Investing in precious metals is one of the oldest ways of storing wealth and generating financial returns. Buying gold, silver, platinum, and other precious metals is still a popular activity today, thanks to the unique opportunities offered by the sector. But which are the best precious metals to trade, and why and how should you buy them?

Gold price chart – 2001 – 2023

Source: IG

The good news is that it is easy to open an online account with a broker and speculate on the price moves in a variety of precious metal markets. Online accounts are designed to be user-friendly and cater to all kinds of investors and traders, ranging from those applying a buy-and-hold style strategy to those looking to day trade and gain from short-term price moves. Whether you’re an experienced investor or new to the financial markets, the first task is establishing which precious metal markets you want to invest in.

What are precious metals?

The eight commonly designated as precious metals are gold, silver, platinum, palladium, iridium, osmium, rhodium, and ruthenium. They are rare, naturally occurring elements which have high economic value partly due to their scarcity but also because of their inherent chemical properties that make them the ideal raw materials to use in specific industrial production processes. The extent to which precious metals are valued as a store of wealth or a manufacturing raw material varies from metal to metal.

For historical reasons, gold, in particular, is traditionally seen as a safe-haven asset, a hedge against inflation and a financial safeguard against detrimental geopolitical change. However, approximately 11% of all gold currently mined is bought by companies that use it in industrial production, with the electronics, automotive, and aerospace sectors being big buyers of the yellow metal. Like gold, platinum can also be used to make jewellery or held as an investment, but more than 41% of all platinum currently mined is used by the automotive industries. That means prices in precious metal markets can be driven by different factors.

Establishing a view on whether gold, silver, or platinum are over or undervalued can be done using fundamental and technical analysis. Fundamental analysis research focuses on real-world aspects of the supply and demand of the metals. It aims to establish fair value based on supply-side factors such as the fact that it takes years for new mines to come into production – supply is inelastic, and demand-side factors such as inflation levels, investor sentiment, and general levels of economic activity.

Technical analysis uses historical price data to try to predict market mood and which direction price will next head. It uses statistics and price charts to create trendlines and generate price indicators such as the Relative Strength Index, pinpointing times to buy and sell precious metals.

Gold price chart with RSI – 2021 – 2023

Source: IG

Trading gold

Gold is the precious metal most often used for investment purposes. It is one of the most actively traded commodities in the world thanks to its use as a means of exchange and a store of wealth.

Like other precious metals, the global price of gold is determined by trading activity on specialist exchanges. Because these are located in different time zones worldwide, gold can be traded 24 hours a day during weekdays. The three most important gold trading centres are the London OTC market, the US futures market and the Shanghai Gold Exchange (SGE). Between them, these markets account for more than 90% of global trading volumes, with smaller secondary exchanges also in operation.

It is also possible to hold gold as jewellery or bullion. However, there is something of a trade-off for investors who have to balance the security risks and costs of holding it in physical form against the idea that if gold’s role as the asset of last resort comes into play due to extreme geopolitical upheaval, having it to hand rather than stored in someone else’s vault is the preferable option.

Gold is traditionally seen as being an essential part of a well-diversified portfolio. It can be the asset that increases in price when every other position is losing money. It is considered an effective hedge against inflation, or at least a better one than fiat currencies. Investors also hold gold to hedge against geopolitical risk or the chance that the financial markets could become distressed.

Trading silver

Silver and gold are often thought of as being interchangeable in terms of investment opportunities, but there are distinct differences in the characteristics of the two markets. Approximately 60% of the global supply of silver is bought to be used in industrial processes, particularly electronic devices. That compares to 11% of gold, which means that the price of silver can be more heavily influenced by general economic cycles and the ebb and flow of demand for consumer products.

Like gold, the price of silver is set on specialist exchanges such as the NYMEX and LME, but trade volumes in silver markets are approximately one-tenth of those in the gold market. One knock-on effect is that individual traders with significant positions can have a greater influence on market price, which results in the price volatility of silver historically being two to three times greater than gold.

