The United States Dollar/Poland Zloty currency pair (also referred to as USDPLN and USD/PLN) represents the currencies of the USA and Poland. In this article, we will examine how USDPLN is performing.

USDPN Key Stats

- 2021 high: 4.2272

- 2021 low: 3.6399

- YTD high: 4.8513

- YTD low: 3.9128

- YTD % change: +15.61%

USDPLN Forecast

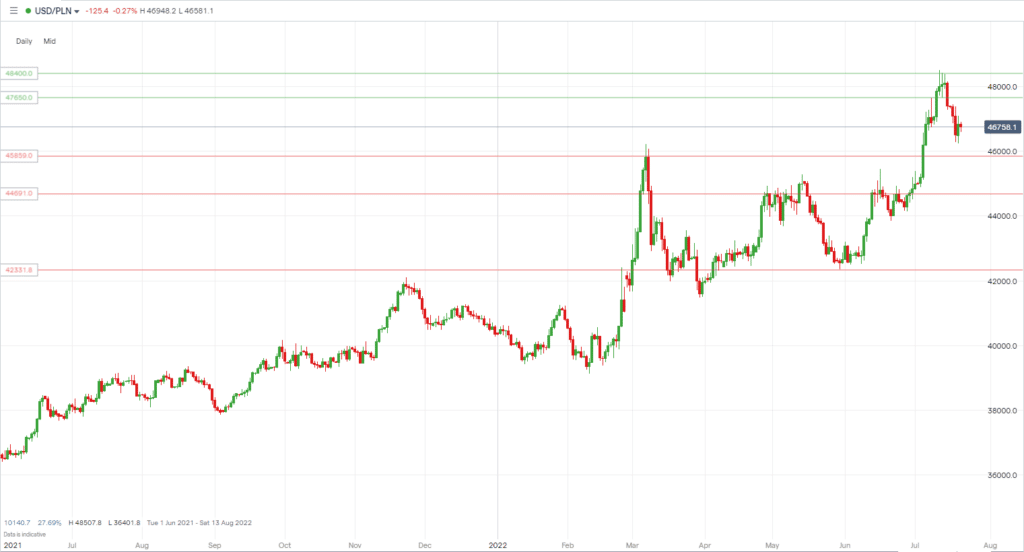

Due to the disparities between the current health of the US economy and the Polish economy, we see the USDPLN moving higher in the medium term. However, with the PLN still near its recent all-time highs, targeting an area above that is a difficult task. So, for now, we are looking for price to move back toward all-time highs, although further pullback to the 4.5859 area is a real possibility in the short term.

USDPLN Fundamental Analysis

If you are looking for long-term investments or short-term trading, understanding the fundamental factors that impact the asset is essential. Currency pairs are moved by trillions of dollars entering the market each day, but major impacts from governments and central banks will dictate the direction of currency moves. For example, actions such as increases or decreases in interest rates, quantitive easing, and economic data will significantly sway the price of each currency.

The USD is the go-to currency for most, especially during times of economic upheaval. The USA’s economy and the fact the USD is the reserve currency for international trade and finance gives it the title of “King Dollar.”

The US has several key data releases each month, including payroll data, GDP, retail sales, non-farm payrolls, and much more. The data releases and their relevance of the strength of the economy at the time they are reported will result in price swings for the currency. As of now, inflation is spiraling, and the Fed recently announced its largest rate increase in 28 years. The Fed raised interest rates by three-quarters of a percentage point. Given the global economic uncertainty and the Fed raising rates, it’s obvious why the dollar has had a major bull run.

The Polish Zloty is a less popular currency to trade. The currency has been under pressure since Russia began its invasion of Ukraine, and soaring inflation has not helped. To combat this, Poland’s central bank raised rates for the 10th consecutive month after consistent weakness in its currency. They raised rates by 50 basis points to 6.5%. However, this has dried up demand for home loans, and the economy has suffered from instability.

USDPLN Technical Analysis

Support Levels:

- 4.5859

- 4.4691

- 4.2207

Resistance Levels:

- 4.7650

- 4.8400

The USDPLN has had a significant run higher over the past year, with the USD, in general, strengthening substantially, providing many areas to look for potential pullbacks. One level we are watching is 4.5859, which price had a hard time breaking at the start of the year. However, since then, it has smashed through but now represents a potential level for buyers on a pullback. Below that, we are watching 4.4691. This area previously acted as a solid resistance level and will definitely be one to keep an eye on if price makes a large pullback. Finally, over the long-term, 4.2207 is an area price could move to and bounce from, although it may take some time to get there.

The USDPLN has been trading at significant highs but has pulled back in recent weeks. The first resistance level to look for is 4.7650, which is not far off the highs but was tested as both resistance and support in July. Next, watch out for the highs at 4.8400, which is just below its highest ever point. Therefore, it may be a little fight before price can break the level.

Trade USDPLN with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.