| Swissquote Pros | Swissquote Cons |

|---|---|

| Market-leading range of assets, from CFDs to Options and RoboAdvisory | High minimum deposit levels |

| A secure Swiss broker with a passion for innovation | Demo account only available for 30 days |

| Multilingual reporting | |

| Choice of four impressive trading platforms

Experts Viewpoint |

Swissquote is a well-regarded and successful Swiss-based online broker and financial services provider. The company has been building its reputation and developing a global client base for some time.

It has a strong track-record which offers a sense of security. Founded in 1996, the firm was floated on the SIX Swiss Exchange in May 2000 and now has more than 230,000 clients. Based in London, Swissquote Ltd is a Swissquote Bank subsidiary regulated by the Financial Conduct Authority (FCA). It has offices around the world and operates under licence from Tier-1 regulatory authorities.

The trading service is one of the best examples of a ‘multi-asset brokerage’. Upon visiting the site, you’ll find nearly every asset group is available to trade. Markets covered include indices, commodities, forex, equities, crypto, bonds and options, warrants, ETFs, mutual funds and RoboAdvisory products. Trade size and leverage terms are variable to client discretion. The provision of an impressive in-house platform and the MetaTrader MT4 and MT5 platforms will tick a lot of boxes for both new and more experienced traders.

Swissquote supports trading of the global markets but targets clients in the UK, EU and Switzerland. Traders in these regions considering using a premium-grade broker would do well to research the many benefits of using Swissquote.

The $1,000 minimum account balance may be a barrier to some but trying out the Swissquote platform is highly recommended if you have those funds available. It provides a unique, high-quality approach to trading the markets.

WHO DOES SWISSQUOTE APPEAL TO?

Swissquote is a Forex and CFD broker with broad appeal, mainly serving investors in the UK and other European countries. The broker’s specialist services mean that it has something to offer more experienced traders who are looking for that little bit extra. Beginners will be drawn to the site’s user-friendly layout, exemplary transparency and well organised educational resources.

The Swissquote platform has been fine-tuned over more than 20 years, and it gives traders just what they need to get to work in the markets. It’s a premium service catering to high-end individuals, and prospective clients require a minimum of $1,000 to join the relatively exclusive club.

Swissquote will be very appealing to those looking to gain exposure to a range of asset groups; the range of markets is second to none. Others will note the innovative features, such as the ability to arrange personal loans using your trading assets as collateral. It’s in many ways a groundbreaking broker but one that is backed up by years of Swiss know-how and strong regulatory protection.

ACCOUNT TYPES

Swissquote offers three main account types: Standard, Premium and Prime. There is a minimum deposit of USD $1000 required to open the entry-level Standard account.

- Trading account “Standard” – deposit: from $1,000 to $25,000

- Premium trading account – deposit: from $25,000 to $100,000

- Prime trading account – deposit: over $100,000

There are differences in the spreads and margin terms for different account holders, and slightly different features and benefits will also apply.

The minimum and maximum transaction sizes are the same for all account holders.

All account holders will welcome the absence of fees for opening and closing accounts. There are no account inactivity fees.

If you’re looking to try a premium-grade trading experience but don’t have $1,000 to hand, you can try the Swissquote service out by registering for a Demo account. It will give you a taste of how good the trading experience can be and might even lead to you trying to find extra funds to get you up to the $1,000 minimum account balance.

Markets and territories

Swissquote operates across many different territories, and it is possible to deal all over the globe in a variety of markets, 24 hours a day, five days a week.

The company structure involves the parent company, Swissquote Group Holding Ltd, based in Gland, Switzerland, which operates Swissquote Bank Ltd, also based in Gland, and Swissquote Financial Service (Malta) Ltd at Mriehel, Malta.

Swissquote Bank Ltd has three principal subsidiaries:

- Swissquote Ltd in London,

- Swissquote MEA Ltd, in Dubai

- Swissquote Asia Ltd, based in Hong Kong

Each branch of the company is regulated by the relevant body in that jurisdiction, so the London-based Swissquote Ltd, for example, is authorised and regulated by the UK Financial Conduct Authority. Also, Swissquote MEA Ltd holds a category four licence from the Dubai Financial Services Authority (DFSA).

INSTRUMENTS AND SPREADS

The Trading Account offers a very impressive and diverse range of tradeable instruments, including almost 80 Forex pairs, around 20 commodity pairs, over 20 stock indices and a few bonds, all available as CFDs.

Minor and exotic currency pairs are available, and commodity CFD pairs tend to be commonly traded assets, such as in oil and gold. It is also possible to trade warrants and derivatives, ETFs, mutual funds, options and bonds.

Some markets are only available to investors in particular domiciles, and such privileges ought to be checked as part of the onboarding due diligence process.

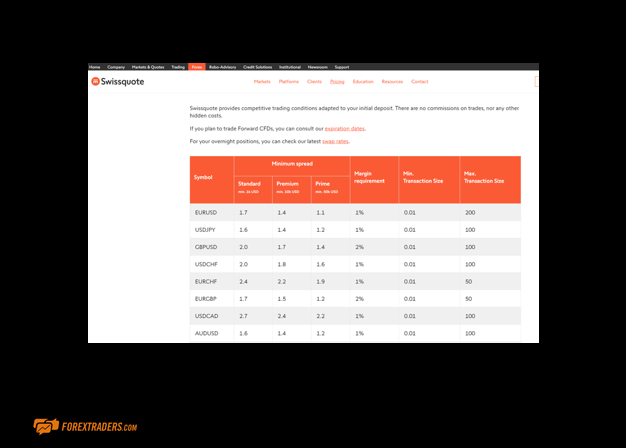

Spreads are dynamic and will vary across different financial instruments according to the type of account you hold. The minimum quoted spreads are:

- Standard account – 1.7 pips

- Premium account – 1.4 pips

- Prime account – 1.1 pips.

Spreads on minor and exotic pairs will be higher, of course, due to lower liquidity, but that is the case at any Forex brokerage.

When you look at each tradeable asset on the website, you will see the spreads currently being charged and other important trading information. There are, as usual, some costs applied to keeping a position open overnight.

FEES AND COMMISSIONS

Swissquote runs on a no-commission model for Standard, Premium and Prime accounts. There are no additional commissions to pay. Instead, the broker’s cut is taken from the difference between the buy and sell price as outlined in the spreads section above.

Swissquote takes a refreshingly transparent approach to the reporting of its T&Cs. The platform includes a monitor displaying up-to-date spreads across the markets. There is also a well laid out section detailing other fees such as overnight interest calculations, minimum trade size and leverage offered.

The minimum deposit to open an account is USD $1000. Swissquote does not generally charge deposit or withdrawal fees, although your bank or credit card company may well levy a fee on such transactions. There is no inactivity fee. Fees and charges are subject to change, so always check current rates and trading policies before you start trading.

Platform Review

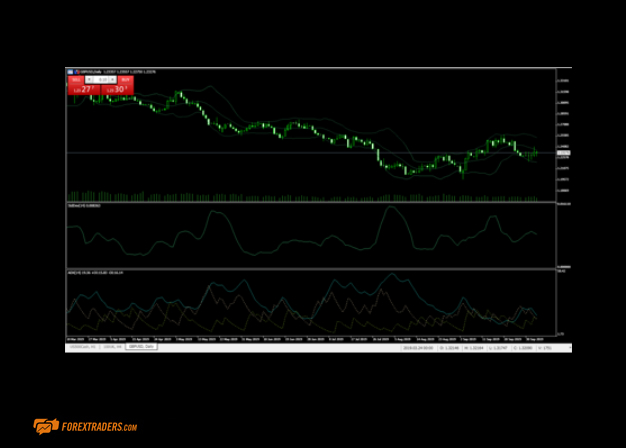

Swissquote provides its clients with both of the MetaTrader platforms. The MT4 and MT5 platforms are the most popular retail trading platforms globally and have earned that position by providing traders with the functionality they want and need. As MetaTrader enthusiasts know, the software has a host of advanced features, including various integrated technical indicators, backtesting facilities and other trading tools. There is also the advantage that MT4 and MT5 software is highly customisable and integrates well with many third-party tools and indicators.

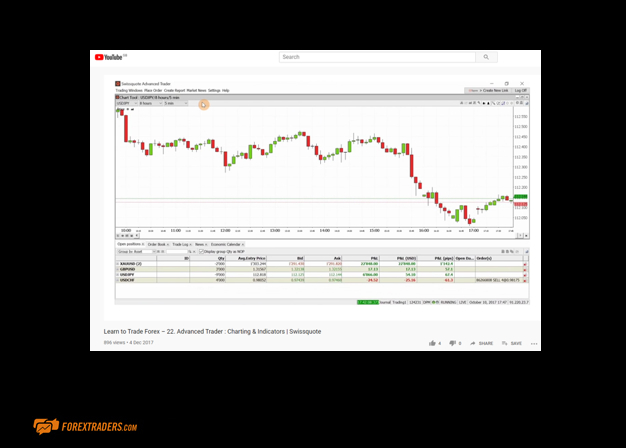

The broker also offers its desktop trading platform, Advanced Trader. Ironically, given its name, it lacks some of the advanced trading tools that MT4 and MT5 traders are used to, but its attraction is in its simplicity. It has a very clean and uncluttered interface and is highly intuitive to use and navigate. It has essential tools such as a watchlist based on a pre-set list of currency pairs, although customisation is limited. However, for newer traders who are not familiar with MetaTrader software and just want a very clear and straightforward platform, Advanced Trader may well be more than sufficient.

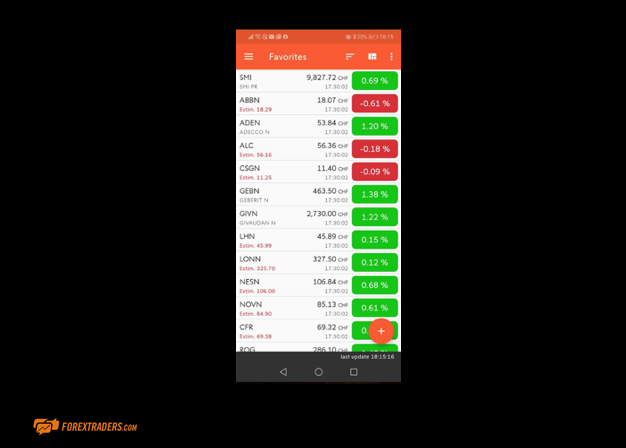

Mobile trading

Swissquote provides a free mobile app that is compatible with both iPhone and Android devices.

We found the app for the in-house platform to be reliable and very user-friendly during our testing. The service transfers well to the small screen, and it has a nice bright aesthetic.

The search function is straightforward; however, some of the results are organised a bit strangely.

The app functions well and has nearly identical functionality to the desktop platform. That is quite an achievement considering the number of markets on offer.

The app also lacks technical indicators and other vital trading tools, but mobile traders can access all trading instruments, account details and other vital functions.

Those using the MetaTrader platforms can access their account using the tried and trusted MetaTrader App.

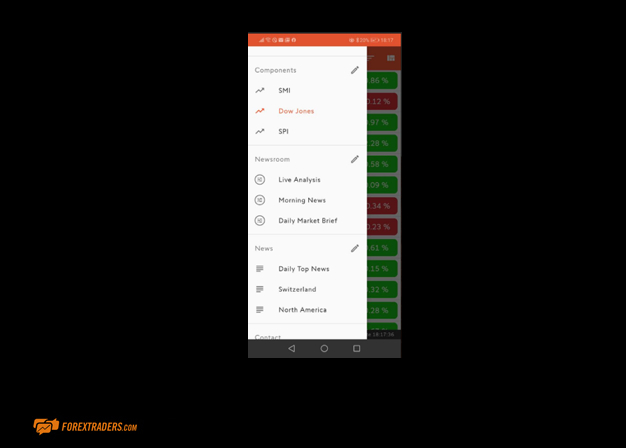

There is a handy mobile news feed integrated into the app, with news from Dow Jones newswire. There are also streaming quotes on all tradeable instruments and a customisable mobile watchlist where you can easily add trading pairs you are interested in by tapping on the + sign at the top of the screen. Charts on the mobile apps are pretty basic and are not as easy to read as they are on a desktop.

SOCIAL TRADING AND COPY TRADING

While Swissquote does not offer what the trading community would identify as a proprietary social/copy trading service, it does have a lot to offer traders looking for a more hands-off experience.

Starting with the important but rather standard offering, clients of the platform can take advantage of the MetaTrader Expert Advisors service. That allows automated trading based on the signals of others and also offers a social trading style forum.

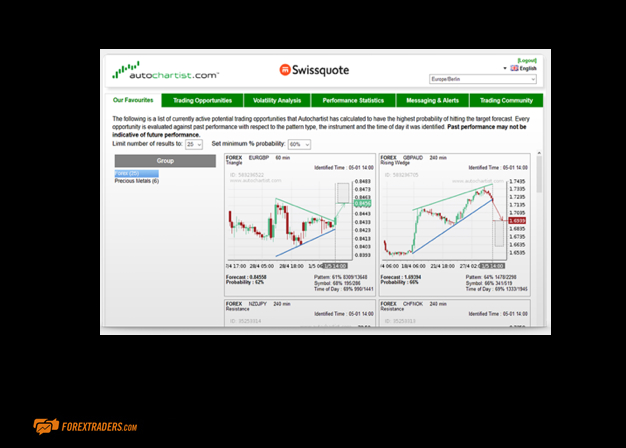

Some features are more distinctive and provide ‘value added’ to traders looking to incorporate others’ ideas. First up is AutoChartist, a tool offering an automated algorithm to identify chart patterns using Fibonacci Patterns and Horizontal Levels. It allows for advanced risk management and some backtesting.

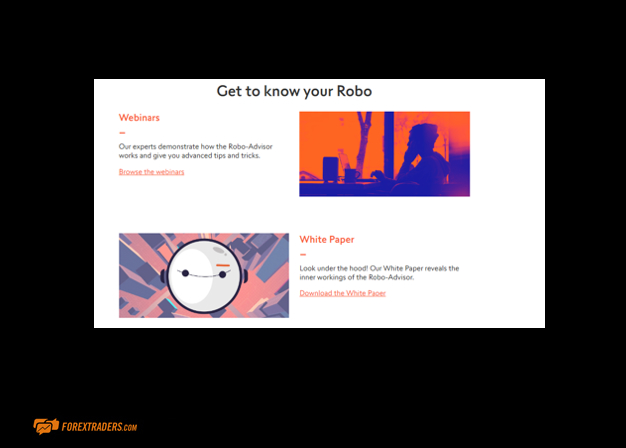

There is also the Robo Advisor service, which is an automated investment manager that creates a bespoke investment portfolio for traders, which is derived from the client’s appetite for risk.

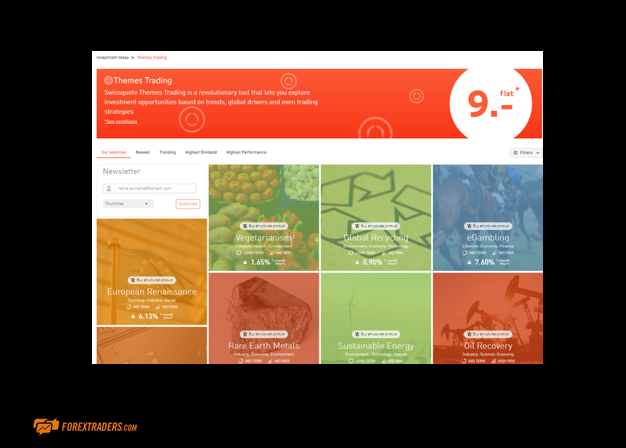

The Themes Trading service is as suggested by the firm ‘revolutionary’. It’s a valuable addition to the broker space and will offer a lot of value to Swissquote account holders.

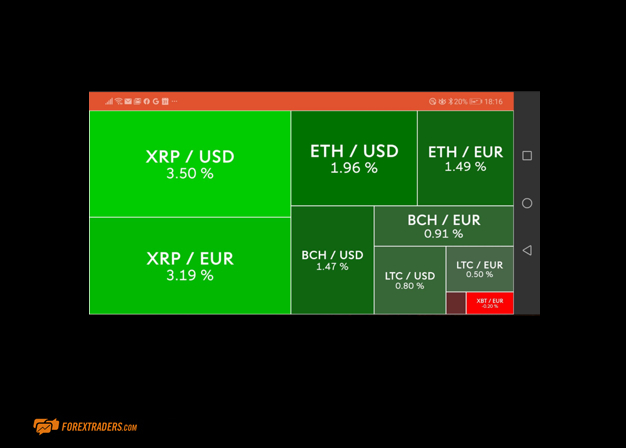

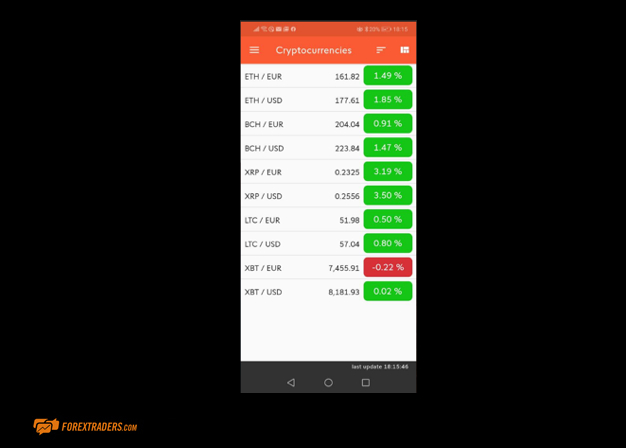

Crypto

The crypto offering from Swissquote is reasonably comprehensive, with a total of 12 crypto markets on offer.

