| NAGA Markets pros | NAGA Markets cons |

|---|---|

| A wide range of tradable assets | Wide spreads compared to other brokers |

| Regulated by CySEC | Customer service only available for five days a week |

| MT4 and MT5 available | |

| Award-winning social trading platform |

Trader’s Viewpoint

- NAGA Markets was founded in 2015, and offers clients over 750 tradable assets in Forex, ETFs and CFDs in stock, indices and commodities. It is a subsidiary of the NAGA Group, an international finch company listed on the Frankfurt Stock Exchange. NAGA Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC).

- NAGA Markets utilises the well-known and highly regarded MetaTrader platform of MT4 and MT5 and its own proprietary social trading platform. The platform appeals to both beginner and experienced traders. Importantly, NAGA Markets own social trading platform enables beginners to gain experience of trading. There is also an AI assistant to help clients minimise risk and take advantage of trading opportunities as they present themselves.

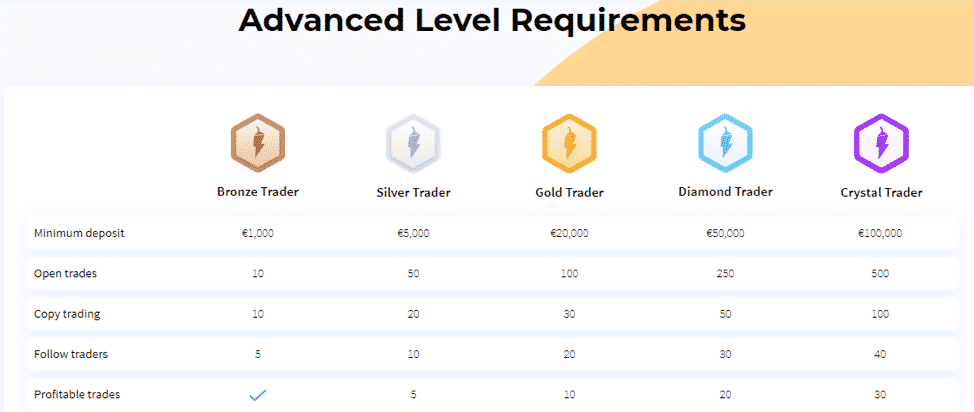

- NAGA Markets offers both a demo and live accounts. There are six types of accounts with limited access namely Iron, Bronze and Silver that attract a withdrawal and deposit fee of EUR10, whilst full access accounts in Gold, Diamond and Crystal have no fees attached. A minimum deposit (upto EUR100,000 for Crystal) and number of trades (30 or more for Crystal) dictate which account a client would qualify for.

NAGA Markets coverage is very competitive. Of the Forex tradable assets, it includes over 45 currency pairs. Crypto offering include 15 pairs based upon the majors of Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Monero, Tron, Zcash, Dash, IOTA, NEO and Ripple. With CFDs, NAGA Markets offers over 24 indices and the major hard and soft commodities. Traders also have access to CFDs to over 650 global stocks.

Whilst NAGA Markets offers both MT4 and MT5 trading platforms, that is rapid and agile, it also operates with TradingView. This gives traders access to a variety of charting tools and an array of technical analysis indicators and automated strategies. The NAGA Markets platforms are compatible with Android and iOS mobile devices.

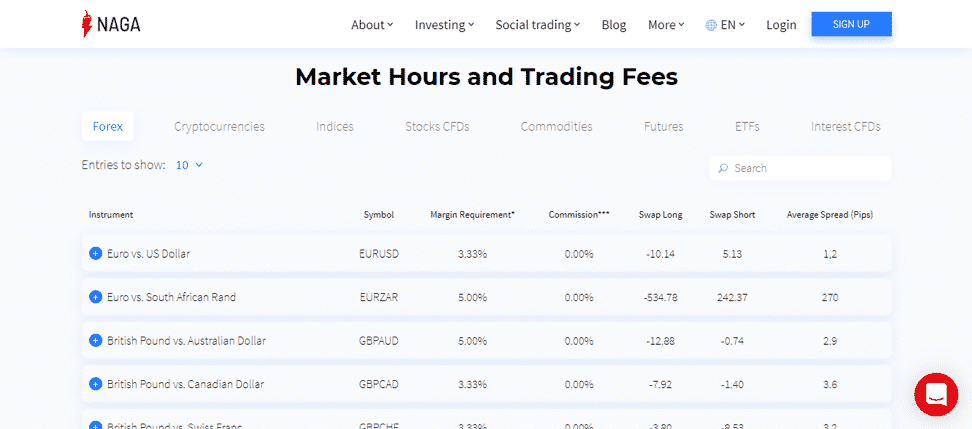

NAGA Markets fees and spreads are not necessarily market leading when compared with its peers. The usual spread for the EUR/USD pair with this broker is 1.2 pips. It charges 0.20% commission on stock CFDs and 0.10% on ETFs CFDs. Regarding withdrawals, NAGA charges USD10 for every transaction up to USD30,000.

The Educational support on NAGA Markets is diverse, offering written guides, webinars, videos and structured courses. There is a live news feed, a real-time economic calendar and regularly updated blogs to keep the traders fully informed of market conditions. Social trading can be very helpful for beginner traders, whilst experienced traders can earn extra income by offering their insights to the NAGA client community. A Customer support team is available, in multiple languages, 24 hours a day, 5 days a week.

NAGA Markets has a strong diverse offering for the erstwhile online retail trader, with access to over 700 markets covering Forex, stocks, crypto and virtual in-game items. It even has developed its own cryptocurrency known as the Naga Coin. It has won awards for the Best Social Trading Platform in recent years, and its game-like interface is well liked by its users. With over 500,000 accounts in the past four years, NAGA Markets is one of the fastest growing in the world.

Introduction

Founded in 2015, NAGA Markets is an STP broker that offers over 750 tradable assets in forex, ETFs and CFDs in stock, indices, and commodities. The broker is a subsidiary of the NAGA Group, an international fintech company listed on the Frankfurt Stock Exchange.

NAGA Markets has its headquarters in Limassol Cyprus and has offices in over ten countries including South Africa, Mexico, Peru, Indonesia, India, Thailand, Malaysia, Vietnam, and New Zealand. Moreover, this broker operates internationally but is unavailable in Belgium, North America, Iran, Cuba, Iraq, North Korea, and Japan.

NAGA Markets is regulated by the renowned Cyprus Securities and Exchange Commission (CySEC). This is one of the most reputable regulatory bodies across the globe. When it comes to trading platforms, NAGA Markets offers both the MT4 and the MT5 and its own proprietary social trading platform.

See our full list of trusted brokers

Who does NAGA Markets appeal to?

NAGA Markets is suitable for both beginner and experienced traders. Firstly, this broker offers a wide range of tradable instruments and hence attracts traders with different interests. Secondly, it provides tools and educational materials to help both the beginner and experienced traders to get the most out of their trading. The educational materials range from basic trading topics to advanced lessons.

NAGA Markets social trading offerings enable beginners to make money as they learn. Experienced traders with limited time to carry out trading research also benefit from the social trading. Furthermore, experienced traders who would like to earn extra income sharing their trading wisdom with others can register as signal providers.

NAGA Markets provides an AI trading assistant to help users minimise errors and capitalise on trading opportunities as they present. Another thing that makes this broker attractive to both beginner and experienced traders is the negative balance protection feature. This feature ensures that traders cannot lose more than their invested capital.

Also worth noting, NAGA Markets is among the few brokers that offer access to tradable virtual items found in online games. This makes it an excellent choice for traders with interests in gaming. NAGA Markets accept a minimum deposit of $100. Furthermore, the broker is available in over 16 languages among them German, Spanish, Italian, and Polish.

Account types

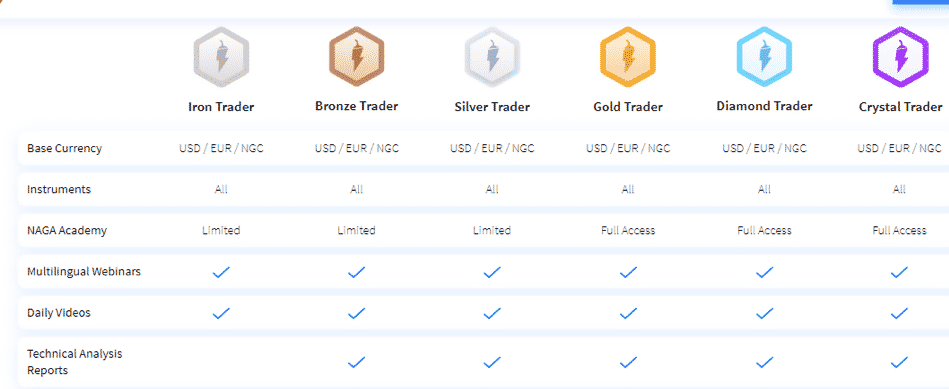

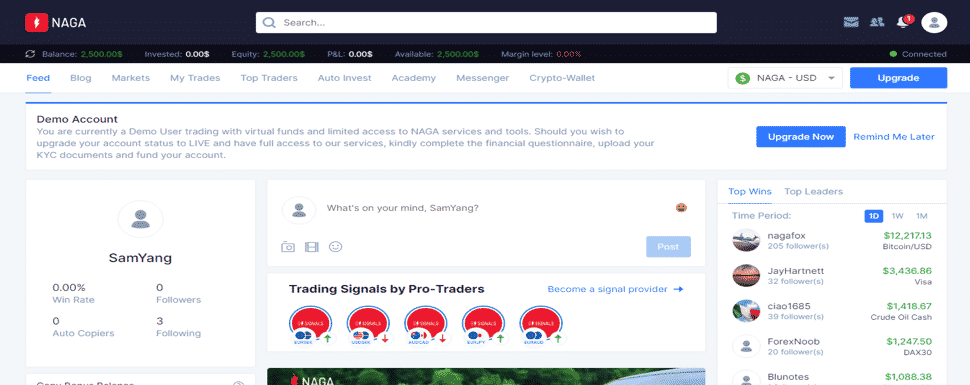

Naga Markets offers both the demo and live account. Instead of classifying the live account as other brokers do, this broker categorises its users. The categories are based on achievement level and include Iron Trader, Bronze Trader, Silver Trader, Gold Trader, Diamond Trader and Crystal Trader.

See our full list of trusted brokers

Each category comes with its requirements, features and advantages. For instance, the Iron, Bronze, and Silver categories have limited NAGA Academy access while the Gold, Diamond, and Crystal levels have full access. Furthermore, the first three categories attract a withdrawal and deposit fee of €10, while the last three are free.

To become an Iron Trader, users must register a live NAGA Trader account and get verified. Moreover, they must close at least five demo trades and copy five demo trades on NAGA Trader. They must also open a real NAGA Stocks account via My NAGA and complete their profile.

See our full list of trusted brokers

Traders upgrade through the levels depending on their invested capital and the number of copy trades, open trades, profitable trades, and follow traders they have. For instance, a trader must have a minimum deposit of €100,000 and 30 or more profitable trades to qualify for the Crystal Trader level.

Markets and territories

As mentioned above, NAGA Markets operates internationally in exception of North America, Belgium, Iran, Cuba, Iraq, North Korea, and Japan.

The broker has its headquarters in Limassol, Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC). While this regulator only caters for clients in Cyprus but its stringent measures makes its regulated brokers reputable across the globe.

Consequently, NAGA Markets has managed to gain trust in most parts of Europe, Asia, and Africa. With over 500,000 accounts in four years, this broker is one of the fastest-growing across the globe.

NAGA Markets platforms are available in over 22 languages, including German, French, Italian, Spanish, Polish, Indonesian, Portuguese, Chinese, Hungarian, and Arabic, among others.

Instruments and spreads

NAGA Markets offers over 750 tradable assets in forex, crypto, ETFs and CFDs on stocks, commodities, and indices. The forex offerings include over 45 currency pairs consisting of the majors, some minors, and a few exotics.

Crypto offerings, on the other hand, include 15 pairs based on Bitcoin, Ethereum, Bitcoin Cash, Dash, Litecoin, Monero, Tron, Zcash, Ripple, IOTA, and NEO. These cryptos are paired against each other and major fiat currencies such as the USD and EUR.

Regarding CFDs, NAGA Markets offers over 24 indices including the S&P 500, DJIA, DAX30, British FTSE 100, Japanese Nikkei 225, Indian NIFTY 50, and many others. Also available are CFDs on commodities such as Gold, Silver, Copper, Soybean, Corn, Coffee, Wheat, Crude Oil, and Natural Gas.

Traders can also access CFDs on over 650 global stocks, including Google, Coca Cola, Facebook, Netflix, and many more. This broker also offers over 17 ETF CFDs that include Vanguard Large-Cap ETF CFD and iShares U.S. Real Estate ETF CFD.

See our full list of trusted brokers

NAGA Markets spreads vary with instruments and market conditions. The typical spread for the EUR/USD pair with this broker is 1.2 pips. This makes a little bit expensive when compared with other brokers in the same category. The spreads for other instruments are also relatively high.

Fees and commissions

NAGA Markets charges a 0.20% commission on stock CFDs and 0.10% on ETFs CFDs. This broker does not charge any commission on other assets.

Traders do not incur any charges for deposits of up to $30k per month when they deposit through Visa or MasterCard. There are also no charges for alternative methods when the deposit is between $1k and $5K.

Regarding withdrawals, this broker charges 10 EUR/USD for every transaction of $30k and below on all the accepted withdrawal methods. NAGA Markets charges an inactivity fee of 50 EUR for all inactive accounts.

Platforms

NAGA Markets offers both the MT4 and the MT5 trading platforms. These platforms are available in web, desktop and mobile versions. Moreover, they are compatible with Windows, Linux Mint 18.2, and Mac. The MetaTrader software has a reputation of being stable and hence can handle fast-paced trading. Furthermore, it is fully customisable, which means that users can modify it to suit their specific needs.

The MT4 is the most popular and comes with a wide range of features and tools to enable users to trade easily and effectively. Moreover, it presents a highly intuitive user interface and simple design that appeal to both beginner and experienced traders.

NAGA Markets operates in partnership with TradingView™ among other third party trading tools providers to ensure that traders have everything they need to trade successfully. With this broker, traders can access a variety of charting tools that enable them to view live prices, list patterns and create custom templates. Also available are multiple technical analysis indicators and automated strategies (EAs).

As we will see later in this review, this broker has its award-winning social trading platform known as NAGA Trader. NAGA Markets is best known for social trading, and hence most of its focus is on this platform.

See our full list of trusted brokers

Social trading

Apart from the MT4 and the MT5, this broker has its own proprietary social trading platform known as NAGA Trader. The platform offer access to over 700 markets covering forex, stock, crypto, and virtual in-game items. NAGA trader has won various awards among them the Digital top 50 Award and the Best of Show award in the Finovate Europe 2016 awards. The platform is also the winner of the Best Social Trading Platform 2017 by AtoZForex Awards and the Red Herring Europe 2017 Award.

See our full list of trusted brokers

NAGA Trader has a game-like interface which makes it easy and exciting to use for all types of users. Furthermore, the platform is available in web and mobile versions. The mobile version is compatible with both the Android and iOS and can be downloaded for free on Google Play and App Store. Some of the features found in the social trader include a news feed and a messenger that allows users to share their analysis and keep up with the experience of other traders.

Through the platform, traders can publish, like, comment and share posts. Moreover, instead of continuously swiping to find traders to copy, users can adjust the platform filters to get recommendations that match their trading style. NAGA Markets also provides an automated AI trading assistant known as CYBO. This robo-advisor relies on powerful algorithms to read the markets and identify high-quality trading signals.

Furthermore, it is equipped with advanced risk management features to prevent unexpected losses. The AI technologies enable it to create a personalised investment strategy based on user preferences, habits, and risk tolerance.

Mobile trading

NAGA Markets trading platforms are compatible with Android and iOS devices. Traders can access this broker’s demo account by downloading the MT4 and linking it to the broker. As mentioned earlier, the MT4 can be downloaded on Google Play or App Store for free. No deposit is required to access the NAGA Markets demo account.

The NAGA Trader social trading platform is also accessible on mobile as an app and also on the browser. Likewise, traders can download it for free on Google Play and App store. After download, traders can go straight to demo to familiarise with the platform.

The NAGA Trader user interface is highly intuitive. Moreover, this broker provides adequate resources to guide users through the setup and trading process. Social trading with this broker is quite impressive, given that their platform is built to encourage community participation.

Crypto offerings

NAGA Markets allow users to trade crypto paired against crypto and major fiat currencies such as the USD and the EUR. With this broker, traders gain access to over 15 cryptos including Bitcoin, Ethereum, Dash, Monero, Litecoin, Ripple, and Bitcoin Cash.

NAGA Markets also has its own crypto known as the Naga Coin (NGC). The firm issued a public sale back in 2017 and managed to fundraise over $50 million to support the growth of the coin.

Traders can register to receive a NAGA Card where their proceeds from trading can be accessed either in NGC, USD, or EUR. MasterCard and Visa power the NAGA Card.

Charting tools

NAGA Markets provides a variety of charting tools through the MT4 and the proprietary social trader. As mentioned earlier, this broker relies on third-party providers such as TradingView™ to provide advanced charting tools to users. TradingView charting tools enable users to view live prices, outline patterns and create custom templates.

Education

NAGA Markets provides a wide range of beginner and advanced educational materials for free through the NAGA Trading Academy. The materials are offered in written guides, videos, webinars, and structured courses. Complete beginners can find basic courses and are assigned a dedicated account manager to assist them through the first steps of trading.

Moreover, they can find mentors in the NAGA Markets community to walk with them through the trading journey. Social trading is highly beneficial to beginners, given that it enables them to avoid costly mistakes and earn while they learn.

As mentioned earlier, experienced traders can earn an extra income by contributing their trading insights to the NAGA community. The platform ranks these traders according to their popularity and recommends their signals to traders with a similar trading approach.

Furthermore, this broker provides a live news feed to help users keep up to date with the latest market developments. Also available is a regularly updated blog that presents expert commentaries on critical market issues. There are also weekly trading webinars to help users stay informed. The broker also provides a real-time economic calendar to enable traders to plan for upcoming market events.

NAGA Markets also provides a well-detailed FAQ page. Most of the educational materials offered by this broker are only accessible after deposit.

Trader protection

NAGA Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 204/13. As mentioned earlier, this regulator is recognised as one of the best across the globe. Consequently, the brokers that fall under this regulatory jurisdiction are trusted worldwide.

CySEC Requires its regulated brokers to segregate clients’ funds and observe strict reporting requirements. Deposit segregation means that the broker cannot use traders’ money for any other purpose other than the intended one. The deposits are also insured to ensure that traders get back their money in the event of the broker going bankrupt. This broker is a member of the Investor Compensation Fund.

NAGA Markets is a subsidiary of NAGA Group AG, a German fintech company that is listed on the Frankfurt Stock Exchange. Publicly traded companies are regularly scrutinised to ensure that the interests of shareholders and investors are protected. This means that they are less likely to engage in fraudulent practices.

NAGA Markets is also compliant to the Cyprus Investment Services Activities and Regulated Markets and the European Markets and Financial Instruments Directive (MiFID). NAGA Capital Limited, another subsidiary of the NAGA Group AG, is registered as an International Business Company under the laws of St Vincent and the Grenadines.

This broker is also compliant to the EU General Data Protection Regulation (GDPR) a law that ensures data protection and privacy for EU citizens.

See our full list of trusted brokers

How to open an account with NAGA Markets

Traders can register with NAGA Markets on their website, which is accessible through desktop and mobile. The required personal details include the trader’s name, email and phone number. Traders must verify their email address to proceed.

After registration, traders gain access to the demo platform. Demo trading with this broker can be done through the MT4 or the proprietary social trading platform. Both the MT4 and the NAGA social Trader are available in web, desktop, and mobile versions.

NAGA Markets seem more inclined towards social trading and is hence the best choice for those who prefer this approach. The social trading demo account is equipped with almost everything that a beginner needs to trade on the live account.

Customer service

NAGA Markets customer service is available for 24 hours a day, Monday through Friday. They are reachable through phone, email, and live chat. While phone calls and live chats take a few minutes to get a reply, emails can take up to 24 hours. This is not unexpected, given the high number of users that this broker serves.

NAGA Markets has offices in Cyprus, South Africa, Mexico, Peru, India, Indonesia, Malaysia, Thailand, New Zealand, and Vietnam. Traders in these regions can reach this broker through a local phone number. Those in other areas are encouraged to use the global support line.

As mentioned earlier, their customer services are available in multiple languages to include English, German, French, Italian, Spanish, Polish, Indonesian, Portuguese, Chinese, Hungarian, and Arabic, among others.

See our full list of trusted brokers

Bottom line

NAGA Markets is a legit Forex, CFD, and crypto trader with a higher inclination towards social trading. Their trading platforms include the renowned MT4 and a proprietary social trading platform known as NAGA Trader. The trading platforms are highly intuitive and come with a variety of features and tools to enhance user trading experience.

With an average spread of 1.2 pips for the EUR/USD pair, NAGA Market is considered to be a relatively priced broker. The broker does not charge any commissions on the majority of its tradable assets. NAGA Markets appeals the most to social traders, given its award-winning social trading platform.

FAQs

How can I open a demo with NAGA Markets?

NAGA Markets require users to register to access the demo account. However you do not have to deposit to use the account.

Is NAGA Markets a regulated broker?

Yes! NAGA Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC). This regulatory body is one of the most revered across the globe.

How can I open an account with NAGA Markets?

Visit NAGA website and click the signup button to create an account. The process should not take you more than 10 minutes. You will be asked to verify your ID later in the process.

How do I withdraw money from NAGA Markets?

NAGA Markets does not have withdrawal restrictions or charges. Fill the provided withdrawal request form and wait for up to 2 business days for your funds to be processed.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk