Whether you are trading foreign exchange pairs or any other tradable asset for that matter, the direction that prices take in a market is often directly related to what is called investor or market sentiment. In the forex market, market sentiment is often equated with the current mindset of major speculators, but where can we go to get an accurate reading on this mindset?

One common way is to read the Commodity Futures Trading Commission (CFTC) Commitment of Traders (COT) report. This US forex regulator produces these reports weekly on a range of different markets, but its report on various currency pairs in the forex market is viewed as a summary or proxy of the current state of the foreign exchange market. It can provide insights on shifting attitudes in the minds of major traders, which can suggest key market trend reversals.

In this article, you will learn more about how COT report forex versions are formatted and assembled, how to understand these reports, and how to incorporate their insights into your daily trading routine in order to leverage the benefits of COT reporting. Lastly, it you are either searching for a forex broker or have decided that it is time to switch loyalties, we will provide a table of best-of-the-best brokers in the market, based upon our ongoing review process.

What Is the Commitment of Traders (COT) Report?

The CFTC has been publishing its COT reports since 1962. The largest futures traders across the globe report their open positions to the CFTC, which compiles and verifies them before publishing. Before the millennium crossover, the CFTC released its report on a bi-weekly basis. It has since converted to releasing Tuesday data on Friday at 3:30pm EST. The reports provide a summary of open interest for futures and options and aggregate the data from three reporting groups: commercial traders, non-commercial traders, and non-reportable traders.

- Commercial traders: Corporate treasury staff constitute this group for large multi-national companies. These companies have long-term contracts for deliveries in international trade, which require the purchase of futures to hedge foreign exchange risk.

- Non-commercial traders: This grouping is where you will find large speculators. Once again, large financial institutions are in play in this space, often taking the opposite position of the commercial trader, who is more concerned with fixing its conversion rates over the near and long-term horizon.

- Non-reportable traders: Smaller entities below reporting levels set by the CFTC, along with retail traders, fall under this category. Their participation is generally insignificant with positions that change quickly. Analysts tend to ignore this group.

There are several iterations of the COT data in various reporting formats, but one single report receives the most attention for traders in the forex market. This report presents the open transactions, whether long, short, or net spread offsets, for each of these three groups. Of special interest is the degree of change in data for the non-commercial (i.e., large speculators) group.

Understanding the COT Report

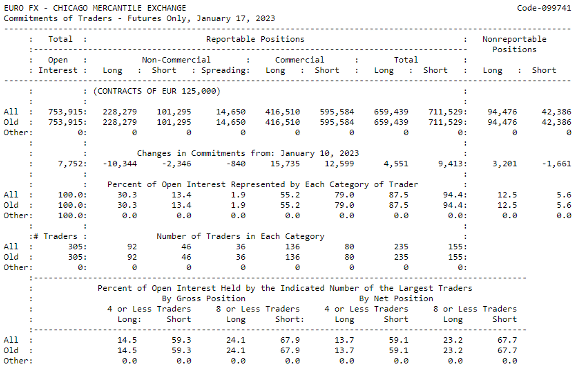

The CFTC provides various versions of the report. The COT data is published for a considerable number of assets, but only in a ‘raw’ view. Here is an example of what can be found on the CFTC website for the euro for Tuesday for the week ending 17th January 2023 for its legacy report:

Graphic courtesy of CTFC.gov

The columns present the open long and short positions for each group. ‘Spreading’ represents long and short contracts that offset one another. The next row of data provides the key insight for the week – the change in commitments from the previous week. For the non-commercial traders, long and short contracts in total declined for the week by 7,998 (10,344-2,346).

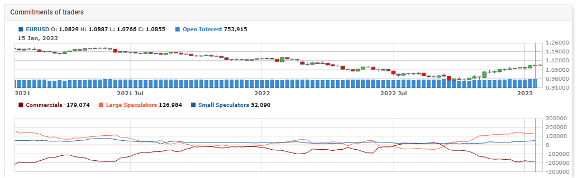

Traders can go directly to the CTFC COT webpage to access the numerical data for their chosen asset, but more convenient options exist. There are several websites that collate the weekly data and produce useful charts for evaluating long- and short-term trends in progress. Here is just one example of what these charts can look like:

Graphic courtesy of Myfxbook.com

It is important to note that these reports are lagging by a few days. At best, you will be making a judgement over the weekend following the previous Tuesday, when the market could have abruptly changed direction due to some subsequent event or economic announcement.

The key insight in these reports is the net change in positioning from week to week on a percentage basis. If a major sign of flipping is noted, as can be seen in the large speculators’ orange line after July 2022, then a prevailing trend may be coming to an end. A reversal in ‘EUR/USD’ prices occurred soon afterwards.

The Benefits of the COT Report

The Commitment of Traders report forex versions reflect changes in futures contracts for a specific currency. Learning to spot differences at a high level that are occurring between large commercials and large speculators, however, is the primary benefit of the COT. These fund managers are paid handsomely to anticipate when reversals are about to occur in the market, based on resources that retail traders do not possess. When a shift in sentiment begins to take shape, you will want to take notice and follow these folks to the bank.

There is another trading benefit to be derived from these reports related to commodities. The Canadian Loonie is tied to oil. The Aussie is tied to anything mined from the earth, and the Kiwi corresponds to agricultural products. A bullish sentiment shift of a pertinent COT report may also signal a similar shift in prices for its respective commodity in the market.

In summary, here is a list of pros and cons to be aware of when using COT reports for guidance:

Pros:

- Gives insights on how attitudes are changing for big-moneyed interests, primarily hedge funds, major investment funds, and commodity trading advisory funds.

- Suggests when positioning long or short in the market might be most beneficial.

- Gives additional insights on commodity prices where a major currency is involved.

Cons:

- Data is only produced once a week.

- Data is a lagging indicator by several days.

Trade Forex With Our Top Brokers

Are you looking for a broker that you can trust and rely upon, whether you are just beginning or looking for a change? There are hundreds of brokers in the forex universe, each one competing for your patronage. However, as with any choice, there are the best of the best, but also a number of shady characters to be avoided at all costs. Based upon our up-to-date reviews, the following brokers have established admirable track records for performance, safety and reliability:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Related Articles

- Forex Sentiment Analysis – A Beginner’s Guide

- What Is Market Sentiment in Forex?

- How to Use Futures Open Interest in Forex Trading

Concluding Remarks

Prices in the foreign exchange market, as well as for prices in other financial markets, are often moving in concert with investor sentiment. Finding an appropriate way to measure changes in this sentiment variable is often a prudent way to tip the odds in your favour as a trader, a necessary insight if you wish to become a veteran forex trader.

The aggregation of futures data contained in the Commodity Futures Trading Commission Commitment of Traders (COT) report is one useful source for this type of data. There are many websites that convert this data to visual charts and graphs. The benefits arise when you note significant shifts in positions held a week previously – but remember that these insights are lagging by nearly a week in time.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.