Would you like your forex broker to offer more than just foreign exchange trading? Welcome to STO. STO is one of three subsidiaries under the AFX Group corporate brand banner. The other two entities focus on affiliate programs and traditional equity portfolio client management activities. Founded in 2010, the firm opened its doors for business in 2011, and in a very short time has amassed a broad customer base, six offices across the globe, and over fifty employees to serve your interests. STO is also not only devoted to retail forex traders, it also offers CFDs for additional opportunities in stocks, indices, commodities, and bonds.

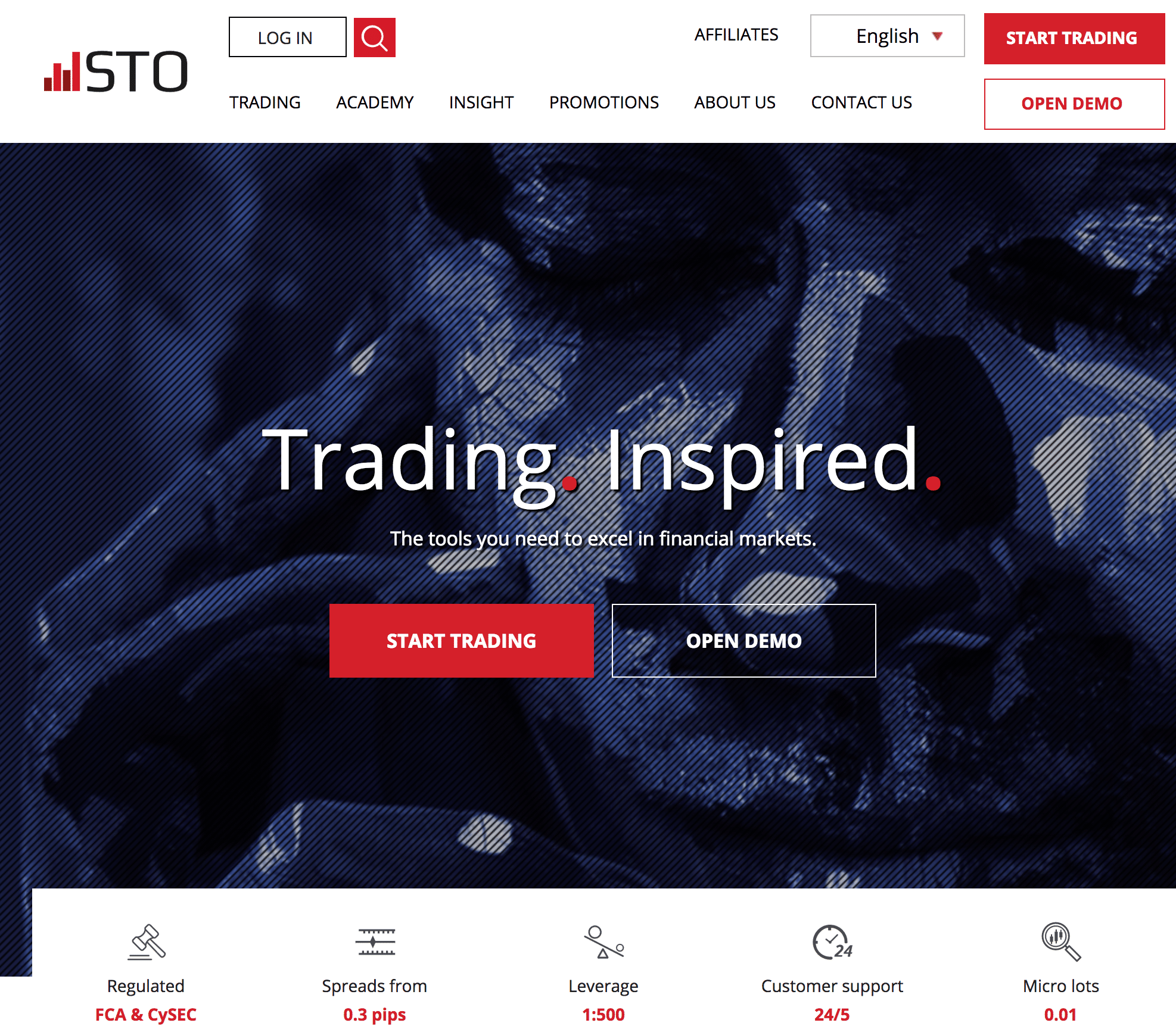

STO is authorized and regulated by the FCA and CySEC and registered with CONSOB and the FSB with offices in London, Cyprus, Milan, Shanghai, New York and Cape Town.

The firm offers four account classifications that provide escalating benefits in the form of tighter spreads and support. Margin requirements and leverage vary by asset choice. Leverage also varies inversely to your account balance, a method used by many firms to limit their risk exposure in the market. You may trade using the popular MetaTrader4 series of products or employ the firm’s proprietary AFX Fast platform. The latter is an ECN/STP set up that provides an environment preferred by professional traders.

STO also garnered a “Best Broker of the Year” in 2014 at the MENA Forex Awards. Learning Academy materials are broad in nature, for beginners, intermediate and advanced traders, as well. There are also several promotional bonuses and contests to entice your patronage, and, as the management team asserts, “Regardless of your trading experience, STO has all the necessary tools and educational resources you need to start trading.” Per its website, STO and AFX Group are trading names of AFX Markets Ltd and AFX Capital Markets Ltd. AFX Markets Ltd is authorized and regulated by the Financial Conduct Authority (FCA) FRN: 560872. AFX Capital Markets Ltd is authorized and regulated by CySEC, licence no. 119/10 and registration no. 253014. Unfortunately, U.S. clients are not accepted at this time.

Features at Super Trading Online (STO)

Features at STO

Why trade with STO? The firm lists these reasons:

• Founded in 2010 offices in London, Cyprus, Milan, Shanghai and New York and Cape Town;

• Regulated by the FCA and CySEC, and registered with CONSOB and the FSB;

• Client deposits segregated in Top Tier bank accounts and further protected by two national investor compensation schemes;

• Four account classifications with escalating benefits: Classic ($200/€200 to $499/€499), Premium ($2000/€2000 to $24,999/€24,999), Pro ($25,000/€25,000 and up), and AFX Fast ($2,000/€2,000 and up);

• Spreads can be as tight as 0.3 pips for the Pro account, or 1.8 pips for Classic;

• Trading platforms include MetaTrader 4 series or proprietary AFX Fast system;

• Over 150 products: Currency pairs (32), Stocks (101), Indices (11), Bonds (7), Commodities (4);

• Leverage can be as high as 500:1 for forex pairs – Varies by asset choice;

• Superior trading tools and market commentary, along with training videos;

• Customer service is multi-lingual and available “24X5” during market hours via live chat, email, fax, or direct phone line.

Platforms

STO offers two ways to trade. You can use the highly popular MetaTrader4 series of platforms or avail yourself of the firm’s highly touted proprietary version, AFX Fast. The latter set of protocols is designed with the professional or institutional trader in mind. It combines the latest in superior technology to yield a seamless, professional user experience. Its ECN/STP format prevents re-quotes and slippage, provides multi-level pricing, comprehensive charting tools, and easy access to reports and position tracking. Mobile trading is also supported, and the latest encryption technology will thwart any attempt by outside hackers to compromise any personal or trading activity data.

Deposits and Withdrawals

STO accepts deposits by way of traditional credit cards or banking wire transfer. There are also a number of other alternative payment systems, such as Skrill, Neteller, CashU, Union Pay and others that are supported. Check the website for updates. Withdrawals are handled quickly, as long as internationally mandated identity documents are current and in order.

Customer Support

Customer Service representatives can be accessed during market hours “24X5” across the globe via live chat, email, fax, or direct phone line. There are also convenient office locations in London, New York, Milan, Shanghai, Cape Town, and Limassol. Support materials include a vast library of video tutorials for beginners, intermediate, and advance traders, alike. Topics also include indicators, analysis, Expert Advisors, and strategy development. Daily commentary, technical analysis, an event calendar, and other tools round out the package to ensure that you get off and running is a positive manner and with the resources that you need.

Super Trading Online (STO) – Conclusion

If you want a forex broker that is also experienced in other investment fields and that offers alternatives to forex under one corporate roof, then STO might be what you are looking for. They also specialize in supporting affiliates, multi-account managers, institutional traders, and private equity portfolio management. The forex subsidiary of the AFX Group brand is also multi-faceted, as well, offering a variety of asset choices and trading platforms to appeal to all levels of trader. Tight spreads and excellent support are givens, as evidenced by the awards and honors already bestowed on this group. Client deposits are protected on many fronts, and multi-regulatory compliance closes the deal.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk