Let’s take a dive into the forex yield curve and its relationship with interest rates. Whether one is a technical or fundamental trader, there is little disagreement that forex prices depend very strongly on the interest rate differentials between currencies. We are most used to measuring this differential in terms of the basic rate of the central bank. Although other factors like the liquidity of the transmission mechanism, the capitalization, and profitability of the banking sector, as well as the openness of the financial system play a great role in determining the relevance of interest rates with respect to forex quotes, most of the time we regard the central bank rate as the benchmark for the future performance of a currency.

Yet the central bank interest rate in general only determines the overnight rate in the money markets, while we know that for most us, individual investors, as well as corporations, overnight transactions are rare. So how does the central banks interest rate decisions get transmitted to the wider economy? How does the main rate of a central bank influence the 3-year borrowing of a firm, or the 30-year mortgage contract of an ordinary citizen?

It is clear that we need a better understanding of the term structure of interest rates in order to understand how interest rates determine economic activity on a large scale. Since this relationship is best defined in the yield curve, in this article we’ll examine it in detail, and the various theories that define what leads investors to favor or disfavor a particular maturity on the scale. In following sections, each of the various interest rate theories will be discussed in their own articles as well.

Interest rate definition

Interest rates are defined as simply as being the cost of borrowing. In defining an interest contract, we use two concepts to explain its terms. One is the rate, the other is the maturity of the payment. Of these two, the rate is the payment that must be made to the lender at regular intervals, and maturity is the time at which the borrowed sum must be returned to the lender.

What is the yield curve?

Yield curve is the term used to describe the maturity-interest rate structure of a borrowing transaction, usually that of government paper, in a given currency. It is created by plotting the interest rates available against the various maturities at which borrowing is possible, and then combining the values with a line, which will resemble a curve. The relevance of the yield curve for economic activity cannot be overstated. Since government securities are regarded as safe assets with maximum liquidity in most circumstances, all other kinds of borrowing transactions, and the risk involved in them are priced and evaluated in accordance with the yield curve of government securities. So if you own a business, and would like to receive credit at a particular maturity for expansion, the lender will desire to know the interest rate of the government security at the same maturity even before knowing anything about your firm, and will always charge you a rate above what it could receive from investing government paper. Since investing in government paper would involve practically no risk, the borrower would demand a premium for taking on the additional risk.

The yield curve is one of the best indicators of current economic conditions as perceived by the bond market. It is crucial for the pricing of many financial derivatives, as well as consumer credit and mortage rates for ordinary borrowers; as such, any analysis of a national economy will incorporate the yield curve data in order to reach at more solid and reliable conclusions.

What is the significance of the yield curve for forex traders?

The benchmark interest rates of 2-year bonds, for example, provide us some hints on the credibility of central bank policies as perceived by the market, via expected inflation in the future. The forex yield curve, (or term structure) is also a reliable indicator of economic cycles. Before economic recessions, it is reversed, that is, shorter-term maturities suffer higher interest than the longer term, hinting at reduced central bank rates (as well as other things depending on how you interpret them. Understanding the term structure allows us to predict future rates with greater accuracy and confidence, a crucial goal for any trader due to the importance of this concept for most traders.

Before going on, let’s see a number of forex yield curve patterns:

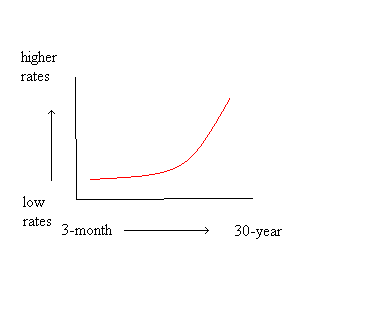

- Upward Sloping Yield Curve

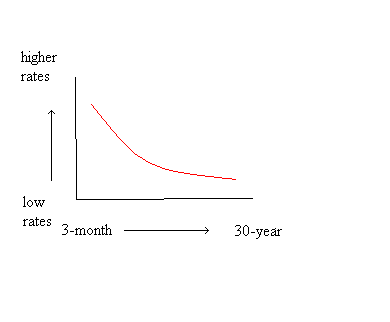

- Downward sloping Yield Curve

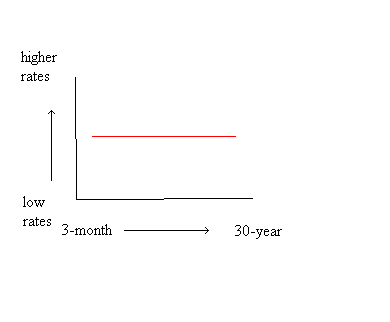

- Flat Yield Curve

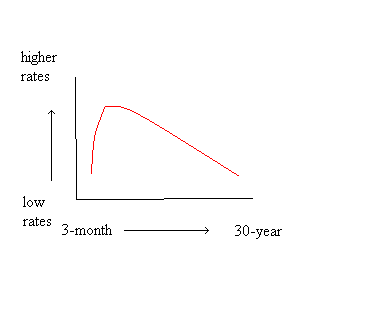

- Humped Yield Curve

Upward slopes are associated with future inflation (appreciating currency, rising yields, growth), while downward slopes are related to depreciation, and economic contraction. The flat yield curve can be either a sign that the yield curve is transforming to another type (upward sloping to downward, and vice versa), or a protracted period where the present conditions will be maintained (such as inflation, yields, and growth). The forex market reacts to a flat curve in one currency on the basis of developments in other economies. The humped yield curve is a sign that some period of uncertainty, volatility, or rapid changes may be in order. The flat yield curve is often encountered where the market is expecting rates to reverse direction after a short while.

Since currency trends are strongly dependent on perceptions about future rates, as well as present yield differentials between nations, comparing the yield curves of two nations will give us a better idea on the attractiveness of a particular currency for a particular profile of investors. Many hedge funds, for example, are active in the short-end of the yield curve, and also trade the spot forex market, so their behavior will tend to reflect differentials in the short-term market. Others, such as mutual funds, tend to seek safety over risk in usual circumstances, and their unleveraged funds will tend to be concentrated a bit further to the right of the yield curve (towards longer maturities).

Other observations to help understand the interest rate theories

Apart from the shape of the yield curve, there are three critical observations that will help us understand the interest rate theories to be discussed below

- Rates of different maturities move together: We know that interest rates on three month, one year, and two year contracts usually move together, and not independently.

- When short rates are low, the curve slopes upward, and when they are long, the slope of the curve is downwards: Most of us are familiar with this fact, and we often tie it to higher interest rate expectations after a period of stimulus, and accommodating monetary policy for example. Conversely, we anticipate a period of lower rates in the future after rates remain high for a period. In other words, a yield curve with high short term rates will be sloping downwards steeply in most cases.

- Yield curves slope upwards in a majority of cases.

Since traders are aware of the importance of interest rates in determining forex trends, it should be obvious that understanding the forex yield curve, and what it signifies can be very useful in trading decisions. We’ll handle each interest rate theory in detail in its own article, but before going further, let’s examine them in an overview in order to stay in touch with the big picture.

Pure Expectations Theory (PET)

The pure expectation theory is the most straightforward and easy to understand of interest rate theories, and is also the most intuitive for traders. It simply assumes that qualitatively there’s no difference between a three-month maturity interest rate contract, and one with a maturity of three years. All that matters is the expected interest rate over the maturity term, as perceived by market participants on the basis of real and predicted interest rates. In mathematical terms, the yield of a long-term interest rate contract will be the geometric mean of yields on shorter-term contracts adding up to the maturity term of the long term contract.

In sum, longer term yields are merely a projection of short term rates to the future without any specific properties setting long term rates apart from short-term ones with respect to risk or predictability. Today’s assumptions by market participants are perfect predictors of future rates, so there’s no need for any premium when buying or selling debt securities on longer maturities. Read more about the pure expectations theory.

Liquidity Preference Theory (LPT)

The pure expectations theory has a clear deficiency in that market participants are not always right about the future. Also, the geometric mean of short term yields across the term structure is rarely a perfect indicator of the future rates over the long term. We often observe that longer-term yields incorporate a premium over the geometric mean, termed the liquidity premium, which is the subject of the liquidity preference theory for the most part.

In mathematical terms, LPT differs in its calculation of the yield curve only with respect to an additional risk premium (rp) component added to the expected rate of the pure expectations theory. Read more about the liquidity preference theory

Market Segmentation Theory (MST)

This theory takes LPT and drives it one step further away from PET by stating interest rate contracts across the term structure are not substitutable. The dynamics creating the interest rate equilibrium for each maturity term are born of independent factors, and as such, the PET is invalid. An investor deciding to purchase a bond, whether public or private, does not regard the short-term/long-term paradigm merely as a matter of convenience, but as a fundamental factor influencing investment strategy, liquidity needs, and of course supply and demand.

This approach to the term structure can explain the sloping nature of the forex yield curve. But since it assumes that term structures depend on independent, it fails to explain why rates across different maturities move simultaneously, albeit often by differing quantities. Read more about the market segmentation theory

Preferred Habitat Theory (PHT)

Finally, the preferred habitat theory attempts to solve the shortcomings of MST by positing that investors have a preferred habitat for their investments. Although interest rate expectations do indeed determine the rate-maturity structure at a basic level, investors demand a higher premium, in most cases, for longer maturity debt, due to their preferred habitat in the left-hand side of the yield curve (i.e. the short term). Thus, although interest rate expectations do play an important role in determining the shape of the forex yield curve (and as such, maturity terms are substitutable to an extent), there is also a powerful non-substitutable component determining the term structure.

The PHT is generally regarded as the most realistic among the four. Read more about the preferred habitat theory

The trader will derive the greatest benefit from this discussion if he gets used to the two concepts of preferred habitat, and risk premium. Especially the latter will be encountered often in financial discussions, and it is the duty of any trader to make it a part of his life.

In the following sections, we’ll discuss each theory in greater detail.

Next >> Pure Expectations Theory >>

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.