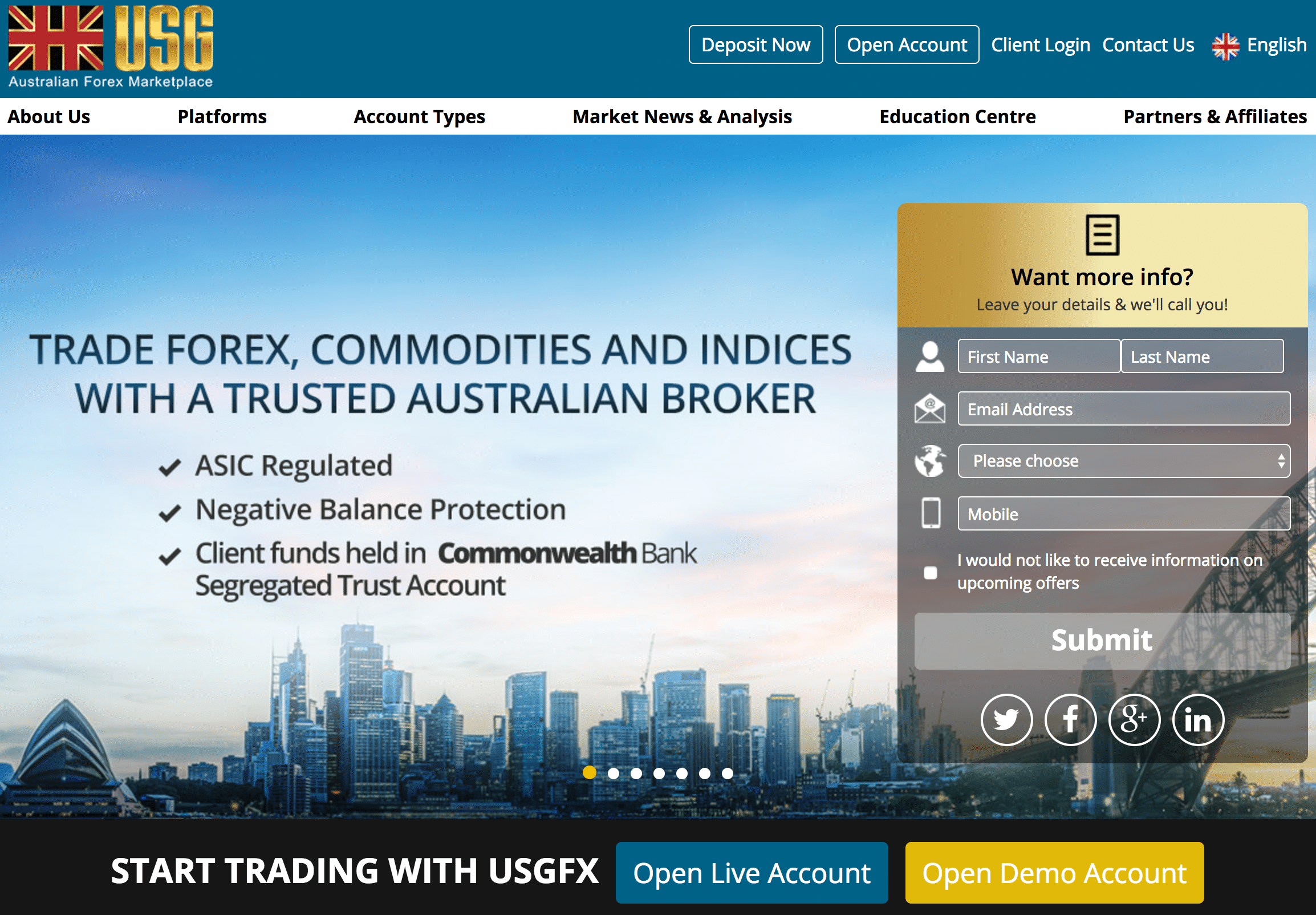

If you are searching for an established foreign exchange broker in Asia, then Union Standard Group (USGFX) of Australia may be the one for you. Headquartered in Sydney, they also have satellite offices in Auckland, Shanghai, and Hong Kong. Their regulatory oversight is from the Australian Securities and Investment Commission (ASIC), which patterns its operations after the UK and USA regulatory models. USGFX, however, is a global entity with servers networked into London, New York and Hong Kong to provide instantaneous execution of orders, no matter where you might reside on the planet. Founded in 2005, the firm is licensed in both Australia and New Zealand and offers a premium foreign exchange service, supplemented by CFDs for additional flexibility and market coverage. Trust, transparency, and respect are its trademarks.

