Newcomers to the world of forex trading are often taught to concentrate on one to maybe three currency pairs in the market. The point is to become familiar with the nuances of a few specific pairings and then focus your trading strategy accordingly. The first recommendation is always the “EUR/USD”, which, according to the Bank for International Settlements (BIS), is the most heavily traded currency pair.

This pairing accounts for 30% of the trades in the market. In fact, the USD is involved in 50% of the daily transactions in foreign exchange. Stability, liquidity, and tight spreads are the prime draws for these USD pairings, but what about other currency pairings not involving the US Dollar? Those pairings have been given a special name – Forex Cross Pairs. Many of these pairings have considerable liquidity in today’s modern forex market and are referred to as major cross pairs. As you might expect, there are also minor and exotic forex cross pairs.

In this article, you will learn about the history of forex cross pairs, the most popular ones, and which traders find the best to trade from both a cost-effective and opportunity basis. As in trading major and minor USD pairings, you still need an edge, but you will be free from the rather large “hammer” that the Fed can wield in the market or the amplified reactions to anything happening in the US economy.

What Are Forex Cross Pairs?

The simple definition of a forex cross pair is any currency pairing with any other currency except the US Dollar. The history of this notion goes back to after the Second World War and well before currencies began floating in true market conditions in the seventies. After the war, the United States was the most stable economic country since it had not been devastated by war. For this reason, nearly all currencies were pegged versus the USD.

If you needed to convert British Pounds to Japanese Yen, the process involved converting first the GBP to US Dollars and then converting the USD to Japanese Yen. This somewhat cumbersome process was not cost-effective since there was no arbitrage market to tighten “Bid/Ask” spreads. As time passed, the more active crosses received their own quotes to help trade and tourist conversion transactions. The “GBP/JPY” evolved as one of these favoured cross pairs.

If you peruse current BIS foreign exchange trading data by volume, the top seven pairings are comprised of the seven major currencies, each paired alongside the USD. Surprisingly enough, the next 21 pairings are for forex cross pairs. The movement from the Gold Standard and the creation of a floating foreign exchange market globally has also benefited global trade. As Globalisation modernised international trade, cross-currency transactions have grown in stature. No longer must these conversions be encumbered by double-spread costs.

Spreads have definitely declined over the years, but they are nowhere near what you might find for the “EUR/USD”. Volume turnover, risk, and cost-justified trading desks still weigh heavy on spread determinations, but since cross pairs are now more common, spreads have tightened. Occasionally, a major trading bank may specialise in cross currency pairings for the countries where it has a physical footprint, thereby creating a cheaper way to handle a specific cross.

What are typical spreads for forex cross pairs, and how do they compare with major pairings? If we start with the “GBP/JPY” example from above, you can repeat the old process by getting the “Bid/Ask” quotes for the “GBP/USD” and the “USD/JPY”. You start with a fixed number of US Dollars. The calculations are tedious, but you will arrive at a spread of roughly 4 pips. If you check with a broker like eToro for the “GBP/JPY” pairing, the spread is about half, or 2 pips, quite a bit above the “EUR/USD” standard of approximately 0.7 pips.

Spreads also vary by time of day, which exchange centre is quoting, and whether the two pairing centres are open at the same time, but the conclusion is clear. Volume is a significant determinant of the spreads quoted. Another popular example on the commodity currency front is the “CAD/JPY’ pair. Spreads widen to roughly 6 pips versus 2 for the “GBP/JPY”. Daily turnover for the latter is actually a “6X” multiple, but the spread only tripled, a result of speculation and arbitrage. For even more minor pairings, you might encounter spreads as high as 10 pips.

Where does one encounter cross-currency transactions? As a retail consumer travelling across a border, you may have converted one currency for another without going through the USD. Credit card transactions also do the math for you instantly by using a median currency value for the conversion process. A forex cross transaction is often part of international trade or debt transactions where multiple currencies come into play.

In the latter case, cross currency swaps are the vehicle used, and then the parties will revert to the options market to hedge their forex risk. Lastly, arbitrage offers another opportunity when access to local currency markets can reveal imperfections in market prices. Using a triangulation process, the trader literally converts one currency to USD and then buys the opposite pairing for a profit. Global banks have been active in the past in arbitrage strategies, but the practice is now rare since today’s market quickly corrects even the smallest of discrepancies.

Related Articles

- Forex Explained – What Are Minor Forex Pairs?

- Forex Explained – What Are Major Forex Pairs?

- Forex Explained – What Are Exotic Forex Pairs?

- Forex Explained – What are Commodity Forex Pairs?

The Most Popular Forex Cross Pairs

As a forex trader, you are aware of the eight major currencies – USD, EUR, JPY, GBP, AUD, CAD, CHF, and NZD. However, the definition of a Major Cross does not flow directly from this list. You may be able to find a forex cross pairs list from your favourite forex trading website, but this classification is reserved for the cross pairings that have dedicated market makers from either the Interbank sector or the brokerage community.

The major crosses tend to fall into a grouping of four pairings – EUR/JPY, GBP/JPY, EUR/GBP, and EUR/CHF. The first three follow volume demographics, but the latter Swiss Franc pairing with the Euro is considered a major due to its support by dedicated Interbank market makers or brokers. From a purely volume perspective, the AUD/JPY and the EUR/AUD exceed that of the EUR/CHF pairing. Brexit also catapulted the EUR/GBP pair forward in popularity.

Outside of these four major crosses, there are several minor crosses, which are various combinations of the seven major currencies, after excluding the USD. Although trading volumes may be considerably less and spreads a bit broader, these groupings have become popular in the forex trading arena. Trading opportunities abound if you follow a disciplined plan for identifying a good trade setup and capitalising upon it. A list of minor crosses is here.

How to Trade Forex Cross Pairs

Trading cross currency pairs can be an exciting new arena for the experienced trader looking to broaden his horizon for opportunistic trading setups. In some cases, more risk, cost, and volatility may be the order of the day, but the predictability of pricing behaviour may suit your trading style to your advantage. When USD pairings are ranging, cross pairings might be trending.

There are a few things a trader must consider. First, what is your account’s base currency? If you are trading the “GBP/JPY” currency pair and your account is denominated in EUR or USD, then you might be at the mercy of your broker when it converts your trading profits and then posts them to your account in a different currency.

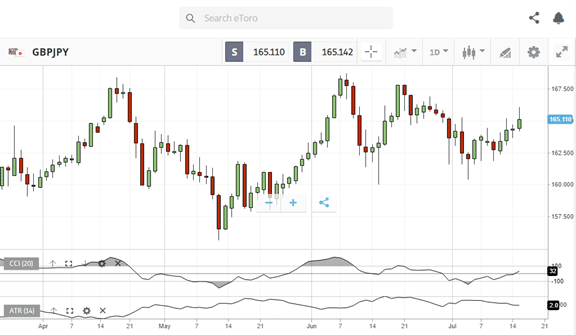

Let’s take a look at a chart, courtesy of eToro, of the GBP/JPY pairing:

During this period, the FED had announced potential upward interest rate changes, which have strengthened the US Dollar and weakened relationships with the GBP and the JPY. By trading this cross pair, there is a relatively predictable up and down trend flow that offers a good swing opportunity for position traders.

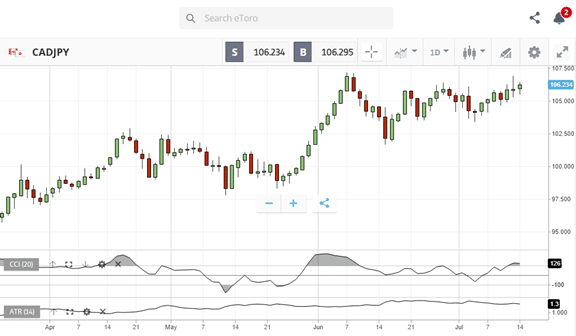

Another popular cross pair is the commodity pairing of the CAD/JPY. Again, courtesy of eToro:

In this case, USD dominance is eliminated, and you see a positive upward trend, supported by rising oil prices. Japan has to import nearly all of its oil, and the effect is that this discrepancy between the two economic models works to the advantage of the forex trader. Let the trend be your friend!

Concluding Remarks

If you are an active forex trader wanting to expand your realm of potential trading setups and opportunities, then cross-currency pairs may be a verdant field for you to explore. These pairs are not overly dominated by the dynamics of the USD and the US economy, but spreads tend to be wider, and periods of high liquidity may not match up favourably with your time zone. Given the inherent pros and cons of cross currency pairs, however, they do offer opportunities where fundamental relationships may be more predictable, even when trading costs are a bit higher.

Trade Forex Cross Pairs with Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.