The Euro/Norwegian Krone currency pair (also referred to as EURNOK and EUR/NOK) is an exotic currency pair. In this article, we will examine how EURNOK is performing.

EURNOK Key Stats

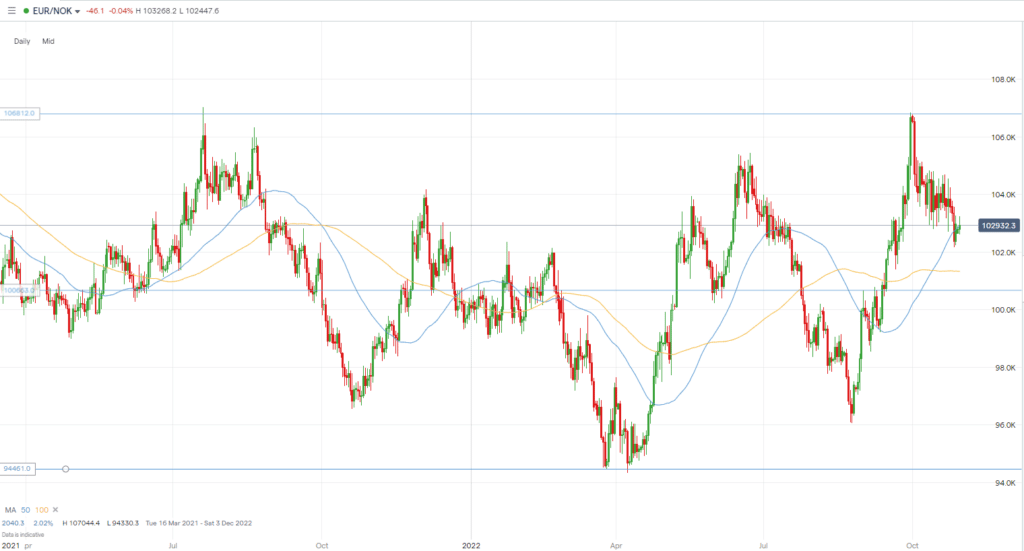

- 2021 high: 10.7043

- 2021 low: 9.8996

- YTD high: 10.6816

- YTD low: 9.4334

- YTD % change: +2.56%

EURNOK Forecast

In recent weeks, the EURNOK has pulled back from its highs after climbing to a level last seen around July 2021. The macroeconomic conditions in Europe for the Eurozone and Norway are challenging at the moment. Still, given the recent inflation data for the EA, we see a further pullback on the horizon for the pair, towards the 10.0663 level. In order for our directional bias to change, we need to see an easing of current macroeconomic headwinds in Europe and for oil prices to ease further.

EURNOK Fundamental Analysis

Developing a bias in the currency market is integral to a trader’s overall strategy. Investors are constantly entering and exiting the market; therefore, fundamental analysis using macroeconomic-related news such as unemployment, government spending, GDP, and inflation is essential.

Over recent months, the euro has been impacted by recent ECB decisions and has faced significant issues from the macroeconomy. Since the beginning of the year, the euro has been negatively affected after Russia’s halt to gas supplies heightened fears about a deepening energy crisis. As a result, the euro has had a significant inverse correlation with natural gas prices in recent months, and with energy prices rising, inflation has soared, sending the euro lower. Europe has attempted to break away from Russian supplies; however, it has been challenging for the economy. As a result, the ECB has begun raising rates and has continued to do so to combat inflation, which continues to rise.

Meanwhile, the Norwegian Krone is mainly affected by oil prices and interest rates in the global market. Norway funds a significant portion of its budget from oil revenues because it is the leading oil exporter in Western Europe. Therefore, the surge in oil prices will benefit Norway’s economy. Furthermore, the krone has remained highly correlated to the Danish krone and Swedish krona. As for its interest rates, to combat inflation, Norges Bank has raised its rates considerably and is expected to raise rates further.

Related Articles

- USDNOK Forecast and Live Chart

- EURSEK Forecast and Live Chart

- What Are Minor Forex Pairs?

- Forex Charts

EURNOK Technical Analysis

The EURNOK has been somewhat ranging over the last couple of years, and no clear direction, on a long-term basis has yet to be established. The currency pair is up so far this year after a recent bullish run. As a result, the price recently crossed above its 100-day moving average. A pullback may be on the horizon, and its 100-day MA would be a significant level to trade into.

Meanwhile, the pair has been trading between a few key support and resistance levels. A key resistance level at the top of the range includes 10.6812, its previous high and highest level for the EURNOK since 2020. On the other hand, at the bottom of the range is level 9.4461, which acts as a key support level. This level was reached early in the year and has been the lowest level since 2018.

Trade EURNOK with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.