The euro /Japanese yen currency pair (commonly referred to as EURJPY, or EUR/JPY) is one of the most liquid pairs that doesn’t include the US dollar as the euro and the yen are commonly held reserve currencies. In this article we will take a look at how this pair is performing in the current markets and where it might go next.

EUR/JPY Key Stats

- 2021 high: 134.124

- 2021 low: 127.383

- YTD high: 140.004

- YTD low: 124.391

- YTD % change: +4.1%

EURJPY Forecast

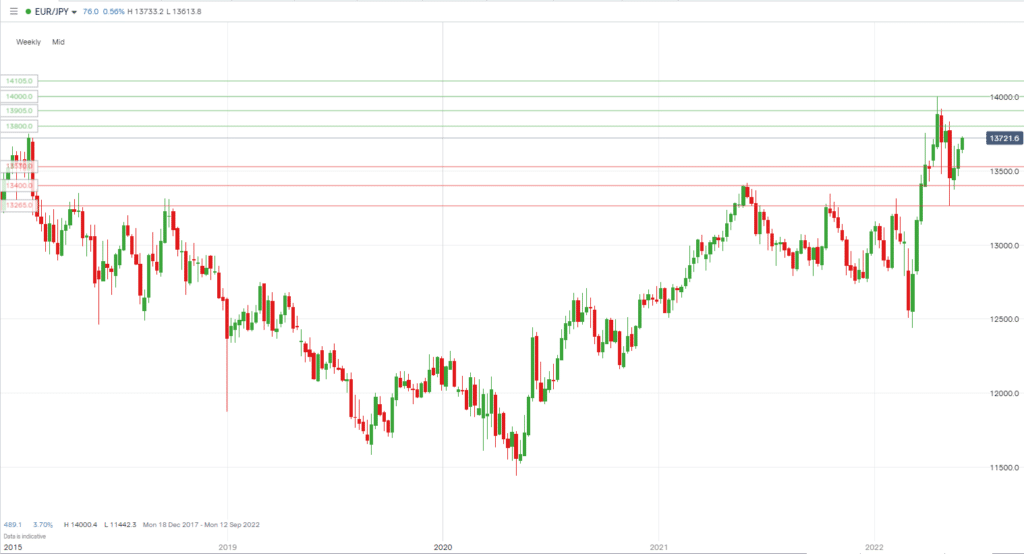

After a break of a long-term, slightly bearish trendline back in March, the EUR/JPY pair has struggled for any solid direction after topping out at 140 in the latter part of April. Since then, it has retested the prior trend and bounced, finding resistance at around 136.80. The recent turmoil in Japanese monetary policy and its economy (explained below) resulted in a big sell-off in the Yen, but it has since regained some losses. The price is currently in somewhat of a rising wedge pattern on the daily chart, but there are two schools of thought here.

First, it is a definite rising wedge pattern, and price will eventually break to the downside. The second theory is that rather than a rising wedge, the resistance level at 136.80 is holding strong but keeps being tested. However, there are only so many times it can be tested before it eventually breaks.

This is where directional bias comes in. We currently believe it is the second case, with the price breaking (which it has now done) and closing higher and back towards the 140 level.

EURJPY Fundamental Analysis

A currency pair’s movement can be impacted by various factors, affecting the individual currencies and the pair itself. For example, the euro is the official currency of 19 out of 27 countries in the European Union.

However, there are a select few big enough to provide economic data to impact the euro price. Germany, France, Spain, and Italy make up three-quarters of the eurozone’s $13.3 trillion GDP.

When trading any pair which includes the euro, it is essential to look out for data relating to inflation (Eurozone Core CPI, German CPI, French CPI), monetary policy (watch out for ECB member speeches, interest rate meetings, and ECB press releases), eurozone GDP (which helps policymakers judge the health of the economy), retail sales, employment and trade balance.

The Japanese yen will also be impacted by the economic data listed above. However, also look out for natural disasters (Japan is an earthquake-prone country), business confidence (the Tankan survey), elections, and government policies.

The yen is seen as a safe haven currency, meaning it is attractive to investors during times of economic uncertainty. However, in recent times, due to its performance during a market downturn, there have been questions as to whether it has lost its safe haven status.

Finally, with the BoJ maintaining low rates, the yen is one of the primary carry trade currencies. A carry trade is a type of trade in which a trader will borrow money in one currency with low interest rates (the yen, for example), then use that money to invest in higher-yielding assets elsewhere.

Related Articles

- EURCAD Forecast and Live Chart

- USDJPY Forecast and Live Chart

- What are Major Forex Pairs?

- Forex Charts

EURJPY Technical Analysis

Key Support Levels:

- 135.30

- 134.00

- 132.65

Key Resistance Levels:

- 138.00

- 139.05

- 140.00

- 141.05

As mentioned for the Euro / Japanese Yen pair, a key level is 136.80, which has recently been broken. A daily and weekly close above this level is key and will provide support for a potential bounce higher in the near term (although we have to be aware of the current volatility due to an uncertain macroeconomic environment). If positive sentiment persists, we can expect the Euro / Japanese Yen pair to continue in the current upwards trend with key levels at 138.00, 138.30, 139.05, and 140.00. Focusing on a potential downside move, watch out for levels at 135.30, 134.00, and 132.65.

Trade EURJPY With Our Top Brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.