Forex Trader’s Viewpoint

The XM experience is very much about trading and trade execution. The market-leading platforms on offer are the most popular retail trading platforms in the world. They combine user-friendly functionality, with powerful software tools. Even more impressive are the razor-thin spreads that XM offers its clients.

XM Group backs this up by being a broker with the intention of meeting the highest regulatory standards. Its activities are carried out under license from a variety of internationally recognised authorities including CySec, ASIC and the International Financial Services Commission of Belize (IFSC). T&Cs such as leverage terms on accounts are determined by the domicile of the account holder.

All the global client base can trade over 60 currency pairs and more than 1,000 other financial markets. Trading is in CFD form which caters to more active traders looking to sell short as well as to buy-and-hold and apply leverage to their trading.

The popularity of XM Group is mainly attributed to its strict no re-quotes, no rejection of orders and no hidden fees or commissions policy, This is backed up by real-time prices on trade execution, with 99.35% of all orders being executed in less than one second. Moreover, 24/5 multilingual Personal Account Managers ensure smooth client communications and professional support for both demo and real account holders.

Setting up an account at XM is easy and the minimum balance required to open an account is a super-low $5. Being subject to the rules and regulations of high-level regulators requires XM to follow a range of Know Your Client (KYC) protocols. They are intended to protect clients and reflect that clients are opening an account with a trusted broker.

XM Group Rating Overview

| FEATURE | XM Group |

|---|---|

| Overall | ⭐⭐⭐⭐⭐ |

| Education | ⭐⭐⭐⭐⭐ |

| Market Research | ⭐⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐⭐ |

ABOUT XM GROUP

XM Group is a unit of regulated online brokers: Financial Instruments Ltd was established in 2009 with headquarters in Limassol, Cyprus,

Who DOES XM GROUP APPEAL to?

The broker offers CFD markets in more than 1,200 financial instruments including Forex Trading, Stock, Commodities, Equity Indices, Precious Metals and Energies. The MetaTrader 4 platform provides cutting-edge conditions for both demo and real trading operations on PC/Mac OS, iPhone, iPad and Android. The advanced features of the mobile trading platforms are a significant plus point for XM.

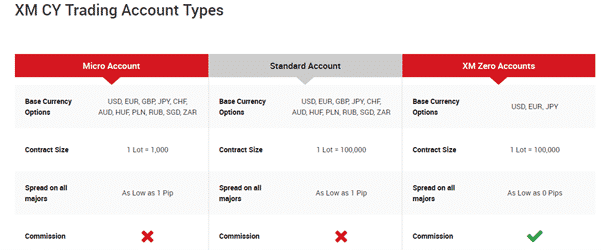

Apart from free and unlimited demo accounts with a virtual currency of $100,000 for beginner traders, XM Group offers three types of live trading accounts with custom-tailored conditions and base currency options of USD, EUR, GBP, CHF, AUD, HUF, JPY, AUD, RUB, SGD, ZAR and PLN:

The provision of a relatively high number of base currency options helps clients by removing the frictional costs associated with trading on a platform with a base currency which is not the same as that of the client. Trading is hard enough without taking on unnecessary operational costs.

With generally tight spreads on over 50 currency pairs and the same spreads offered for all trading account types, XM Group also provides fractional pip pricing. That means clients can trade with tighter spreads and benefit from the most accurate quoting available.

XM will appeal to those who are looking to use a trusted broker. The firm has a global client base so exact T&Cs vary from region to region but clients in EU countries benefit from their accounts being operated in line with ESMA rules. In that region XM Group offers maximum leverage of 1:30 and clients are also covered by Negative Balance Protection (NBP) and client account segregation rules.

Funds transfer processing time is quick and in line with standard banking practices. XM doesn’t apply any charges on money transfers.

The different account types have broadly the same terms and conditions. As a result, beginner traders and seasoned investors benefit equally. There is full access to the real-time market prices, 100% execution guaranteed with no rejection of orders and no re-quotes.

Client support is a central theme. Personal Account Managers are provided and available 24/5. Uniquely developed free tutorials on how to get the best out of the trading platform and free live webinars are available to those who want to perfect their trading skills.

The broker offers CFD markets in more than 1,200 financial instruments. The MetaTrader 4 platform provides cutting-edge conditions for both demo and real trading operations on PC/Mac OS, iPhone, iPad and Android. The advanced features of the mobile trading platforms are a significant plus point for XM. Apart from free and unlimited demo accounts with a virtual currency of $100,000 for beginner traders, XM Group offers three types of live trading accounts.

XM is recommended for - beginner to intermediate traders familiar with MetatraderMARKETS AND TERRITORIES

With over 1,200 markets on offer, XM provides a comprehensive service. It’s possible to get exposure to the far corners of the global financial markets. Whichever market you are trading, you can rely on the XM platform to be supporting you through state-of-the-art trade execution services.

INSTRUMENTS And SPREADS

XM offers clients the opportunity to trade in more than 1,200 markets. That is a healthy number and means even the most discerning trader will be likely to find the market they want to trade.

There are 57 currencies to trade, which means Major, Minor and Exotic pairs are all covered.

Shares, metals, soft commodities, and equity indices are all there. One market which isn’t currently covered is cryptocurrencies.

There are some neat additional extras available at XM. The Volatility 75 index offers a way to trade the VIX index. The VIX, otherwise known as the ‘Fear Index’ reflects market appetite for risk. Trading it can offer a ‘hedge’ against other positions in a portfolio.

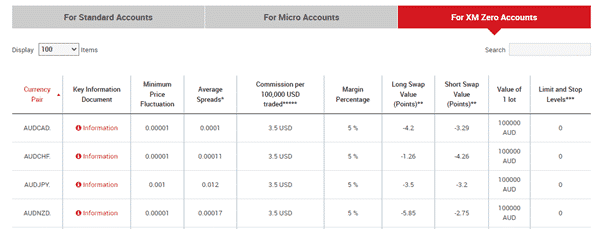

Trading spreads on all major currency pairs are as low as 0pips. XM also offers fractional pip pricing to get the best prices from its various liquidity providers. Instead of 4-digit quoting prices, clients can benefit from even the smallest price movements by adding a 5th digit (fraction).

The XM experience is very much about trading. The competitive pricing is also backed up by clients being offered a free VPS and the behind the scenes infrastructure ensures the execution is fast and reliable. 99.35% of all trades are executed in less than one second and there is a strict ‘no re-quotes’ policy and no virtual dealer plug-ins.

FEES & COMMISSIONS

As is often the way with brokers who feel their pricing is a major selling point, XM’s site contains an easy to read and super-transparent breakdown of all costs. Their tables include spread rates but also detail if any other commissions might apply and what financing rates on trades might be. This all adds up to traders being able to easily establish the risk-return on trades and go into the markets with increased confidence.

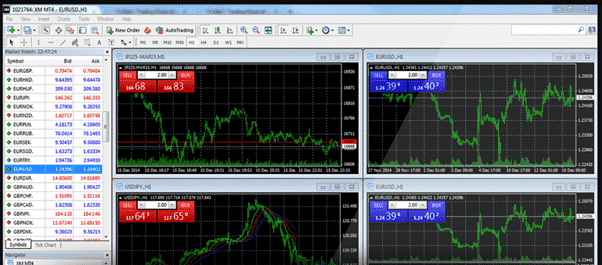

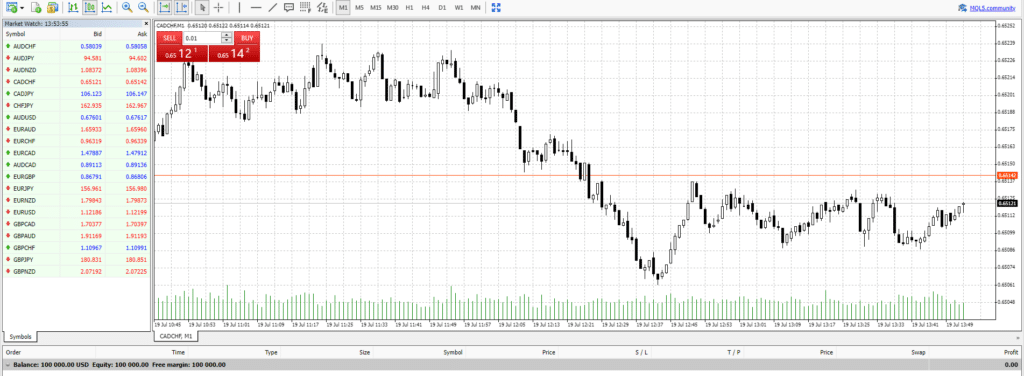

Forex Trading PLATFORM REVIEW

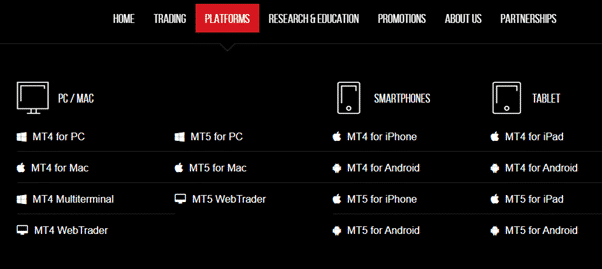

XM clients on both demo and live accounts can trade on a range of high-quality trading platforms. Each provides the full range of trading tools such as market, limit, stop and trailing orders, all are directly accessible from one account.

The seamless cross over between platforms speeds up trading operations and gives traders the flexibility to trade from locations and at times that suit them from anywhere and at any time with ease.

The MetaTrader MT4 platform is the most popular retail trading platform in the world. Millions of traders are drawn to the trading edge offered by being able to apply powerful software tools to their strategies.

The free trade indicators and razor-sharp graphics help MT4 stand out. It is also very reliable.

MT4’s sister platform MetaTrader MT5 is also on offer and offers a slightly different take on the trading experience. Both MT platforms are compatible with PC, Mac, iPhone and Android devices.

The XM WebTrader platform is accessible via any web browser ensuring access to the markets can be gained from anywhere with an internet connection.

MOBILE Forex TRADING

The MetaTrader mobile app provides an experience similar to the high-quality desktop version. Clients can access all the services necessary to support their trading.

There are a handful of tools and indicators which do not transfer over to the smaller screen but those that do ensure the mobile package is still of the highest quality. The application supports 30 technical “indicators” and 24 analytical “objects”, such as Gann and Fibonacci levels.

SOCIAL TRADING & COPY TRADING

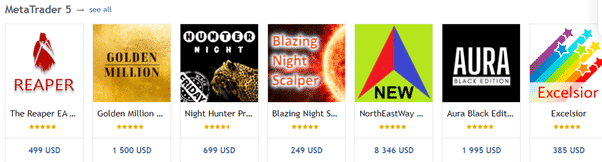

The MT4 and MT5 platforms are much loved by the trading community. They established their impressive reputation by offering manual and automated trading but those looking for a more passive way to gain exposure can also use the MT services relating to Copy and Social trading.

XM clients who access the MQL5 and Expert Advisors networks can set up their account to take on trading signals from 1,000s of other MT traders. It’s possible to analyse and evaluate the profiles of traders who are looking to be copied and the connection to copy trades can be broken at the copying trader’s discretion. Alternatively algorithmic trading models can be downloaded, some for no charge and accounts ran using the code within those models.

With MetaTrader’s platforms being the most popular in the world there is also the option to tap into the online chat rooms where other MT traders share ideas on the markets or ways to get the best out of the platform.

Crypto

XM do not currently offer markets in cryptocurrencies. It did used to offer markets in Bitcoin but has positioned itself as more of an expert service for trading in other markets.

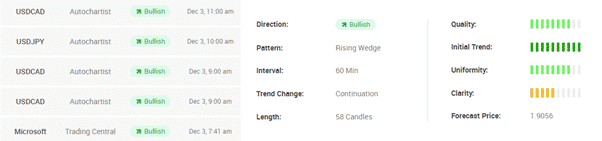

Forex Charting & Tools

The charting and tools found on the MT4 and MT5 platforms are still widely considered to be the industry benchmark.

MT4’s razor sharp graphics are supported by a default offering of more than 50 indicators and charting tools. The MT5 platform has a slightly greater number of indicators set up as default than MT4. The 80+ indicators can be applied to a charts which can be set to a wide range of time frames and the ‘last market price’ monitor allows clients to see into the heart of the market they are trading.

Both platforms can be adapted to suit personal preference and there are 1,000s of additional tools available from third-parties.

