| Pros | Cons |

|---|---|

| High levels of regulation and customer protection | Relatively small number of CFD instruments available to trade |

| Low minimum deposit |

Trader’s Viewpoint

Falling under the corporate umbrella of Indication Investments Ltd, Libertex is one of the many exciting new online brokers to have burst onto the scene in recent decades. Although Libertex is only around two decades old, having been founded in 1997, Libertex has gradually become one of the more well-established names on the online brokerage scene. And with a customer base that is reported to be in the millions spread across twenty-seven different countries, you would be hard-pressed to find a broker as well established as Libertex now are. But how do Libertex stack up against the competition; in an increasingly crowded space, what makes Libertex stand out from the competition?

In terms of regulation and customer protection, Libertex clearly goes out of their way to keep things above board. With a presence in twenty-seven countries—mainly spread across Europe—Libertex fall under the regulatory oversight of a number of financial regulators. Of these, CySEC is the most notable, who is one of the most stringent financial regulators around. Libertex is bound by both local laws in Cyprus, as well as European Union-wide regulations, which makes Libertex a very safe investment from a customer perspective.

When it comes to actually trading on the platform, Libertex put on a decent spread for customers. There are hundreds of asset classes available to trade, which includes major, minor, and exotic currency pairs, cryptocurrencies, stock indexes, and a wide range of commodities. The commissions charged on trades of these assets is relatively low and compares well with Libertex’s competition. Although it should be noted that the exact commission you get charged will vary across asset classes.

Setting up an account with Libertex is a relatively quick and painless affair, which is helped by a low minimum deposit amount. Trading is delivered through a single account type, with no pro or advanced accounts as of yet on offer. For those of you looking to try out the platform before committing any real funds, a full-featured demo account is available once you have set up and verified your account information.

Once you have set up your account, trading is delivered through a proprietary trading platform that balances functionality and simplicity. Overall, the proprietary Libertex platform is very easy to use and get used to, and makes a great alternative to MetaTrader.

With all that said, although Libertex might not have the same brand power as some of the other names in the industry, what they are doing is clearly working. Libertex provides a generally seamless trading experience through its proprietary platform, which offers favourable trading conditions. Although the commissions and fees are a little on the high side, they offer a range of other features which nevertheless make them a very competitive option.

Libertex is a brand for the trading platform and brokerage arm of Indication Investments Ltd, a member of the Forex Club Group, which is based in Moscow within the Russian Federation. Forex Club Group was originally founded in 1997, and the company has since been providing clients with trading services in stocks, commodities, currencies, indexes, gold, oil and natural gas.

Libertex currently claims to have 2.2 million clients trading from 27 countries worldwide. The company has 700 employees working in the Russian Federation, Belarus and Cyprus, as well as an offshore unit registered in St. Vincent and the Grenadines. The company has won 30 international awards, including an award in 2016 for Best Trading Application in the European Union by Global Banking and Finance Review and an award for the Best Trading Platform by FinEXPO.

Indication Investments Limited, Libertex’s parent company, is headquartered in Limassol, Cyprus and operates as a Cyprus Investment Firm or CIF that is authorized and regulated by the Cyprus Securities and Exchange Commission or CySEC under the license number 164/12. The company’s registration number under Companies Law is HE 251168, and it has its registered office located at 134 Agia Fylaxeos & Amisou, ANISSA COURT, 4th Floor, 3087, Limassol, Cyprus.

Due to its CySEC oversight, Libertex is bound by local laws and under European Union regulations including the MiFID (Markets in Financial Instruments European Directive) to protect its clients in various ways. The company must also adhere to the European Union’s Law 144(1)/2007 or the Investment Services and Activities and Regulated Markets Law of 2007.

The official website for Libertex is located at www.libertex.com, and a screenshot of its home page appears below:

Libertex does not accept U.S. based clients, therefore, U.S. residents are encouraged to seek another forex broker.

Features at Libertex

Libertex customers have access to 150 tradable assets, including 44 major, minor and exotic currency pairs; cryptocurrencies such as Bitcoin, BitcoinCash and Litecoin; 17 world class stock indexes; three types of crude oil, heating oil and natural gas; soft commodities including, sugar, coffee, cocoa, corn, soybeans and wheat; metals such as gold, silver, copper, platinum and palladium; and an extensive list of shares including Apple Inc., Google, etc.

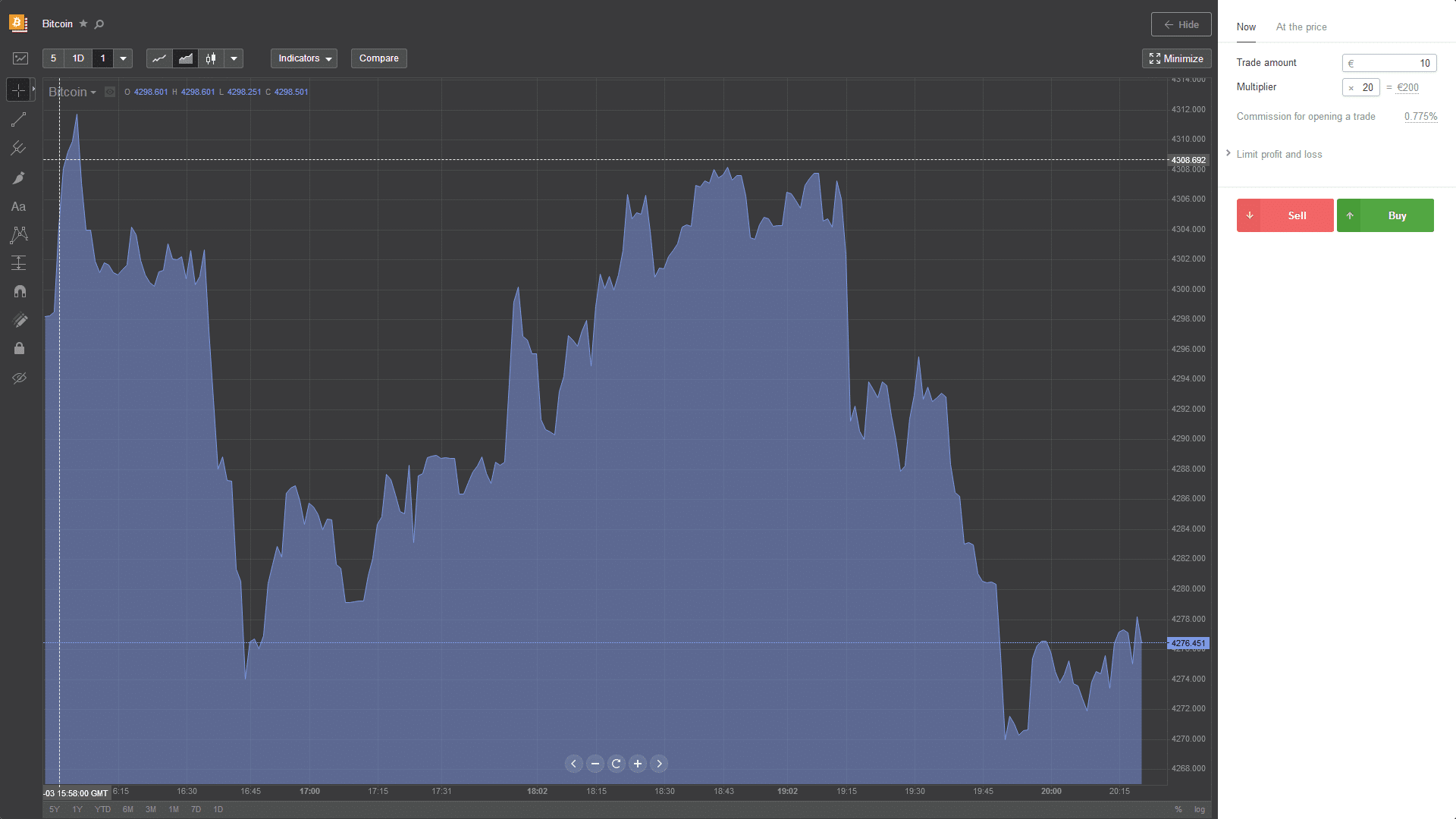

A critical issue for traders to consider is that the company charges a commission on each transaction that is calculated as a percentage of the monetary amount of the trade. For example, for a trade in EUR/USD, Libertex charges 0.011% of the dollar amount of each trade.

All currency pairs and other instruments have different percentage charges. The forex currency pairs that includes the Russian Ruble carry the highest charges, with commissions of up to 0.41% for USD/RUB and 0.386% for EUR/RUB. Dealing spreads are nonexistent since trades are executed at mid-market or directly in between the market bid and the offer, regardless of whether the client is buying or selling.

Another issue to consider with Libertex is how its leverage is expressed. Instead of using a set ratio of 100 to 1 for example, the company uses a “Multiplier”. The multiplier is a risk management coefficient that varies significantly among the different trading instruments. For example, for forex currency pairs the maximum multiplier for EUR/USD is 500, while the maximum multiplier for USD/RUB is 10.

Other Services:

Libertex offers their trading platform on mobile devices, which allows clients to trade from their Android or iOS smartphone or other mobile device.

To open a live account, a minimum deposit of $250 is required. All client account funds are held in segregated accounts, as per CySEC regulations.

Libertex offers only one type of live trading account and a demo account that all feature their proprietary trading platform.

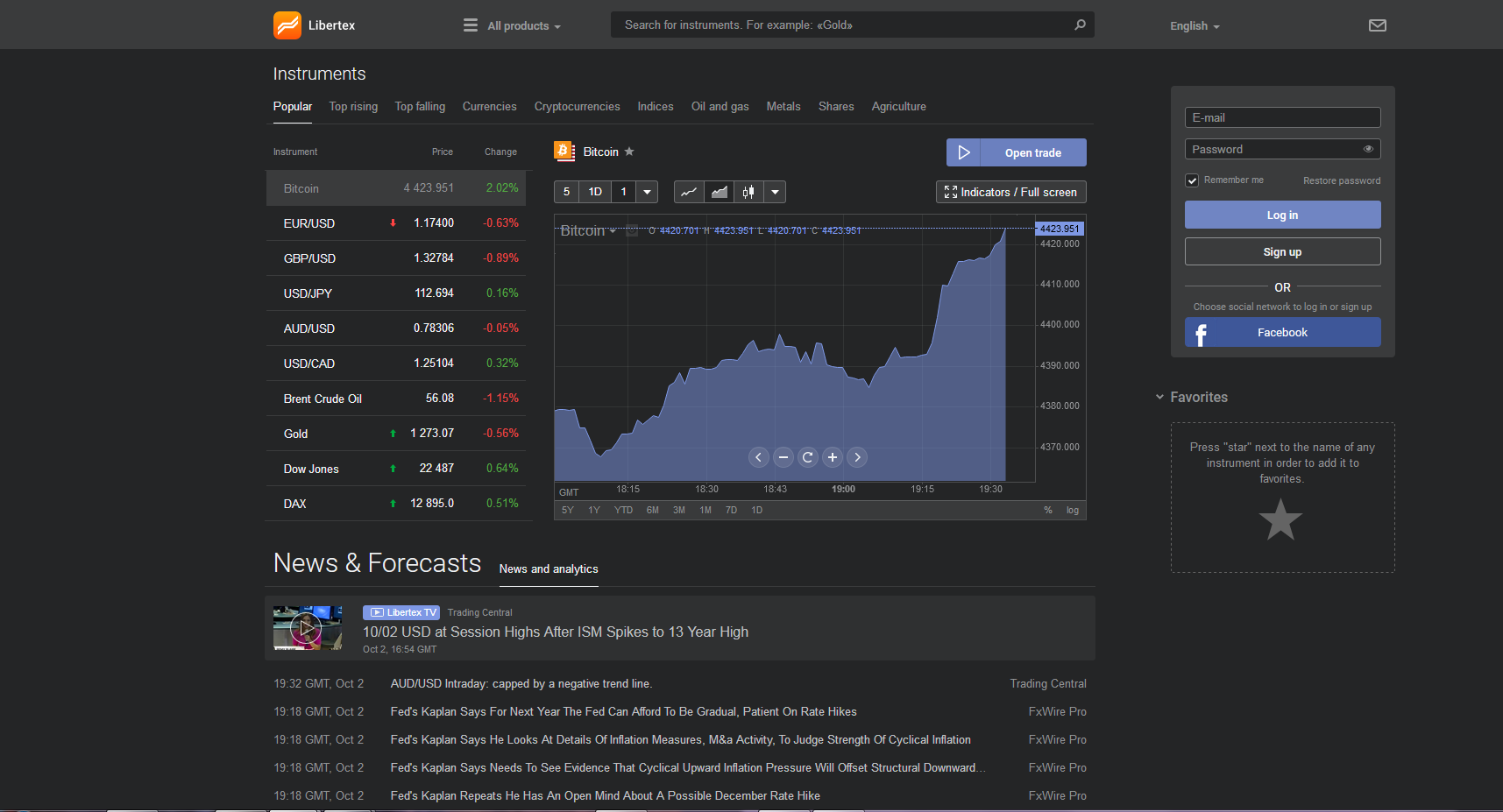

The company also offers an impressive news feed complete with its own Libertex TX channel. News and market commentary comes from FxWire Pro and Trading Central.

Platform

The Libertex trading platform is the epitome of market simplicity. The proprietary web-based platform lacks variables such as leverage, spread or margin, and instead simply allows the user to pick an asset, the amount that the trader wants to commit to the trade, and the market direction they expect to prevail.

The platform includes several technical analysis features that are divided into Trend, Volatility and Oscillators. Other features include fundamental analysis ideas and the ability to adjust the time period on charts from one minute to one month.

A screenshot depicting Libertex’s dealing platform can be seen below:

Deposits and Withdrawals

Funding a Libertex account can be done through major credit or debit cards, bank wire transfers or SEPA transfers. Other methods of deposit are accepted at the discretion of Libertex; however, the company does not guarantee that all transfer methods are available in the user’s country of origin.

Proper identification, which is customary for online brokerage accounts, is requested upon opening the account, and deposits are credited to the trading account within one day of the funds being cleared in the bank account of the broker.

Withdrawals must be requested by 1:00PM CET with instructions to make the transfer to the account where the funds originated. The identity of the client is then verified by the valid access codes used for generating the withdrawal request. The client is responsible for all third-party costs for withdrawals.

Customer Support

Libertex customer support has extremely limited options. The website does not include a customer support email, telephone number or web support form, so support seems limited to only the Live Chat feature. The lack of customer support extends to Libertex’s educational resources, which seem equally non-existent.

Libertex – Conclusion

Libertex appears to be a no-frills broker that caters to traders that prefer to pay percentage commissions instead of dealing spreads. The company is well regulated and offers a unique and easy to use web-based trading platform and a decent news feed. In addition, the company offers its clients limited risk exposure.

On the downside, trading commissions are variable depending on the asset involved, and leverage is accomplished through the company’s “multiplier”, which may seem somewhat foreign to many forex traders. Also, there is no choice of trading accounts, with only one type available. The lack of a customer support email or telephone number or any educational material is also a detriment to the broker.

Finally, no support is available for MetaTrader4 or 5, which means clients currently lack the ability to use automated trading solutions implemented with that platforms Expert Advisor functionality.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk