About FBS Broker

Financial Brokerage Service, or FBS, is a Russian forex company with satellite offices in China, Malaysia, the Philippines, Jordan and Vietnam. The company’s website claims it has 13 million traders and 370,000 partners in 190 countries.

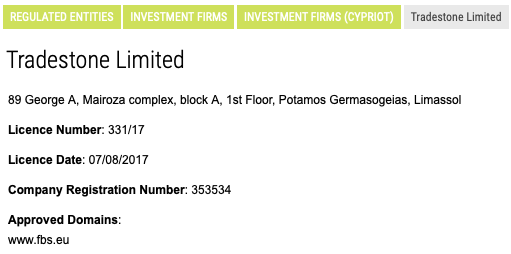

FBS Inc. is registered in the Marshall Islands. FBS Markets Inc. is the global brokerage arm of the company and is registered in Belize. FBS.eu is the European arm and is operated by a Cypriot investment firm called Tradestone LTD.

FBS Markets has operated primarily in offshore, unregulated jurisdictions, although it is regulated by the International Financial Services Commission (IFSC) in Belize. The IFSC is not known for strict oversight of forex brokers.

The European subsidiary is regulated by the Cyprus Security and Exchange Commission (CySEC). Although CySEC had a less-than-stellar reputation until about 2012, it has recently emerged as one of the better regulators.

History of FBS

FBS entered the forex market in 2009 and grew quickly through an aggressive marketing campaign of bonuses, cash-back rewards and volume rewards. Until 2017, when it opened its Cyprus subsidiary, FBS was mainly focused on Asian markets. In 2019, The European Magazine named FBS the best forex broker in Europe. International Business Magazine named FBS the most progressive forex broker in the same year.

Who is FBS aimed at?

FBS has a very low barrier to entry; international accounts can be opened with as little as $1. This is a good broker for traders who want to get into forex on a small budget. It is also well suited to beginners and small traders who want to try social copy trading.

FBS account types

Rating: 2/5

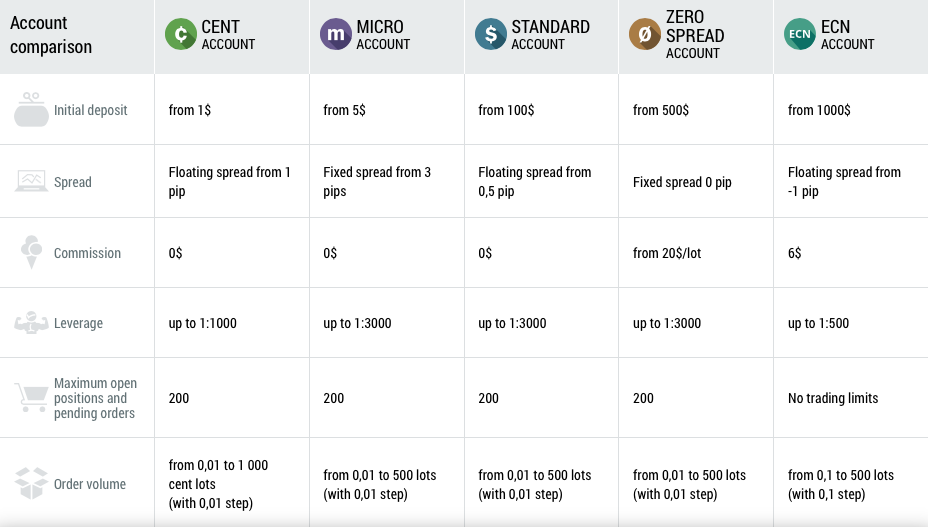

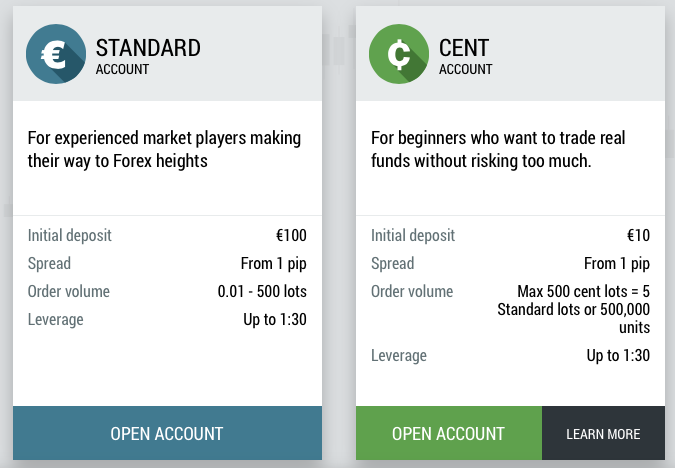

FBS offers five different accounts but only two are available to European clients, the standard account and the cent account.

Small traders can open micro accounts with just $1 or cent accounts with $5. The floating spread in the cent account starts at one pip. The micro account has spreads starting at three pips. The standard account requires an initial deposit of $100 and has floating spreads starting at 0.5 pips. FBS also offers a zero-spread account, but offsets it with large commissions.

FBS sets some eye-popping leverage limits. The standard, zero spread and micro accounts are set at 1:3000, the ECN account offers 1:1500 leverage and the cent account “only” allows 1:1000.

For EU clients, the account opening deposit is €100 for the standard account and the spread starts from one pip. The cent account has a minimum deposit of €10 with spreads starting at one pip. The maximum leverage on EU accounts is 1:30.

Demo accounts are available for all account types, except in the EU, where only the standard and cent accounts have demo account options. Currently, US citizens are unable to trade with FBS.

International account types

EU accounts

The cent account is an unusual option. It differs from a standard because the balance is reflected in cents: A one-cent lot equals 0,01 of a standard lot or 1,000 units. The max order volume is 500 “cent lots,” which is the same as five standard lots, or 500,000 units.

Pros

- Open an account with as little as $1

- Leverage up to 1:3000

- Zero-spread account available

Cons

- Only two account types for EU traders

FBS markets and trading instruments

Rating: 2/5

FBS offers forex spot trading, limited commodities, limited precious metals, limited stocks and exotic forex.

| Forex Spot | CFDs | Precious Metals | Stocks | Exotic Forex | |

| 28 currency pairs | Brent crude oil, WTI crude oil, DAX30 | Palladium, platinum, silver, and gold spot | 33 stocks | 9 currency pairs |

Pros

- Good variety of trading instruments

- Major currency pairs

Cons

- EU account holders can only trade 28 forex pairs and two metals

- Very few products within each market

FBS trading commissions and fees

Rating: 3.5/5

Three of the five different FBS account types trade commission free. ECN account holders pay $6 commissions per lot and zero-spread account holders pay $20 commissions per lot.

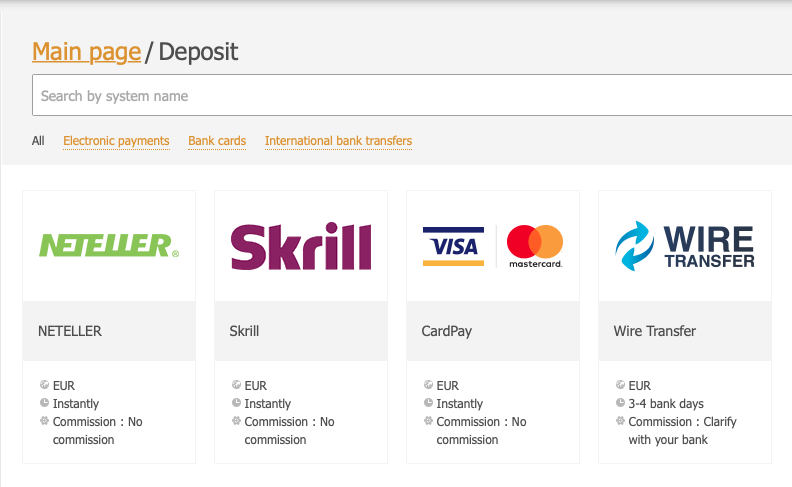

There may be fees associated with funding your FBS account and making deposits and withdrawals. FBS lists over 50 different funding methods on its website, including debit/credit cards, bank transfers and services such as Skrill and Perfect Pay.

The table below shows sample fees for some of the more common funding methods.

| Method | Currency | Deposit fee | Withdrawal fee |

| Debit/credit card | USD/EUR | $0 | $1 |

| Bank transfer | USD/EUR | $20 (plus your bank fees) | $20 |

| PerfectMoney | USD/EUR | $0 | 0.5% of withdrawn amount |

| Skrill | USD/EUR | 7.5% | 1% + $0.32 |

| Neteller | USD/EUR | 1% (up to $10) | 2% (up to $30) |

| OKPAY | USD/EUR | $0 | 0.5% (up to $2.99) |

You can pay in your national currency even if it isn’t USD or EUR, but it will be converted using the exchange rate at the time of deposit.

There is a €10 inactivity fee after 12 months.

Spreads

The table shows typical spreads for various trades on the FSB platform (note: this information was taken from the FBS.com website, not the EU site).

| Bitcoin | 300 |

| Dash | 500 |

| EUR/GBP | 1.5 |

| GBP/USD | 0.9 |

| USD/JPY | 2 |

| AUD/USD | 0.8 |

| USD/CHF | 7 |

| Stocks | 3 |

| CFDs | 2 |

| Metals | 240 |

Pros

- Zero commission accounts

Cons

- Not the tightest spreads

FBS trading platform

Rating: 3/5

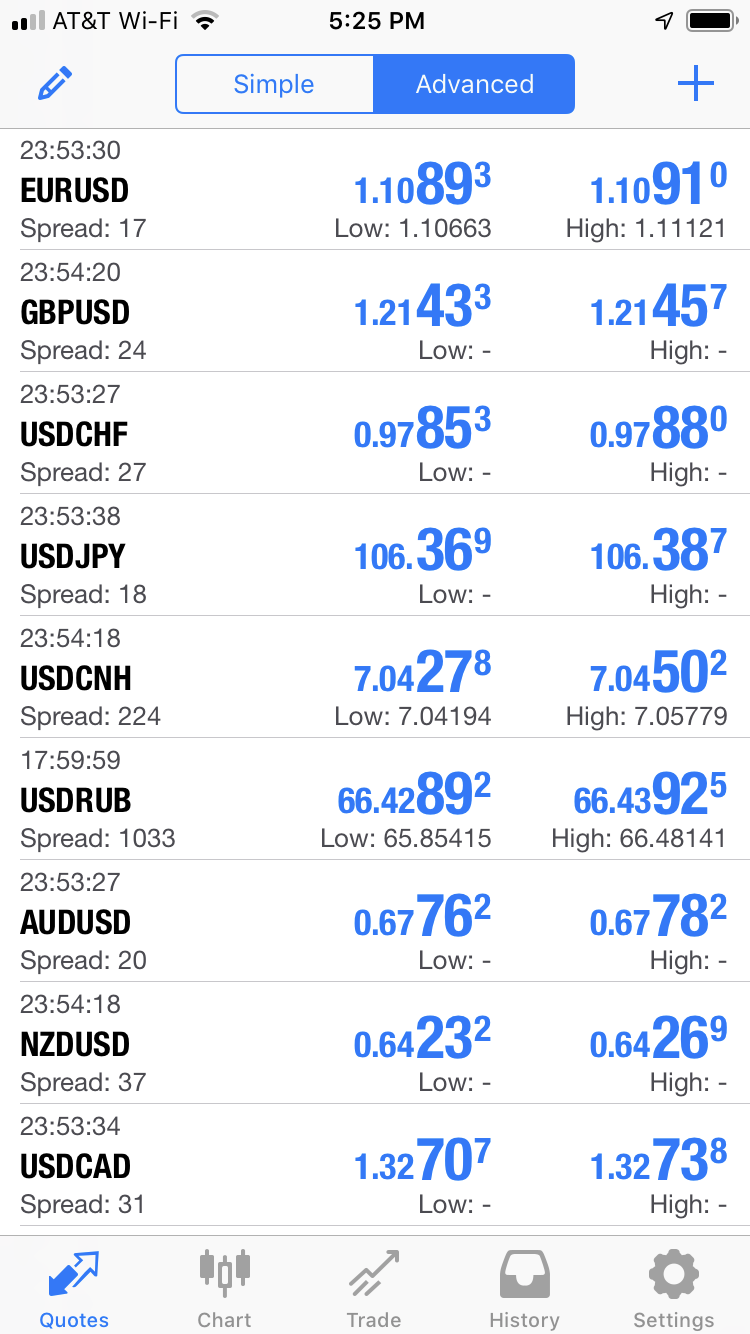

FBS exclusively uses MetaQuote’s suite of platforms, including MT4 and MT5, but only MT4 is available for web trading from the EU site. MetaTrader platforms are used by hundreds of forex brokers—they are the de facto trading systems for many forex traders. There is very little difference in MT4 functionality from broker to broker, but there can be big differences in how the system is configured for spreads and trade execution.

One notable feature in MT5 is trading bots and trading signals for automated trading. MT5’s algorithmic trading feature analyses the market and execute trades according to your pre-set trading strategy. You can use the MLQ5 Wizard to create your own trading bot or you can buy ready-made bots from the market or from professional developers.

MT5 for iOS

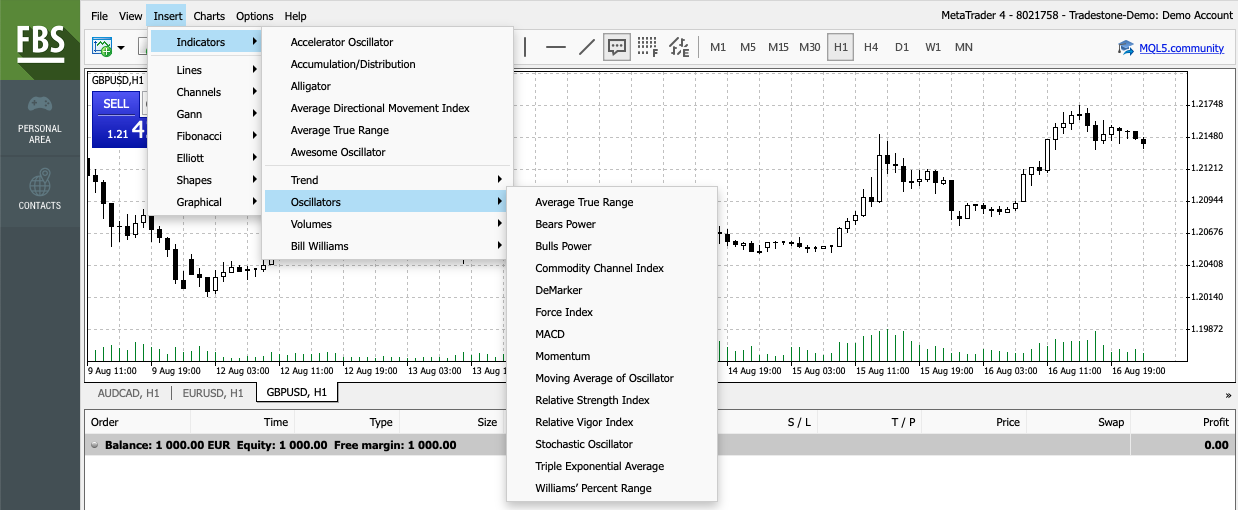

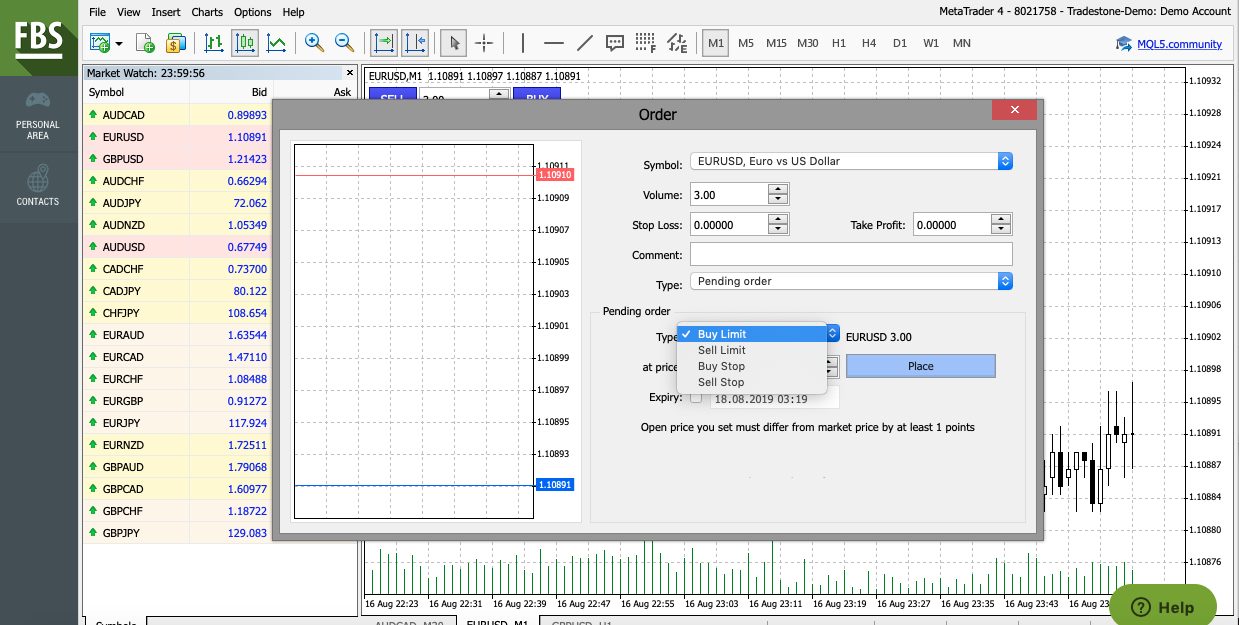

The MT4 web platform has a broad range of charting tools and 30 technical indicators to enable technical analysis. Timeframes range from one minute to one month. The platform supports multiple order types.

The web trading platform has one-click ordering with several order types. Of note, on multiple occasions, there was a connection error while trying to execute a trade in the demo account.

FBS’s proprietary mobile trading platform, FSB Trader, is available for both Android and iOS devices. According to the company, the FBS Trader app gives you instant, on-the-go access to account management including deposits and withdrawals, live charting, access to 24/7 support and access to detailed trade and order information in real-time.

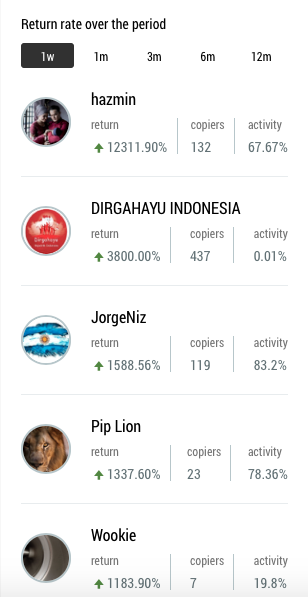

There’s a third trading platform, FBS CopyTrade, which is a proprietary social copy trading platform. It’s available in app form only for both Android and iOS. Copy trading lets you replicate the strategies and trades of high-performing FBS traders. You can search through trader profiles to see their performance, the number of followers and commission they charge. Copy trading isn’t free—these professional traders earn their income off commissions from the people who copy their strategies.

FBS CopyTrade app

Although we did not test this feature, you can get a good idea of how it works from the company’s video tutorial:

Pros

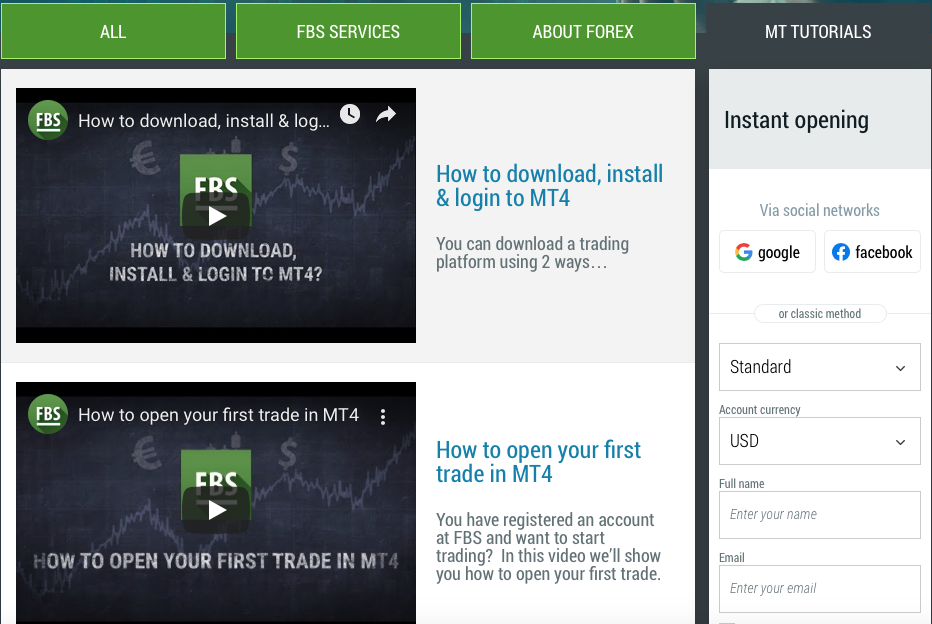

- MT4 is universally used and there are many video tutorials to help you get started

- Social copy trading is a popular option not widely available

- FBS offers a free VPS to clients who deposit at least $450 a month and trade at least 3 lots a month

Cons

- VPS server not available to EU clients

Broker research and education

Rating: 4/5

FBS does well with its educational offerings. There is an extensive video library of tutorials on everything from the basics of opening and managing your FBS account to using the MT4/MT5 platform and mobile apps, to understanding technical indicators and managing risk. Although short (each tutorial is five minutes or less), the videos are clear, easy to understand and very helpful to get a new trader up and running.

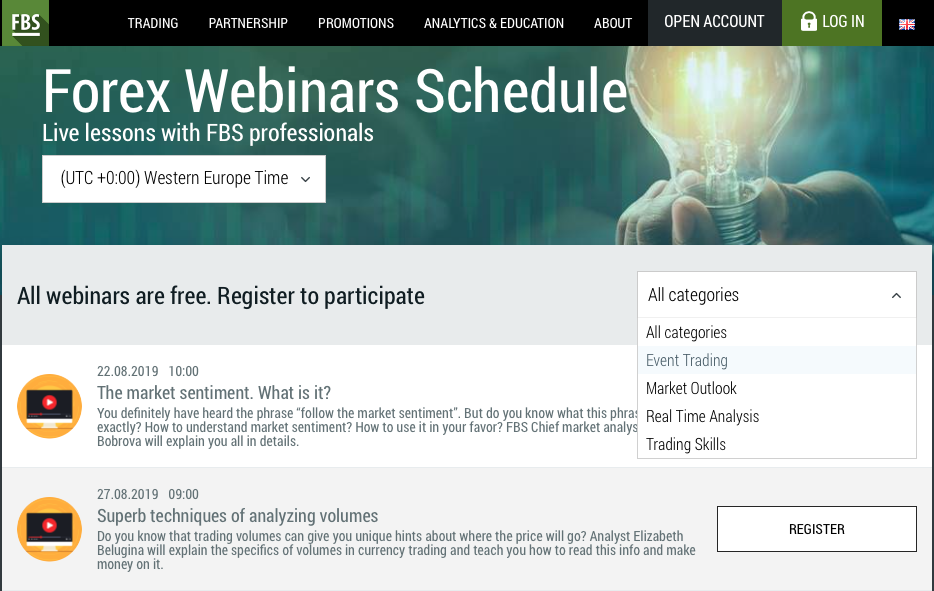

FBS also offers free live webinars with a professional trader; topics vary but they are designed to fine-tune your trading skills by learning more about economic indicators, mitigating risk and mastering technical analysis. You don’t need to be an account holder to participate in the webinars.

FBS also offers guidebooks and free downloads on all aspects of forex trading designed for everyone from beginners to experts. The daily market analysis is another nice feature; several times a day, FBS experts post updates on the forex markets.

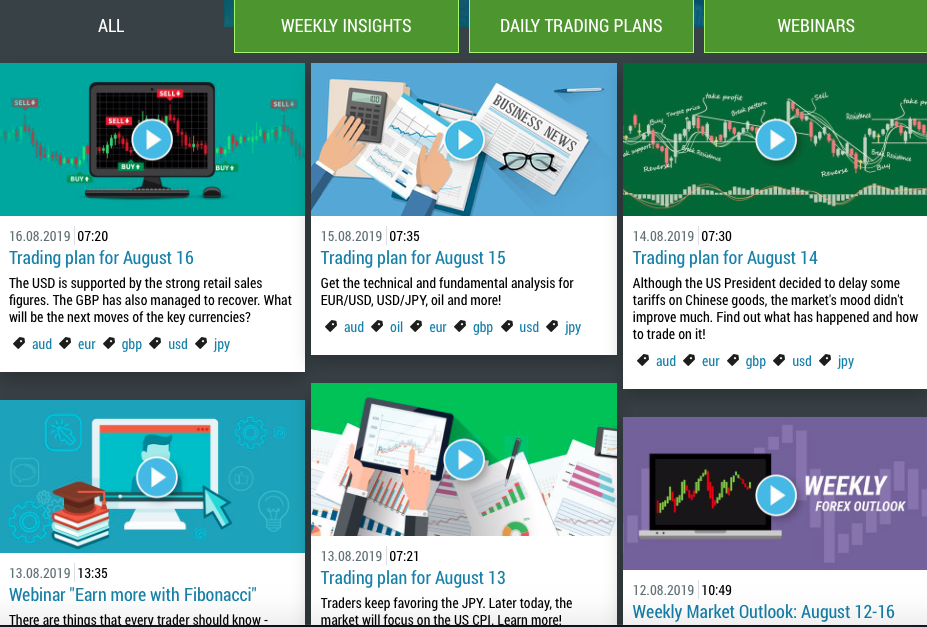

One other feature of note: FBS’s forex TV channel. Each day, FSB publishes a daily trading plan based on current market indicators, along with a weekly insights summary to equip traders with relevant economic information to shape their trades.

Pros

- A lot of easy-to-understand video tutorials for beginners and advanced traders

- Forex TV with daily trading plans and market insights

- Free live webinars

- Extensive forex trading guidebooks

Cons

- Offerings very much geared toward novice to intermediate traders. Advanced traders will be disappointed.

FSB charting tools

FSB is an MT4/MT5-exclusive broker, so traders have access to all the charting tools that go along with that platform. This platform has a comprehensive suite of tools for forex trading.

FBS notable features

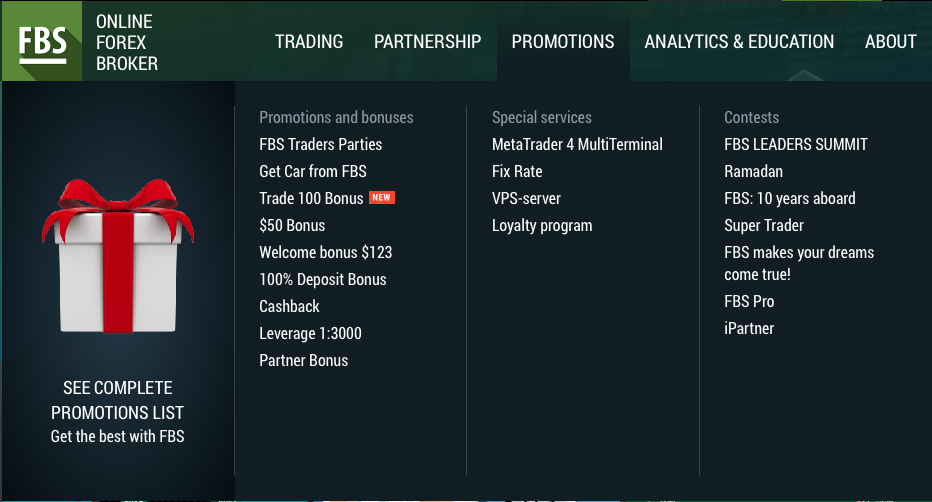

A huge part of FBS’s global success is related to its aggressive rewards and bonus programs. Sections of the FBS website are devoted to encouraging traders to recruit “partners.” You earn money off the trades and activities of your “partners,” and the more partners you recruit, the higher your share of their trading activity.

FBS offers contests and bonuses and “parties” to give account-holders rebates, cash awards and even gifts (there is actually a free-car contest) to encourage trading and building a partner network. Obviously, none of these schemes are available to EU customers under CySEC regulations.

FBS trader protections

FBS EU is regulated by CySEC, which compensates account holders up to €20,000 if the broker becomes insolvent. Those on the international site do not have similar protections.

FBS also has negative balance protection, which is probably a good thing given the huge amount of leverage available. The stop-out level on all accounts is 20% margin, which means if your account drops below that level, all your trades will be automatically closed. Once that happens, negative balance protection kicks in. Your account will be reset to $0. Even with the massive leverage, FBS will not allow you to lose more than you deposit.

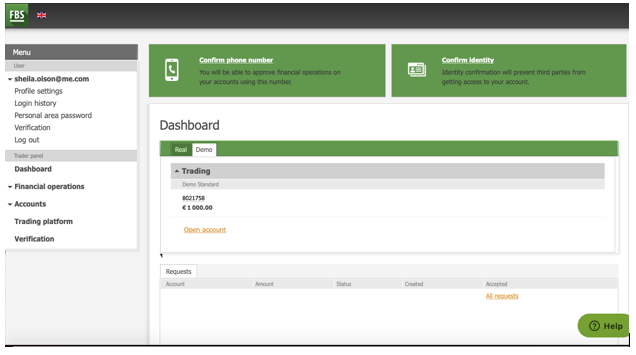

How to open an account with FBS

Opening an account is straightforward and fast, especially for demo accounts where you aren’t required to verify your information. Simply click on the red “open account” tab at the top right corner of the screen. You need to provide a name and email address; alternatively, you can open an account with your Facebook or Google account.

Once you submit the request, you get a verification email. After you verify your email address, you get a second email with your account number and password.

After you log in for the first time, you go to the personal area to change your password. Demo accounts are credited with €1,000.

If you want to open a live account, you’ll need to provide proof of residence and verify your identity and phone number. The phone number attached to your account can be used to confirm trades. You can open multiple accounts from the Personal Area on the FBS site.

You’ll also find the Financial Operations menu in the Personal Area. This is where you fund your account. As mentioned previously, you have several funding options depending on where you live. On the EU website, the funding options are as shown below. You can only deposit funds from accounts in your name.

Withdrawals are also managed via the Financial Operations menu. Note that deposits are accepted at any time, but withdrawals are managed by staff only during business hours.

Withdrawals generally hit your account within 1-3 days, although debit and credit card withdrawals may take between 3 and 8 days to clear.

Our expert’s view of FBS

FBS has been in the forex market for about 10 years, so it’s had time to build up a reputation and a niche clientele, although the broker is new to the EU. It is a non-dealing desk, straight-through processor, which means it passes orders directly through to a liquidity provider through the electronic communications network. It makes its money from spreads and commissions.

The trading platform is standard MT4/MT5, so there is nothing new to learn nor feature that stands out. Since this is a widely used forex platform, even if you’ve never used it before, it’s easy to find tutorials—and it’s very intuitive. There’s a good selection of technical indicators and charting tools. If you use the MT4 mobile app, you can set push notifications to your phone when a currency hits price action level.

FBS has a very limited range of markets and products, especially in the EU. Although the company doesn’t charge commissions on many of its accounts, the floating spreads are larger than many competitors. You can get a zero-spread account, but the corresponding commissions are high.

The FBS EU site is dated and not particularly functional. There is a lot of clicking around to find the action or information you’re looking for. There navigation is clunky and it’s difficult to access educational and analysis information once you’re logged into the site. Response time was slow and the web trading platform disconnected multiple times during order execution in the demo account.

There is a good amount of educational material on the main site, but not so much on the EU site. Most of it is aimed at beginners, although there are some resources for more advanced traders. This broker feels more suitable to novices and small traders.

The customer service is lacking. Although the site claims to have 24/7 support, the “help” button is not staffed by a human or a bot. You submit a message and they get back to you; I did not receive a reply in the 48 hours my demo account was open. Perhaps there is better customer service for paid accounts or for those using the non-EU site.

The massive leverage could be potentially dangerous, but FBS does automatically liquidate accounts that reach 20% margin and set balances to zero. This is a good feature, because it protects you from losing more than your original deposit.

FBS has made inroads into social trading and its proprietary platform seems to have a sizeable number of users and influencers. Non-EU users on the social trading app can even earn “commissions” off the users who copy their trades. In fact, non-EU account holders have opportunities to earn a lot of cash bonuses and awards, which is a large part of this broker’s appeal.

The bottom line on FBS

Overall rating: 2.5/5

FBS is not geared toward sophisticated traders, but more toward small traders and those just getting to know the forex market. They don’t trade many markets and have a very small product offering in each market compared to other brokers.

On the other hand, FBS has eliminated the barrier to entry into forex by offering accounts with just $1 minimums and micro-lots. If you just want to experiment with forex without risking much capital, this is an excellent choice. FBS offers some of the highest leverage of any forex broker in the international market, although EU customers are limited by law to 1:30.

Pros

- CySEC regulated for EU customers

- Extremely low capital required to trade (as low as $1)

- High leverage of up to 1:3000 (limited to 1:30 for EU traders)

- Negative balance protection—you can’t lose more than your deposit

- MT4/MT5 trading platform

- Social copy trading

- Generous rewards and bonuses for non-EU customers

- Good educational resources for beginner to intermediate traders

Cons

- Larger spreads than many retail brokers

- Limited markets and products

- No live customer service

- Inactivity fees, withdrawal fees

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk