The forex market is by far the largest financial market in the world with trillions of dollars of transactions taking place on a daily basis. A large portion of these daily transactions are made by traders who trade for speculative purposes only, which makes the forex market a very competitive and potentially lucrative market to trade.

Traders will use any means of analysis at their disposal, such as technical, fundamental and forex sentiment analysis, to gain an edge in the competitive forex marketplace.

The purpose of this article is to highlight the importance of forex market sentiment indicators, how they work, and the various indicators available to gain that extra edge that all forex traders seek.

How Do Market Sentiment Indicators Work?

Forex market sentiment indicators are tools that are widely used by traders to gauge the general mood or outlook of all market participants engaging in currency pair trading. These indicators can be useful to identify whether a market is predominantly bullish or bearish, or whether a currency pair might be nearing a reversal.

There are a number of different market sentiment indicators available to forex traders. Some of the most popular include futures open interest, the Commitment of Traders (COT) report, and brokers’ position summaries.

The commonality between various market sentiment indicators is that they all offer information into the overall investor sentiment for a particular market. However, the metrics or factors that are used to calculate the values of these indicators may differ.

For this reason, traders will often analyse different forex market sentiment indicators to get a more well-rounded view of the overall sentiment, rather than focusing on one alone. Combining market sentiment data with technical and/or fundamental analysis is also a good approach followed by experienced traders.

Next, we will look at each of the above mentioned forex sentiment indicators, explain how they work, and discuss where you can find the necessary data to use in your own analysis.

Futures Open Interest

Unlike the forex market, which does not have a centralised exchange, futures exchanges are physical exchanges that offer a wide range of financial products, including equity futures, index futures, commodity futures, currency futures, and interest rate futures.

Because futures are traded on centralised exchanges, it is easier for these exchanges to report on important trading metrics such as volume and open interest, which in turn makes it easier to gauge market sentiment.

When it comes to the futures market, traders transact in contracts, whereas in forex, transactions take place in position or lot sizes.

Futures open interest simply refers to the number of active contracts (positions) that remain open on any particular futures market that have not been settled yet.

Although the futures market differs from the forex market in many ways, forex traders can obtain valuable information by analysing the open interest of the currency futures that trade on futures exchanges.

Open interest is calculated by taking the total number of new contracts added to a futures market minus the total number of contracts that have been closed or settled. For example, if 1,000 new contracts were added on any given day, while 500 contracts were closed or settled, then the open interest would increase by 500 contracts.

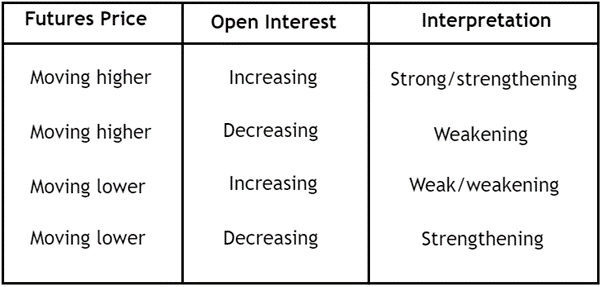

The table above shows how the price behaviour of the currency futures market, in combination with an increase or decline in open interest, can be interpreted to make decisions in the forex market.

Let’s say that you wanted to use the reported open interest data of the British pound futures as a forex sentiment indicator. If the open interest is currently increasing in conjunction with a rise in the price of the British pound futures, it can be interpreted as bullish and that the upward move in price is strong or even strengthening.

Forex traders can then use the futures open interest data and assume that the GBP/USD will likely also move higher.

Currency futures open interest data can be found on the websites of the Chicago Mercantile Exchange Group (CME) or the Intercontinental Exchange (ICE), which are updated on a daily basis.

The Commitment of Traders (COT) Report

The COT report is a weekly publication compiled by the Commodity Futures Trading Commission (CFTC) that show the positions held by non-commercial (large speculators), commercial hedgers and small traders in a variety of futures markets.

The report breaks down the positions held by each group into the overall amounts of long and short contracts, and also provides a net position for each market.

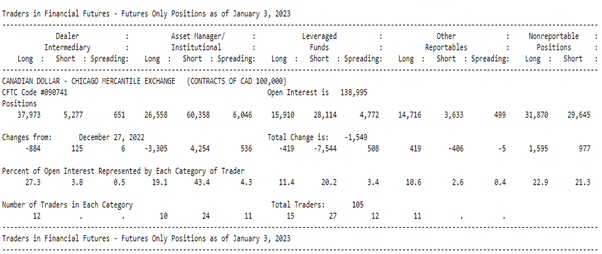

The report is released every Friday at 3:30pm EST and covers data from the previous Tuesday. Although the COT data is not available in real time, it is still a useful indication of market sentiment. That being said, it can be difficult to make sense of the COT report because the CFTC only releases the COT data in tabular format, as shown by the image below.

Image Source: CFTC

To the untrained eye, all the numbers presented in table format can be confusing, but charting the COT data instead makes it easier to interpret.

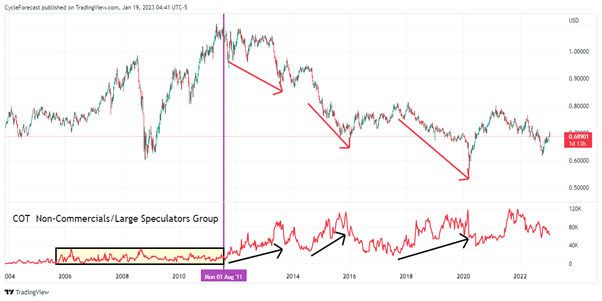

Image for illustration purposes only

Forex traders mainly focus on the large speculators group, as they are typically trend followers and have the financial resources to influence the price direction of a currency market. Meanwhile, the commercials group primarily use the futures market for hedging purposes.

On the chart above, the red line shows how the large speculators group continued adding to their short positions while the Australian dollar moved lower. Before the year 2011, the total amount of short positions that the large speculators group held stayed within a narrow range (yellow rectangle), and significantly increased right after the 2011 peak.

Before we move on to the next section of this article, it is important to note that there can be a delay between which direction price takes and what the COT data suggests these groups of investors are doing with their positions. It is therefore a good idea to incorporate other means of analysis to confirm trend direction or possible reversals.

Brokers’ Position Summaries

Many forex brokers offer position summaries that show the percentage of traders with long or short positions in each currency pair.

The data used in these summaries only reveals the sentiment of all the traders who are clients of the broker and does not reflect the market sentiment of the entire forex market. It is therefore important that broker position summaries are cross-referenced with other sources of market sentiment to see how accurate they are.

The size of a forex brokerage is also important if you want to gauge market sentiment using the position summary report. Large brokers with many clients will likely give you a better indication of overall sentiment compared to a small broker with fewer clients.

Business and Consumer Confidence Surveys

Business and consumer confidence surveys measure the strength of and confidence in a country’s economy. These reports can be used to predict future economic activity, and are therefore important forex sentiment indicators.

Business confidence surveys ask firms about their plans for investment, hiring and inventory over the next quarter. Consumer confidence surveys ask households about their plans for spending, savings and borrowing over the next year.

Both types of surveys are useful for predicting future economic activity. If businesses are confident about the future, they will invest more and hire more workers. If consumers are confident about the future, they will spend more money.

To get an accurate picture of a country’s economic health, it is important to look at both business and consumer confidence surveys. Together, these reports can give you a good idea of whether a country’s economy is strong or weak – and how this might impact the value of its currency in the forex market.

How Fundamental Analysis Influences Market Sentiment

In forex trading, fundamental analysis focuses on key economic data to determine the strength of a currency. Important monetary policy decisions such as interest rate hikes can have a big impact on a country’s currency.

Generally speaking, when interest rates are high, investors are willing to put their money into investments in that country in order to earn higher returns. This demand for the currency can help push up its value.

Likewise, when interest rates are low, investors may look elsewhere for better returns, leading to decreased demand for the currency and downward pressure on its value.

As such, fundamental analysis plays an important role in influencing market sentiment.

Related Articles

- Forex Sentiment Analysis – A Beginner’s Guide

- What Is Market Sentiment in Forex?

- How to Use Futures Open Interest in Forex Trading

Conclusion

In this article, we discussed some of the most popular forex sentiment indicators available to perform your own analysis and the important relationship between fundamental analysis and market sentiment.

Forex market sentiment indicators can be a useful tool in a trader’s arsenal as they provide helpful insight into underlying shifts in trader behaviour and the potential impact of these shifts on the currency market.

Combining forex sentiment analysis with other means of analysis can greatly help in determining the overall mood of market participants and the possible future direction of a currency pair.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.