Novice traders who enter the world of forex trading for the first time will inevitably be faced with a lot of new and probably unfamiliar trading terms. Understanding what all these terms mean forms part of the foundation of a beginner trader’s understanding of the forex market.

Forex trading terminology can be likened to stepping onto a sailing boat for the first time, where almost all the names we would usually use on land differ on a boat. Sailors do not refer to the left-hand or right-hand side of a boat, for example, but rather port and starboard, though they reference the same things.

The same goes for forex trading, and in this article, we will be focusing on one specific yet important term used when selling a currency pair.

Understanding How Forex Pairs Are Quoted

To better understand what it means to buy or sell a forex pair and the terms used for doing that, we first need to look at how forex pairs are quoted. As forex trading involves two currencies that are paired together, it is important to understand what exactly happens when you decide to trade a forex pair in either direction.

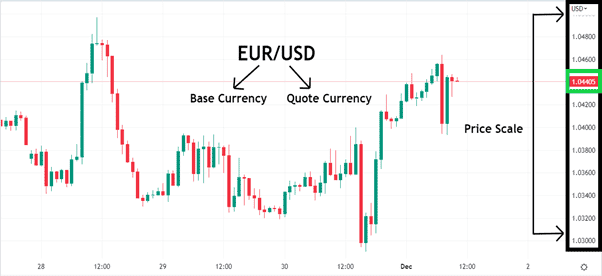

Image for illustration purposes only

The image above shows the EUR/USD forex pair on a trading chart. This is the most widely traded currency pair in the world.

With forex pairs, the currency that appears on the left is referred to as the base currency, while the currency on the right is called the quote currency. Simply put, the price that appears on the scale on the right reflects how much of the quote currency will be needed in exchange for the base currency.

At the time the above screenshot was taken, the EUR/USD was trading at a price of 1.04405, meaning that it would have cost 1.04405 US dollars in exchange for 1 euro.

Should prices rise, using the example above, it simply means that the euro is appreciating in value versus the US dollar, while a decline in prices means that the euro is depreciating in value versus the dollar.

Knowing what happens to each currency in a pair when prices move higher or lower forms the basic foundation to understanding forex pricing. This is especially important if a trader wants to formulate an opinion about which direction any particular currency might take.

Take important monetary policy decisions as an example. These decisions can strengthen or weaken a particular country’s currency, making it important for a forex trader to know which currency in a forex pair might be affected. This, in turn, could help a trader decide whether they should be buying or selling the currency pair as a whole.

Selling At the Bid Price

Now that we have taken a closer look at how forex pairs are quoted and what it means for each currency in a forex pair when price moves higher or lower, we can proceed to the terminology used for selling.

There are always two parties involved when trading from your trading platform: yourself and the broker you decided to use. If you were of the opinion that a currency pair is going to move lower, then you would want to sell the forex pair, and to do so, you will need to select the bid price.

Image for illustration purposes only

The bid price is the price at which you as an individual trader can sell a forex pair, but as your broker will also be involved in the transaction, your broker buys at the bid price. For every seller, there needs to be a willing buyer and vice versa.

Explained in a slightly different way, the bid price represents the price at which your forex broker will be willing to buy the base currency from you, in exchange for the quote currency.

This time around, the chart example above shows the GBP/USD with the quoted bid and ask prices on the price scale. The window on the far right of the chart is the order window from where you can decide to buy or sell a forex pair.

Because we are talking about selling a forex pair in this hypothetical example, price needs to decline, or rather the quote currency, in this case the US dollar, needs to appreciate in value versus the British pound for you to make money.

If you look closely at the bid price on the price scale, then you will notice that it is slightly lower than the current price of 1.21944 (also known as the market price). So, if you were to sell the GBP/USD forex pair at that very moment, you would receive the bid price of 1.21943 from the broker at a lower price than the actual market price.

The difference between the bid price and the ask price is called the spread (green box in order window), and it can be seen as the fee that brokers charge for providing immediate transactions.

Bid Price Example

As a novice forex trader, you might become overwhelmed by the multitude of forex pairs that are available to trade, which can make it difficult to decide which currency pairs are best suited for beginners.

Image for illustration purposes only

The best forex pairs to focus on, especially when you are starting out, are the major forex pairs.

Major forex pairs account for most of the volume traded in the forex market on a daily basis, making their price movements more stable and easier to get in and out of trades fast.

Previously, we mentioned that the difference between the bid and ask price is referred to as the spread. Major forex pairs typically have very small spreads, so if you were to trade them, you should be able to get very close to the price you want to enter at.

The chart example above, however, shows what the spread of an exotic currency pair looks like – in this case, the EUR/MXN (euro/Mexican peso) with a spread of 200.6. Note how large the spread was at the time the image was taken compared to our previous example using the GBP/USD.

This is an important concept to understand. If you were to enter at the bid price to sell the EUR/MXN, you would get a far worse price than where the market price was trading at that time, and it would result in higher brokerage fees.

Although the explanation of what a bid price is and what happens to either the base or quote currency when selling a forex pair might sound confusing at first, all trading platforms make it pretty easy to enter a sell order, and the rest is automatically taken care of by your broker.

Related Articles

Conclusion

The title of this article asked, what is a bid price? Hopefully, you will now have a better understanding of this important forex trading term. As forex trading involve pairs, unlike a stock or commodity, it might be confusing at first to get to grips what happens to either of the currency pairs when you decide to trade.

As long as you always consider what occurs during a trading transaction from both your perspective and the broker’s perspective, you will soon get a better understanding of the ‘mechanics’ involved in selling a forex pair.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.