The US Dollar/Hungarian Forint currency pair (also referred to as USDHUF and USD/HUF) is considered an exotic currency pair. In this article, we will examine how USDHUF is performing.

USDHUF Key Stats

- 2021 high: 333.455

- 2021 low: 282.766

- YTD high: 437.430

- YTD low: 306.940

- YTD % change: +31.92%

USDHUF Forecast

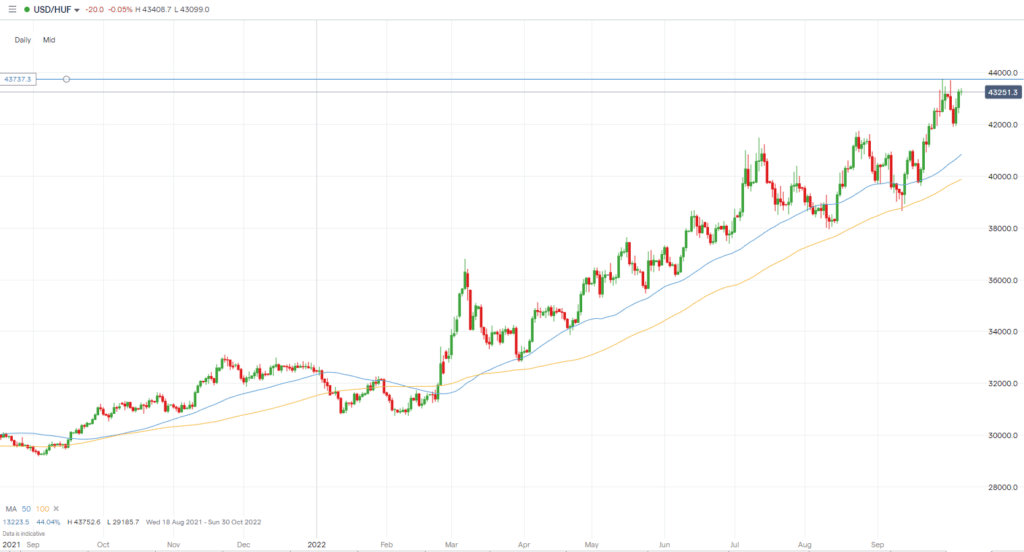

There is only one direction the USDHUF pair has headed since late 2021, upwards. Given the strength of the US dollar and the risk-off nature of markets in 2022, it is no surprise. While some macroeconomic headwinds have eased slightly, it’s hard to go against the current trend, and we see a continued move higher in the near term. The only reason for a change in directional bias will be if the current market and economic conditions change. At the moment, that has yet to occur, despite a recent rally in risk assets. Therefore, to the upside, the recent highs will be the first target we look to.

USDHUF Fundamental Analysis

During times of uncertainty, the US dollar is considered a safe haven for risk-averse investors. This is due to the strength of the US economy and the currency’s world reserve status. As a result, investors frequently refer to the currency as “king dollar.”

Related Articles

For the USD, it is crucial to keep an eye on the major economic data releases. These will generally occur weekly and monthly. For example, releases such as employment data, GDP, retail sales, consumer price index, and much more help investors assess the current health of the US economy. As a result, if the dollar has a release that is deemed positive for the country’s economy, it will usually result in the US dollar strengthening against other currencies (although it’s not always that straightforward). As of now, inflation has been a key issue in the US, although it moved lower at the last reading, which may indicate the Fed’s rate hike program is having an impact. Some suggest inflation is not falling fast enough and expect the Fed to continue raising rates.

The Hungarian forint has been impacted in 2022, most significantly by Russia’s invasion of Ukraine. Many Hungarian businesses have opted to accept the euro instead of its local currency, although Hungary is still far off from adopting the single currency. In addition, the National Bank of Hungary has been raising rates to cool prices; it recently raised its benchmark base rate by 100 basis points to 11.75%, with its borrowing costs climbing to their highest levels since May 2004.

USDHUF Technical Analysis

The USDHUF is up significantly in the last year, especially so far in 2022, as traders and investors take riskier bets off the table. The 50 MA is currently acting as a strong support level for the pair, which is not far off its most recent highs. Its most recent high is also the pair’s all-time high. Since that all-time high, price has run into some resistance, and with a recent rally in risk assets, a pullback may be on the cards. However, as mentioned earlier, we see that high being hit again in the not-too-distant future.

Trade USDHUF with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.