Most novice traders have likely heard the term ‘volatile’ used to describe different markets or specific currency pairs, but what is volatility, and how may it impact your trading?

In simple terms, volatility is a measure of how much the price of a market changes over time, and depending on how volatile a market is, how risky it is to trade such a market.

In general, the higher the volatility, the riskier a market may be to trade. However, this doesn’t mean that volatile conditions are necessarily a bad thing. In fact, some traders such as scalpers actually seek out volatile trading conditions to profit from.

In this article, we will explore what volatility is, how it is measured, and what it means for traders.

The Meaning of Volatility

Volatility is closely associated with risk. When a market experiences large swings that often move fast and that are either unexpected or related to some economic news events, such a market is considered volatile.

During times when a market’s price does not fluctuate dramatically and moves steadily, it is considered less volatile.

As mentioned before, volatile conditions, especially the ones where volatility is expected, offer the ideal trading conditions for active traders such as scalpers. Important economic news events such as interest rate decisions, for example, can increase the volatility in major forex pairs, which scalpers often like to trade.

Volatile trading conditions might not suit every trading style though, and as always, it is a good idea to take note of important economic market events and to use a trading strategy that includes strong risk management techniques.

Types of Volatility

Understanding volatility and knowing how it is measured is an important part of being a knowledgeable trader.

One way to measure how variable a market’s price fluctuations are is to look at how volatile prices have been historically. Historical volatility measures the size (or range) of any given day’s price and then compares it to historical values. Calculations are based on the standard deviation of price that is then multiplied by the square root of the number of periods of time.

The number derived through this calculation method is expressed as a percentage, making it possible to calculate daily, weekly, monthly and even annualized volatility.

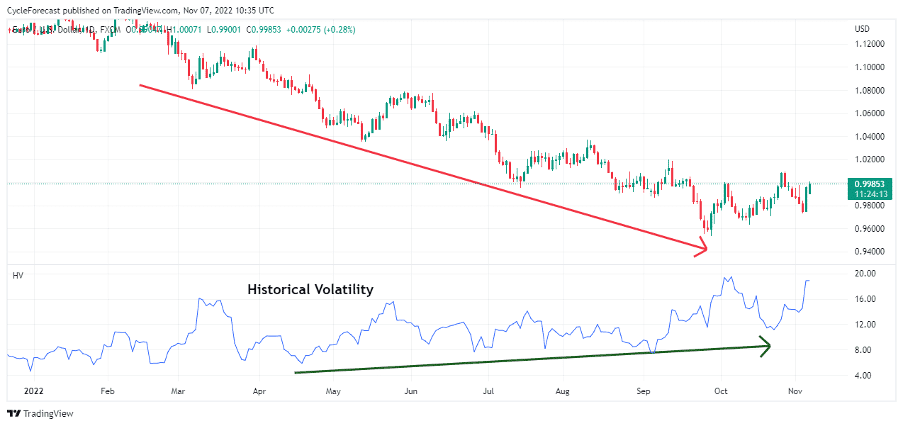

Image for illustration purposes only

The chart image above shows the historical volatility (HV) of the EUR/USD on a daily timeframe and how it has steadily increased during the strong bearish decline. Luckily for us, we do not have to manually calculate historical volatility, but it is worth noting how it is calculated if you are more mathematically minded.

If your trading platform has the historical volatility indicator included, then it is as simple as applying it to your chart for quick reference.

Implied volatility (IV) is another type of volatility and an important metric for pricing options. Traders look at IV to determine how the market views where volatility could be heading in the future, and it is only a measure based on probabilities.

The higher the implied volatility of a market is, the more expensive put and call options become.

Options trading falls out of the scope of this article, but for reference, options are derivative financial products. Option prices depend on the likelihood that the price of a particular market will increase by a specific amount (called the strike price or exercise price) within a certain period of time.

Put options are contracts that give the holder the right to sell a security at a certain price, while call options are contracts that give the holder the right to buy a security at a certain price.

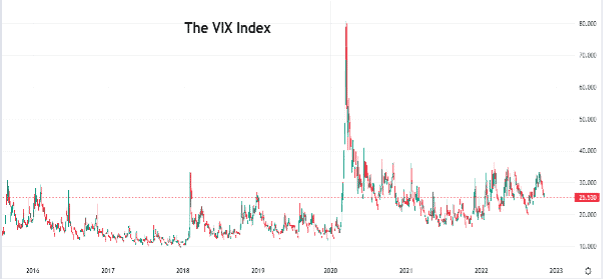

Volatility in the stock market can also be seen though the Volatility Index (VIX)

Image for illustration purposes only

The image above shows what the VIX Index looks like on a chart.

The CBOE Volatility Index (VIX), also known as the ‘fear index’, was first introduced in 1993 by the Chicago Board Options Exchange (CBOE). The intention of this real-time exchange is to measure the expected volatility in the stock market over the coming 30 days and is derived from the S&P 500 index options (SPX).

Managing Volatility

During periods of high volatility, some traders might not be comfortable with unpredictable and wild price swings. It is therefore advisable that you determine which trading style suits your personality best. Not everyone likes volatile conditions, while others thrive off them.

For example, long-term investors may find short-term volatility distressing, which is generally amplified during volatile market conditions. It is therefore important for long-term investors to factor in periods of elevated volatility and to stay the course with their trading plans.

Trading styles that rely on highly volatile market conditions require solid risk management techniques and a constant eye on the markets traded. Day traders and scalpers generally fall under this category and may benefit from elevated volatility.

Whatever your trading style might be, sticking to your trading strategy while managing your risk properly remains a crucial part of trading.

Conclusion

Volatility is an important concept for traders to understand, as it can have a big impact on the prices of a market. By understanding what volatility is, how it works, and where to find information on how volatile a market is, traders can make better-informed trading decisions.

While a volatile market might be seen as inherently risky, there are traders who rely on volatility to execute their trading strategies. Some traders might get distressed by volatility, but in the end, volatility will inevitably show up in any market.

As long as you always understand the risks involved in trading and use proper risk management techniques, you should be able to deal with volatility, whether it is profiting from it or having to deal with potential adverse swings that negatively affect your trading positions.

People Also Read

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.