Forex Education

Whether you are new to online trading or trying out a new broker the educational materials found at XM are worth checking out. The cover topics ranging from bare essentials of forex to research on the fundamentals of commodities trading.

Each of the six chapters of XM’s specially designed ‘Learn Trading’ course covers one of the key areas of trading and investing. Put together the free course offers a chance for traders to develop a winning mindset and learn how to get the most out of the tools on offer.

The multimedia research offering includes videos on trading strategies, Q&A with experienced traders and live debates and webinars.

Forex Trader Protections by Territory

CySEC regulates the EU located branch of XM which has license 120/10 (Cyprus Securities and Exchange Commission). Financial Instruments Pty Ltd was established in 2015 with headquarters in Sydney and is regulated by ASIC with license No. 443670 (Australian Securities and Investments Commission). Australia and XM Global Limited were established in 2017 with headquarters in Belize and is regulated by the International Financial Services Commission (000261/106”).

Compare XM Group with other approved brokers

|  |  |  | |

| Education | educational content, webinars, market analysis | courses, market analysis | webinars, market analysis | courses, webinars, market analysis |

| Customer Support | email, phone | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Minimum Deposit | $5 | $100 | $100 | $200 |

| Total Markets | 1300+ | 1260 | 725 | 1000+ |

| Total Currency Pairs | 57 | 55 | 64 | 62 |

| Total Cryptos | 0 | 17 | 3 | 12 |

| Total CFDs | 1200+ | 626 | 725 | 900+ |

| Trading Platforms | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | MT4, MT5 | MetaTrader 4, MetaTrader 5, cTrader |

Opening an account

The link to opening an account with XM is found on the broker’s homepage. By clicking on ‘Open an Account’, the user is taken to an area of the site where they can set up either a live account or a demo account.

Opening a demo account takes moments to do. During our review, we discovered that, whilst opening a live account involves a greater amount of form filling, the process could be completed within five minutes.

With regards to the forms, the information you will supply is to make sure that you can be identified by the broker; during this process, you will need to upload some proof of identification. This helps to ensure that your account is only accessible by yourself.

The forms will also ask a range of questions relating to your previous trading experience, the source of the funds you’ll be using, and your educational background. These questions allow XM to build a profile of each account holder. The questions are also in place to verify that XM complies with the KYC (Know Your Client) protocols that are stipulated by the regulator which licenses their activity. The regulators which license XM and its parent company include a range of tier-1 regulators including CySEC where it operates under license number 120/10.

Once the application is complete, there is a short delay whilst the broker verifies your details. During this waiting period, it is possible to fund your account before it is live.

Making a deposit

One of the attractive features of the XM set up is that the broker allows a larger than average number of base currencies. This helps to avoid conversion fees. When setting up your account, you will need to select what your preferred currency is. If you deposit funds using any currency other than those offered by XM, your funds will be converted into the base currency by the broker.

To fund your new account, visit the ‘Deposit’ section of the trading platform. Here you will be asked to confirm which approach you will be taking. It is possible to send funds using bank transfers, debit and/or credit cards, and e-Payment providers such as Skrill.

The minimum deposit size is an appealing $5. This reduces the barriers to trying out live trading. It is also beneficial to beginners as they are often recommended to start trading in small sizes – this can help to build a degree of risk management.

You can only deposit funds from a bank account or card which has the same name as that on the trading account, meaning that it is not possible for friends or relatives to send cash to it.

Placing a trade

There are more than 10 trading platforms available at XM, meaning you can easily find the trading dashboard to suit your style. MetaTrader’s MT4 and MT5 platforms are available in a downloadable desktop form; this can be used on PCs and Mac devices. You can also access your account and trade through any internet browser. The mobile apps are compatible with both iOS and Android devices.

Both MT platforms provide markets in over 1,000 instruments and, whichever you choose to trade, you will quickly come to realise why the MetaTrader dashboard is so highly regarded in the trading community.

During our testing, we booked trades in two different currency markets: EURGBP, and CADCHF. Trade execution was instant, and positions were accurately reported in the Portfolio section of the site. We could track moves in P&L. The ability to change background colours is a nice feature and can be applied to whichever version of the platform you are using.

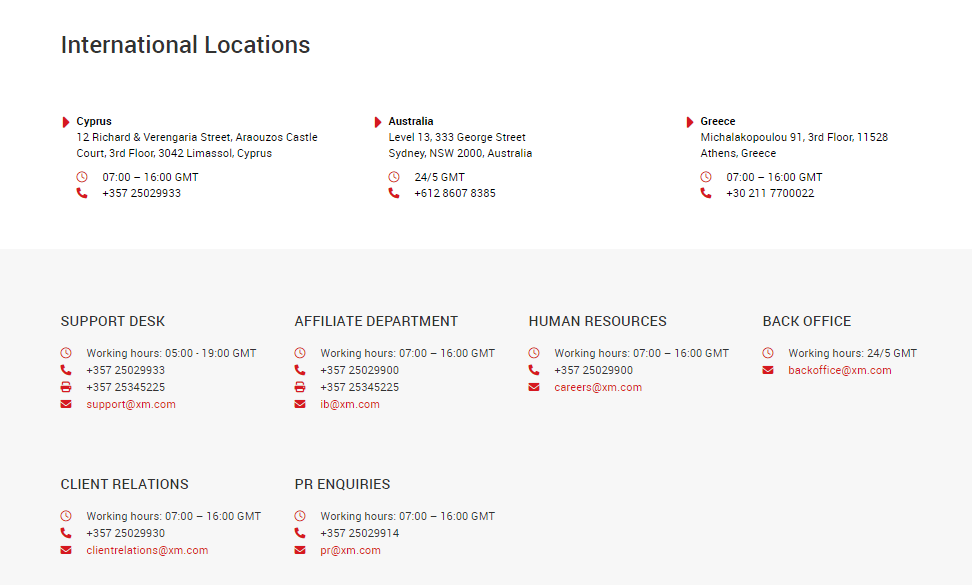

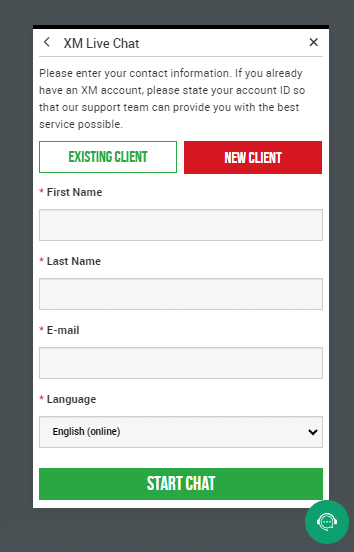

Contacting customer support

The XM customer services team benefits from global operations and can be reached in 27 different languages. This is well above average for the sector and reflects the commitment that the broker makes to client support.

Trading, operational, and tech issues can be addressed in a variety of ways. It is to XM’s credit that they allow users to steer queries to human agents from the outset, rather than making them work through a bot-orientated Live Chat system first.

We raised test queries with the broker using Live Chat, telephone, and email. In all cases, the response times were in line with the market standard, and our issues were resolved in a more than reasonable timeframe.

XM has been operating since 2009 and the broker has used that time to develop an impressive and useful range of FAQs. The related questions can be easily accessed from the side bar, meaning that receiving further information can be done so intuitively.

The Bottom Line

XM Group is committed to offering its services to a large global client base by setting high standards and by maintaining the following core values: business transparency, unified business principles and outstanding customer communications.

From the first moment of signing up with XM and throughout trading operations, clients can experience the benefits of trading with a leading forex broker.

XM offers its clients everything they need to trade and a chance to improve their chances of success.

Footnote

*Clients registered under the EU regulated entity of the Group are not eligible for the bonus.

Faq’s

How Can I Open A Demo Account With XM?

The Open An Account section of the site is where to head if you want to try out the XM trading experience using a Demo account. They are free to use and take moments to set up and clients get $100,000 in virtual funds to practise with.

Does XM Offer An Islamic Account?

Yes. XM offers three types of account, Micro, Standard and Zero. Each one of these three can be set up for swap-free trading which complies with Shariah law.

What Are The Deposit Options For XM?

Clients of XM can set up their accounts to be in the following base currencies – USD, EUR, GBP, CHF, AUD, HUF, JPY, AUD, RUB, SGD, ZAR and PLN. Funds can be paid in using debit card, credit card, bank transfer or ePayment agents.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk