The commodity and forex markets continue to be popular targets for investors and traders running a range of strategies. Whether you are looking to day trade EURUSD or have a long-term view on the price of gold, there are opportunities to take positions which can help you achieve your financial aims.

With some research, it’s possible to find a trusted broker offering cost-effective terms in a range of instruments and providing a trading platform such as MT4 or MT5, which contain tools specifically designed to enhance your performance. However, as the different forex and commodity markets have distinctive characteristics, there is value in extending your research to include finding the commodity or forex market that best suits your trading style.

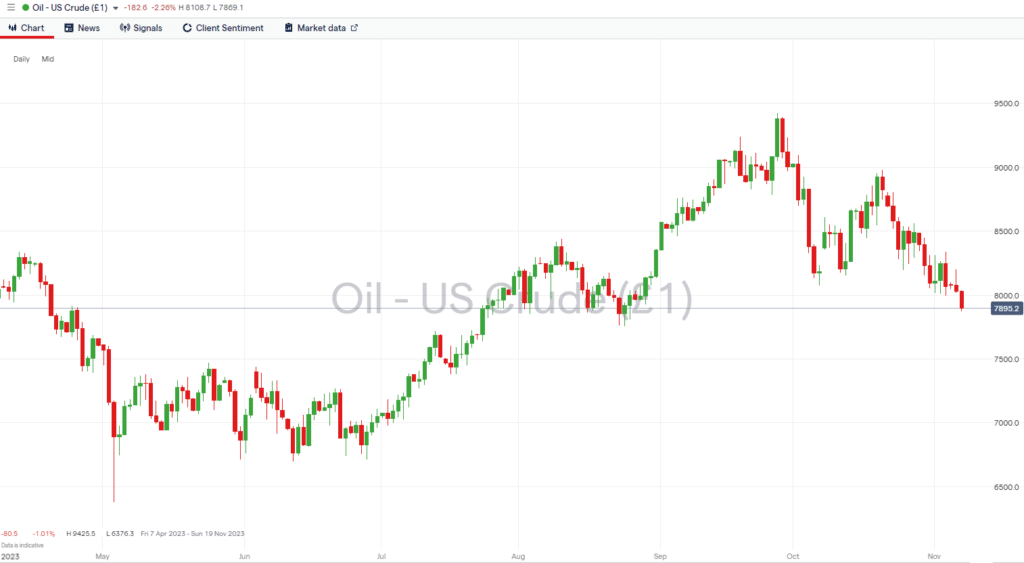

Crude oil price chart – 2023

Source: IG

The Commodities Market

Commodities are natural resources or agricultural products that are the building blocks of industrial activity. After being mined, grown, or reared, the market price is determined by the laws of supply and demand and the decisions made by big corporations, governments, and suppliers to buy and sell.

Investors can also profit from commodity price moves even though they don’t necessarily want to take delivery of cocoa or zinc. Using an online broker allows you to take a speculative view of how levels of economic activity might impact the price of instruments, ranging from wheat futures to copper miner stocks.

The heart of the commodity markets and where global prices are set are specialist exchanges around the world. They are situated in different time zones so that commodity trading can be conducted on a 24/5 basis, with the list of major regulated exchanges including the Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYME), the Intercontinental Exchange (ICE), the Tokyo Commodity Exchange (TOCOM) and the London Commodity Exchange (LCE). Brokers use data from the exchanges to set the price on their trading platforms. That allows them to set up markets for their clients in instruments such as CFDs (Contracts for Difference), which track price moves in the underlying market. That allows retail investors to follow moves more conveniently without having to set up a trading account on the exchange.

How to Trade Commodities

A good broker will offer an extensive range of commodity markets. These will cover the sub-sectors of the commodity space and include energy commodities such as crude oil and natural gas, precious metals such as gold and silver, base metals such as copper and aluminium, and agricultural commodities such as coffee and soybeans.

Trading in them simply involves spending a few minutes to open an account with a broker, navigating through a trading dashboard, such as MetaTrader MT4 or MT5, locating your chosen market, and clicking on ‘buy’ or ‘sell’. From that point, the unrealised profit or loss on your position will reflect live market prices and the decision on how long you want to hold the position will be down to you and your strategy planning.

Commodity Trading Pros and Cons

There are certain features of the commodity markets which investors would do well to understand fully. These primarily relate to the underlying fundamentals of how commodities are produced and how demand can sometimes fluctuate wildly.

Supply-side issues are a major price driver in commodity markets and can trigger significant price trends lasting for multiple years. It can, for example, take ten years for a new mine to come into production, and agricultural commodities are produced according to growing seasons. That means that short-term spikes in demand levels can drive prices up as manufacturers scramble to ensure the supply of a product. Whether this is a ‘pro’ or a ‘con’ will depend on whether you made the right decision to buy or sell, but the potential for increased price volatility needs to be incorporated into your risk management.

Commodity traders also need to factor in political sensitivities. For example, approximately 43% of global uranium production is carried out by just one country, Kazakhstan. With energy and food security being critical concerns for all governments, there is a risk that they may intervene in a market by stockpiling or introducing price controls. Conflicts that threaten commodity supplies can also result in increased volatility, as can extreme weather events impacting harvest yields.

A final feature that commodity traders need to consider is the level of speculative trading that takes place in the markets. Some trading decisions will not be directly related to the underlying value of a commodity but influenced by other factors such as a ‘herd mentality’, and still have a significant impact on price.

The Forex Market

The forex markets are the most actively traded financial markets in the world. Transactions involving buying one currency and selling another are hosted by platforms, central banks, and governments, as they conduct business overseas or aim to stabilise the markets. Cash held by investors also flows across borders in search of better returns offered by countries with higher interest rates, which adds up to $7.5trn worth of currency trades being booked each day.

As with the commodity markets, an element of forex trading is carried out by speculators aiming to profit from the price moves. Online brokers provide markets in the major currency pairs such as EURUSD, GBPUSD, and USDJPY, minor currency pairs such as EIURGBP, and exotic currency markets such as CHFHUF, USDTRY, and MXNJPY. It’s possible to apply day-trading strategies which identify short-term pricing anomalies or take a buy-and-hold position based on analysis suggesting the relative value of two currencies will change due to a shift in the economic fundamentals of the countries involved.

While forex prices are dictated by trading activity on global exchanges, the forex markets and currency instruments are unregulated. Traders can instead take comfort from the fact that the vast size of the major currency pair markets makes it difficult for any individual agent to manipulate price.

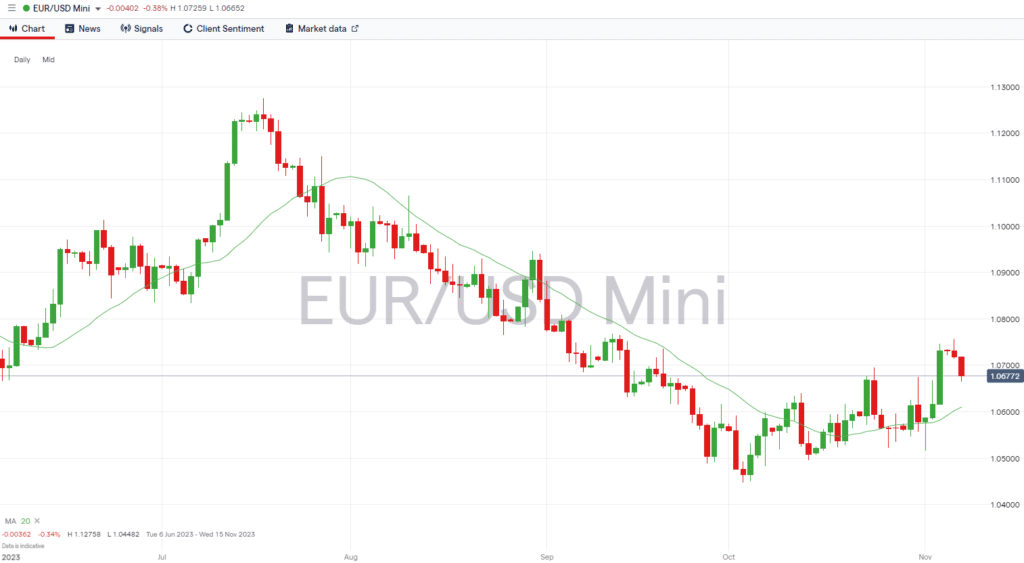

EURUSD price chart – 2023

Source: IG

How to Trade Forex

The most popular forex trading platforms are MetaTrader’s MT4 and MT5. Most brokers provide their clients access to one or both of these dashboards and an in-house designed platform. There is something of an MT4 vs MT5 debate, with some traders expressing a preference for the original MT4 or the later version of MT5.

Regardless of your stance on the MetaTrader 4 vs 5 discussions, both platforms have similar functionality, but MT5 has the edge regarding the number of trading indicators provided as part of the package and the number of markets available. Many still opt to use MT4, either for legacy reasons or because of how the platform supports the trading of automated algorithm-based trading models. The good news is that it takes moments to set up a Demo account to try the different MT platforms and establish which one suits you best.

Forex Trading Pros and Cons

The vast trade volumes, a feature of the currency markets, make trading conditions attractive to speculative traders. Tight bid-offer spreads on major currency pairs make it cost-effective to frequently trade in and out of positions and profit from short-term price moves.

There is also the potential to sell a currency pair as well as buy one. When that happens, traders can profit from a downward move in price, meaning there are opportunities to trade all market conditions. The ability to sell as well as buy is made more significant because forex markets, unlike stock markets, for example, don’t have a natural bias to go up or down. Currency prices are ultimately driven by the relative strength of the economies of two countries and how they perform over time. In contrast, historical data points to stock markets experiencing a long-term upward trend, making short-selling stocks a risky proposition.

Forex vs Commodities

There are plenty of good reasons to trade both forex and commodities. Building a diversified portfolio with exposure to different asset groups can help minimise risk and smooth out returns. Both markets operate on a 24/5 basis, so it is possible to trade them around the clock.

Traders might be drawn to trading one of the groups of instruments. Commodity markets offer opportunities for those looking to trade short-term price volatility or invest in long-term trends. The forex markets are cheaper regarding trading costs, making them popular among day traders and those using systematic models to buy and sell.

The Best Forex and Commodities Brokers

Once you’ve established which forex or commodity market you want to trade, the next step is to choose a trustworthy broker that offers the tools that best support your trading style.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.