“A Forex Broker Worthy of Your Trust” is the main slogan of ATFX, an online Forex and CFD brokerage, which at first glance ticks all the right boxes: it is regulated, it is part of a large and well known group of financial companies, and it uses the MT4 Platform… Let’s take a closer look at all that though, and also at how its trading conditions shape up.

According to the About Us page of the operator, ATFX was launched back in 2014, by ATFX Global Markets (CY) Ltd., which used to be known as Positiva Markets (CY) Ltd. According to the said page, the decision to launch this retail-oriented trading destination was made after the company had already achieved success at an institutional level.

ATFXGM.eu is the property of the above mentioned ATFX Global Markets (CY) Ltd. The company is registered in Cyprus, under #HE 340674 and it is based at Silver House, 19 Spyrou Kyprianou Avenue, Ground Floor, 3070 Limassol, Cyprus.

ATFX offers its services worldwide, with the exception of a handful of countries specified in the footer of the official website. This brief list includes the US, Canada, Japan and Mexico.

Regulated by CySEC, under number 285/15, ATFX is fully MiFID-compliant. It has been authorised to offer financial services in the EEA, by the UK’s FCA (Financial Conduct Authority). The reference number in this regard is 750501.

According to its official website, ATFX is in fact registered and approved in all EEA countries.

Now that we know who and what we’re dealing with, it is time to take a look at:

What exactly does ATFX offer products-wise?

Having proclaimed itself a Forex broker and CFD brokerage, ATFX features a fairly standard product selection for this industry. The company offers over 200 financial instruments to trade with, including a range of forex pairs, and CFDs in indices, commodities, cryptocurrencies, and shares.

As far as the Spot Forex offer is concerned, ATFX boasts great order execution, attractive leverage, and a superb client portal for account management – among other things. Some reviewers say their spreads are not quite tight enough, and it’s true that spreads seem to be above average, compared to competitors. There are also allegations that the site does not offer a choice of trading platforms, but we found that simply does not hold water.

There are no commissions on Forex. The only fees charged are on the spreads, which explains why the spreads are somewhat above average – under such circumstances, they more or less have to be…

There’s flexible, non-stop long/short trading, which in Forex terms translates to 24/5. Top-notch execution is assured by STP (Straight Through Processing). The asset list includes 43 currency pairs, among them majors (like the most popular EUR/USD), minors like AUD/CAD, and exotics, such as the EUR/HUF.

The precious metals section includes XAU/USD and XAG/USD. Available 23/5, metals trading offers a maximum leverage of 1:200, with deep liquidity and high volatility, for those looking to take chances in the hopes of lavish profits. The required starting investment is low, which means that this product category is accessible to all comers.

The following commodities are available:

- Gold

- Silver

- Palladium

- US WTI Oil

- UK BRENT Oil

- US Natural Gas Futures

Oil trading – like the trading involving most of the other available assets – is CFD-based, which means that traders never gain actual possession of the traded asset. They just exchange contracts based on the value of the underlying asset.

The indices section at ATFX offers access to a wide range of underlying assets, such as the SPX500, US30 and NAS100. Cryptocurrency trading is also available.

The exact trading conditions for every one of the supported indices, metals and currency pairs are made available in great detail in the trading conditions section of the ATFX website.

Advantages of Opening An Account with ATFX

- Regulated by the FCA and CySEC

- Commission-free account models

- Competitive spreads on Edge accounts

- More than 200 financial instruments

- MT4 trading available

- Free VPS (subject to account type)

- Raw Spreads On Premium accounts

- Excellent Forex Education Centre

- Multi asset trading including FX, Commodities, Indices, Stocks and Cryptocurrency

- Award winning customer support – 2019 Best Customer Service Award by ADVFN

ATFX Account Types and Trading Conditions

Although some say there’s a lack of variety in account types offered at ATFX, the brokerage supports 3 live accounts for retail customers: Standard, Edge and Premium, as well as offering a Demo account. The Demo account is useful for those looking to take a closer look at the available trading platforms and executing a few risk-free trades. The Demo works with virtual money (USD 100,000), so there’s not much point in going into details on the trading conditions it offers. Opening a Demo account is relatively fast and straightforward.

The Standard account is the operator’s “Low Market Entry” account. The spreads it features start from 0.5 pips, which is indeed above the average. The minimum required deposit for this account is just $500. Margin Call is set to 100% while the maximum available leverage is 1:400. Hedging and scalping are allowed.

For the Edge account, the minimum required deposit is $5,000. Spreads on this account start from as little as 0.5 pips, which is much more competitive. The margin call and the leverage settings are the same, as are the other perks offered: scalping, hedging, negative balance protection, and EAs.

It has to be noted that traders are required to keep at least $5,000 in their Edge accounts, to maintain their status. ATFX reserves the right to change Edge accounts to Standard in the event this minimum equity is not maintained.

The Premium account requires a deposit of $10,000 and offers a minimum spread on the benchmark EUR/USD currency pair of 0.0 pips, but there is a commission charge with this account.

For traders with experience and who meet a certain criteria the broker also offers a professional account. This account allows traders to trade on all instruments with higher leverage (of up to 400:1) as long as they meet the threshold to qualify as an elective professional, (evidence will be required when applying). More information and eligibility conditions can be found on ATFX professional account page here. Negative balance protections do not apply to professional clients, so it is possible that losses will exceed the amount on deposit.

Depositing and withdrawing funds with ATFX is an easy and secure process. Accepted payment methods include credit cards, debit cards, or wire transfer, as well as electronic payment methods such as Skrill and Neteller. Withdrawals can be made in the same ways. ATFX does not impose any minimum requiremehttps://landing.atfx.com/uk/en/professional-clients/nts on deposits or withdrawals, but some payment channels may have restrictions regarding this.

ATFX Trading Platforms

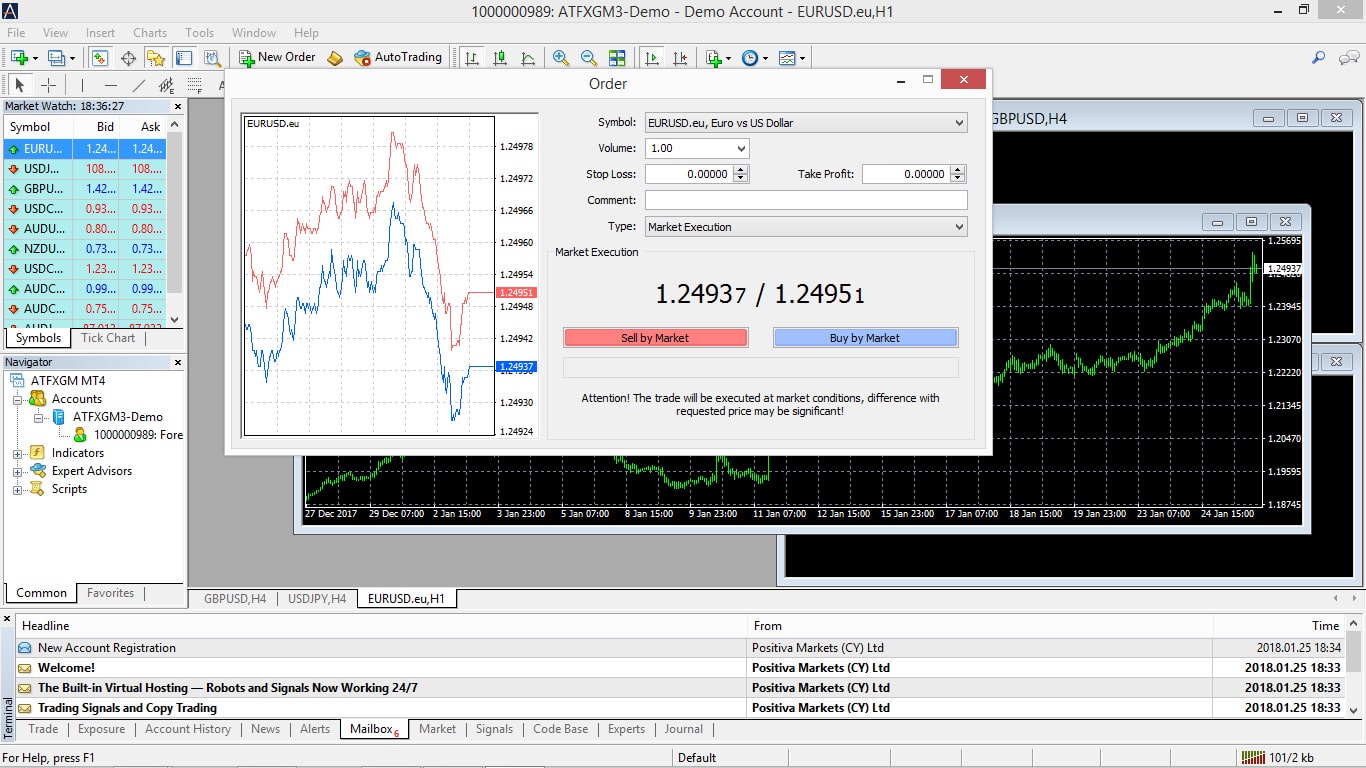

ATFX features two trading platforms: a proprietary web trader and MT4. Of these, the latter is obviously the more attractive: it delivers all the perks and features a professional trader would expect from his/her trading platform. The MT4’s charting features are excellent and it supports a wide array of time frames, charting features, drawing tools, and technical indicators. While MT4 execution is said to be extremely fast, we experienced some rather surprising delays on a few trades that we launched through a Demo account.

MT4 comes in 3 versions, covering Windows, iOS and Android compatibility. All three versions carry all the capabilities of the Windows-based platform. One-click trading, and the history of the trading operations are also included in the package.

The Web Trader is a much simpler platform, which is obviously less powerful than the downloadable MT4 in the way of charting options and trading tools. It too can be used for opening positions though, and its execution is indeed rather impressive.

Market analysis and account management features can also be used through the web interface.

ATFX Funds Protection

As said in the beginning of this ATFX review, the brokerage is fully MiFID-compliant. What this means is that customer capital is held in segregated accounts, with reputable European banking institutions. The capital adequacy requirements set forth by the MiFID framework are more than met by the broker.

As a Cyprus Investment Firm, the operator is a member of the investor compensation fund. The Financial Services Compensation Scheme (FSCS), covers eligible investments of up to £85,00 per person, per firm. The books of the operator are subjected to regular audits by the competent financial authorities and the brokerage observes strict KYC and AML policies. Retail accounts also offer negative balance protection, meaning you can never lose more than you have on deposit with the broker.

Customer Support

ATFX provides award-winning customer support, having been chosen as the broker with Best Customer Service in 2019, by ADVFN. The company provides exceptional multilingual customer service and is committed to building and maintaining client relationships by providing customers with an impressive range of services and products, online education, and prompt responses to any queries.

Learn Forex Trading with ATFX

ATFX training provide many educational resources, including daily webinars, one-to-one coaching, a dedicated forex education centre, and advanced education for Premium account holders. The ATFX educational programme ensures that clients have access to the knowledge they need to be successful with online trading.

ATFX Review Conclusion

All things considered, ATFX is a decent trading destination. Its legitimacy cannot be called into question, and its regulatory status is more than satisfactory. The trading conditions associated with its Standard account are not really attractive, but one has to bear in mind that trading is commission-free.

The trading platforms offered by ATFX are outstanding and EAs are supported. The leverage levels are reasonable as well, and customer support is excellent.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk