Over the past few decades the popularity of retail forex trading has soared across the globe. The appeal of trading one’s home currency versus one of another country is one reason, but the overarching reason has to do with the nature of the foreign currency market. It is the largest and most liquid market in the world, and it is open for business 24 hours a day, five days week. There are no daily session cut-offs that are prevalent in stock exchanges. The weekly process begins early in Asia on Monday morning and then concludes late Friday in New York. In this article we will look at the best time to trade forex in Kenya.

How large is this market? According to the report from the Bank for International Settlements (BIS) it is very large indeed. The daily turnover of all forex related instruments in 2023 is roughly $7.5 trillion (Yes, that is Trillion with a capital “T”). That is a 14% increase on the $6.6 trillion figure recorded in 2019. Many newcomers have recently taken up forex trading during the Covid-19 pandemic when most people worked from home and had the time to learn to trade.

In the discussion that follows, you will learn about how the Interbank market operates, what determines the best and worst times to trade in the market, and what are some of the most reputable brokers for residents of Kenya. As well as answering the question of “what is the best time to trade forex in Kenya”.

Forex Trading in Kenya

It is also a known fact that forex trading has gained a large following in the Republic of Kenya, swelling by 80% in 2020 alone and approaching estimated levels of approximately 100,000 active traders across this east African nation. The local regulator, the Capital Markets Authority (CMA), facilitated this growth by instituting a legal framework within Kenya in 2017 that supports the licensing of forex brokers, monitoring broker compliance, and educating and protecting residents of Kenya. These actions established trust in this new trading regimen, a prerequisite for growth.

Economic conditions in Kenya have also enabled the forex trading community to grow in this leader of east Africa with over 55 million residents. Kenya’s GDP was $113.42 billion in April 2022 and it is expected to reach $119 billion in 2024. The Republic of Kenya is still classified as a lower to a middle-income developing country from an economic perspective. It ranks third behind Nigeria and South Africa, but its middle class has been increasing and comprises 45% of the country’s population. Forex trading is also legal in Kenya and has been growing rapidly in popularity over the past five years.

Related Articles

How do you determine the best and worst times to trade forex in kenya?

A newcomer to the world of forex trading, however, must assimilate a great deal of information and knowledge before ever attempting to place a trade in the market. Success depends on awareness, as well as on hours of practice while developing a forex trading strategy to approach the market in a disciplined fashion. There is one bit of knowledge, however, that neophytes often overlook. Even though the forex market is enormous, there are both good and bad times to trade in the market.

Determining when the best times are is based on how the market operates, what currency pair you wish to trade, what time zones apply to where you reside, and your personal trading style. The forex market may be large, but volatility and liquidity move through it in waves. Your success may depend on catching these waves at the right points in time. When volatility is at low ebb and trading is active, liquidity can be in your favour, producing tight spreads and the ability to open and close positions with ease.

How does the Interbank forex market operate? Over 50% of the forex market is known as the Interbank market, where large movements of capital, averaging over $5 million per transaction, are moved about daily to facilitate international trade and commerce. This market is classified as a decentralised over-the-counter market because there are no exchange floors where market makers shout out bids and take orders. The market makers here are the banks themselves.

Major electronic networks, provided by EBS and Reuters, connect these major banks together, and competition and high volume keep trade margins tight and instantly reflective of economic market conditions. The market opens every business day in New Zealand and follows the sun around the globe. London is the largest market with 43.1% of the volume. New York has 15.5%, Tokyo, 4.5%, and Singapore/Hong Kong, 7.6%.

The best times to trade forex in Kenya are when these various markets overlap, a topic discussed below. From a time zone perspective, Kenya is perfectly situated to take advantage of the overlap between the European and North American sessions. Nearly 70% of the entire turnover for the day takes place during these two sessions.

During this optimum period, liquidity is high for nearly all “EUR” and “USD” currency pairs. In a few instances, the Asian session may offer tighter spreads for “JPY” and “AUD” pairs. The worst times to trade are when these sessions open and close. Professional traders are busy opening and closing positions for their trading day, resulting in heavy volatility for a short period.

The Three Forex Market Trading Sessions

Liquidity and volatility are key considerations when searching for the most favourable times to trade in the forex market. Your objective is to have smooth trades that transact quickly with tight spreads. Your chosen currency pair does have an optimum trading period, but your trading style may influence this period, as well.

Would you believe that spreads could vary by as much as from 10 to 50 pips for even active pairs during times of low liquidity? Are you also aware that high volatility can swing prices by these amounts and much more when chaos rules in the market? Being successful in forex trading demands that you be disciplined and not trade when 50 to 100 pip swings could destroy even the best of forex trading strategies.

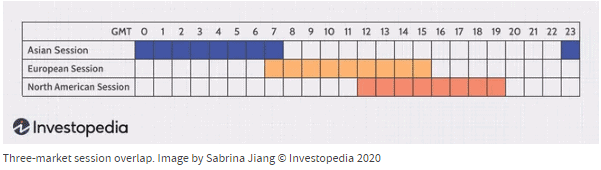

The forex market operates in three distinct sessions – Asian, European, and North American. You may notice that some tutorials split the Asian session into two separate ones, but the main point is that, when the sessions overlap, there is greater liquidity. Asian is all-inclusive, and Sydney is only a 2-hour difference before Tokyo opens, some may say not enough to justify another session portrayal. These overlap periods can provide great liquidity, but also great volatility, as well. Veteran traders may see opportunities in highly volatile transitions, but beginners would be wise to avoid them. The graphic below illustrates how these three basic trading sessions interact and overlap:

Daily, the forex cycle begins in New Zealand. Sydney soon takes over, and then Tokyo joins the fray two hours later. The European session kicks end as the Asian one concludes. London is the major player in this timeframe. During the brief overlap of these two sessions, you might find the tightest spreads for the “EUR/AUD” or the “EUR/JPY” pairs.

When London has four hours remaining, New York turns on, and, after a brief period of chaotic transition, the best period for trading presents itself. 90% of the forex trading activity takes place with currency pairs involving the US Dollar or USD. Be wary of the turbulent nature of the market an hour or so before London closes. Professional traders are closing their books for the day, and the abundance of orders can swamp the market.

| Local Time | EST | UTC |

| Sydney Opens – 7:00 AM

Sydney Closes – 4:00 PM |

4:00 PM

1:00 AM |

9:00 PM

6:00 AM |

| Tokyo Opens – 9:00 AM

Tokyo Closes – 6:00 PM |

7:00 PM

4:00 AM |

12:00 AM

9:00 AM |

| London Opens – 8:00 AM

London Closes – 5:00 PM |

2:00 AM

11:00 AM |

7:00 AM

4:00 PM |

| New York Opens – 8:00 AM

New York Closes – 5:00 PM |

8:00 AM

5:00 PM |

1:00 PM

10:00 PM |

The Best Time to Trade Forex in Kenya

The first determinant for finding the best time to trade forex in Kenya is your trading style. If you prefer volatility and day trading, then the chaos that occurs when London and New York open and close may suit you. A more conservative trader might prefer the overlap period of the two exchanges. Nairobi’s time zone precedes London by two hours and New York by seven hours.

The overlap of these two trading sessions would yield the best liquidity and tightest spreads for the most popular USD and EUR pairings within Kenyan daily business hours. What about the Asian session? If you are a night owl that thinks clearly during the midnight shift, then you could get better spreads and liquidity for popular Asian pairings for the “JPY” or the “AUD” during late night/early morning hours. It is not recommended. Your judgment might be impaired.

Conclusion

Trading forex is legal and gaining popularity in the Republic of Kenya. A burgeoning middle class with a younger age demographic has discovered this exciting trading environment. The brokerage community has also taken notice. Many of the most reputable global forex brokers are offering their services to residents of the country, and we can help you choose which one might be best suited for your personal tastes.

The best times to trade in Kenya will tend to be from noon through 6 pm, Nairobi time since the favourable overlap of the London and New York markets occurs during this time. If you are accustomed to trading when volatility is high, then you may want to look beyond the confines of this timeframe. In any event, practice on a demo system during these market hours. Experiment with different time slots and observe how volatility picks up in anticipation of London and New York opening and closing. When you feel comfortable, try your strategy in real time and enjoy.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

The Best Brokers to Trade Forex with in Kenya

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.