Forex Traders’ Viewpoint

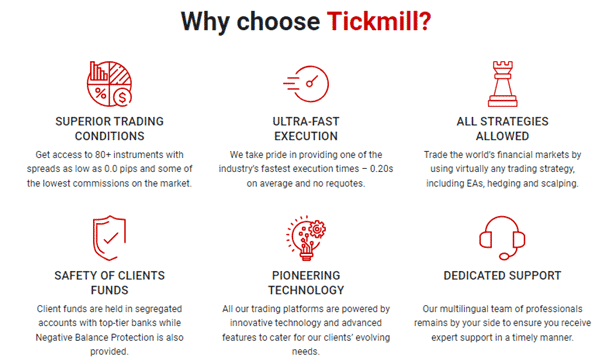

- Tickmill is very much about the trading experience. The user-friendly customer interface is supported by high-spec trading infrastructure which ensures you get the best access to the markets. Trade execution is super-fast with speeds averaging 0.20 seconds and the spreads are as tight as zero pips.

- Trade execution is about order quality as well as speed and price. A wide range of order-types can be used, there are no strategies which are off-limits and leverage terms are flexible.

- Autochartist is just one of a range of third-party research tools which can be used to develop and enhance trading ideas. The Expert Advisors tool which comes as part of the MetaTrader package allows clients to apply the ideas of others to their account and those who want to try trading their own algorithmic models are also well catered for. The recent addition of the Acuity market sentiment service highlights how Tickmill continues to expand its suite of services to give their clients the best chance of being successful.

Tickmill ticks the boxes on many levels. It appeals as being one of the cheapest brokers in the market to trade on. It has a very fast and stable registration process backed by a strong regulatory framework, and it is getting strong positive feedback on its customer service.

This Tickmill review will provide an insight into the pros and cons of the platform, but as it is rated ‘safe’, a hands-on trial of the service using the free Tickmill demo account is highly recommended. Trying out the service will aid your understanding and give a glimpse of how good the trading experience can be.

Tickmill Rating Overview

| FEATURE | Tickmill |

|---|---|

| Overall | ⭐⭐⭐⭐⭐ |

| Education | ⭐⭐⭐⭐⭐ |

| Market Research | ⭐⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐⭐ |

ABOUT TICKMILL

Tickmill is an award-winning global broker founded in 2014. The broker has different entities operating around the world which together for the Tickmill Group of companies.

Tickmill accepts clients from all countries except the United States, Iran, Iraq, Cuba, Sudan, North Korea, Syria, and Myanmar. These countries have restrictions or sanctions in place that prevent this broker from operating there and the minimum age to sign up for an account is 18 years.

Awards won in 2021 include:

- #1 Broker for Commissions and Fees – ForexBrokers.com Annual Forex Broker Review

- Best Forex Customer Service – Global Tickmill

- Best Forex Trading Experience – Asia Tickmill

- Best Forex Trading Experience – Middle East Tickmill

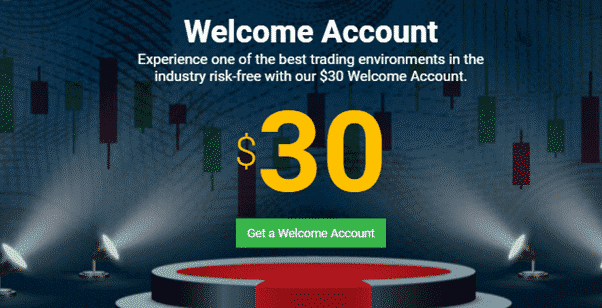

Tickmill UK clients are protected by some of the most highly regarded regulators in the world including the FCA and CySEC. Clients from other domiciles may be able to access Tickmill bonus plans, which are updated regularly but even include a $30 Welcome Account and Trader of The Month competitions.

WHO DOES TICKMILL APPEAL TO?

Tickmill is a good broker for both beginner and experienced traders. Starting off by using the free Tickmill demo account means that beginner traders can get enough experience before trading live and, as such, can avoid costly mistakes. Traders do not need to make a deposit to access the demo account which takes less than 10 seconds to set up.

All traders like to know that their broker gives priority to client protection, and on this topic, Tickmill is hard to beat. The regulatory framework, KYC protocols, cyber security set-up, Negative Balance Protection (NBP) and segregation of funds are all of the highest standard. One standout feature of Tickmill’s set up is that if offers NBP safeguards which stop clients from losing more money than they deposit on ECN accounts. Most brokers don’t offer an NBP and ECN combination, so Tickmill scores highly by combining the two.

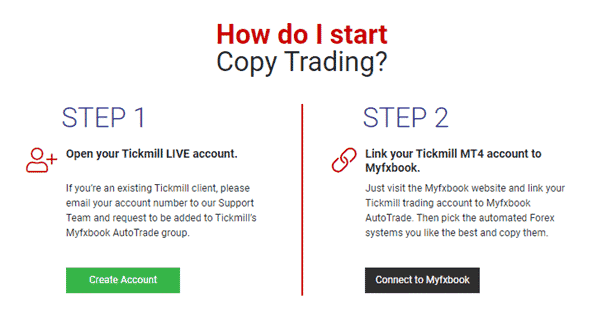

Moreover, Tickmill provides comprehensive guides to develop traders’ skills and knowledge. Beginner traders can access introductory materials and are assigned a dedicated support agent to guide them through and answer questions. Another differential offered by Tickmill is the firm’s partnership with Myfxbook that offers clients advanced robot-trading options through the AutoTrade platform.

Tickmill is a good broker for both beginner and experienced traders. Starting off by using the free Tickmill demo account means that beginner traders can get enough experience before trading live and, as such, can avoid costly mistakes. Traders do not need to make a deposit to access the demo account which takes less than 10 seconds to set up.

Tickmill is best for - Beginners and IntermediatesForex ACCOUNT TYPES

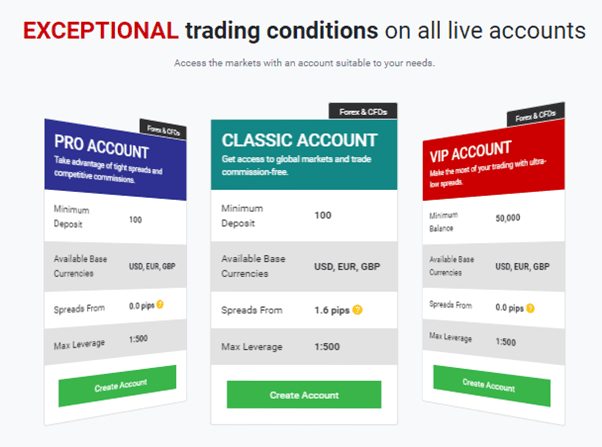

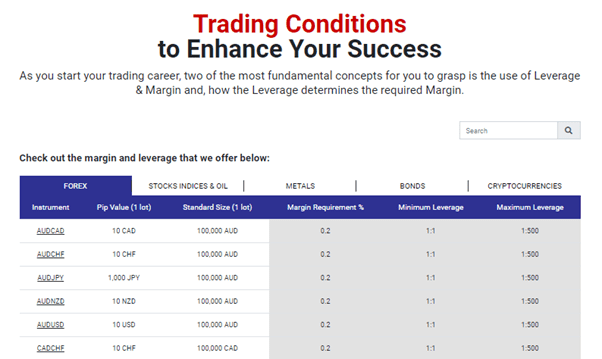

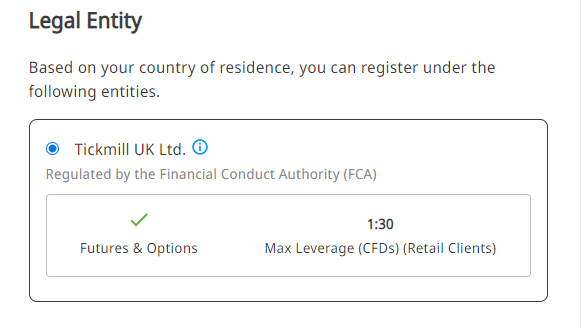

There are three different Tickmill account types, Pro, Classic and VIP. All offer leverage up to 1:500 and can be set to Swap-Free Islamic trading terms and conditions. Base currency options include USD, EUR and GBP, and having a choice helps clients to avoid frictional costs of converting their cash deposit into another currency.

The minimum deposit for the Pro and Classic account is $100. High-volume traders with a minimum balance of $50,000 are registered under the VIP account and enjoy institution grade trading conditions.

MARKET AND TERRITORIES

Tickmill is a global broker available in nearly all countries with exceptions including, Iran, Iraq, North Korea, Cuba, Syria, the US, Sudan and Myanmar. This broker has its headquarters in London and offices in Seychelles and Cyprus.

Tickmill is regulated by world-leading bodies such as the FCA and CySEC, and hence, users across the globe have a guarantee that their money is safe. While the FCA and CySEC only safeguard European domiciled clients they are considered as a seal for broker legitimacy across the globe.

Tickmill’s global approach extends to the broker supporting a wide range of languages. Its platforms and customer services are available in Chinese, Indonesian, Russian, Vietnamese and Spanish.

INSTRUMENTS AND SPREADS

Tickmill offers markets in a variety of asset groups including forex, cryptocurrencies, stock indices, metals, energy commodities and bonds. Markets in individual stocks are due to be rolled out on the MT5 platform in the near future.

The total number of markets on offer is not as high as at some other brokers but there is a good range of asset groups to choose from.

- The forex offerings include over 60 currency pairs consisting of all majors, the majority of minors and a few exotics. The 14 stock indices include UK 100, US 100, France 40, Italy 40 ad DE 30

- Energy products include the WTI and Brent while precious metals include gold and silver.

- Tickmill also offers German bonds at competitive spreads and with zero commissions.

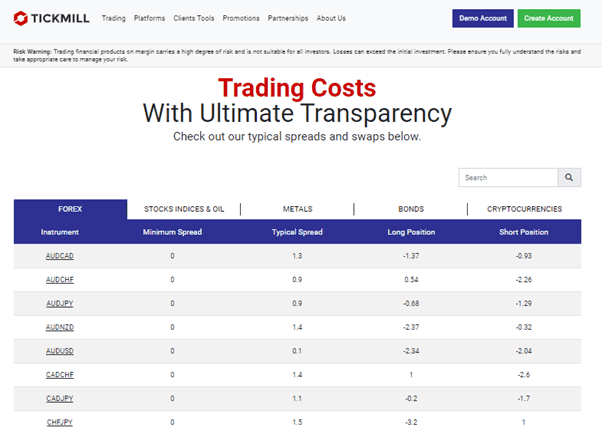

The trading conditions for CFDs are also highly favourable with spreads starting from as low as 0.00 pips.

Tickmill accounts operates using floating spreads which start from 0.00 pips. It’s hard to compete with zero which goes some way to explaining the popularity of the platform.

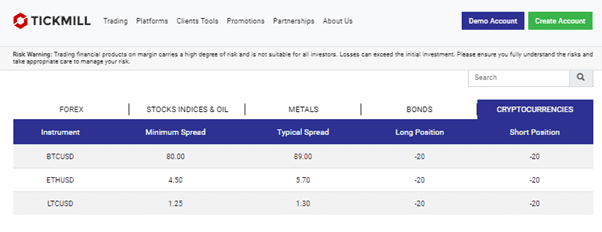

This broker has recently started offering Bitcoin, Ethereum and Litecoin. These can be traded without the need of a special ‘wallet’ and can be bought using USD, the GBP and Euro.

FEES AND COMMISSIONS

Trading spreads begin as low as 0.0 pips and whilst exact T&Cs depend on the type of account selected the broker takes an aggressive approach to providing cost effective trading. What is noticeable is that Tickmill offer some of the most transparent reporting on fees and commissions in the industry. The easy to read table makes it easy to establish what charges apply and such transparency is a sign that the broker knows it has a competitive advantage over a lot of its peer group.

Given its low deposit requirement and zero fees, the Classic Account is best suited for beginner traders and spreads start at 1.6pips. The ECN Pro Account, on the other hand, has spreads starting from as low as 0.00 pips and a cost of $2 per side per lot. This account margin call and stop out levels are also 100% and 30% and the average execution speed for both accounts is 0.2 seconds.

The VIP account is the epitome of everything that is good about this broker. As mentioned earlier, Tickmill requires a minimum deposit of $50,000 for the VIP account. This account type requires a commission of $1.6 per lot per side, which is considered among the lowest of all brokers. Furthermore, the commissions are bound to decline as the trading volume increases. This account type also has a margin call and stop out levels of 100% and 30% respectively.

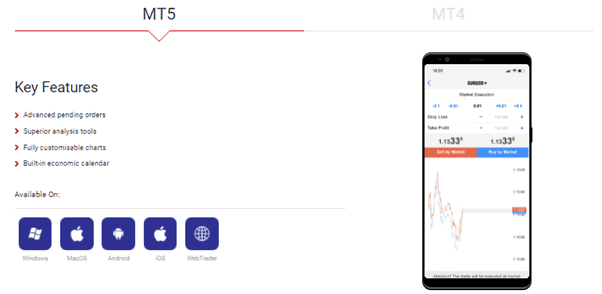

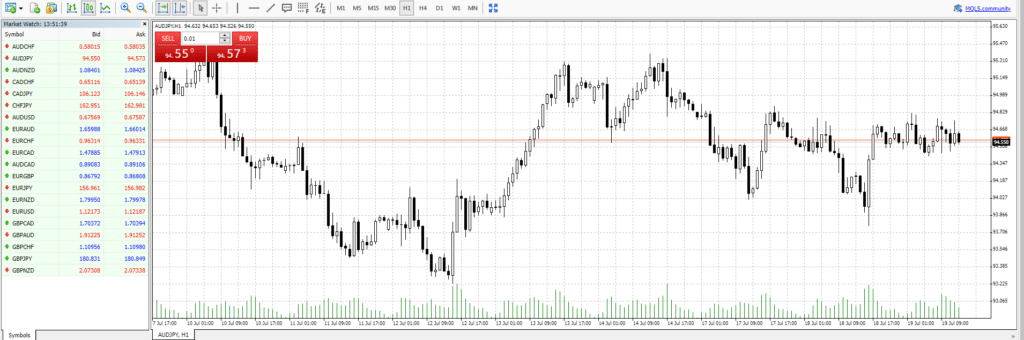

Forex Trading PLATFORM REVIEW

Tickmill offers both of MetaTrader’s market leading platforms, MT4 and MT5. They can be installed on Mac, Windows, Android and iOS devices or accessed using the WebTrader format. The platforms are super-popular among the trading community due to them offering a combination of easy functionality, speed, and powerful software tools. Moreover, they are easily customisable to meet specific needs of those looking to adapt the platform to meet their particular type of trading.

The platforms allow clients to apply strategies including scalping and hedging.

MT4 comes with advanced technical analysis tools, including 50+ indicators and customisable charting tools. MT5 has a wider product range, more timeframes and 38+ integrated indicators.

The provision of Autochartist is a big plus point as it helps clients to identify optimal trade entry and exit points. Further granular analysis options are provided by MetaTrader’s Expert Advisor service and its extensive back-testing environment.

Tickmill also provides a VPS service that upgrades the quality of trade execution. In general, most users who have left a review on Trustpilot and Forex Peace Army report that this broker has efficient, easy-to-use and secure trading platforms.

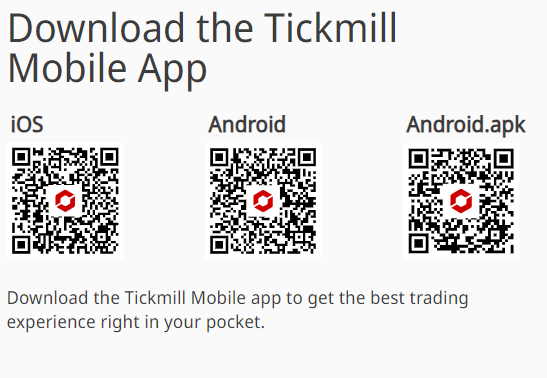

MOBILE Forex TRADING

Mobile trading is available in both an iOS and Android versions. Traders can download the apps for free on the Apple App Store and Google Play Store, respectively. The Tickmill Web Trader platform can also be accessed through any browser window so there are lots of ways to stay on top of your trading using handheld devices.

This broker’s mobile platforms come with nearly all the features found in the desktop version. Some of the features accessible through the mobile app include the demo account, over 30 technical indicators and fully interactive candlesticks and bar charts. The mobile platforms also offer an easy price viewing and trade ordering process.

SOCIAL TRADING AND COPY TRADING

Tickmill provides users with tools to copy the trades of savvy traders and replicate them in their accounts. The process involves linking to the Myfxbook, AutoTrade or Expert Advisors services. Traders can then pick the automated forex systems they like best and copy them. This range of copy trading options means there are useful options to consider for both beginner and experienced traders.

Copy trading involves relying on a third-party so comes with inherent risks but it can help beginner traders to improve their trading skills and offers a more hands-off way to trade the markets. With Tickmill, traders and clients can trade using MQL signals, AutoTrade or even a multi-account manager. Visit the Tickmill resources and education centre to learn more about social copy trading.

CRYPTO

Demonstrating the innovative nature of the firm Tickmill has recently introduced crypto markets to its platform. Bitcoin, Ethereum and Litecoin can all be traded from the same account as other markets are. There’s no need to set up special accounts or worry about ‘hot’ or ‘cold’ wallets.

The ability to use a regular platform rather than a specialist exchange to trade crypto has other benefits, most notably in terms of pricing. The spreads and financing at Tickmill are highly competitive and once more, shared in a user-friendly transparent way.

Forex CHARTING AND TOOLS

Tickmill provides access to over 31 charting tools. This broker has partnered with Autochartist to offer free actionable trading signals. Autochartist is a top third-party online technical analysis tool that uses indicators such as Fibonacci retracements to identify chart patterns. This tool runs for 24 hours a day, alerting its users of trading opportunities in real-time.

Autochartist comes with a customisable search pane to enable its users to define the market parameters that the program scans. This means that it fits different trading styles and can be used to search unfamiliar markets and discover new opportunities. Another great feature found in this tool is a built-in price movement scanner. This feature highlights the range at which the price of an asset has moved in a given period.

Tickmill offers Autochartist for free to all live accounts and also the demo account on a delay of five candlesticks. Tickmill provides guides to help beginner traders familiarise themselves with this technical analysis tool. Users can also get additional information on the Autochartist website.

Forex EDUCATION

Tickmill provides comprehensive educational materials for both beginner and experienced traders. The resources come in downloadable eBooks, videos, infographics, articles and regular webinars. Also available is a regularly updated blog and news portal. Tickmill’s FAQ page and forex glossary are also comprehensive enough for traders.

Beginner traders are welcomed with a free 46-page eBook titled ‘The Majors – Insights and Strategies’. The book covers topics such as how forex trading works, an introduction to major currency pairs, forex analysis and trading strategies. Tickmill video resources also cover a wide range of topics from beginner level education to the experienced trader, continued training and updates. The videos are available for free to all clients.

Tickmill webinars are available in English, Italian, German and Arabic. The webinars cover the latest updates in the industry and also refresher training. Users can find the Tickmill webinar schedule on their website and view old recordings on their archives.

Tickmill’s blog is another essential resource tool for both the beginner and the experienced trader. The platform covers topics revolving around fundamental and technical analysis. Users do not need to register to access the blog. Tickmill encourages readers to contact the authors of specific blogs with questions relating to its articles.

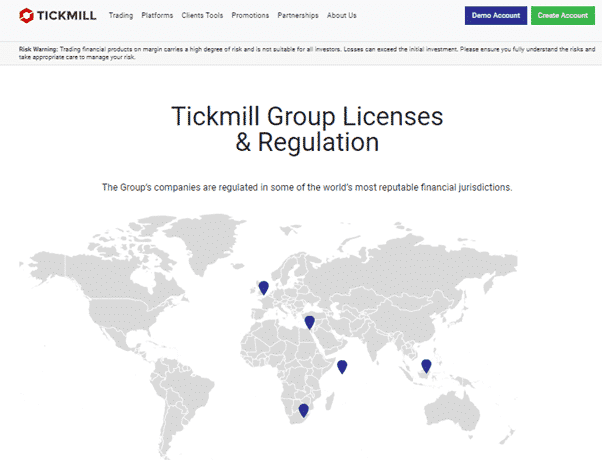

Forex TRADER PROTECTIONS BY TERRITORY

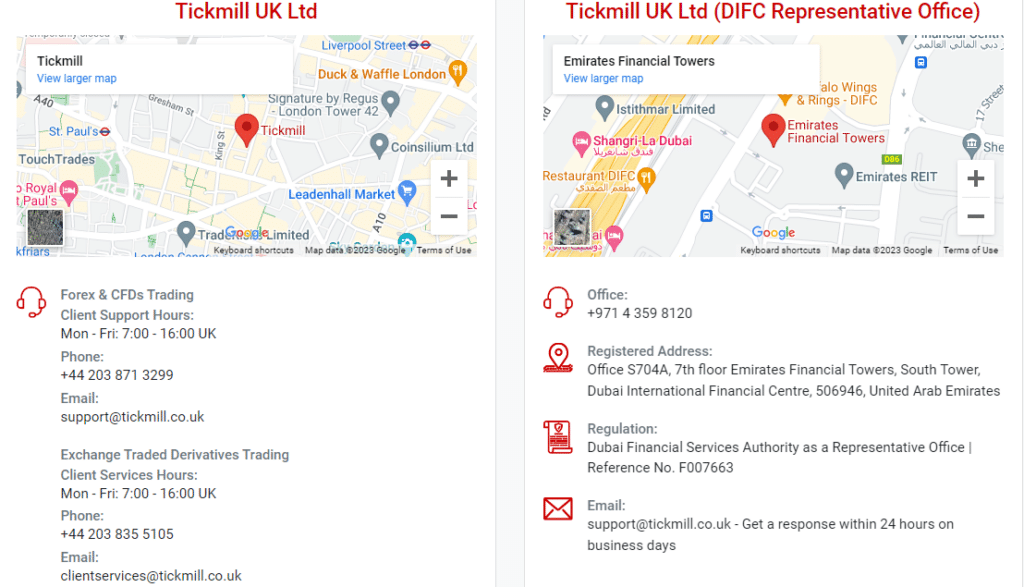

Tickmill UK Ltd is regulated by the Financial Conduct Authority (Registered Office: 3rd Floor, 27 – 32 Old Jewry, London EC2R 8DQ, England).

Tickmill Europe Ltd, regulated by the Cyprus Securities and Exchange Commission (Registered Office: Kedron 9, Mesa Geitonia, 4004 Limassol, Cyprus).

Tickmill South Africa (Pty) Ltd, FSP 49464, regulated by the Financial Sector Conduct Authority (FSCA) (Registered Office: The Colosseum, 1st floor, Century Way, Office 10, Century City, 7441, Cape Town).

Tickmill Ltd, Address: 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles regulated by the Financial Services Authority of Seychelles and its 100% owned subsidiary Procard Global Ltd, UK registration number 09369927 (Registered Office: 3rd Floor, 27 – 32 Old Jewry, London EC2R 8DQ, England).

Tickmill Asia Ltd – regulated by the Financial Services Authority of Labuan Malaysia (License Number: MB/18/0028 and Registered Office: Unit B, Lot 49, 1st Floor, Block F, Lazenda Warehouse 3, Jalan Ranca-Ranca, 87000 F.T. Labuan, Malaysia).

Regulators such as the FCA and CySEC require brokers to segregate traders’ money and adhere to strict reporting requirements. This ensures that they do not use their clients’ money for any other purpose other than the intended one.

Tickmill is also supervised by BaFin in Germany, CONSOB in Italy, ACPR in France and CNMV in Spain. BaFin is also known as the Federal Financial Supervisory Authority and is the leading financial regulator in Germany. CONSOB, ACPR and CNMV are also government bodies responsible for regulating financial and securities markets in their countries.

Compared to other brokers, Tickmill is adequately regulated. As mentioned earlier, this broker has operations in most countries across the globe, meaning that it is trusted even in jurisdictions where it does not have a regulator.

Compare Tickmill with other approved brokers

|  |  |  | |

| Education | webinars, market analysis | courses, webinars, market analysis | courses, market analysis | courses, webinars, market analysis |

| Customer Support | email, phone, live chat | email, phone | email, phone, live chat | email, phone, live chat |

| Minimum Deposit | $100 | 50$ | $100 | $200 |

| Total Markets | 725 | 2000+ | 1260 | 1000+ |

| Total Currency Pairs | 64 | 49 | 55 | 62 |

| Total Cryptos | 3 | 37 | 17 | 12 |

| Total CFDs | 725 | 2000+ | 626 | 900+ |

| Trading Platforms | MT4, MT5 | eToro Platform | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | MetaTrader 4, MetaTrader 5, cTrader |

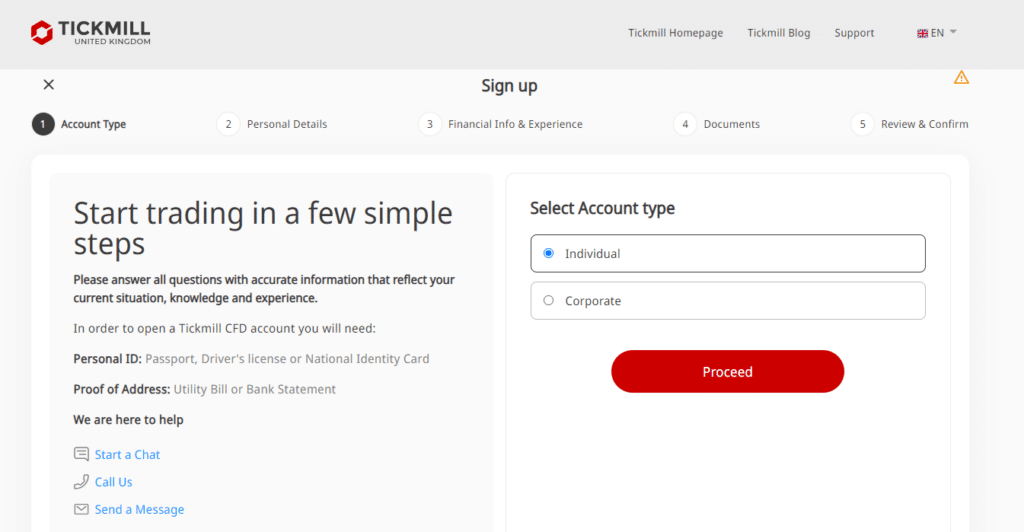

Opening an Account

Tickmill is a global broker with offices operating in various jurisdictions worldwide. The exact onboarding process for new clients depends on the regulatory environment in which the Tickmill entity they sign up to operates. That being said, the broker is well-established and has obviously spent time designing ways to make the process of opening a new account as user-friendly as possible. When testing this process, the application procedure for new accounts took approximately eight minutes.

All the form filling is completed online, with the broker asking various questions to establish your identity and to gain an understanding of your trading experience. Questions are asked about educational background, source of funds, trading experience and financial market knowledge. There is also a need to upload personal identification documentation such as a driver’s licence or passport. This is to comply with KYC (Know Your Client) processes and duty of care protocols stipulated by financial regulators.

The broker stipulates that it might take up to 24 hours to verify your documentation and approve the account for live trading, but the actual processing time was less than five hours. During registration, it was possible to access the trading platform to familiarise yourself with the trading dashboard in the intervening period. Live trading commenced after the new account had been fully approved and funds deposited.

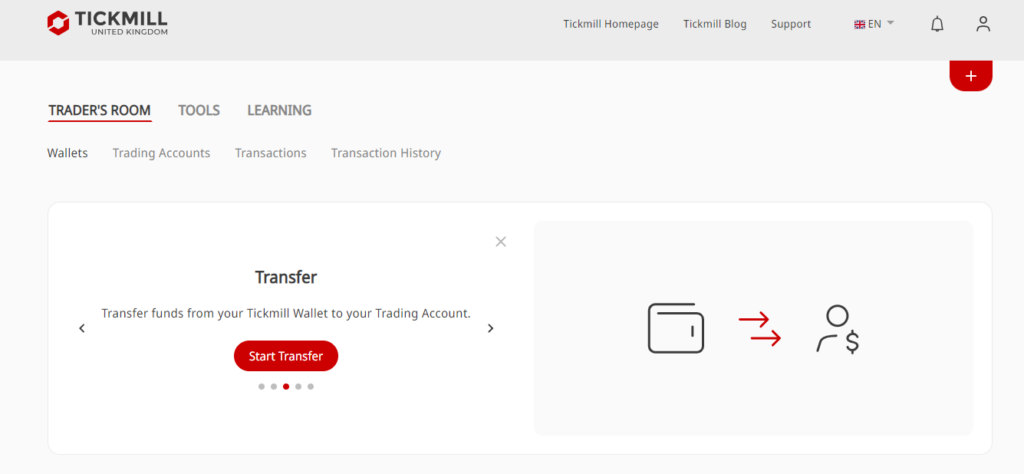

Making a Deposit

Given the increasing popularity of trading using handheld devices, the neat features offered by Tickmill regarding app downloads were welcome as they made the onboarding process more user-friendly.

It is possible to send funds to your new account using the desktop platform and handheld devices with easy-to-follow steps. Credit card, debit card and PayPal deposits are processed instantly, but bank wire transfers can take up to 24 hours to clear.

There is also an impressive range of e-payment options, including Skrill, Neteller, Dotpay and SOFORT. These also result in funds being instantly credited to your broker account and provide an alternative way of sending cash needed to trade.

To wire funds to your Tickmill account, simply sign into your account and, from the client home page, select the payment method you would like to use. Specify the amount you want to deposit and select ‘Submit’.

The time taken to withdraw funds is slightly longer, regardless of your chosen payment method. Credit card and debit card transactions are, for example, quoted as taking up to 24 hours to process.

It is possible to create ‘wallets’ in EUR, USD, and GBP. That allows Tickmill clients to fund accounts in different currencies which can be beneficial in terms of managing forex exposure levels on some strategies.

Placing a Trade

The MetaTrader MT4 and MT5 platforms offered by Tickmill have been used by millions of traders since they were first established. That extensive user-based testing has resulted in a super-reliable platform that has had any glitches removed.

The crisp aesthetic is ideal for charting and technical analysis. When booking test currency trades in the Demo account format, we found all the indicators required to establish clear trading signals.

The Demo account environment is obviously different from the live trading environment, where slippage and order errors can have a material impact on trading profile and loss. But booking trades in multiple asset groups was met with the familiar reliability of the MetaTrader service.

The MT5 platform has a slightly different feel and more default indicators than MT4. It also offers a larger number of asset groups and total markets. Deciding which of the two platforms to use will come down to personal preference, but during our testing, both were found to be good options. They have the feeling of being designed for traders, by traders, and are an ideal option for Tickmill clients to keep on top of the markets.

Contacting Customer Support

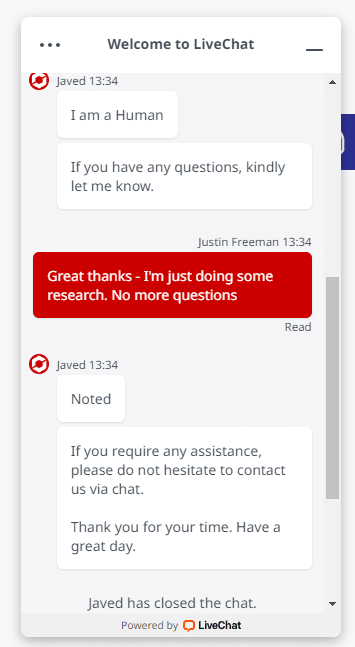

Tickmill continues to pick up industry awards. The Best Forex Customer Service prize received at the Global Forex Awards of 2022 illustrates the importance this broker gives to customer support.

The Live Chat service is available in a range of languages not available at many other brokers. Help can be accessed across multiple languages, including Korean, Spanish, Vietnamese, Polish and German, and the response times varied during our testing period. Some queries were dealt with instantly, and in some instances, we had to wait in a queue for approximately 20 seconds. That slight delay was worth it as the Live Chat service takes you directly to a human support team member, so there is no time spent navigating an automated bot-style agent.

The telephone numbers for the Tickmill customer support team are easy to find, and our test queries were dealt with by professional-sounding and client-focused staff. Questions sent via email on more involved issues were responded to within the stated 24-hour period.

THE BOTTOM LINE

Tickmill is a great broker with features that appeal to both beginner and experienced traders.

A market leader in terms of pricing, Tickmill fees are among the lowest in the market. The popular EUR/USD forex pair has a typical spread of 0.2 pips at Tickmill, compared to the industry average of 0.7 pips.

The trading experience is supported by an exceptionally high-grade IT framework, and the research services provided to clients are designed to improve the odds of traders making a profit. The final cornerstone of trading is client safety, and Tickmill gets that right also.

Registration with Tickmill is fast and straightforward and highly recommended. Once you have set up your Tickmill login, you can access your account in desktop or mobile format and try out one of the best brokers in the market.

FAQS

How can I open a demo account with Tickmill?

Beginner traders can open an unlimited demo account which doesn’t even need a deposit. Live accounts can be set up online and funded using a wide range of payment methods including debit and credit card and e-payments.

Is Tickmill a regulated broker?

Tickmill is regulated by a range of highly regarded international institutions.

Tickmill UK Ltd is regulated by the Financial Conduct Authority, Tickmill Europe Ltd, regulated by the CySEC, Tickmill South Africa (Pty) Ltd, is regulated by the Financial Sector Conduct Authority (FSCA), Tickmill Ltd, is regulated by the Financial Services Authority of Seychelles and Tickmill Asia Ltd – is regulated by the Financial Services Authority of Labuan Malaysia.

What are the deposit options for Tickmill?

Tickmill has a $100 minimum initial deposit requirement which is in line with the market standard. The VIP account which offers special trading conditions including lower fees has a minimum balance requirement of $50,000.

How do I withdraw money from Tickmill?

Tickmill says that it will process all withdrawal requests within 24 hours on business days, with the time for the funds to reach your bank account depending on your bank’s own policy, which usually takes 3-7 working days. These timings are in line with the peer group, but Tickmill does have an edge on some rivals by not charging clients to withdraw funds.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk