At first glance, Strattonmarkets.com is a peculiar FX/CFD trading operation, for several reasons. The first “issue” of sorts, that pops up, is the unintuitive nature of the whole strattonmarkets.com experience. The website does feel a bit like it was tossed together in a hurry and it simply fails to deliver sufficient information on several key aspects of the operation, including the trading platform it uses. Suwre, it is fleetingly mentioned that the brokerage supports MT4 as well as its proprietary web-based trading platform, but that’s about it.

Some reviewers have called the operation “offshore” and unregulated, but that is simply no longer the case. It looks like Stratton Markets are in fact looking to clean up their act and they are definitely taking steps in the right direction.

In addition to securing a CySEC license and making sure the brand is indeed backed by a Cyprus-based CIF, the broker is apparently getting ready to launch a completely new website too, one that will hopefully make the above said user experience problems forgotten.

Another issue which sticks out a bit in regards to this broker is that there is almost no relevant user feedback available about its services. No one is calling this operation a scam and no one seems to be able to offer even a subjective opinion about how it works…

As already said above, the Stratton Markets brand is operated by a company based in Cyprus. The name of this company is F1Markets Ltd, and it is indeed a Cyprus Investment Firm, which means that it is entitled to offer its clients some very offers concerning their deposits. Head Office Address: Kolonakiou Avenue 43, 4103 Ay. Athanasios, Limassol, Cyprus.

The regulatory authority behind the brokerage is CySEC. The license number of the operator is 267/15. the broker follows MIFiD regulations. Add that they offer their services to Switzerland but not to Belgium. The website of the broker does not say anything about the US, but it is safe to assume that – since the operator is not licensed by any US authority – no traders are accepted from the US and Canada either.

What exactly does strattonmarkets.com promise that would justify your adding it to your preferred online FX/CFD trading destinations?

Well, for one thing, the broker is regulated. In addition to that, it, its traders become members in the Investor Compensation Scheme.

The trading conditions offered by the broker are very attractive as well. While the maximum available leverage is just 1:400 for professional traders and up to 1:30 for retail traders (which isn’t really bad at all, if you ask us), its spreads are super-competitive.

Stratton Markets Account Types

The broker offers a total of 4 different account types. Again, several important pieces and bits of information are missing from the account types presentation page, such as the minimum deposit requirements for each account type. Apparently though, the smallest amount of money you’ll be able to open an account for at strattonmarkets.com is 250GBP,USD,EUR,CHF, which is rather steep, considering the overall deal here.

The Basic Account is obviously the most accessible and at the same time, the poorest in regards to features. This account offers a free platform presentation, a dedicated “Support Guy”, as well as access to a number of education-oriented features, such as a selection of seminars and webinars. Daily market analysis is also included in the offer.

In addition to all the above, the Basic Account also offers a $100k Demo Account, to give novice traders the possibility to put the whole deal to the test, without risking any real money.

The Silver Account covers everything the Basic Account does, and it tosses in a few new features. Risk Management is also included in the Silver package, in addition to free maintenance and a selection of tutorials on technical analysis as well as sentimental- and fundamental analysis.

The Gold Account – which is designated the best choice – ups the stakes quite a bit in every regard. It obviously covers everything the Silver Account does and it adds a course on MT4 (potentially VERY useful), as well as improved Max Lots and access to Trading Central.

The free withdrawal is the cherry on top of the Gold Account cake.

The Platinum Account is at the very top of the Stratton Markets account-tier ladder. It covers all the perks and it offers the best trading conditions. Its spreads are the best of all account types.

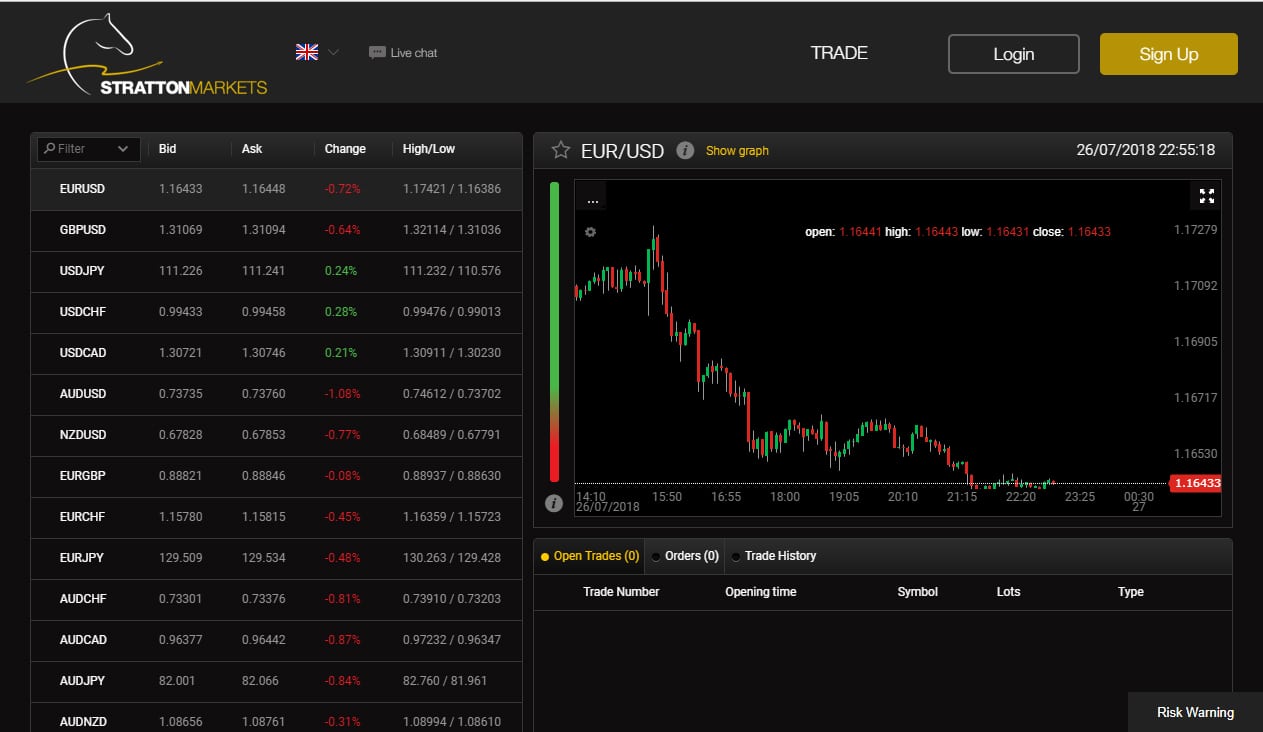

Stratton Markets Trading Platforms

As said above, the broker features two trading platforms. Its proprietary web trader, called downright “weird” by some reviewers, is the one featured in screenshots at the website. Despite its simplicity, it does feature a decent charting package, as well as a handful of technical indicators, not to mention drawing tools.

Despite its functionality and utility, the web trader in and of itself does not create the impression of a serious brokerage.

This is where MT4 comes into the picture. Though it is unclear where one can download the platform at the broker’s website, there is no doubt about the fact that MT4 is the gold standard in online trading. It has everything a serious trader could possible require: charting, analysis, order types, on chart, one-click trading and much more.

Normally, MT4 comes with about 50 technical indicators pre-installed. Of course, traders can install more and they can even code their own indicators and custom scripts, through the advanced developers’ environment featured by the platform.

Supported Deposit/Withdrawal Methods

Three currencies are supported by the broker: USD, CHF, EUR and GBP. The accepted methods for deposits are the standard ones: Credit/Debit cards (of which scores of different types are accepted), wire transfers and eWallets, such as Neteller and Skrill. The broker’s site features a comprehensive table regarding the minimums and maximums allowed for each of the above said deposit methods.

As far as withdrawals are concerned, the same methods are accepted. Those who deposited via Skrill for instance though, can only make their withdrawal via the very same method.

Stratton Markets Support

Support can be contacted via a handy live chat feature, as well as through phone, email and an email form available at the Contact Us page of the broker.

The Bottom Line

Strattonmarkets.com looks like an up-and-coming broker that failed to get everything right from the get-go and which is now busy making amends and sorting out its act. It is regulated and it now has MT4 added to its trading platform lineup, with a new website allegedly on the way too.

Read more broker reviews

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk