| Pros | Cons |

|---|---|

| Wide range of tradable instruments | Inadequate trading education materials |

| $50 minimum deposit |

Traders’ Viewpoint

GKFX Prime is a brokerage firm that offers forex and other CFDs to trade. The broker provides over 47 FX currency pairs, including all the majors, most minors and popular exotics. CFD offerings, on the other hand, include over 400 instruments in forex, shares, market indices, commodities and cryptos.

With this broker, traders can access global stocks such as Facebook, Netflix and Amazon. Major global commodities include the S&P 500, DAX 30 and FTSE 100.

GKFX Prime commodities traders, on the other hand, can access popular offerings including gold, silver and crude oil. In terms of product offerings, this broker is highly competitive.

GKFX Prime offers competitive pricing with spreads starting from as low as 0 pips. The typical spread for the EURUSD, at the time of writing this GKFX Prime broker review, is 0.3 pips. Furthermore, the broker offers a leverage of up to 1:1000 and has a $50 minimum deposit.

The low $50 minimum deposit means that this broker is affordable to beginner traders. Even so, traders with some level of expertise should deposit at least $200 to get the best out of this broker. GKFX Prime offers multiple account types. These include the ECN Zero account, Standard Variable account, Standard Fixed account, and VIP Variable account.

Each account type comes with its advantages and requirements. The ECN Zero account seems to be the best fit for beginner traders. Regarding trading platforms, GKFX Prime offers MT4/MT5 and also a proprietary copy trading platform. MT4 is the industry standard and is what most brokers and traders prefer. However, it would be great if GKFX Prime provided other alternatives.

Overall, this broker can be termed as a low-cost one. Moreover, it offers everything that a forex and CFD trader needs to trade easily. A background check on the web reveals that it is popular with both beginner and expert traders.

Are You Ready To Trade?

Get Started Within Minutes With The Simple Sign Up Process

About GKFX Prime

GKFX Prime is a brokerage firm founded in 2012. The broker offers forex trading and other CFDs in stocks, commodities, market indices and crypto. GKFX Prime is regulated by the Financial Services Commission of the British Virgin Islands.

GKFX Prime offers a leverage of up to 1:1000 to enable traders to take large positions. GKFX Prime offers four types of accounts, namely the ECN Zero, Standard Fixed, Standard Variable, and VIP Variable. The broker also offers an Islamic account option.

As we will see in this GKFX Prime review, each account type comes with its requirements and advantages. The GKFX Prime trading platforms include MT4 and MT5. Social trading tools include the broker’s proprietary copy trading platform, known as PAMM. Popular third-party social trading tools such as AutoTrade and ZuluTrade are also available.

As mentioned above, this broker adopts the STP+ECN trading model and therefore offers floating and fixed spreads depending on account type. The spreads begin from as low as 0.00 pips.

GKFX Prime offers a first deposit bonus of up to 55% and a re-deposit bonus of 25%. This broker has won various awards, including the ‘Best Forex Broker 2019’ by the Forex Expo and the ‘Best CFD Broker 2019’ by Onlinebroker-Portal.de. GKFX Prime is an official partner of Arsenal FC.

Who does GKFX Prime appeal to?

GKFX Prime appeals to both beginner and expert traders. This is because it offers specialised support for all types of traders. Moreover, it provides a wide range of educational resources covering beginner, intermediate and expert lessons.

New traders are assigned a dedicated account manager to help them through account set-up and trading practice. The GKFX Prime demo account is a copycat of the real trading platform and trades on historical market data to simulate live trading.

Consequently, new traders can test their skills on a live account without having to risk a lot of money. VIP Variable account holders must deposit at least $5,000. As we will see below, the VIP Variable account is only recommended for expert traders.

GKFX Prime offers a Multi-Account Manager (MAM) option for clients interested in professional funds management. Consequently, it is fit for expert traders looking to make money managing clients’ funds. Clients without trading know-how or time can also get a professional fund manager to trade for them.

GKFX Prime supports institutional traders but is highly popular with retail traders. The broker stands out among competitors when it comes to catering for beginner traders with limited budgets.

Account types

As mentioned in the introduction, this broker offers four types of accounts, namely Standard Fixed, Standard Variable, ECN Zero and VIP Variable. The broker also offers an optional swap-free/Islamic account.

The ECN Zero account is the most basic with floating spreads from as low as zero pips. It charges a commission of $10 per lot and is, therefore, a bit expensive when compared to competitors.

The Standard Variable and Standard Fixed accounts offer variable and fixed spreads starting from 1.8 pips and 1.3 pips, respectively. Unlike the ECN Zero account, these account types do not charge any commissions.

The VIP Prime account requires a minimum deposit of $5,000 with floating spreads from as low as 0.6 pips and zero commissions. VIP Prime account holders enjoy additional benefits, including more specialised and comprehensive educational materials, trading tools and VIP customer services.

The maximum leverage for the VIP Prime account is 400:1, while that of the other account types is 1:1000. The VIP Variable and Standard Variable accounts offer 47 FX pairs. The Standard Fixed and ECN Zero accounts offer 43 and 41 FX pairs, respectively. As stated earlier, GKFX Prime offers an Islamic trading option to users with a deposit of at least $10,000.

Open Your GKFX Prime Account Today

Easy Sign Up Process, Get Trading Within Minutes

Markets and territories

GKFX Prime is a subsidiary of Global Kapital Group, a global financial technology company with 28 offices across 18 countries. It is headquartered in London in the UK with offices in over 20 different locations, including Frankfurt, Madrid and Dubai.

GKFX Prime is available in the EU (non FR and BE), the GCC, India, Southeast Asia and the UK. Its platforms are multilingual, covering over 15 languages, including English, French, German, Chinese, Arabic, Vietnamese, Indonesian and Spanish.

As mentioned earlier, GKFX Prime offers over 400 tradable instruments in the world’s top financial markets. With this broker, you can access major global offerings, including stocks such as Facebook and Netflix. GKFX Prime indices include the S&P 500, and commodities such as US oil, silver and gold.

GKFX Prime is regulated by the Financial Services Commission of the British Virgin Islands under licence number 1728826. This regulator is popular but is not among the most reputable. Even so, GKFX Prime has earned global trust, given the reputation of its mother company.

Instruments and spreads

GKFX Prime offers 47 currency pairs, including all the majors, some minors, and popular exotics. As mentioned earlier, the spreads start from as low as 0.00 pips for the Zero ECN account. As an example, EURUSD spreads start from 0.0 pips. A commission of $10 per lot is applicable in this account. The spreads for the Standard Variable and Standard Fixed accounts are 1.8 pips and 1.3 pips respectively.

It’s worth noting that the spreads for the Standard Variable account are floating, while those of the Standard Fixed account are fixed. The average spread for the EURUSD pair when trading with this broker through the Standard Variable account is 1.3 pips. This is slightly above the industry average.

As part of this GKFX Prime CFD review, it is worth noting that the broker offers CFDs on forex, crypto, stock, market indices and commodities. CFD traders who choose this broker get to speculate on major global offerings, including popular stock CFDs such as Facebook, Google, Amazon and Netflix.

Fees and commissions

GKFX Prime charges a $10 commission per lot on top of a floating spread on the ECN Zero account. This makes it a bit pricey when compared to competitors. However, the no deposit requirement and high leverage make it ideal for traders with limited budgets.

GKFX Prime charges rollover fees on positions left open past 10:00pm UK time. The amount depends on the traded pair and the volume and order type (long or short). Traders can track the rollover fees on the trading platform dashboard under ‘Product and Properties’. There are no swap fees for Islamic accounts.

GKFX Prime does not charge any deposit or withdrawal fees. However, traders may incur charges on the side of financial institutions facilitating the transaction. It is important to verify if there are any charges when choosing a deposit or withdrawal option.

Deposit For Free

Get Your Trading Progress Started

Platform review

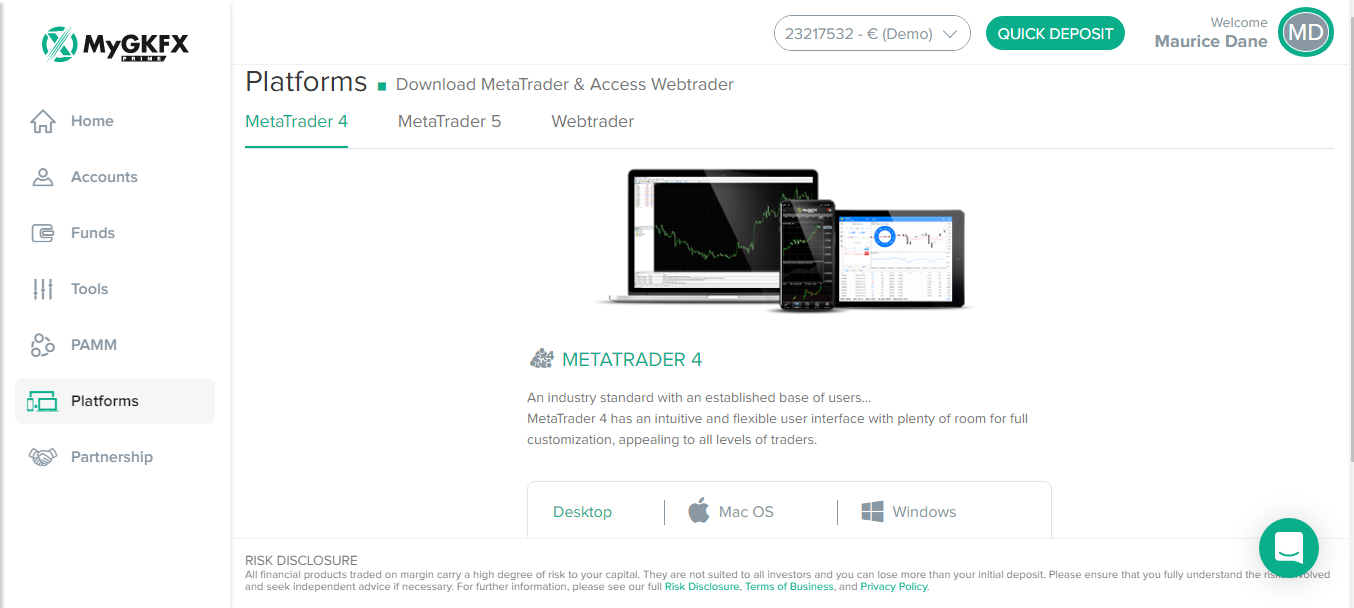

As stated earlier, the GKFX Prime broker offers both the MT4 and the MT5 trading platforms. Most brokers offer MT4 alongside their proprietary software. GKFX Prime offers a proprietary copy trading platform known as PAMM. MT4 offers nearly everything that a forex and CFD trader needs. Consequently, it is a top choice for both the broker and the trader.

MT4 is available in desktop, web and mobile versions. The web version is accessible from all major browsers, while the desktop app is compatible with both Windows and Mac devices. The mobile versions are available for free on Google Play and the iOS App Store.

The GKFX Prime MT4 platform is easily customisable to fit users’ needs. Moreover, it allows traders to automate trading through what are known as Expert Advisors (EAs). It also comes with a variety of technical and fundamental analysis tools, including Fibonacci and Gann-based tools. Furthermore, it has over 80 pre-installed indicators, a market watch and navigator window, and a comprehensive charting system among many other features.

The broker also offers additional social copy trading tools alongside MT4. We will discuss these tools later as we continue to review GKFX Prime.

Mobile trading

The GKFX Prime mobile trader comes with all the features available in the desktop and WebTrader. Traders can access and trade with the demo and live accounts on any Android or iOS mobile device. The trading apps are available for free on the GKFX Prime website, on Google Play and the App Store.

You can access the broker’s demo account by searching for it on the ‘link broker’ tab on the MT4 mobile app.

Social trading and copy trading

GKFX Prime supports copy trading through its proprietary PAMM platform. It also offers third-party social trading platforms such as AutoTrade and ZuluTrade.

The PAMM copy trading platform allows traders to replicate the trades of proven expert traders. This means that beginners who opt for copy trading can earn a profit right from the beginning as they learn about trading.

Moreover, those without time to research can use the PAMM option to replicate the returns of expert traders. Experienced traders can also use the platform to share their strategies with other traders at a fee. It is also worth noting that MT4 comes with advanced social and copy trading tools.

Crypto

With regards to GKFX Prime cryptocurrency trading, the broker provides CFDs on popular pairs such as BTCUSD, BTCEUR and BTCETH, among many others. Crypto CFDs allow traders to bet on crypto volatility without having to go through the tedious crypto buying process. You do not need a crypto wallet to trade crypto through GKFX Prime.

The pricing for crypto CFDs differs with the type of account. GKFX Prime has made all the necessary disclosures about its fee mechanisms. You can learn more about the spreads on crypto by clicking the ‘Spreads’ link under the ‘Trading’ tab on the GKFX Prime website.

Trade Crypto With GKFX Prime

Ride The Bitcoin Wave Without The Technical Fuss

Charting and tools

GKFX Prime offers comprehensive and easily customisable charting software. As mentioned earlier, this broker provides MT4 and MT5 alongside its proprietary copy trading platform. It also offers third-party research tools such as Autochartist and Trading Central.

The MetaTrader software analysis tools include 80 built-in technical indicators, 2,000+ custom indicators, and 700 paid ones. This means that the trader can analyse the market at any level of complexity.

Also, MT4 offers 24 analytical objects, including lines, shapes, arrows, channels, and the Gann and Fibonacci tools. These tools allow the trader to predict future price dynamics. The analytical objects can easily be applied to charts and indicator windows.

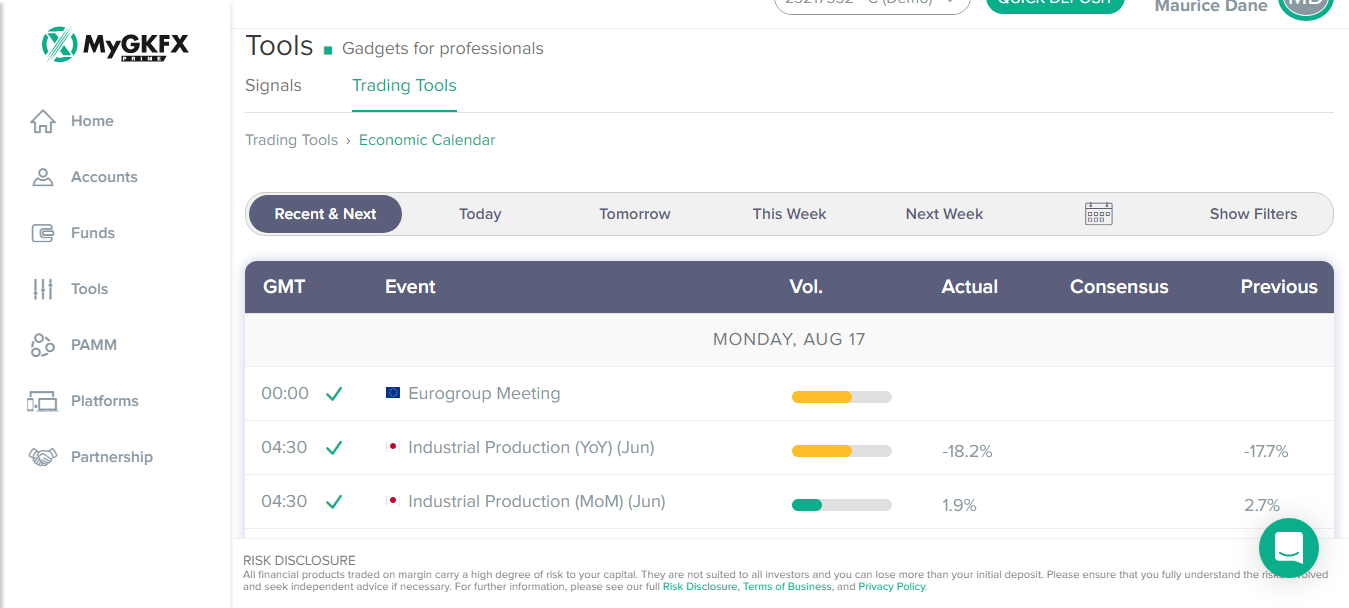

GKFX Prime MT4 Fundamental analysis tools include an economic calendar and a regularly updated news portal. Registered users can access all these materials for free.

Education

GKFX Prime offers a variety of trading education materials covering beginner, intermediate and experienced trading education. The materials are available in PDF guides, e-books, video tutorials, an economic glossary, structured courses and webinars.

Also available is a regularly updated blog providing commentaries on the latest market developments. Traders can share their views or ask questions on the comments section and get expert feedback from top analysts.

Registered users can download the e-books and PDF guides on the GKFX Prime website. They can also identify upcoming webinars on the provided webinar calendar and register to join them. GKFX Prime also hosts trading competitions aimed at helping traders to learn from each other.

As mentioned earlier, GKFX Prime assigns all beginner traders a dedicated account manager to guide them through the first stages of trading. There is also a highly intuitive demo account for beginner traders to practise their skills without risking actual money.

Practice Trading For Free

Claim Your Demo Account And Learn The Steps With No Cost

Trader protections by territory

GKFX Prime is regulated by the Financial Services Commission (FSC) of the British Virgin Islands under licence number 1728826. Most brokers prefer the FSC since it does not require them to maintain a segregated account for clients’ deposits. Moreover, the start-up capital with this broker is lower when compared to what most regulators require.

Even so, there are many benefits of trading with an FSC-regulated broker. The key advantage is that there is no leverage limit. Regulators in most jurisdictions, including the US, prohibit traders from taking on leverage of more than 1:20.

As mentioned earlier, GKFX Prime is a subsidiary of Global Capital Group, a global reputable financial technology company. The association with Global Capital and the reputation that the broker has gained over the years have earned it trust across the globe.

How to open an account

Registering a trading account with GKFX Prime is easy. Visit the broker’s website and click the ‘open account’ tab on the top of the page. Fill in the registration form and create a strong password as instructed.

GKFX Prime is compliant with the global KYC requirements. This means that you will need to upload a scanned copy of your government-issued ID or driving licence to confirm your identity. You will also be asked to upload a recent bank statement or utility bill to verify your current address.

The verification process takes up to 24 hours, but users can proceed to deposit and demo trade as they wait. GKFX Prime accepts deposits through major credit cards, bank transfer, and Skrill and Neteller. Deposits through credit cards are transferred to the trader’s account almost instantly.

Account funding through bank transfer and e-wallets may take some time to process. GKFX Prime supports credit cards and bank transfers for withdrawals. As mentioned earlier, this broker doesn’t charge any deposit or withdrawal fees.

Customer support

GKFX Prime provides a 24/5 multilingual customer service. Clients can contact the agents through phone or the live chat on the website. They can also contact them through emails, but it may take up to 24 hours to get a reply.

A test on the phone and live chat services reveals that it takes less than a minute to get connected to an agent. Moreover, the agents are friendly and knowledgeable. GKFX Prime offers an FAQs page, but it is not comprehensive.

Phone support: +44 (0) 203 695 9713

Email: [email protected]

The bottom line

GKFX Prime offers 400+ tradable instruments in forex and CFDs. The broker was founded in 2012 and is headquartered and regulated in the British Virgin Islands. GKFX Prime is a low-cost broker offering floating spreads starting from as low as 0 pips. The broker offers a leverage of up to 1:1000.

Regarding trading platforms, GKFX Prime offers MT4, MT5 and a proprietary copy trading platform. It also provides third-party social trading tools such as ZuluTrade and AutoTrade. GKFX Prime is accessible in some parts of Europe, Asia and Africa.

All users must verify their identity and current address to trade with this broker. GKFX Prime offers a variety of trading tools and a comprehensive trading education resource centre. The educational materials cover beginner, intermediate and expert trading education. Moreover, the broker provides 24/5 multilingual customer support.

Link to ‘contact us’ page: https://www.gkfxprime.com/support

Link to homepage: https://www.gkfxprime.com

Link to demo account: https://www.gkfxprime.com/Register/open-trading-account

GKFX Prime special risk warning

Open Your GKFX Prime Account Today

As Approved By Forextraders.com

FAQs

How can I open a demo account with GKFX Prime?

Open the GKFX website, press Open Account button and register for a free account. Then, open a free demo account by filling up a form to test their trading platforms easily.

Is GKFX Prime a regulated broker?

Yes, GKFX Prime is monitored by the Financial Services Commission of the British Virgin Islands. While this is not a tier-one regulator, GKFX Prime has managed to establish itself as a trusted broker across the globe.

What are the deposit options for GKFX Prime?

GKFX Prime accepts account funding through credit cards, bank transfer, Neteller and Skrill. This broker doesn’t charge any deposit fees.

How do I withdraw money from GKFX Prime?

The withdrawal process is simple. Fill in the withdrawal form on the funds management page and wait for up to 24 hours for the transaction to be processed.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk