Pros & Cons

| tixee Pros | tixee Cons |

| Choice of 220+ CFD assets | Regional restrictions |

| 6+ platforms | Customer support is not available on weekends |

| Licensed and regulated | No mobile app on iOS yet |

About tixee

Licensed by multiple regulators, tixee provides traders with a bespoke range of trading instruments. These instruments include CFDs on forex, stocks, indices, commodities, cryptocurrencies, and more across 6+ platforms.

Still considered a newcomer to the broker sector, tixee has already built a user base of 155,000 registered clients located in over 115 countries. tixee is also the recipient of awards, including the ‘Best Newcomer Broker’ and ‘Best IB Programme’ at the Ultimate FinTech Awards 2022.

Key Features

- 220+ CFD assets available, including FX, commodities, stocks and indices.

- 6+ platforms available, including MetaTrader 4, MetaTrader 5, social trading and the tixee mobile app.

- Licensed and regulated by the Financial Services Authority Seychelles (FSA), the Financial Sector Conduct Authority (FSCA) and the Cyprus Securities and Exchange Commission (CySEC).

- Free educational resources for traders of all experience levels, including eBooks, webinars, daily market updates and more.

- Friendly Customer Support 24/5

- Financial news, insights, economic calendar and customized tools from Trading Central.

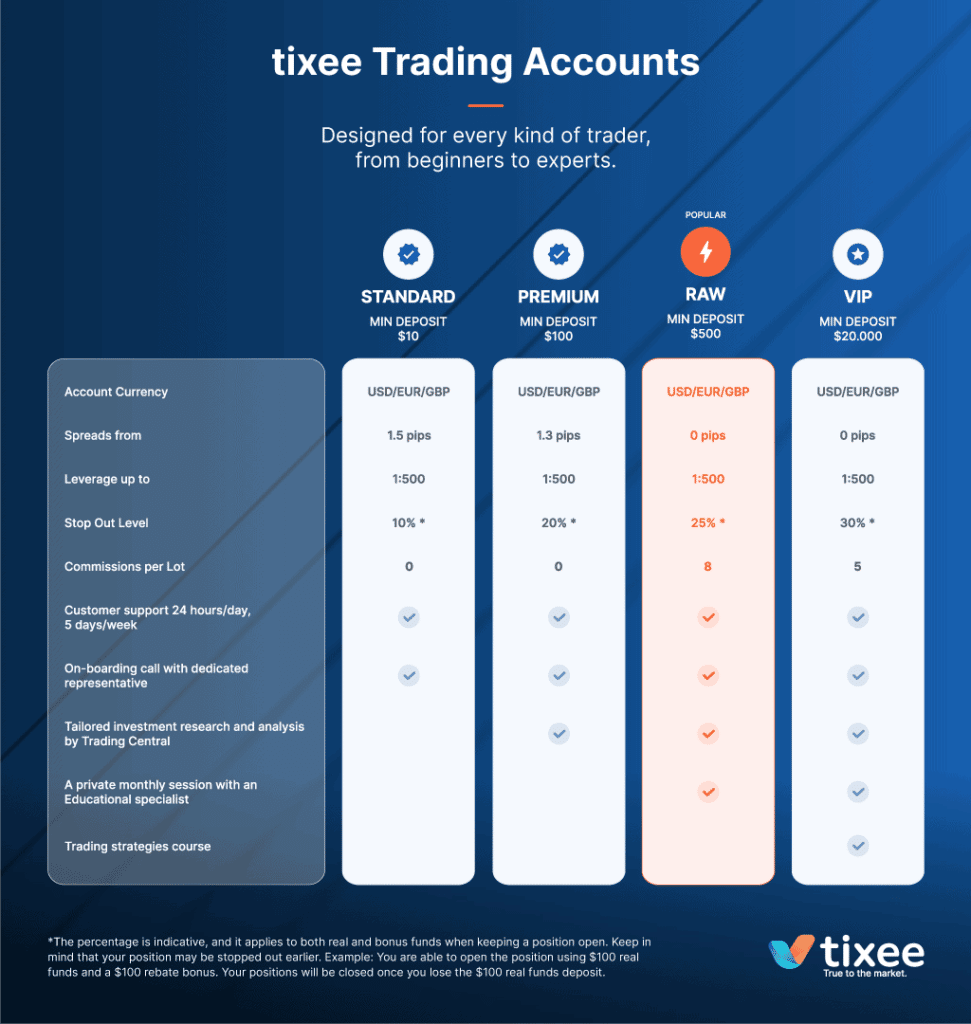

Account Types

tixee provides traders with four different accounts: Standard, Premium, Raw and VIP. With a minimum deposit of just $10, the Standard account is a suitable choice for those that are new to trading. The Raw account is another favourite – requiring a minimum deposit of $500. The additional features here include private monthly sessions with educational specialists and spreads from 0 pips. tixee also provides a demo account for its users.

Fees and Commissions

The minimum deposit required to open an account with tixee is $10. The broker itself charges no fees on either deposits or withdrawals (however, the payment provider may choose to do so). Spreads are dependent on the account type, ranging from 1.5 pips on the Standard account and 1.3 on the Premium to 0 pips on both the Raw and VIP accounts.

How to open an account

1. Registration

It is easy to register with tixee. Customers need to start by visiting www.tixee.com and completing an online registration form, which can be found by clicking the ‘Get Started’ button on the broker’s homepage.

2. Account Verification

Following the online form submission, the tixee team will verify user details and send a unique tixee username and password. Users will also need to provide copies of identification documents (details provided upon registration) to fully complete their account set-up.

3. Log in to the tixee client portal

Users can then access their client portal to see the full range of assets available and choose their account type.

4. Make a deposit

Users will need to make an initial deposit before they can begin to trade. This amount depends on the chosen account type.

5. Start trading

Once the required minimum deposit is made, users can start trading CFDs on FX, stocks, indices and more.

Customer Support

tixee is well known for its dedication to customer service. With its Customer Support team available 24/5, the broker’s contact methods include email, live chat and telephone. New traders are allocated an advisor to help them begin their trading journey. The broker also provides traders with a tixee expert for any further queries or assistance.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk