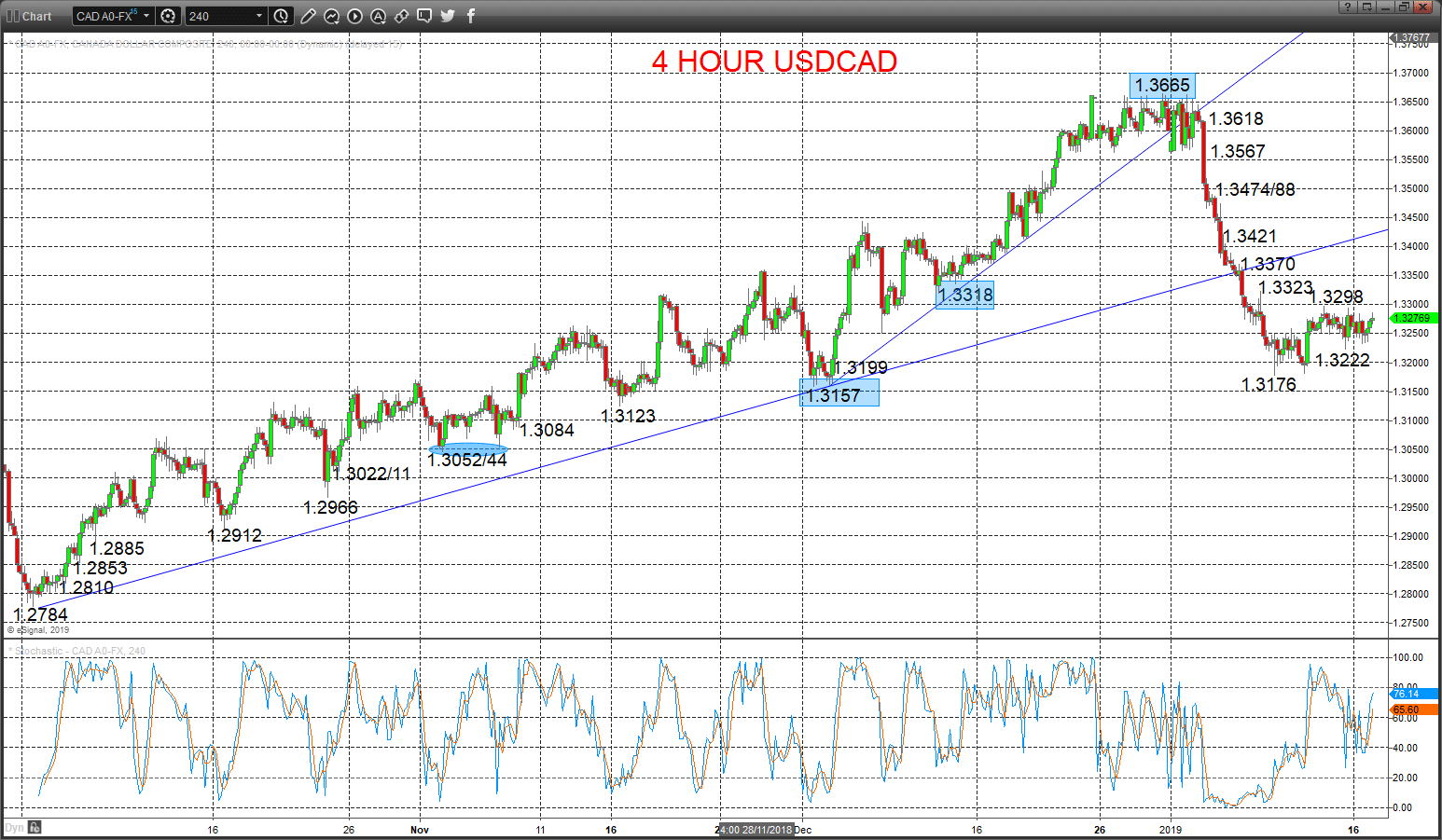

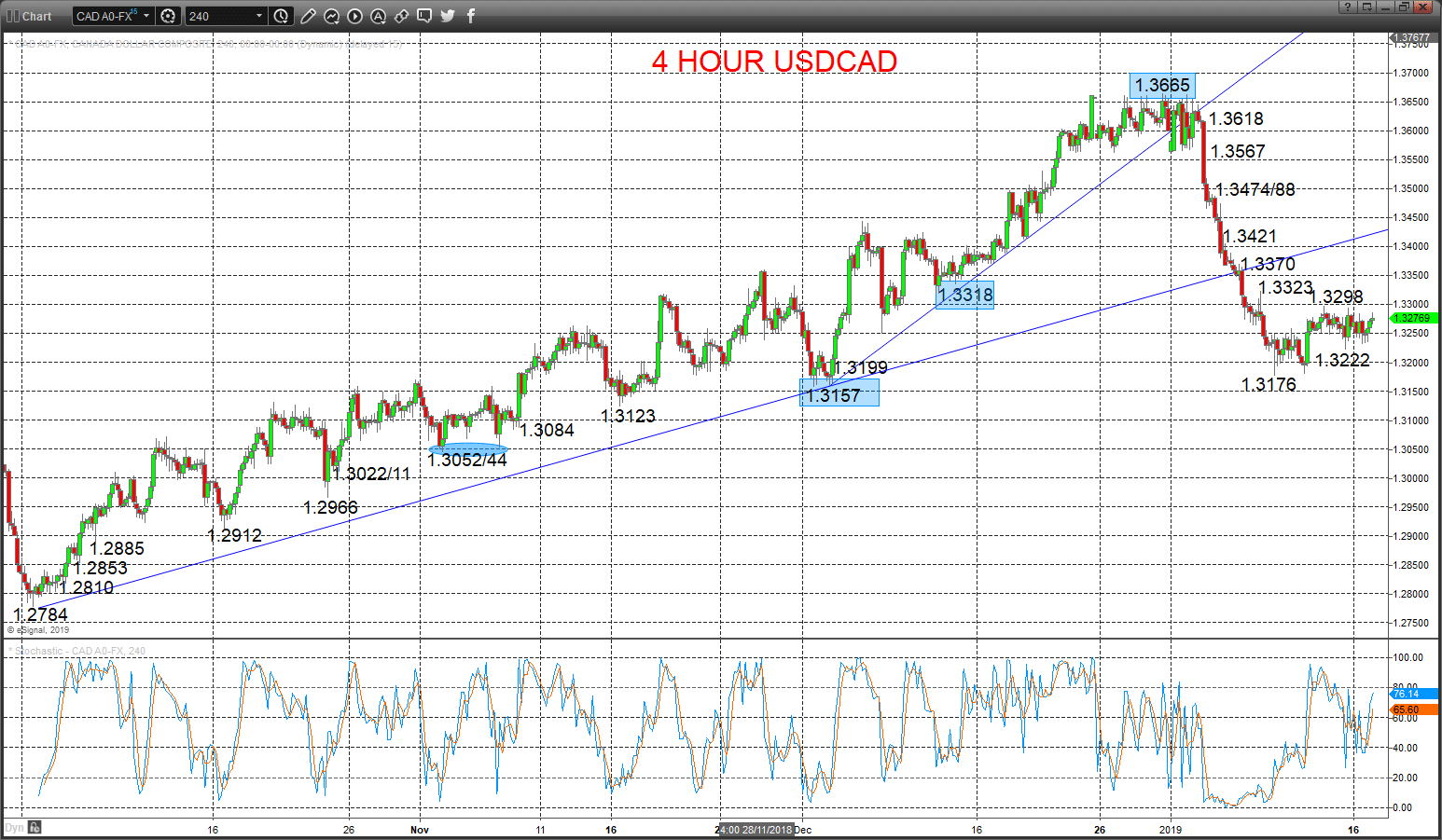

- Back on 7th January when we last reviewed USDCAD and USDJPY we questioned the USDCAD intermediate-term bullish trend bull trend and for USDJPY highlighted a threat to shift the intermediate-term bearish outlook to neutral.

- A more aggressive selloff for the USDCAD Forex rate into mid-January, as we had flagged, was assisted by a rebound in the Oil price (benefiting the Canadian Dollar) and has pushed through some notable USDCAD support levels (see below).

- This has shifted the intermediate-term outlook for USDCAD from bullish to neutral, with asymmetrical risks towards an intermediate-term shift to bearish.

- As expected, the USDJPY currency pair continued the rebound since the “flash crash” that started the year, to push above the 108.90 level, which neutralised the intermediate-term bearish outlook, to set a broader range theme into the second half of January.

USDCAD downside bias

A prod lower Wednesday having been capped by 1.3323 during the recent corrective rebound, sustaining negative forces from the earlier January plunge through the up trend line from October and key 1.3318 support, to leave the bias to the downside Thursday.

The early January plunge to push below the 1.3318 level set a neutral intermediate-term range we see as 1.3157 to 1.3665, BUT with skewed risks now towards the lower target.

For Today:

- We see a downside bias for 1.322 and 1.3176 and quickly for key 1.3157; break here aims for 1.3123 and 1.3084.

- But above 1.3323 opens risk up to 1.3370 and maybe towards 1.3421.

Intermediate-term Range Breakout Parameters: Range seen as 1.3157 to 1.3665.

- Upside Risks: Above 1.3665 sets a bull trend to aim for 1.3777 and 1.4000/17.

- Downside Risks: Below 1.3157 sees a bear trend to target 1.3000, 1.2912 and 1.2784.

Resistance and Support:

| 1.3298 | 1.3323* | 1.3370* | 1.3421 | 1.3474/88** |

| 1.3222 | 1.3176 | 1.3157*** | 1.3123 | 1.3084* |

4 Hour USDCAD Chart

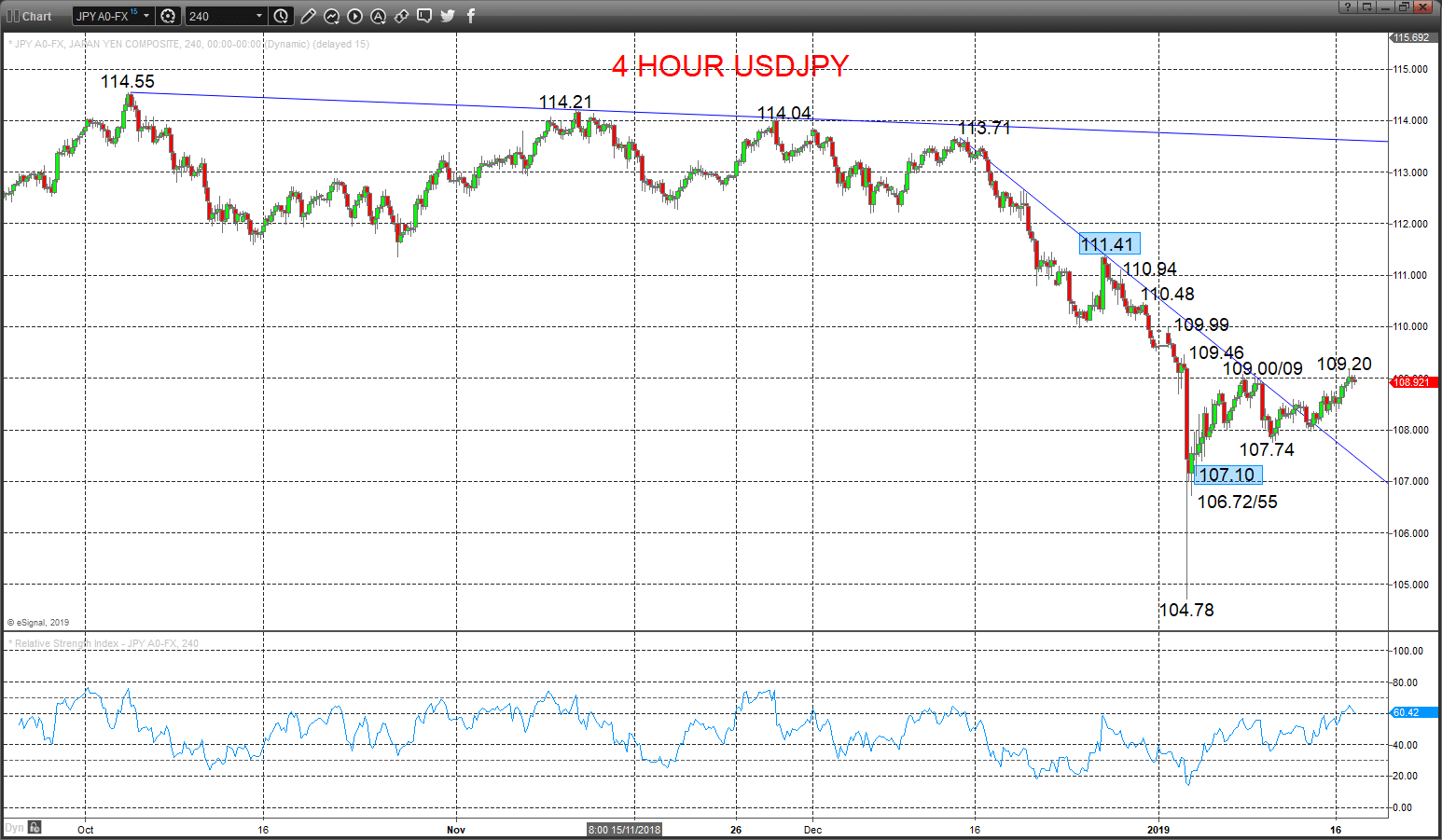

USDJPY risks still just skewed to the downside

A prod higher Wednesday and again overnight to just overcome the 109/.00/09 resistance area, but an abeyance of an upside follow-through and whilst capped by 109.46 we still see negative forces from last week’s selloff from this zone, to keep the immediate risks lower into Thursday.

The probe above 108.90 set an intermediate-term range, seen as 111.41 to 107.10.

For Today:

- We see a downside bias for 107.74; break here aims for key 107.10.

- But above 109.46 opens risk up towards 109.99.

Intermediate-term Range Breakout Parameters: Range seen as 111.41 to 107.10.

- Upside Risks: Above 111.41 sets a bull trend to aim for 71, 114.55 and 115.00.

- Downside Risks: Below 107.10 sees a bear trend to target 72/55, 104.78/56 and 100.00.

Resistance and Support:

| 109.20 | 109.46* | 109.99 | 110.48** | 110.94 |

| 107.74 | 107.10*** | 106.72/55** | 106.00 | 105.53 |

4 Hour USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.