If you are a beginner or even a tenured retail forex trader, you will have soon learned the importance of approaching the forex market with a well-practiced strategy. Developing a strategy is what will tilt the odds in your favour, and one way to do this is to discover what is going on in the minds of major speculators.

Veteran traders derive insights from a report published every Friday by the Commodity Futures Trading Commission (CFTC), which goes by the name of the Commitment of Traders (COT) report. This forex regulator in the US collects outstanding transaction data from futures and options exchanges on a weekly basis. The aggregation and compilation of these data submissions take place on the Tuesday of the week, with release on the following Friday.

Although the COT report contains lagging information, a great deal has been written about how to use its insights to determine trends and potential reversals in the market, whether you are a position, swing, or even a day trader. In this article, you will learn more about the COT report, how to incorporate a COT report trading strategy into your daily routine, and then review an example, which will show signals for going both long and short. Lastly, in case you are looking for a trustworthy broker, we will share our list of the top-rated brokers in the industry.

What Is the Commitment of Traders (COT) Report?

The CFTC routinely collects data related to futures and options to ensure compliance with various regulatory standards. After realising the benefit of investors knowing position changes on an overall basis, the agency began publishing weekly versions of this collected data in 1962. The reporting groups are commercial traders, non-commercial traders, and non-reportable traders, defined as follows:

- Commercial traders: This group is composed of large global corporations and banks that are hedging foreign exchange risk related to international trade agreements.

- Non-commercial traders: This group constitutes the large speculator pool and is the most important of the three categories. It includes major hedge funds, financial institutions, commodity advisory firms, and other investment companies focused on forex speculation.

- Non-reportable traders: This group includes smaller companies that fall beneath the CFTC’s reporting guidelines, as well as the world of retail forex traders and brokers. Analysts tend to ignore this category and favour the inclinations of major speculators.

The data is collated for a multitude of assets and can pertain to foreign currencies, commodities, and just about any other asset where futures and options are transacted. The CFTC also publishes various versions of the data, based upon the classifications chosen by data submitters. However, the legacy version of its reporting is the most cited and studied format of this information. A snapshot of the report is as follows:

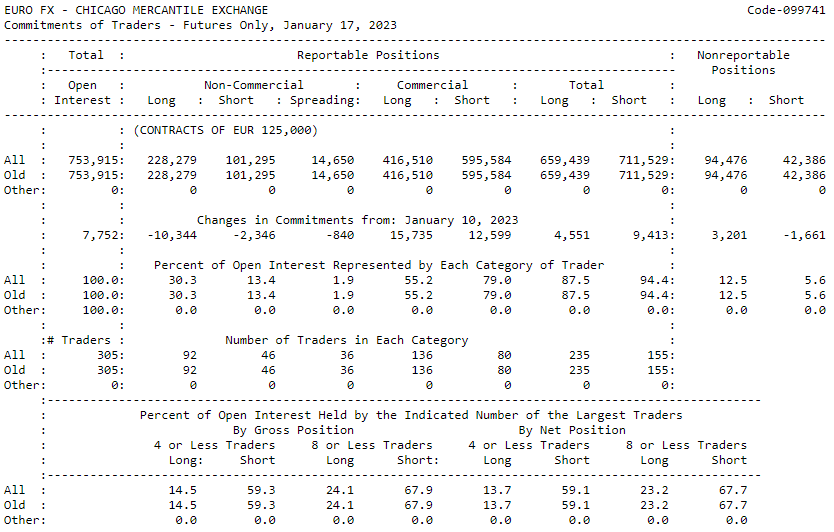

Graphic courtesy of CTFC.gov

This compilation of data for the euro refers to the reporting on Tuesday, 17th January 2023. The data was released on Friday, 20th January, at 3:00pm EST. Open interest relates to the number of outstanding contracts. Long contracts anticipate the euro strengthening, while short contracts expect the opposite. Spreading refers to two netting long and short transactions.

The value of these reports is to spot when significant changes occur in key data points from professional speculators. These differences can signal a potential reversal for prices for a chosen currency. In this report, changes from the previous week appear beneath the heading, “Changes in Commitments from:”. Significant shifts on a percentage basis are important signals.

For large speculators (i.e., non-commercial traders), long contracts decreased by 10,344, while short contracts fell 2,346. This group remains net-long by 126,984, computed by subtracting 101,295 from 228,279. Unless you want to maintain spreadsheets on your own to track changes in the data over time, it is highly recommended that you choose to use one of the many websites that collate the data each week and produce updated charts for your review.

How to Use the COT Report in Forex Trading

There are a considerable number of well-meaning explanations and videos on the internet designed to tell you how to use COT reports in forex trading, but many of these may appear more complicated than necessary. The key variable that deserves your attention is how the large speculators in the industry are changing their mindset. These major hedge funds and fund managers have ample capital and staff to research the fundamentals to determine the proper direction that prices might take in the future. Retail traders are advised to follow their lead.

In this regard, it is helpful to find a website that will take the raw COT data and convert it to visual charts for your use. It is much easier to spot trends and interpret how the various data points correlate to previous pricing behaviours. Here is just one example of one of these websites:

Graphic courtesy of Myfxbook.com

These charts were produced following the Friday release of the COT data for the euro for Tuesday, 17th January 2023. The large speculator orange chart line is in the lower section of the graphic. This group gradually unwound their short positions over time, but the line formed a plateau in July 2022. Notice how this chart line then began shifting to long positions before forex prices reflected this upward pressure. Presently, this indicator is starting to recede, which might be an indication that the rising trend of the euro may also be due to weaken.

An Example Trade Using the COT Report

When do you know when to go long or short from COT data? Let’s look at this example:

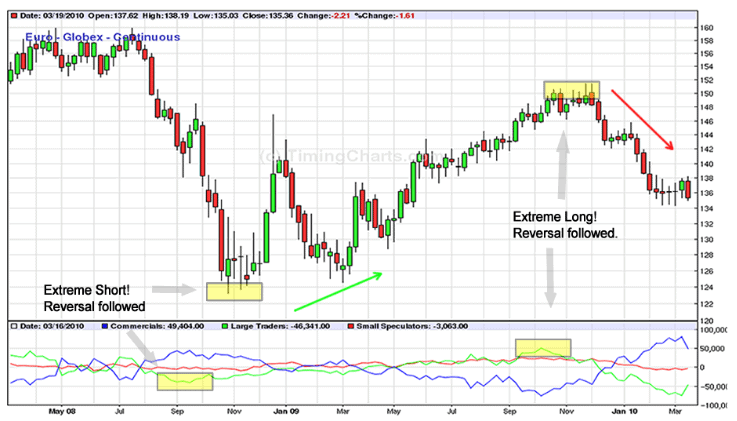

Graphic courtesy of Daytradetheworld.com

The chart shown above depicts the pricing behaviour of the euro over 24 months, along with COT trending data supplied on the bottom of the chart. The key takeaways are when the green line for large traders/speculators flattens and then changes course ahead of a significant reversal. The sections highlighted in yellow show reflection points for going long and then, later, going short.

Can a short-term trader also glean valuable information from the weekly COT data release? Once again, a major shift in the positioning of large speculators in the weekly data is a signal to recognise. Take time to gain experience of how to interpret the COT data, and you will soon have enough confidence to incorporate it into your daily trading strategy.

Trade Forex With Our Top Brokers

Are you looking for the very best-of-the-best forex brokers in the industry? If so, search no further, because we have assembled the table below of our top brokers, based upon our up-to-date reviews of the forex industry:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Related Articles

- What Can the Fear and Greed Index Tell Us About Forex Markets

- What Is Market Sentiment in Forex?

- What Is the COT Report in Forex Trading?

Concluding Remarks

Following the changes over time in the weekly COT data can improve your odds when trading foreign exchange pairs. Key insights are when large speculators suddenly reverse their positioning in the market, whether over an extended period or even in one week.

The data release may lag the market, but, as shown above, major shifts can occur well before prices switch direction. Shifts observed in commodity currencies such as the Loonie and the Aussie can also be signals that prices for respective commodities will shift in tandem. Take time to familiarise yourself with COT reports and benefit accordingly.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.