Deposit peace of mind is a solid benefit, due to strict ASIC compliance. All client funds are held in segregated accounts at the Commonwealth Bank of Australia with no possibility of commingling with operating capital. USGFX also takes great pride in its customer service, providing every client with a dedicated account manager, free of charge. Depending on your account type, the firm supports both market maker and STP business models, and the management team has elected to provide access with the highly popular series of Metatrader4 protocols. MT4 options also include mobile and multi-terminal varieties, and, if you have access to the web, but without the MT4 download, the company also supports Webtrader, a leading system that is web-based and that provides free access to your MT4 account. Social trading is also supported.

There are three account classifications (Cent, Micro, and Standard) with varying spread benefits that will appeal to the majority of retail forex traders, and two account classes that cater more to corporate and professional traders (VIP and Pro-ECN). Minimum deposits for the former are $100 USD, versus $50,000 for the latter upscale accounts. USGFX does not accept cash or cash equivalents, in compliance with AML standards, but you can use bank wires, major credit cards, or a host of alternative payment services. They also provide a wide variety of contests and promotional bonus programs. Check the website for details and trading commitments. Spreads are very competitive and vary by account type, as does leverage, which can be as high as 500:1. Lastly, USGFX has invested in a broad-based educational curriculum and partnered with Trading Central to provide top-of-the-line market commentary, technical analysis, and trade setups. At this time, unfortunately, U.S. clients are not accepted.

Features at USGFX

Why trade with USGFX.com? The firm lists these reasons:

- Founded in 2005 by foreign exchange industry professionals;

- Headquartered in Sydney with regional offices in Auckland, Hong Kong, and Shanghai and licenses in both Australia and New Zealand;

- Regulated by the Australian Securities and Investment Commission;

- State-of-the-art telecom connections to Interbank servers in New York, London, and Hong Kong;

- High tech infrastructure enables high speed order execution for currency pairs and for CFD derivatives for indices and commodities;

- Five account classifications, including a free demo account: Cent, Micro, and Standard for retail forex traders, and VIP and Pro-ECN for professional and corporate traders (Minimum Deposit = $50,000);

- Minimum deposit is $100 USD for basic trading accounts, but accounts may be maintained in USD, AUD, EUR, or GBP;

- No U.S. clients accepted at this time;

- Micro lot trading available, as is automated trading with Expert Advisors and scalping (only on VIP and Pro-ECN accounts);

- Competitive spreads for all major pairings with low slippage and minimum requotes;

- Segregated Client Funds at the Commonwealth Bank of Australia in compliance with strict regulatory standards;

- Negative Balance Protection;

- Withdrawal requests are approved within 24 hours;

- Leverage varies by account class from 100:1 to as high as 500:1;

- Large library of educational and support materials, including a structured forex education course – The TradersClub Coaching Program;

- Top level market commentary and technical analysis;

- MT4 trading, the world’s most popular platform, supplemented with Webtrader for web-based only approach;

- Social trading supported with access to either ZuluTrade or Myfxbook;

- Dedicated personal account manager, along with professional and friendly staff available on a 24-hour basis.

Supported Platforms

The management team at USGFX elected to go with the highly popular Metatrader4 platform options, including mobile and multi-terminal applications. If you prefer or are in need of accessing your MT4 account without the necessary download, then the firm also provides a Webtrader option. If you prefer an automated trading approach, then Expert Advisors are supported, and social trading is enabled with access to ZuluTrade or Myfxbook. Advanced encryption protocols are also utilized for security purposes to protect your trading activity and personal information data at all times.

Deposits and Withdrawals

USGFX accepts deposits from a variety of sources, including traditional bank wires, credit cards, and alternative payment processing service providers. These providers are comprised of Webmoney, OK Pay, Perfect Money, Fasapay, Skrill, and Neteller. In line with AML standards, any form of cash deposit is unacceptable. Withdrawal requests are authorized within 24 hours, but there could be delays if your internationally mandated ID document requirements are not in order. Check the website for details.

Customer Support

In its effort to provide the best trading experience, USGFX guarantees that every client has, free of charge, a dedicated personal account manager to guide you through the process and ensure that your use of their service is both favorable and effective. Service representatives are available on a 24-hour basis via live chat, phone or email, and there are offices located throughout financial centers in Asia, including Sydney, Auckland, Hong Kong, and Shanghai. USGFX also excels in its learning academy that includes guides, ebooks, webinars, seminars, and a TradersClub Coaching Program, all supplemented with top-level market commentary, fundamental and technical analyses, and a revolving economic calendar.

USGFX – Conclusion

Asia was a bit slower than other regions to jump on the forex trading bandwagon and offer its own regionally based brokerage firms. The client base needed time to grow to justify the investment, but firms like USGFX were on the forefront of Asian developments in this industry. This firm has been around for more than a decade, growing quickly and expanding to support a global customer base with high quality service that includes tight spreads, fast execution, top-level customer service reps, and an excellent offering of support materials. Combine this package with strict regulatory compliance and safe deposit maintenance and you have a broker that you can trust from the land down under or wherever you might be on the globe. The management team truly envisions “becoming the most trusted and respected forex broker in the world.”

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk