Financial markets are anything but stable these days. Volatility has slowly raised it head, if only to get a sniff of air before descending to the depths once again. Political risk has escalated, as discordant tweets and tariff threats sweep the airways, and our new “low and slow” growth posture offers little hope of a major upside move in anything. As a result, the “R” word has re-entered the daily lexicon, if only for the fact that article authors, who have seldom felt a need to express an opinion on the topic, are doing so.

Yes, Recession is either right around the corner, at our doorstep, or more than a decade away, depending upon which news snippet title piqued your interest. Uncertainty reigns, a good thing if you are a forecaster that avoids accountability, but a distraction if you are really trying to discern the future. One thing is for sure, the Fed met on Wednesday. Jerome Powell attended his first FOMC meeting as Fed Chairman, and it appears that he will not rock the boat, but follow pre-established dogma.

If you had believed the current storyline, then you would have assumed that the market had already baked in three rate hikes for 2018, as this merry band of bankers carried out its plan of interest rate normalization and continued to unwind its bloated balance sheet. Its “Dot Plot” of future benchmark rates also stimulated discussion, if only to question when inflation and a recession might enter the picture. As always, monetary policy changes by any central bank will trigger fluctuations in our foreign exchange markets. It is at that point that you can determine if the market had truly “baked in rate changes” or if a few major investors had somehow been asleep at the Interbank wheel.

Read all forex news

What is the Fed thinking and will anything really change under a new chairman?

Position statements for the past few weeks have followed the well-trodden path of widely varying opinions about what Fed actions may transpire, what the impacts will be, and how long-term scenarios might play out. The novel twist this time around was the appearance on the scene of a new face, Jerome Powell, someone with Trump’s apparent seal of approval. Speculation may now favor a smooth transition, but analysts, as they have always done, are gearing up for a complete dissection of the meeting minutes that will be published a few weeks from now. New opinions will evolve.

As for expectations, the preliminary consensus followed: “At the meeting this week of the Federal Open Markets Committee, the first with Jerome Powell as chairman, the Federal Reserve is likely to raise interest rates by 25 basis points, renew its commitment to two more hikes of similar size in 2018, and reaffirm the plan to gradually reduce the size of its balance sheet. These actions will constitute another step forward in the “beautiful normalization” of monetary policy.” It was spot on.

Is Recession really nearby, as many pundits claim, or is it way down the road?

We have consistently updated our readers with the latest forecasts from only the most reliable recession models. The numbers continue to present smooth sailing for at least four more quarters or more, The “Doom-and-Gloomers” may take issue with these facts, but the sane ones among us are not screaming to exit stage left. It is only when the news cycle hits this end-of-month and end-of-quarter phase that negative posturing seems to gain traction in the investor community.

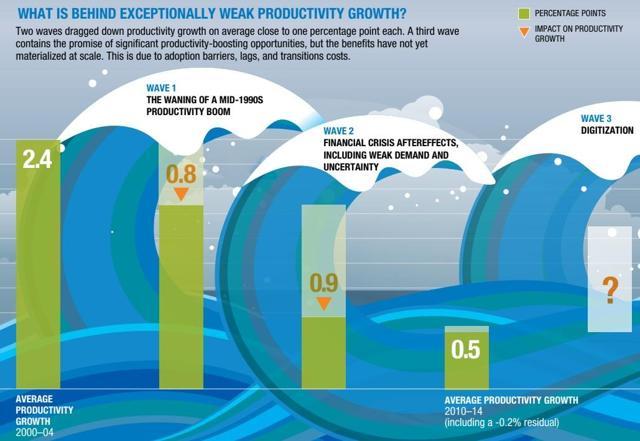

Perhaps, the slow-growth scenario is wearing on peoples’ nerves. If you get behind the numbers, however, fear is at every turn, especially with productivity lagging, as it has:

There have been two major pullbacks in the global economy during the past two decades, but productivity gains, or the lack thereof, over this period have got economists the world over concerned. Debt is piling up, reaching a peak by any measure, but productivity gains could help a great deal. Per one analyst: “In order for productivity to increase, corporations need to reinvest in their companies. Capex needs to increase, and in particular, investments in technology need to be made at a faster pace. This is, unfortunately, not happening. Without investment into improved production technology, productivity doesn’t increase, neither do wages, and growth slows to a crawl.”

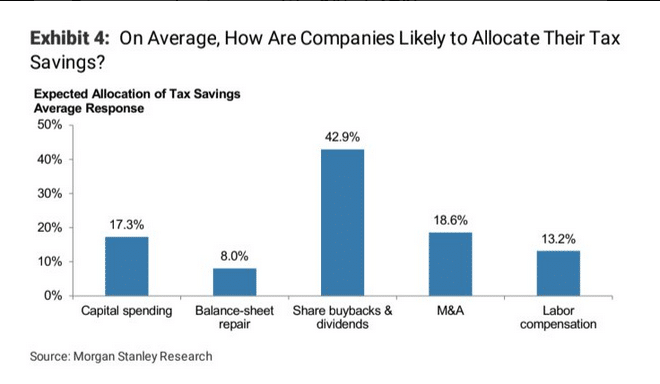

The hopeful types look to “Digitization” as the next positive wave, but, without the necessary investment in technology from the corporate sector, this wave may just be a ripple. The major selling point for recent tax cuts that benefited corporations was that these funds would spur a round of investment like the world has never seen. If previous attempts in this genre hold true and current survey responses are to be believed, then the following graphic supports the “ripple” theory.

As we have stated on several occasions, return on investment is the primary issue in developed economies, the reason why so much corporate capital has gone overseas, despite the risks involved. At the end of the day, the rates of return are considerably higher, well beyond what can be expected in either Europe or North America. The group that is concerned about the lack of investment/productivity gains believes that recession is not that far down the road for the following reasons:

- “Pie in the sky ideas about perpetual economic growth, in the face of questionable tax and budget policy, is naive at best.

- While the “slow growth forever” global economy is real news, a lack of appropriate expectations and policy still create volatility.

- When people talk about the next recession being decades away, then I know that we are in the irrational exuberance mania stage.”

One could make an argument that the reason there have been so many articles about the possibility of a near-term recession is that many reacted to a piece by an investment advisory group named Dividend Sensei, entitled, “The Next Recession Could Be Decades Away.” The article was well constructed, with supportable logic at every turn, but many who read it felt compelled to express a different interpretation. The basis for such an optimistic view of the next ten years followed these lines:

- “Since the financial crisis Americans have lived in fear of an imminent recession.

- Despite strong fundamentals and rising consumer, small business, and corporate confidence, many still expect the economy to fall off a cliff relatively soon.

- While economic growth continues to be weak by historical standards and expectations are falling for short-term growth, the economy remains on track to deliver where it counts.

- In fact, a slow but steady pace of gradual economic growth, coupled with an ever-stronger labor market, could keep a lid on both inflation, and long-term interest rates.

- When combined with an eventual gradual rise in wages and increased investment into productivity boosting technology, this congruence could result in a decades long economic expansion like seen in Australia.”

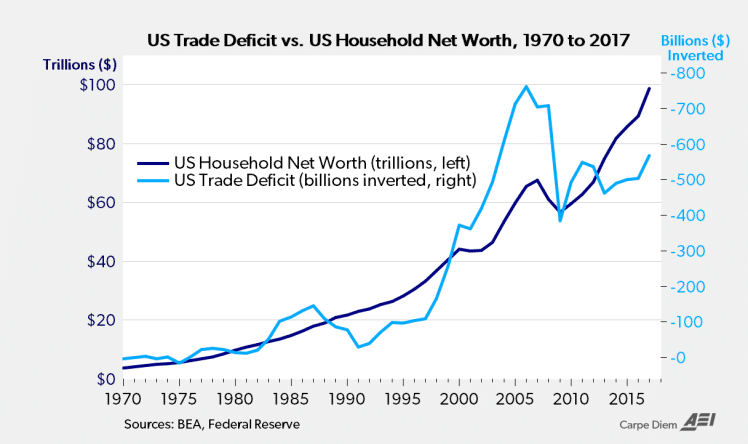

At least there is one optimist in the group. Yes, several things have to fall in place for this forecast to become reality, but the reasons given for a near-term recession, according to this author, have been overblown. His Bottom Line: “Slow And Steady Is What America’s Economy Needs To Avoid A Recession And Keep Expanding For Decades.” Why are others not convinced? The following chart is just one example that some type of “correction” is inevitable in the short term. Household Net Worth is due for a fall:

The chart above is just one more example where it is highly probable that, based on previous market activity, two lines must regress to a predictable mean. Current conditions, however, are anything but normal. Central banking policies have distorted reality for a decade, thereby distorting any attempt to extend existing curves to any expectations of your choosing. It is still interesting to engage in this activity, if only for the fun of it. In this case, either U.S. Household Net Worth comes down or the Deficit rockets upward. Figure out when for both, and you, too, can be a forecasting expert.

How have forex markets reacted to the latest wave of uncertainty and volatility?

Forex volatility has risen in tandem with equity markets, but the major currencies continue to obey tight boundary conditions. Yes, the Dollar has weakened over time I line with current scenario planning, but the gains have not been across the board. As one analyst conceded: “The renewed sell-off in equities is the most important market development. The S&P 500 was sold in eight of the past ten sessions for a two-week drop of more than 7%. The threat of a trade war did not spark the decline, but it appeared to provide extra fuel.” Look for more, not less, forex volatility.

The Yen and Pound Sterling appear primed to strengthen against the greenback in the weeks to come. The Euro, on the other had, has been range-bound between $1.21 and $1.25 for the first quarter of 2018. Since early January of 2017, however, the Euro had advanced from a low of 1.0340 to peak at $1.2550 in mid-February. The debate is ongoing as to what will happen next. When uncertainty is the tune, the Euro seems always to dance higher.

Concluding Remarks

The Fed has met again. A new chairman is on board, and nothing much has changed, at least for now. As markets adjust, you can expect a plethora of articles, each searching for the hidden meanings behind the Fed’s latest actions, as if some new secret plan is about to be hatched. Everyone likes a conspiracy theory, but the dust will settle. Recessionary fears will gain more traction, but volatility may once again lapse into a lower frequency. Slow growth can be boring, but it can also be steady and dependable. Quarter-end and a 4-day holiday in London should also make for interesting trading ahead.

How will financial and forex markets react to this so-called new news? In the absence of a “Big Rock” being thrown into the pool, markets could be subdued, but when President Trump just suggested more tariffs on China, markets took an expected plunge. The talk of trade wars and Chinese retaliation will dominate headlines this week. The existing scenario that includes more weakness in the U.S. Dollar will be re-examined, which may also suggest that the Euro could be a major benefactor. In times like these, it has never been wise to bet against the Euro. The potential for shorting the common currency may come and go with the spring showers, unless the ECB decides to rock its own boat.

Stay tuned! Stay cautious!

Are you ready to trade?

Sign up with 51% of eToro CFD traders lose

51% of eToro CFD traders lose

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk