The Australian Dollar/Japanese Yen currency pair (also referred to as AUDJPY and AUD/JPY) is a frequently traded forex pair. In this article, we will examine how AUDJPY is performing.

AUDJPY Key Stats

- 2021 high: 86.25

- 2021 low: 77.89

- YTD high: 96.88

- YTD low: 87.90

- YTD % change: +10.95%

AUDJPY Forecast Summary

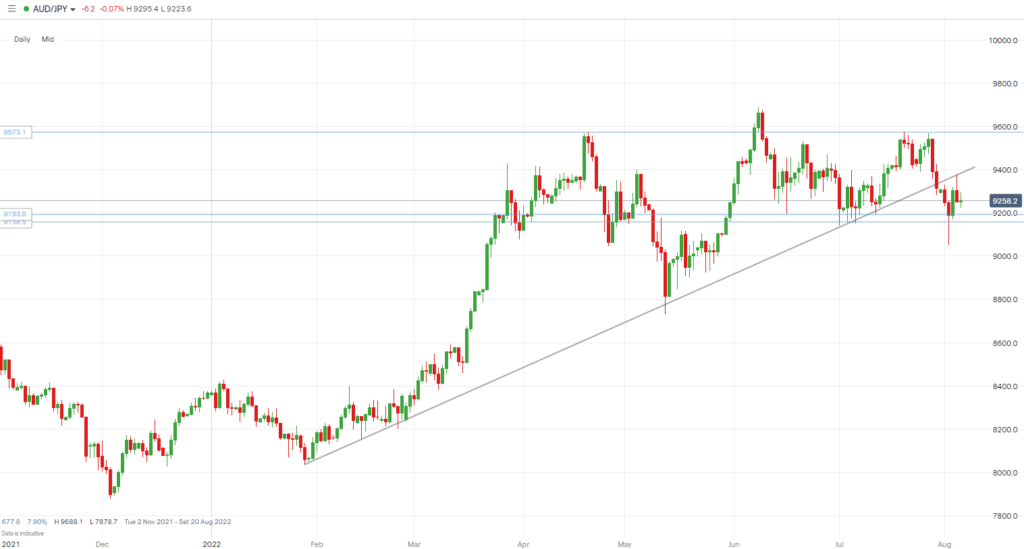

The AUD/JPY had a strong move higher in the early part of 2022, but that has somewhat stalled now. There have been a couple of attempts to move higher and a couple to the downside, with no momentum, gained either way. While in the near-term, we see a potential rise to the 95.73 level, over the long-term, our directional bias is lacking, so we will be sitting on the sidelines.

AUDJPY Fundamental Analysis

While technical analysis is an essential tool in entering, exiting and pinpointing trades, the directional bias is usually influenced by macroeconomic factors that impact broader markets and individual economies. For example, the Ukraine-Russia conflict, inflation, soaring energy prices, and more have been market drivers so far this year. In addition, interest rates, employment, inflation data, GDP and more will impact the movement of a country’s currency. Therefore, while using technicals to enter and exit the market (set stop-losses, take profits, etc.) is vital, keeping up to date with economic/geopolitical data and activity is equally important.

The Australian Dollar is a major currency and one of the most traded worldwide. Australia has a considerable amount of natural resources, including iron ore, coal, and gold which make up a significant percentage of its exports. Due to their proximity, India and, even more so, China are large importers of Australian commodities and goods. In addition, Australia imports heavy machinery and goods produced in those countries. As a result, when countries that are big importers of Australian goods encounter periods of economic instability, it impacts Australian exporters, hurting the supply chain and resulting in a weakening Australian dollar.

The JPY has been considered a safe haven and investors tend to invest in the currency during times of economic risk. Furthermore, the JPY is a valuable funding source for investments in other nations because of its low-interest rates. Therefore, financial risks may lead investors to unwind their positions in high-yield assets and boost the JPY.

However, while the above, regarding the JPY as a safe-haven asset, has been true previously, the statement hasn’t exactly proved true so far this year, with the yen falling against most other major currencies. A surging dollar and concerns about the Japanese economy, and the central bank’s lack of action to combat soaring inflation have seen the safe haven yen tumble.

Related Articles

- AUDUSD Forecast and Live Chart

- USDJPY Forecast and Live Chart

- What Are Commodity Forex Pairs?

- Forex Charts

AUDJPY Technical Analysis

The AUDJPY, after a nice run higher in the early part of the year, is now ranging somewhat between 91.73 and 9573. At the time of writing, markets are rising, but there is still a fear amongst many investors that the bear market is not over. The now broken trendline has worked as resistance, with price moving back to the area before falling. However, given the current market environment and the fact price is at the bottom of its recent range, there could be another short-term move to the upside.

Trade AUDJPY with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.