The foreign exchange market, as with any other human endeavour, has its own language, set of terms, and buzzwords to learn and understand. If you are new to this space, the terminology can be overwhelming, but part of your preparation phase is to become familiar with what could be called ‘forex speak’. Did you catch your first term? ‘Forex’ is an abbreviation of foreign exchange, and your next term will be ‘conversion rate’, or exchange rate in some quarters.

What is a conversion rate? With respect to currencies, a conversion rate represents the amount of currency that can be exchanged for another currency at a specific point in time. Over 50 years ago, before there was a free-floating foreign exchange market, central banks would set these exchange rates on a daily basis for the purposes of settling international trade transactions and enabling capital flows across national borders.

As simple as this concept sounds, there are many applications of it when dealing with anything to do with currencies, from investing and trading to providing convenient exchange services for individuals travelling within foreign countries. These retail rates can vary by large degrees, depending upon the type of access to local conversion services. It is therefore a good idea for tourists to become acquainted with the variety of conversion services that exist in the marketplace and the markups they apply to a basic rate.

There are no rules that require the disclosure of retail market pricing applications, but you are best served by the use of plastic debit or credit cards. There are rules that guide these applications, but you may have to look at the fine print of your cardholder agreement or heed the warnings that ATM machines often provide about additional surcharges.

We encounter conversion rates on many occasions, but in the world of forex trading, the rates generally include a ‘bid/ask’ spread and in, some cases, additional fees or add-ons. In this article, you will learn more about forex conversion rates, how they are created, how they are stated, a bit of background information, and, lastly, a few examples to provide a visual context for them. This basic knowledge will help guide you in your forex trading adventure and beyond.

Background/Context

What is a conversion rate definition? When currencies are the area of focus, a conversion rate is literally the ratio between two different national or, in some cases such as the euro, regional currencies. When stated as a single figure, it is the equivalent of what one unit in the ‘base’ currency will convert to in the ‘counter’ currency.

This pairing of two currencies will appear, for example, as ‘EUR/USD’ or ‘EURUSD’, a comparison of the euro (EUR) versus the US dollar (USD). The International Organization for Standardization (ISO) has designated a three-letter code or symbol for every recognized global currency. In this example, EUR is the ‘base’ and USD is the ‘counter’ currency. The first two letters represent the ISO country or region code. The third letter will typically be the initial for the first letter of the currency, but not in all cases, as in the euro or EUR.

Related Articles

Currencies may also have nicknames or, in some cases, stylized symbols. There are major, minor or crosses, and exotic currency pairings, but as an initial introduction to the eight major currencies, here are their names, abbreviations and symbols, if they exist:

- AUD – Australian dollar or ‘Aussie’ or ‘A$’

- CAD – Canadian dollar or ‘loonie’ or ‘C$’

- EUR – euro or ‘€’

- JPY – Japanese yen or ‘¥’

- GBP – British pound or ‘sterling’ or ‘cable’ or ‘£’

- CHF – Swiss franc or ‘Swissie’ or ‘S₣’

- NZD – New Zealand dollar or ‘kiwi’

- USD – US dollar or ‘greenback’ or ‘US$’

Before the 1970s, central banks would set and regulate exchange rates for their home currency versus other currencies. When the free-floating currency market was established, currency pairs that were in the market floated with real-time valuations, as banks, speculators and traders introduced supply-and-demand forces to the equation.

Each country is free to choose its own exchange rate regime, which can be free-floating, fixed, or a hybrid of the two previous types, typically formed by pegging the local currency to a major one such as the euro or the US dollar. For the latter case, the government will review the ‘peg’ and make adjustments. These rates are affected by a series of factors, which may include balance of trade data, interest rate levels, inflation, fiscal and monetary policy, speculation, intervention by a government body, geopolitical pressures, and the economic strength of a country.

Banks and other large financial institutions operate the global interbank network, which establishes the wholesale price for currency pair exchange rates. Your broker will access this market on your behalf and mark up the conversion rate with a ‘spread’, a small percentage on either side of this rate to set a ‘buying’ price and a ‘selling’ price. This ‘bid/ask’ pricing pair is one way that the broker profits from your transaction.

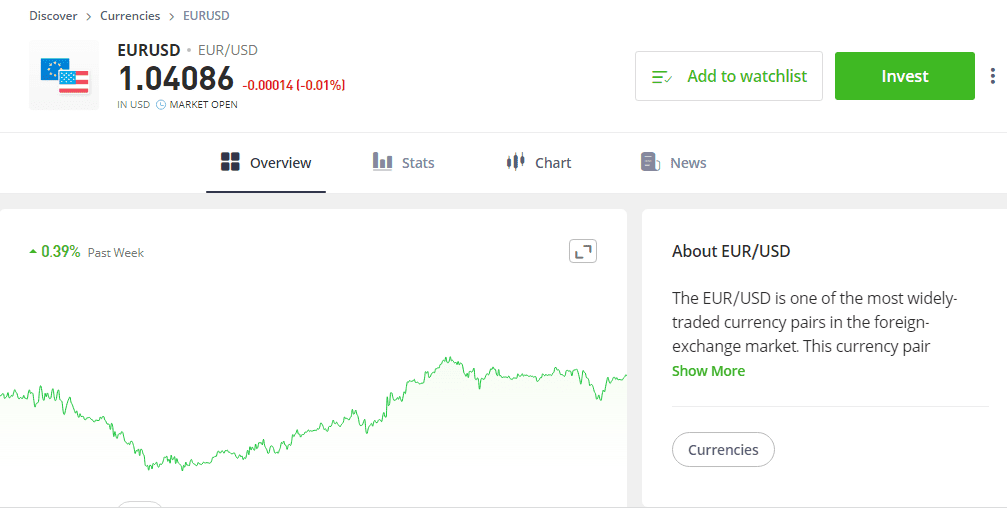

Let’s look at a common information screen from a broker for the EUR/USD pair, this example courtesy of eToro:

The ‘1.04086’ figure, shown in the top-left corner of the graphic, is the amount of US dollars that one euro would buy at the moment, with the spread shown in ‘red’. If you wished to sell your position, the price or exchange rate would be the ‘net’ of the two figures, but this spread amount can vary considerably over time, due to the same factors listed in a previous paragraph. Spreads can be particularly wide after an economic announcement and hinder effective trading.

Beyond your relationship with your forex broker, there is also a retail market that provides conversion services for the public when travelling or in need of physical currency. Banks will typically list buying and selling rates in their windows, as will money dealers on the street or in airports or other points of call. The spreads will be wider, and commissions and transaction fees may also be added. It is not uncommon for costs to range from 5% to 10% or higher above the average of the buy and sell rates posted.

Where can a consumer find the best exchange rates for buying and selling currency pairs? Well, before the millennium crossover, Visa and Mastercard moved in tandem to secure the best possible exchange rate for international transactions for their respective cardholder bases. A bank will start with a low wholesale rate, but each bank at its own discretion can add a markup to this rate, as disclosed in the applicable cardholder agreement. A 1% to 3% cost is much better than the 5% to 10% cost for dealing with a public, over-the-counter money changer.

There are more complications if you happen to reside in a developing country where the government fixes the rates that are used. Its rate may only apply to international trade, whereas a consumer must deal with a ‘black market’ type of regime where the public market rate can vary greatly from the government mandate. Regions where the currency is tied to the EUR or USD may have other issues, when local inflation and economic conditions do not match up well with these two major currencies. Distorted price levels for foreign goods may cause more inflation.

Examples

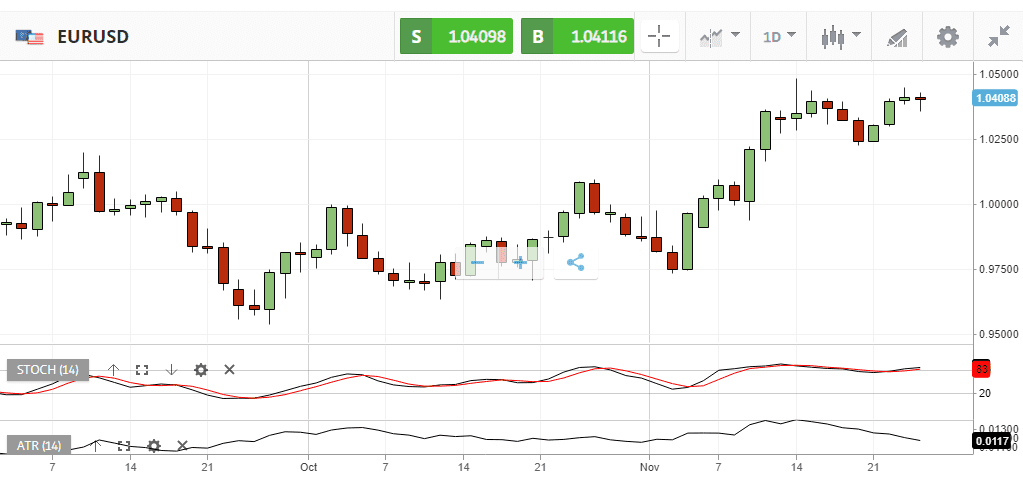

In this article, our focus is primarily on the conversion rates used for trading purposes. Let’s revisit the EUR/USD pair and review a pricing chart from eToro:

Here, we have a daily chart for the EUR/USD currency pair over a three-month period. The vertical axis to the right of the chart states the conversion rate, the amount of USD that can be purchased with one EUR. The red and green candlesticks reflect how these rates fluctuate on a daily basis. The latest value is highlighted in a light blue colour at the top of the axis on the right. From this rate, the prevailing selling (S) and buying (B) rates are presented in the green boxes on the top of the chart.

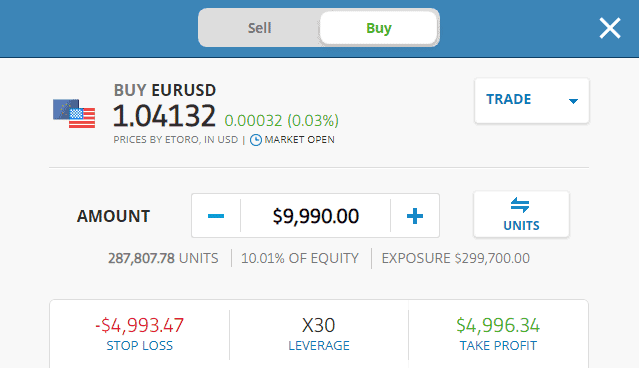

When it comes time to secure a position in the market, one click on either of these green boxes will take you to a trade execution screen. In this example, we accessed the buy order execution screen, but the rate had already changed minutely from the chart’s posted value, not unusual for this highly volatile, highly reactive forex market:

In this case, we pressed the ‘Buy’ button, and the screen depicted the applicable buy rate and spread – 1.04132 and 0.00032. On this screen, the ‘Trade’ button will reveal the various execution order types that can be selected, and you may also enter the amounts for your trade, your stop loss, and your take profit. Once completed, an ‘Execution’ button will appear. The rate may only apply for a short period, so time is of the essence.

Conclusion

Understanding how conversion rates are created, presented on charts and execution screens, and how they can change is a prerequisite for effective trading. It may appear confusing at first, but you will become familiar with the process over time. The next step is to know how ‘bid/ask’ spreads are applied to this rate and how these spreads can also vary over time. Practice on a demo system to gain experience and confidence before undertaking real-time action.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.