- Broad based US Dollar weakness has been seen since the December 2017 rate hike, with a noteworthy setback for the US$ during the late 2017 holiday season and in places also into 2018.

- The latter 2017 AUDUSD forex rate surge higher through .7730 suggested a far more bullish intermediate-term view, at least into January 2018 (and likely into February).

- NZDUSD has rallied through December above .6980 and now into January, which leaves an upside bias, minimally for early Q1 2018.

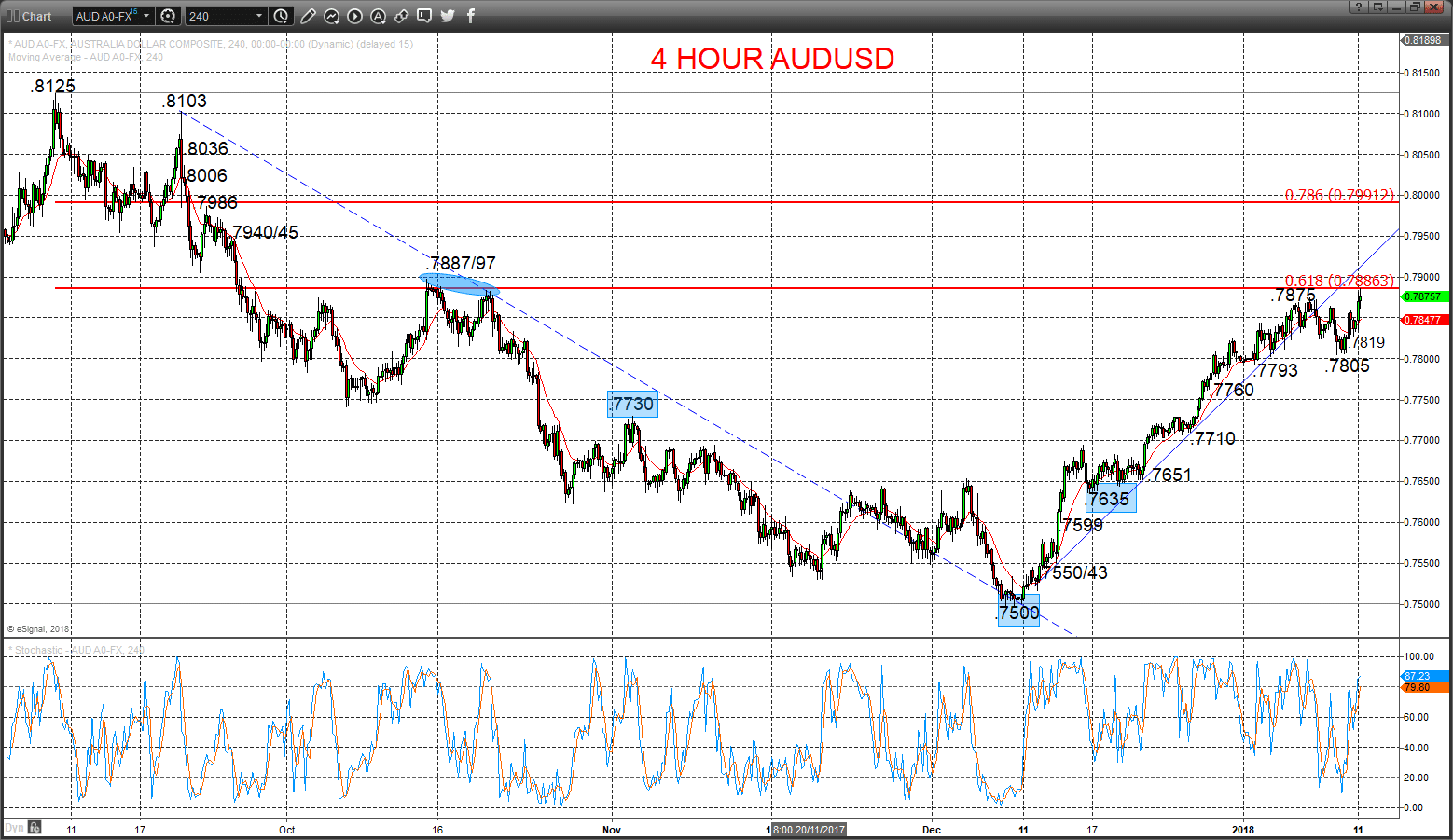

AUDUSD Recovery theme resurrects

A solid rebound Wednesday through minor .7836 resistance and already Thursday above the prior .7875 cycle peak, to dismiss the Tuesday erosion through .7824 support and resurrect the immediate bullish theme from the rebounds seen Monday and last Friday, aiming higher for Thursday/Friday.

The December break above the .7730 level shifted the intermediate-term view to bullish.

For Today:

- We see an upside bias for.7886; break here aims for 7897 and maybe .7940/45.

- But below .7819 quickly opens risk down to xxx.7805, 7893 and maybe then towards 7760.

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to the .7886/97 area.

- Above here targets .8000 and .8125.

- What Changes This? Below .7635 signals a neutral tone, only shifting bearish below .7500.

Resistance and Support:

| .7886** | .7897** | .7940/45 | .7986** | .8000/06** |

| .7819 | .7805/7793* | .7760 | .7710** | .7651* |

4 Hour AUDUSD Chart

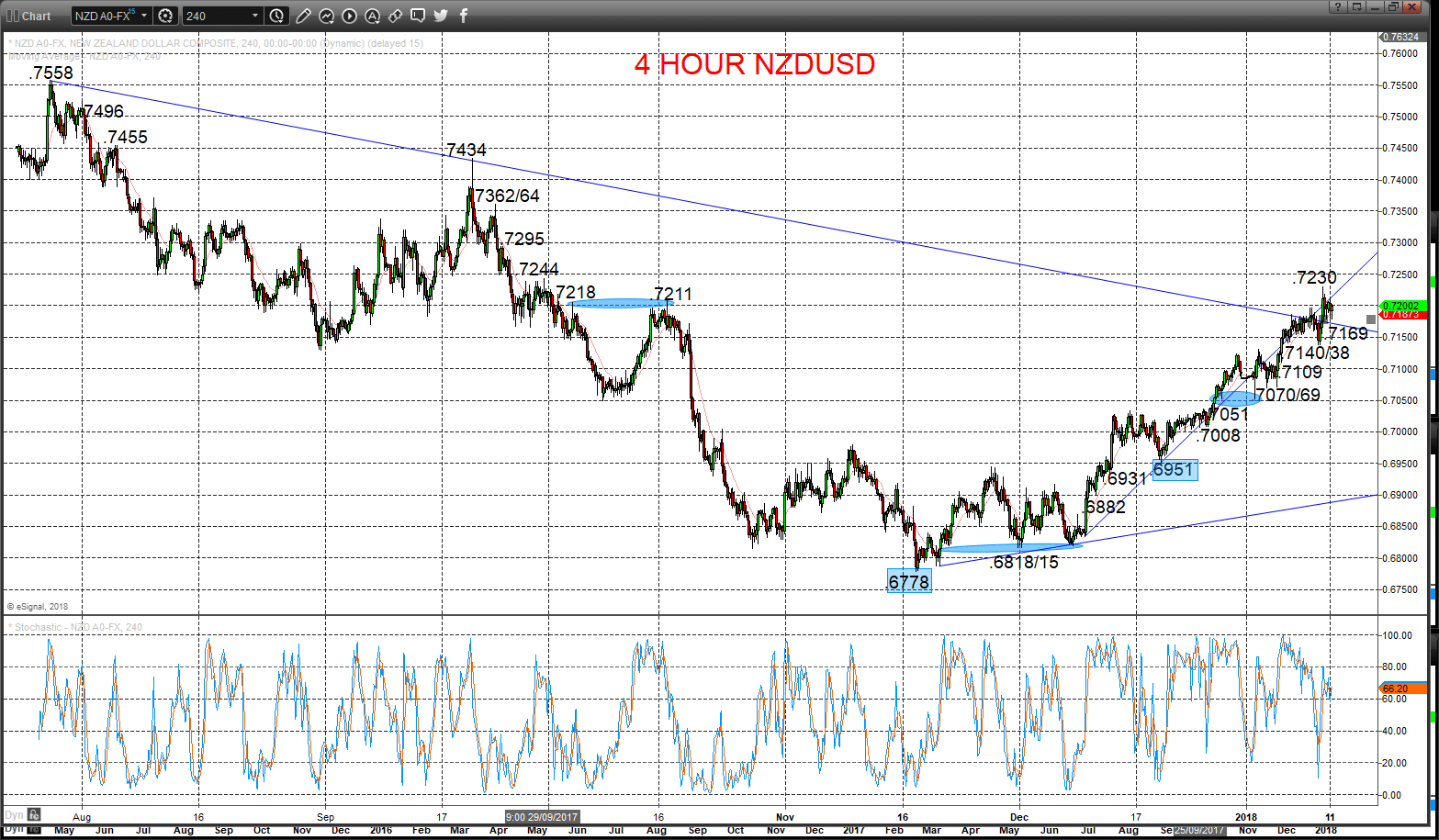

NZDUSD Bullish theme re-energizing

An initial dip lower Wednesday to prod at our .7140 support, but a rebound from just below here (off .7138) to a new recovery high for the rally from November through the .7211/18 resistance area, has quickly flipped the risks back to the upside Thursday.

The mid-December push above .6980 produced an intermediate-term shift to a bullish theme, reinforced by the extension rally into early 2018.

For Today:

- We see an upside bias for .7230 and .7244; break here aims towards .7295.

- But below .7169 opens risk down to the .7140/38 area (which we would look to try to hold).

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to the .7211/18 area.

- Above here targets .7434 and .7558.

- What Changes This? Below .6951 signals a neutral tone, quickly shifting bearish below .6778.

Resistance and Support:

| .7230 | .7244 | .7295* | .7362/64* | .7400 |

| .7169 | .7140/38* | .7109* | .7070/69 | .7051 |

4 Hour NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.