The difference between the two markets has resulted in some traders applying strategies based on the gold-silver ratio that tracks the price of gold compared to the price of silver. A ‘pairs’ strategy involves going long on one of the metals and short on the other. This hedging of the two positions results in strategies being market-neutral to a greater degree, with returns based on relative performance.

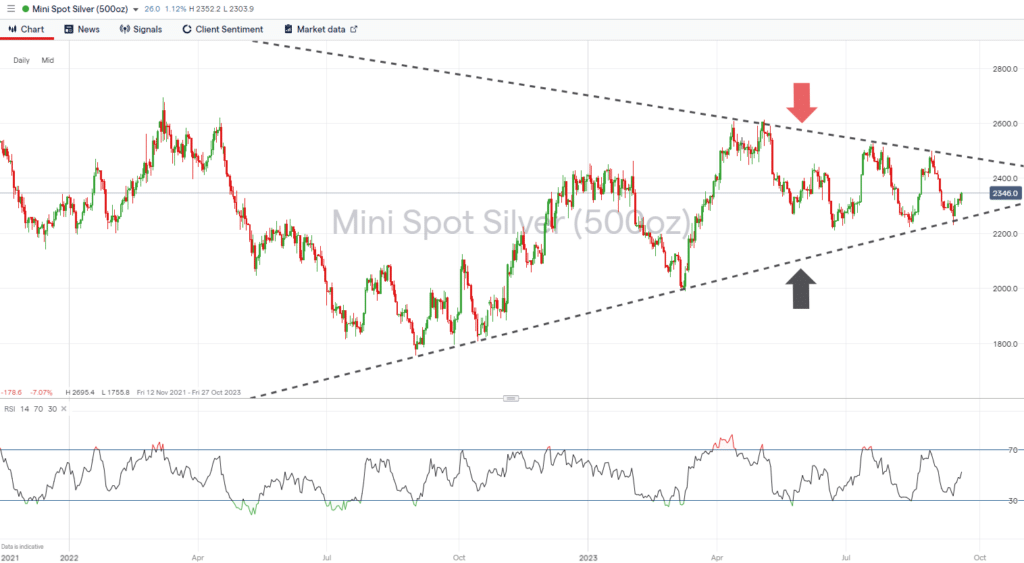

Silver price chart – 2021 – 2023

Source: IG

Trading platinum

Like gold and silver, platinum markets are open on a 24/5 basis thanks to traders buying and selling the metal on a range of global exchanges. Platinum is rarer than gold; in weight terms, annual production levels of newly mined platinum can be as little as 5-6% of the amount of gold mined. The supply of platinum is bolstered by the metal being recycled from used catalytic converters. That process accounts for approximately one-third of the annual supply. Rarity is a crucial factor in the platinum market, and the price of platinum per ounce has historically been higher than that of gold.

Investing in platinum requires understanding the nature of the metal’s demand and supply. Auto manufacturers buy up between 31-46% of the global supply of the metal, and other industries take up another 26-34% of the supply. Lockdowns introduced during the Covid pandemic caused a demand shock thanks to vehicles being left idle, and when you factor in that EVs don’t require a catalytic converter, there is a question mark as to how the shift to cleaner energy will impact the long-term price of platinum.

In terms of supply, one of the key features of the platinum market is that three countries, South Africa, Russia, and Zimbabwe, account for approximately 92% of all platinum mined each year. That concentration of supply lines introduces an element of geopolitical risk, which can dramatically impact platinum prices.

Other precious metals

One common link between precious metals is that they are a collection of chemical elements in scarce supply. Their intrinsic properties can extend to them being inert, having a relatively high melting point, and being ductile. Using that definition results in the group of precious metals expanding to include other less well-known names such as palladium, rhodium, ruthenium, iridium, and osmium, metals that can also be considered investment opportunities.

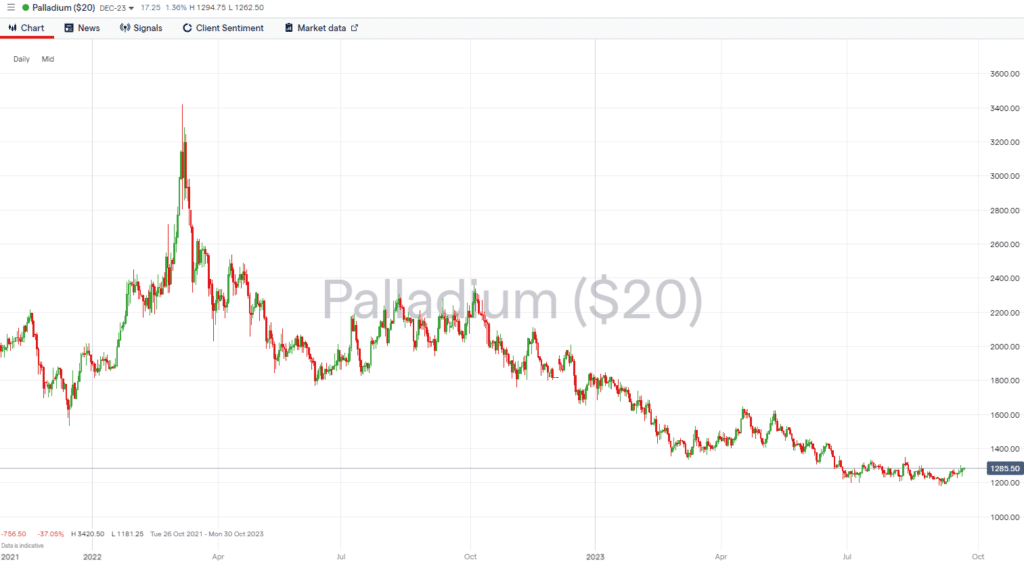

Palladium is used widely in industrial production, particularly for catalytic converters, electronics, and health care. One growth sector with which the metal is associated is renewable energy – palladium plays a vital role in the production of solar energy and fuel cells.

Palladium price chart – 2021 – 2023

Source: IG

Rhodium, ruthenium, iridium, and osmium are traded on exchanges in the same way as gold, silver, and platinum. They are less widely traded by retail investors for various reasons, mainly convenience. Gold remains the natural ‘go to’ market for investors who focus on other asset types but are looking for some kind of broad exposure to the precious metal sector. News flow, trade volumes and market liquidity are greater in the gold market, making it easier and more cost-effective to trade.

The prospects of the other metals shouldn’t be dismissed. As with the more mainstream metals, price is a function of supply and demand; for example, political instability in regions which produce them can disrupt the supply chain. As the markets in these metals can be less liquid, price volatility is typically higher than that of gold, so investing involves taking on a greater degree of risk return.

How to trade precious metals

The sector’s popularity has resulted in brokers offering a variety of ways to trade precious metals, the various instruments suiting different trading styles and strategies.

CFDs (Contracts for Difference) are synthetic products that track the price of precious metals on the big exchanges. They can be used to buy and sell any asset, including precious metals, and they also allow traders to use leverage.

Futures are an option for more experienced traders. There are some barriers to entry based on the minimum size of the lots which are traded, and CFD instruments tend to track the price of underlying futures, offering a more convenient way to trade the same price moves.

Options give the owner the right, but not the obligation, to buy or sell a precious metal at a future date. Two alternative ways to gain exposure to the sector are stocks and ETFs (Exchange Traded Funds). The prices of stocks of mining companies can be closely correlated to the metal being mined. That makes intuitive sense, and stocks are a great entry-level way to trade precious metals. Trading costs are low, tax-friendly schemes are available, and many mining stocks pay dividends, representing a form of passive income.

ETFs can be made up of mining stocks, metal futures, or other assets relating to the sector. They offer a way to gain diversified exposure to the sector with the click of one button rather than having to buy each constituent part of the fund individually.

Why invest in precious metals?

It’s possible to access freely available research on all the precious metals and form an opinion on how supply and demand might influence price. In that respect, trading them is very much like trading any other asset, and the increased levels of price volatility will attract some traders.

One of the key reasons to consider investing in precious metals is that they build in a degree of portfolio diversification. The extent to which they balance out price moves in stocks, bonds, forex, and crypto assets varies from metal to metal. That’s why many experienced investors hold a percentage of their wealth in precious metals to smooth out overall portfolio returns.

What are the risks of investing in precious metals?

While gold and other precious metals might be considered a form of insurance against price moves in risk-on assets such as stocks, the sometimes dramatic price moves won’t suit all traders. Shifts in market sentiment or underlying economic factors can trigger market price moves. The average daily price volatility for gold, one of the more stable precious metal markets, can be as high as 1.53%.

Those price moves can be hard to predict thanks to supply being concentrated in a limited number of regions of the world associated with relatively high levels of political uncertainty. Demand levels can also change due to technological and societal trends, as exemplified by the long-term move towards EVs, which don’t require catalytic converters.

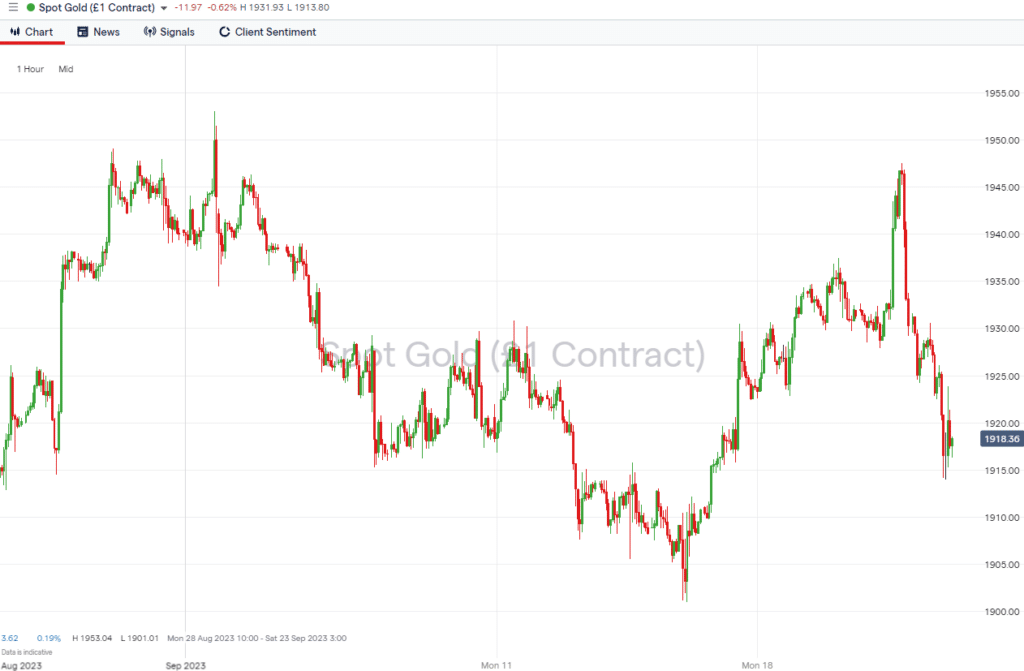

Intra-day gold price chart – 2023

Source: IG

The best commodity brokers

Once you’ve established which precious metal you want to trade, the next step is to choose a trustworthy broker that offers the tools that best support your style of trading.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Final Thoughts

There are plenty of good reasons to invest in precious metals, and with more investors entering the sector, brokers have set up a range of easy ways to gain exposure to this form of investing. Nothing is guaranteed in the financial markets, and precious metals trading can be considered to have greater risk-return than other asset types; however, the sector provides an angle into investing that other asset groups just don’t offer.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.