Irving Fisher, an American economist of note, developed the Fisher Effect (FE), also known as the Fisher Hypothesis, in the early 1900s. The Fisher effect equation posits that the real interest rate in a domestic market will be the difference between the nominal interest rate, which is what a loan might be paying, or a savings account might be earning, and the expected rate of inflation. Stated simply as an equation:

Real Interest Rate = (Nominal Rate) – (Inflation Rate)

Consequently, for countries with identical real interest rates, their nominal interest rates will differ due to their individual expected rates of inflation. Fisher published several economic concepts over his lifetime and summarised them in his 1930 treatise, entitled ‘The Theory of Interest’.

Fisher expanded his thesis into the domain of foreign exchange prices, which has a bearing on how forex rates might change over time – a dynamic that impacts forex traders across the globe. In this case, the International Fisher Effect (IFE), also known as the Fisher Open Hypothesis, predicts how various forex rates are expected to change in the future. Per one source, the IFE is an economic concept that states, “the difference between the nominal interest rates of any two countries is equal and proportional to the changes in their exchange rates at any given time”.

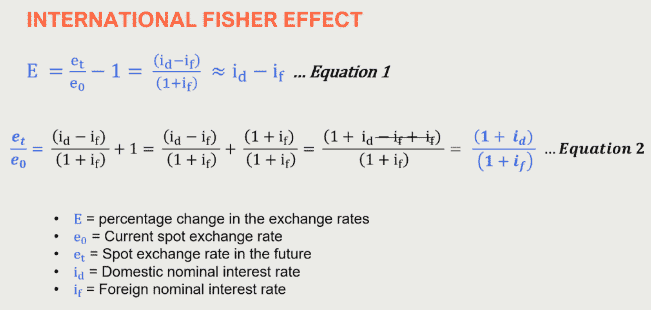

The basic IFE formula can be derived in a few steps from the Fisher Effect formula and is presented in the graphic below:

Source: Penpoin.com

The International Fisher Effect holds that investors will keep assets denominated in depreciating currencies only to the extent that the interest rates are sufficiently high enough to balance the expected currency losses. This point is especially important for both investors and governments of countries with currencies expected to depreciate. In order to attract and retain foreign investment capital inflows to such countries, it is vital that interest rates exceed expected losses on foreign exchange.

Fisher’s concepts were important in forecasting the direction of exchange rates over longer periods of time. Before his conceptualisations, predictive indicators relied only upon interest rates, but a more reliable prediction method was assured by modelling both domestic and international effects over time. Interest rate projections may be short-term in nature, but when combined with expected inflation rates, investors could now make better long-term investment decisions.

Related Articles

Background to the fisher effect

Who was Irving Fisher? According to public statements made by many economists, and the likes of James Tobin and Milton Friedman, Fisher was “the greatest economist the United States has ever produced” (source: Time).

Fisher’s seminal period was during the first four decades of the 1900s. He published numerous works on such topics as utility theory, interest and capital, monetary economics, and debt-deflation. He has also been noted as the first economist to achieve celebrity status. Still, unfortunately, a few misguided statements before the Wall Street Crash of 1929 and during the subsequent Great Depression tarnished his reputation.

Nine days before the crash on 24th October, Fisher pronounced publicly that stock prices had reached what looks like “a permanently high plateau” (source: Time). He later assured the public that the market was “only shaking out of the lunatic fringe” (source: Yahoo), and on the day before the debacle, he told bankers that security values in most cases were not inflated. In the years to follow, Fisher lost most of his wealth and academic reputation, which was later resurrected in the 60s and 70s when his econometric models and mathematical theories were rediscovered.

His formulations are important because they involved a level of numerical sophistication that had yet to be appreciated in most circles of academic thought. When he was later rediscovered, the reliance on mathematical models to justify policymaking decisions was on the rise, and his concepts provided the foundation for the evolving field of econometrics to expand its influence.

The evolution of Fisher’s concepts about capital, money, interest rates, and expected inflation rates came at a time when policymakers and their supporting economists were limited in their ability to make forecasts over any extended period of time. His body of work ignited a new wave of forecasting specialties. Unfortunately, he did not live to see his approach canonised within the econometrics community that was soon to evolve.

The ability to model markets and the economies across the globe have come a long way in the past 50 years. While Fisher’s concepts revolutionised the field, today, his theories seem to be from another time. Financial modelling has moved on to a higher level, along with computers and data analytics. Although Fisher’s relevance may seem diminished today, his principles still find use in a variety of areas.

Examples of the Application of the Fisher Effect and its Limitations

Fisher’s concepts have been in use for more than a century, a remarkable feat in itself, but the relevance of his various theories is waning.

If you take a broad view of Fisher’s contributions, he argued that overall price levels in an economy were a direct function of the size of the money supply and the rate of inflation. Within the context of these guiding principles, forex analysts and traders can utilise the FE and IFE as tools to discern the future direction that floating exchange rates might take over time. A simple example is that a country experiencing high-interest rates can expect its exchange rates to depreciate.

What would a real-life example look like? Let’s assume that the current spot rate for the GBP/USD pair is 1.32. Next, assume that one-year notes in the US pay 4% and, in the UK, 6%. What would the IFE predict for the spot rate one year from today? After inserting values:

From the formula: Future Rate = 1.32 X ((0.04 – 0.06)/1.04) + 1.32

After calculations: Future Rate = 1.32 X (-0.0192) + 1.32 = 1.32 – 0.0253 = 1.2947

History has shown that the IFE is not good at near-term predictions. There are far too many other variables that may have an impact on short-term rates, many more so than just nominal interest rate differences. These other variables, like capital flows and trade, can also influence the value of interest rates, but the IFE has more relevance when looking at longer time periods.

Are there other limitations? The IFE resembles many of our favourite forex indicators. It may predict outcomes beyond one year on a reasonable basis, but it does not tell you when the change in direction might occur or what type of price behaviour might lead to the ultimate change. Much in the same way that the Relative Strength Index (RSI) might reveal an imminent oversold or overbought condition, it does not indicate when prices might move up or down.

During the era when IFE calculations became popular, governments via various fixing mechanisms controlled most all exchange rates. It was not until the 1970s that forex rates began to float with equilibriums set by market forces at work. The effectiveness of the International Fisher Effect equation then became questionable over time as a valuable tool.

Has the near-zero interest rate environment also cast doubt upon the IFE’s effectiveness? As more and more central banks set targets for inflation instead of using a base interest rate as a tool for modifying monetary policy. The relationships between interest rates and future exchange rates become cloudy. In these instances, IFE calculations can be problematic,

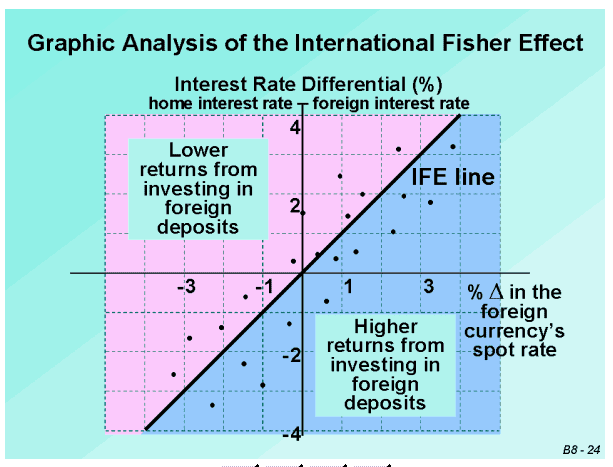

Today’s financial models may be more complex and involve the use of a multitude of economic variables to make valid predictions, but IFE, as basically simple as it is, can still be useful in long-term decision-making, whether it be from a lending, investing, or trading perspective. The following graphic illustrates this point:

Source: Swlearning.com

The 45-degree line indicates that there is equivalency in each market. Investors have less concern about the direction that exchange rates might go under this scenario. As the difference between interest rates in each market widens, then exchange rates are more important. Over the long term, higher interest rates in a market might yield higher returns, but these gains might be outweighed by subsequent changes in the corresponding exchange rate.

Conclusion

Irving Fisher was a remarkable economist, perhaps, way ahead of his time. His economic theories have earned him the title of ‘the greatest economist the United States has ever produced’. His body of work revolutionised the field of econometrics and the ability to forecast economic conditions in the future. Unfortunately, he did not live long enough to see his work recognised once more by academia, but his Fisher Effect and International Fisher Effect concepts can still be worthy tools for today’s forex analysts and traders.

Continue Learning

- Forex Glossary

- What is Devaluation?

- What is Implied Volatility?

- What is a Trailing Stop Loss?

- What is the Dow Theory?

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.