point until your stop-loss level is hit, comparing that to the number of pips between the trade entry price and your projected take profit level. If your analysis shows that a failing trade would post a 40 pips loss, but a winning one would record an 80 pips gain, then the risk-reward ratio would be 1:2.

A trade set-up with a potential 20 pip loss and 100 pip gain would have a risk-reward ratio of 1:5. It is worth noting that the risk-reward ratio relates to the size of potential returns, not the likelihood that the trade will be a winner or a loser. A strategy with a risk-reward ratio of 1:2 and a win-loss ratio of 1:1 would, in cash terms, be more successful than one with a risk-reward ratio of 1:3 and a win-loss ratio of 1:5.

What is a good risk-reward ratio for forex trading?

Risk-reward ratios aren’t inherently good or bad. Their benefit stems more from using them to understand your personal risk appetite and to develop a better understanding of market conditions. They can then be used to determine optimal times to open and close forex trading positions and what size those positions could be.

There are various factors to consider when determining whether a risk-reward ratio encourages or discourages you from taking on a trade, the first being how much you are willing to lose. A more conservative trader might adopt a policy of only taking on trades with a risk-reward ratio below 1:3. A more aggressive one might take on trades with a higher ratio.

Using the risk-reward ratio also needs to factor in market conditions, specifically price volatility. The range of any typical price move in a particular period will be a function of the market involved; crypto prices, for example, are typically more volatile than those of gold. Overall market volatility will peak and trough as news flow impacts the financial markets.

Reverse engineering the process would allow you to find the right market for your personal approach. Suppose your preference is to use a higher risk-reward ratio; in that case, there may be a benefit from identifying and trading a more volatile market, one that has price moves that make winning possible in a shorter time. Or else you could be holding a position and tying up capital, which could be better used elsewhere.

If news events are causing the prices in all forex markets to fluctuate to a greater extent, then once again, that would signal a time when traders with a higher risk appetite become more active. A strategy with a higher risk-reward ratio is more likely to be confirmed as a winner or loser in a shorter period. The reverse could also be the case, with quieter markets being favoured by traders with lower risk-reward appetites.

The ideal risk-reward ratio for you or your strategy can vary over time. It might also be that you take on positions that run different strategies using various risk-reward ratios. All in all, risk-reward ratio analysis is more effective when other factors are taken into account, which is preferable to just considering the ratio in isolation.

Sizing positions using risk-reward

Once you have established the potential gains or losses from a particular trade, you can introduce money management techniques to finesse your returns.

If you are considering two trading opportunities which you believe have an equal likelihood of success, applying more capital to the one with the greater risk-return ratio should result in greater overall financial returns. To enjoy the benefits of adopting a diversified approach, you might not want to allocate all of your capital to that one trade, but at least your analysis has highlighted that approach as an option.

Managing potential risk is a core element of successful trading, and using the risk-reward ratio when considering the potential downside can also help your trading returns. Consider a scenario where you have $500 in your trading account and are considering a sequence of trading situations with a risk-return ratio of 1:8. That high-risk scenario comes with an appropriately low projected win-loss ratio of one in six. Staying in the game long enough to run the strategy effectively becomes crucial. If you were to allocate $100 to each trade, then the statistics suggest it is easily possible for you to experience five losses in a row. Your account will be wiped out by the fifth trade, leaving you unable to continue running the strategy and benefitting from the winning trade, which would post a profit of $800.

An example trade using risk-reward

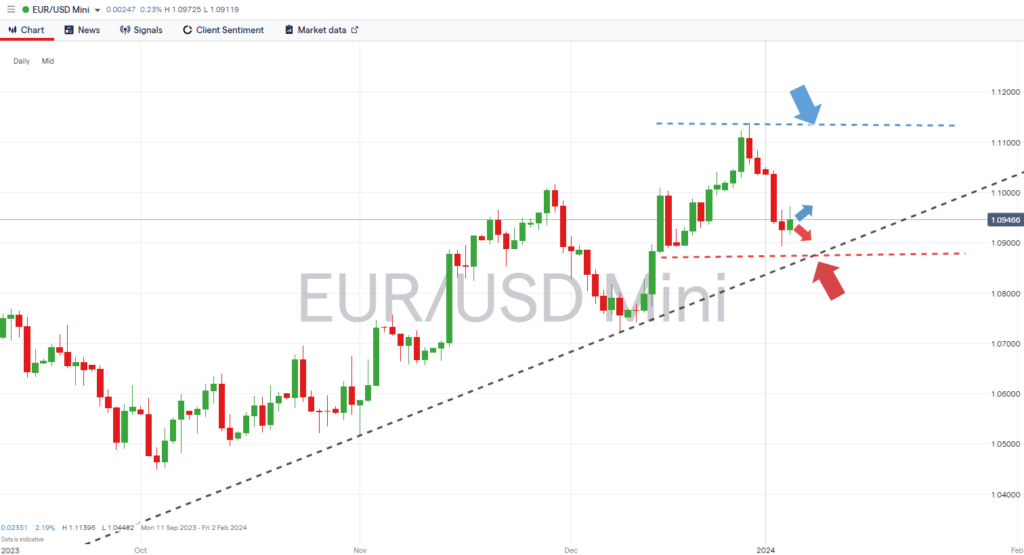

Working through the steps of trading examples can illustrate how risk-reward can be used to improve your trading. The trading opportunity illustrated below in the EURUSD market has a risk-reward ratio close to 1:3.

Buying EURUSD at a trade entry point of 1.09414 is based on the belief that the upward trendline will hold and the price will move upward to test the recent high of 1.11396. The stop loss on the trade is set at 1.08760, just below the trendline.

Points loss on losing trade: 1.08760 – 1.09414 = -0.00654

Points gain on winning trade: 1.11396 – 1.09414 = 0.01982

Risk-reward ratio = 1: 3.03

EURUSD price chart with risk-reward stop loss and take profit levels

Source: IG

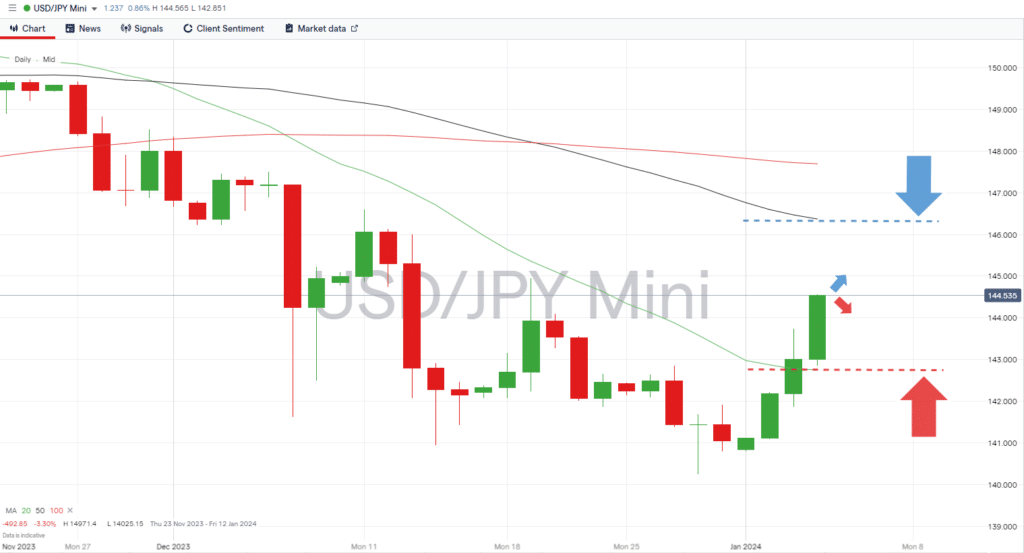

The trade below involves going short USDJPY with an entry price of 144.58. The take profit and stop loss orders are in line with the 20 and 50 SMAs on the Daily Price Chart, which results in a lower risk-reward ratio of approximately 1:1.

Points loss on losing trade: 144.58 – 146.37 = -1.79

Points gain on winning trade: 144.58 – 142.75 = 1.83

Risk-reward ratio = 1: 0.97

USDJPY

Source: IG

The risk-reward ratio offers an insight into the dynamics of each potential trade; however, a decision on which of the two would be the better option would also need to factor in the probability of the respective winning or losing outcomes.

Final thoughts

The above highlights how the risk-reward ratio should form part of your overall risk management analysis, but the probability of outcomes, as well as money management techniques, also need to be considered. You might think you are adopting a more conservative approach by taking on trades with a risk-reward ratio of 1:3, but if you are trading in too large a size, there is still potential to make excessive losses. A trader active in a market offering a higher 1:5 risk-reward ratio but trading in a much smaller size can, in overall terms, be considered to be more risk-averse.

Related Articles:

- Read about other methods for position sizing here.

- You can read more on risks here.

- The relative risk of a forex portfolio.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.