Not all account holders in all regions will have the same access to the crypto markets, but those that can trade them can access all the big names.

Some clients will also be able to make easy transfers between their Swissquote Bank account and their external cryptocurrency wallets, although this is currently only possible with Bitcoin and Ethereum.

Clients of Swissquote Bank can make crypto deposits and withdrawals by selecting ‘payments & transfers’ in their Account Overview within the eBanking portal or the ‘cryptocurrency’ section.

Charting and tools

Swissquote provides basic charting options and other trading tools for all customers. The AutoChartist feature is a very handy tool for those looking for automated advanced data analysis, backtesting and the ability to base risk management strategies on customised data by calculating their real capital exposure and then setting risk-adjusted position sizes.

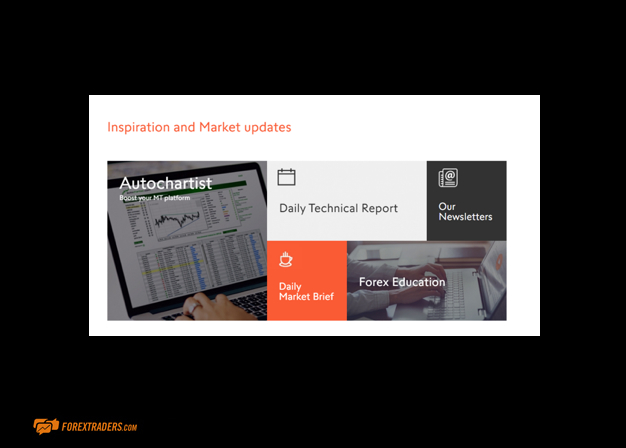

Swissquote Ltd also provides research tools and insights, although they are not very extensive. They offer a limited amount of technical and fundamental analysis, with analyst reports available to all customers via a free email subscription newsletter. A basic economic calendar is available via both the desktop and mobile platforms, and there is also a real-time news feed covering relevant market developments and analysis.

MT4 and MT5 traders have access to all the integrated and third-party tools provided with those services. They come with functionality to allow clients to customise the platform, combine their preferred technical indicators and charting tools, and add Expert Advisors and other relevant plugins.

EDUCATION

Swissquote offers a range of educational resources to its clients, and while not offering anything particularly outstanding, the offering from the broker is in line with the peer group.

There are training videos, eBooks and webinars available, with plenty of information on a wide range of topics. One refreshing feature is that educational resources cater for more experienced traders and not just beginners.

The learning centre includes simple, stylised videos, split into sections, covering topics such as an introduction to forex, an introduction to CFDs, technical analysis, fundamental analysis, and risk management. There are also user guides to MetaTrader software and the proprietary platform Advanced Trader.

Several webinars can be accessed from the learning centre, both live and on-demand. These webinars are offered in multiple languages, which is a bonus for international traders. We noted that the webinars were all listed together, and there did not seem to be a function to browse, for example, all the webinars available in English. The same webinars appear to be available in each major language, but it is just not that easy to filter down to the one you want.

Swissquote breaks up its online training into different topics. One section focuses on instrument types, such as CFDs or Forex; another offers training on technical analysis and risk management strategies, which are more generic.

The cataloguing of the learning resources is done neatly. Towards the bottom of the main education page, there are some helpful links, such as a product guide. It is a complete summary of all Forex and CFD products offered by Swissquote with the individual trading conditions and other details.

There is also a complete guide to trading conditions at the broker for all account types, specifying spreads, leverage, maintenance margin, minimum trade size and other essential information. Swissquote also provides various research tools and a live news feed. Generally speaking, the education and research sections are pretty good, and there is something for all types of traders.

TRADER PROTECTIONS BY TERRITORY

Swissquote is a globally regulated online broker. The main trading company, Swissquote Ltd, is based in the UK and is therefore authorised and regulated by the Financial Conduct Authority (FCA). However, the company also has the appropriate authorisations and regulations in all the jurisdictions in which it operates. Swissquote is regulated by:

- FINMA – Swiss Federal Financial Market Supervisory Authority

- DFSA – Dubai Financial Services Authority

- SFC – Securities and Futures Commission

- MFSA – Malta Financial Services Authority

- FCA – Financial Conduct Authority

Swissquote Bank Ltd is a member of the Swiss Bankers Association, and the parent company Swissquote Group Holding Ltd is listed on the SIX Swiss Exchange. Traders with Swissquote Ltd are protected by the Financial Services Compensation Scheme (FCSC), meaning clients may be entitled to compensation in the event of insolvency, up to a limit of £85,000 per account. Swissquote uses best practices for data security, with client data encrypted and protected across the site. The trading App has recently been upgraded to allow users to take advantage of two-factor authentication.

How to open an account

Swissquote trading accounts are available in the UK, all European countries, and many other countries worldwide. Those domiciled in these countries can set up an online Demo account in seconds. Notable exceptions to the coverage include the USA, Canada, and Japan.

Traders in different domiciles will engage with separate entities of the Swissquote group but generally speaking, for trading purposes, trading accounts are registered with the London-based Swissquote Ltd. All potential clients of Swissquote (and indeed any other broker) should prioritise carrying out due diligence on account terms and corporate structuring.

When you are ready, simply go to the website and click on ‘Open Your Account’. Then follow the instructions. Remember that Swissquote offers a demo account with a balance of USD $100,000 of virtual money with which to practice. The demo account uses real-time market data and prices and is a very useful tool, so if you need to familiarise yourself with the platform, that is the one you are looking for. The demo account is only available for 30 days, at which point, if you are happy with the platform, you will need to upgrade to a real account. You can, of course, do this anytime within the 30 days.

Given that Swissquote holds licences with a range of top-grade global regulators, there is a need for new clients to complete a ‘Know Your Client’ process. These checks can take some time, but once complete, the account is ready to trade as soon as funds are deposited. Funding can be done using GBP, EUR, CHF, AUD, JPY, PLN, CZK, HUF and USD. Swissquote only works with banks with a minimum AA credit rating.

No broker fees are levied on deposits made via bank transfer, but credit card deposits may incur fees, depending on your country of residence.

Customer Support

At Swissquote, customer support can be easily accessed by phone and email, and there is also a responsive live chat option available on the website. During testing, response times were good, and the staff very knowledgeable of their product. One drawback is that general customer support is only available during business hours, Monday to Friday. Outside of those times, it is possible to contact the Trading desk, which operates 24-hours a day from Sunday 23.00 to Friday 23:00 CET. The trading desk might not be the ideal partner for solving more obscure customer support issues, so the direct line to the execution team is reassuring in the sense that during extreme market conditions, there is a back-up route to managing your positions.

The company also runs active social media accounts, providing a convenient way for customers to make contact. Support is multilingual.

In addition to these customer support channels, there is also a lot of helpful information on the website in several languages. Swissquote products and policies are clearly explained, and trading policies and terms and conditions can be easily found.

The bottom line

Swissquote launched the Robo-advisor service in 2010 and, by doing so, became the first Swiss firm to introduce an electronic wealth manager. The firm is very proud of its achievement, which reflects a willingness to push boundaries to empower investors. That particular milestone is just one example of the firm’s approach, and innovation continues to this day across the whole Swissquote platform. There is a feeling that Swissquote offers its clients something different, based on the creative use of technology and an in-depth understanding of trader needs.

The firm has been around for over 20 years and has been listed on the Swiss stock exchange since 2000. It operates out of a robust regulatory framework, and the number of compliance pop-up buttons that appear may be momentarily frustrating for new users. However, it demonstrates that the firm takes compliance and its reputation very seriously indeed.

Its hosting of 231,000 clients demonstrates Swissquote’s success, despite the larger than average minimum deposit size, which shouldn’t be too much of an issue for the more serious trader. It appears the firm prefers to take on quality rather than quantity.

How can I open an account with Swissquote?

Account registration is completed online. The broker asks a series of questions to build your profile, and there is a need to upload some i.d. verification documents.

Is Swissquote a regulated broker?

Yes. Swissquote is regulated by a range of highly regarded financial authorities, with the majority of accounts coming under the protection of the Financial Conduct Authority (FCA)

How do I withdraw money from Swissquote?

Cash withdrawals are made by bank transfer. The firm suggests this can take 2-3 days to process but, in reality, tends to take less time.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk