A brokerage based in Malta and launched in 2017, ALB.com is one of the newest online FX/CFD operations. Despite its tender age, it boasts an impressive number of achievements and industry awards.

Being such a new broker, ALB has thus far not accrued much relevant user feedback, however it has been proven serious and trustworthy in several reviewer tests.

While its trading conditions are not particularly outstanding, the broker boasts very solid regulatory footings.

Its main regulator is Malta’s MFSA (Malta Financial Services Authority), but ALB.com is apparently registered with a number of other European authorities too.

The company behind the ALB brand is ALB Limited, and it is based at 48 Casa Roma, Sir Augustus Bartolo Street, Ta’Xbiex, Malta. The registration number of ALB Limited is C 79767.

ALB Ltd. is authorised and regulated by the MFSA to provide investment services under the Investment Services Act. It holds a category 3 licence and is authorised to provide 2 investment services; dealing on own account and the execution of orders on behalf of other persons. It caters to retail clients, professional clients (including collective investment schemes) as well as eligible counterparties.

Whether or not this MFSA license grants the broker the right to peddle its services all over the EU, is unclear. What is clear though is that MFSA is indeed an EU regulator, and that being regulated by it means that financial operators become members of the Investor Compensation Scheme, as required by EU directives.

At any rate, ALB Limited is registered with a number of other European regulatory authorities too, such as Italy’s CONSOB (reg. number 4654), the UK’s FCA (786939) and Germany’s BaFIN (1665201).

Above and beyond the sturdy regulatory status: what would a trader find attractive about ALB.com?

The broker boasts competitive spreads and ECN execution. Its trading platform selection is quite impressive and more importantly: well-tuned to the needs of its clients. Besides MT4 and MT5, the broker also features a handy WebTrader (also a MetaQuotes creation).

The support offered by the broker is allegedly top-notch. Available through a number of channels such as email, phone and live chat, ALB.com support is effective and professional.

The best possible way to trade securely is to choose a regulated broker, as regulation requires that the broker protects a customer’s negative balance, thus clients cannot lose more than they have initially deposited. As a regulated broker ALB provides this. Moreover, as a member of the Investor Compensation Scheme (ICS), customers enjoy the protection of a rescue fund in the event that the firm ceases to operate due to failure.

It is also available in no fewer than 8 languages – very important in light of the fact that the operation is Europe-focused.

Personal account managers are apparently available for all account-holders.

The broker offers market-analysis and education services, though these are all sourced from a 3rd party.

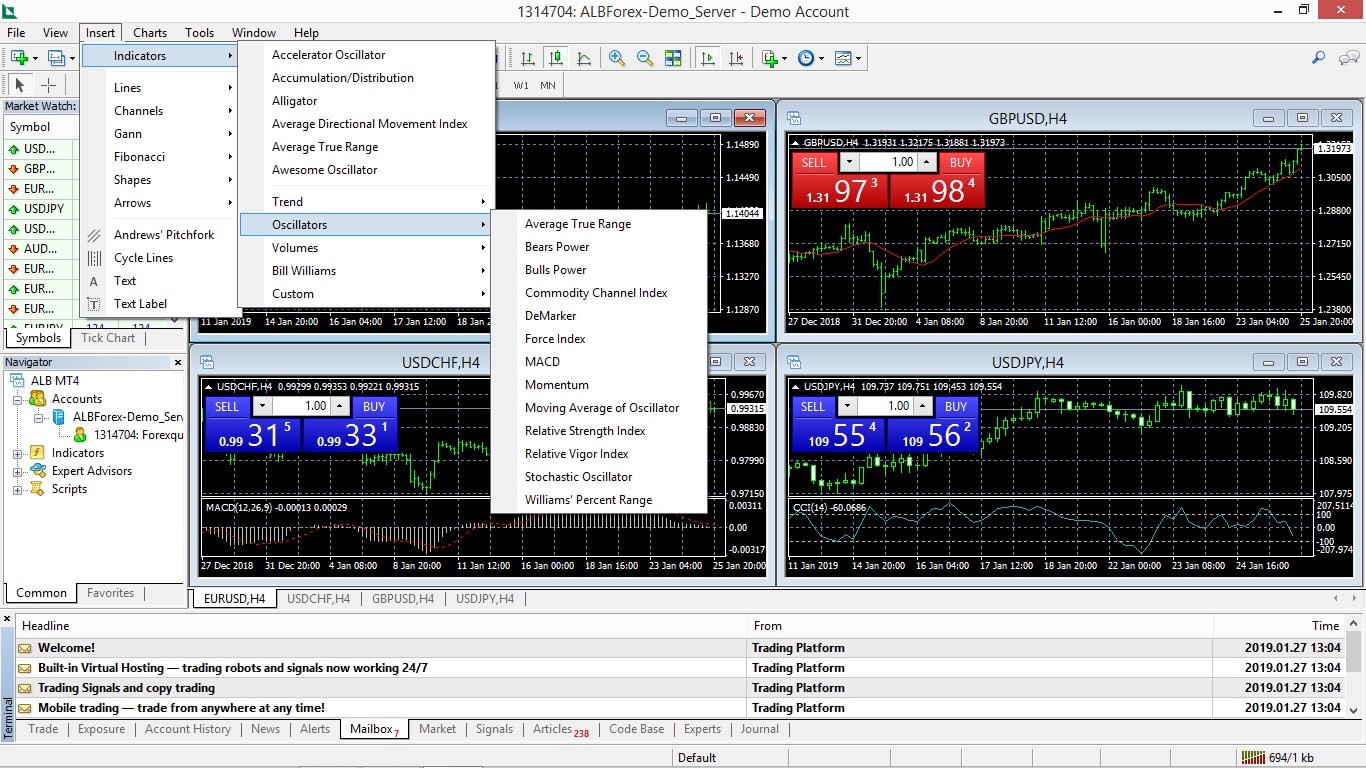

Trading Platforms

ALB.com’s trading platform selection is spearheaded by everyone’s favorite MT4. MT4 is the superstar of the FX scene for several good reasons. The platform provides a fully customizable environment in which traders can twist and mold charts and scores of technical indicators to their hearts’ content.

Supporting an impressive number of order types, MT4 features no fewer than 9 time-frames, allowing users to perform perfect short- as well as long-term technical analysis.

One-click trading, market execution and automated trading are all MT4 staple features. Auto-trading is done through EAs (Expert Advisors) which can be fully customized, or even built from the ground up by traders.

Various scripts can be used in combination with EAs for increased control and efficiency.

In addition to the full desktop version, ALB.com has made a mobile MT4 version available to traders as well. The mobile variant offers features just as impressive as the full one, while fitting in the palm of one’s hand.

MT5 is quite a bit more than the next evolutionary step of MT4. It ups the stakes charting/analysis-wise, by covering 21 time frames. No fewer than 100 charts can be simultaneously opened through the platform.

MT5 comes with 80 preinstalled technical indicators. On MetaQuotes’ platforms, traders are welcome to create and add their own indicators. They can also buy them from third parties.

MT5 is available in a mobile version as well.

The WebTrader rounds out the ALB.com platform offer. It is obviously aimed at users who – for whatever reason – cannot download software to their local computers. The obvious goal of the platform is to squeeze as much of the utility and functionality of MT4 into a browser-based package as possible.

In regards to compatibility: the WebTrader supports most major browsers. All one really needs to have it up and running is an internet connection.

WebTrader supports no fewer than 9 time frames. A selection of 30 technical indicators is part of the package. One-click trading and real-time quotes are available as well.

As far as analysis is concerned, the broker delivers a selection of trading opportunities based on technical analysis, through AutoChartist. The main selling point of this feature is the frequency with which it churns out its trading signals. These signals cover a wide range of tradable assets.

Deposit/Withdrawal Options

It supports credit cards, such as VISA and MasterCard, as well as bank wires.

Withdrawals are said to be processed on the day when the request is received.

All client funds deposited with ALB are fully segregated from the company’s own funds and are kept in separate bank accounts. ALB ensures that funds belonging to clients cannot be used for any other purpose. Furthermore, ALB has its interim and annual financial reports audited by Price Waterhouse Coopers, a leading global financial auditor.

ALB Market Coverage and Trading Conditions

In this regard, the main focus of the broker seems to be on FX currency pairs. More than 100 such pairs are supported and they come with some of the best trading conditions the broker has to offer. Forex pairs can be traded through raw spread accounts as well as ECN accounts.

On the EUR/USD pair, the spread can be as low as 0.7 pips – provided one trades on a VIP account. On the most basic account type – the Silver one – the spread on this pair is 1.1.

The leverage is kept well under control. The maximum on EUR/USD is just 1:30 on a retail account, and 1:100 on a Pro one.

On commodities, such as copper, corn and wheat, the maximum leverage is even more conservative. On retail accounts, the maximum is 1:10 on every one of the supported assets. On Pro accounts, the maximum is 1:50.

As far as indices go, 12 of them are supported. The commissions are set to EUR 10 on every tradable asset falling into this category.

Cryptocurrencies make up the most interesting/dynamic tradable asset class. A surprising number of these digital asset are supported: besides Bitcoin and Bitcoin Cash, the broker offers Litecoin, XRP and Ethereum too. The maximum available leverage on crypto assets is 1:2 for retail accounts and 1:5 for Pro ones.

It has to be mentioned that ALB.com does not buy/sell actual cryptocurrencies, so traders won’t be able to acquire any through the broker. The traded vehicles are CFDs – a type of financial derivative based on the ebb and flow of the asset price.

Conclusion

ALB understands that its customers, whether retail or professional, may be daunted by the prospect of online trading, which is why it trains customers in the use of the software/trading platform, so that they can trade with confidence. To ensure a personalised service is given to each customer with the utmost confidentiality and professionalism, ALB services its clients in 8 different languages with a personal account manager available in live chat and phone support.

Everything considered, ALB.com is a decent FX/CFD trading destination indeed. Its trading conditions are OK, its platform selection is superb and the same goes for its market coverage.

The fact that it is well regulated and registered with several financial authorities is also a major mark in the “plus” column.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk