- The US Dollar has broadly stayed strong during May against the major global currencies (and also Emerging Markets currencies) with a “risk off” theme continuing to dominate most global financial markets.

- Although USDJPY was initially weaker for the first half of May due to Japanese safe haven strength, the USDJPY FX rate rebound from mid-month has reflected a more indecisive phase for global financial assets.

- USDCAD stays somewhat indecisive in a choppy, May range, but holds onto both short- and intermediate-term positive themes.

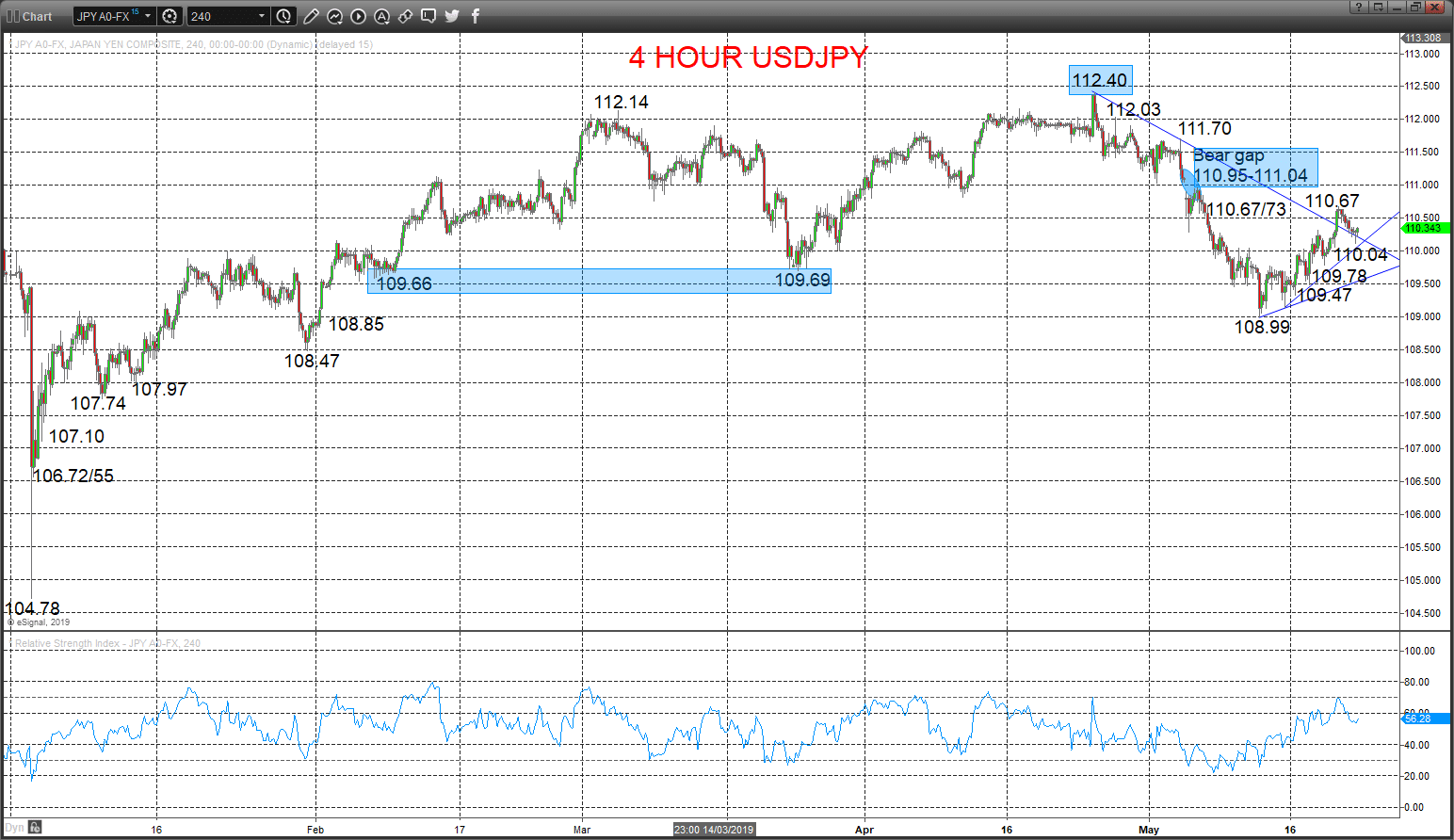

USDJPY setback, but bias stays higher

A small setback Wednesday from exactly the bottom of our 110.67/73 resistance zone, but whilst holding above 110.04 support sustaining positive forces from this week’s strong advance and the whole rally since the mid-May rebound from 108.99 swing support, keeping the bias higher Thursday.

The May surrender of 109.66 set an intermediate-term bear trend, BUT risk is growing for a shift back to neutral above the key bear gap at 110.95-111.04

For Today:

- We see an upside bias for 110.67/73; break here aims towards the key bear gap at 110.95-111.04.

- But below 110.04 quickly aims for 109.78 and maybe opens risk down to 109.47.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 108.47.

- Lower targets would be 107.74 and 106.72/55.

- What Changes This? Above the resistance gap at 110.95-111.04 shifts the outlook back to neutral; above 112.40 is needed for a bull theme.

Resistance and Support:

| 110.67/73* | 110.95-111.04*** | 111.70** | 112.03* | 112.40*** |

| 110.04 | 109.78 | 109.47* | 109.31 | 108.99** |

4 Hour Chart

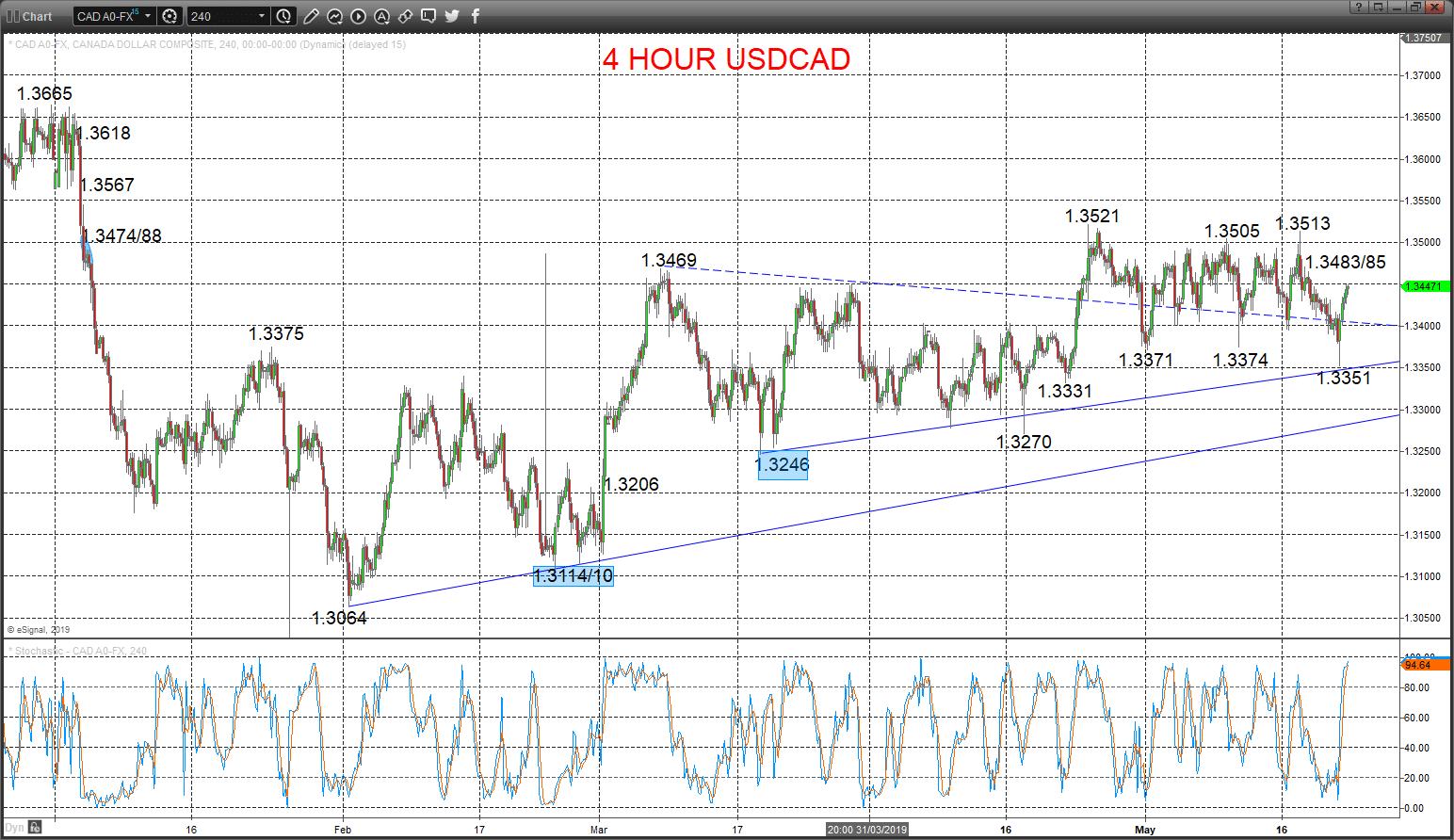

USDCAD hanging onto a positive tone

A spike lower and a strong rebound Wednesday from below 1.3394/89 aims for 1.3374/71 supports, from 1.3351, to hang onto positive pressures from the mid-May rebound from above the 1.3374/71 support area to 1.3513, to keep risks higher for Thursday.

The early March surge through 1.3375 set an intermediate-term bull trend.

For Today:

- We see an upside bias for 1.3483/85; break here aims for 1.3513/21.

- But below 1.3385/80 aims for 1.3351 and maybe 1.3331.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 1.3665.

- Higher targets would be 1.3794 and 1.4000.

- What Changes This? Below 1.3246 shifts the outlook back to neutral; through 1.3110 is needed for a bear theme.

Resistance and Support:

| 1.3483/85 | 1.3513/21* | 1.3567 | 1.3618* | 1.3665*** |

| 1.3385/80 | 1.3351* | 1.3331 | 1.3270* | 1.3246*** |

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.