The Great British Pound/United States Dollar currency pair (also referred to as GBPUSD and GBP/USD) is one of the most actively traded major pairs in the world. In this article, we will examine how GBPUSD is performing.

Key Stats

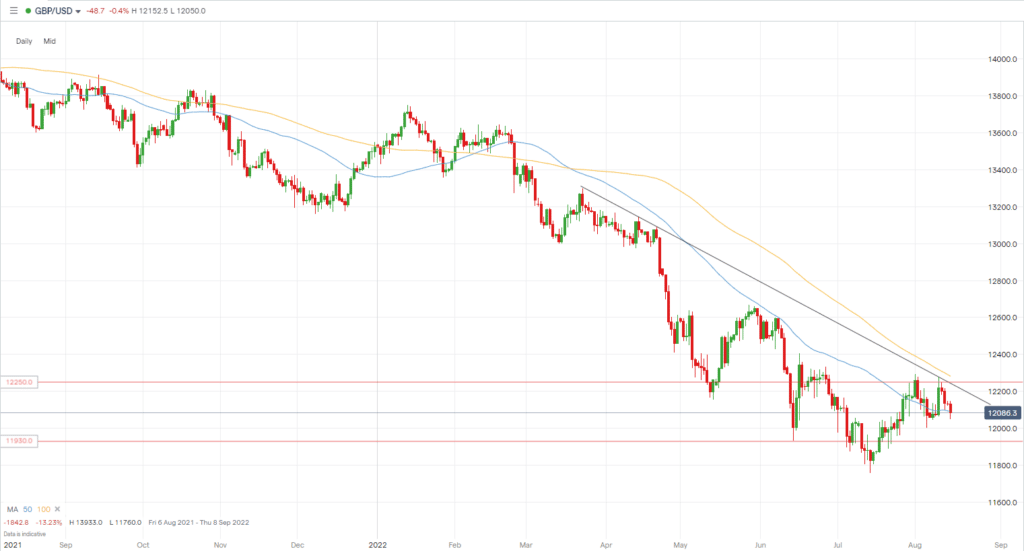

- 2021 high: 1.4250

- 2021 low: 1.3160

- YTD high: 1.3749

- YTD low: 1.1760

- YTD % change: -10.83%

GBPUSD Forecast

With the GBP at lows, it’s hard to forecast further downside for the pair. Even so, we believe lower is the best option in the medium-term. While the recent run higher in stocks may give near-term confidence to GBPUSD bulls, until the current uncertain macroeconomic climate begins to ease, our preferred direction is to the downside for the GBPUSD, targeting the 1.1930 area. However, the current market environment is uncertain, and it is essential to have a flexible view when trading the pair.

GBPUSD Fundamental Analysis

The GBP is one of the largest traded global currencies and one of the major currencies. Several factors dictate the price movements of the pound, including Brexit and, more recently, Covid-19 restrictions. Previously, Brexit and a trade deal between the UK and EU resulted in significant price moves for the GBP, depending on whether the deal and components within the agreement were viewed as positive or negative. In addition, Covid restrictions had an adverse effect on the UK economy and other economies around the world. While Covid restrictions are long gone, and a trade deal with the EU is now in place, there are still arguments between the UK and EU over one part of the deal. This has impacted the GBP. As a result, uncertainties about the UK economy and the recent flight to the safe haven of the USD have seen the GBP tumble against the dollar.

On the other hand, the USD has strengthened significantly in 2022. This is because its safe haven status has made it the go-to currency during times of economic instability. In addition, this is due to the strength of the USA’s economy and the fact the USD is the reserve currency for international trade. As a result, it has earned the title of “King Dollar.”

There are several key economic data releases each month in the US. These include payroll data, GDP, retail sales, non-farm payrolls, and much more. These releases give central bankers, the government, traders, investors, economists, and others an idea of the current health of the US economy and, as a result, can cause significant price swings in the USD, depending on their importance at the time. For example, inflation is a crucial data point to watch at the moment after surging in 2022. The US dollar’s safe haven status, global economic uncertainty, and the Fed raising rates have resulted in a major bull run for the USD.

Related Articles

- EURUSD Forecast and Live Chart

- GBPAUD Forecast and Live Chart

- What Are Forex Cross Pairs?

- Forex Charts

GBPUSD Technical Analysis

As mentioned, the GBPUSD is in a downtrend following several fundamental and macroeconomic issues impacting risk sentiment and the pound. When looking at technicals on the GBPUSD, we can plot a trendline on the daily chart that the price has so far adhered to. In addition, it is still below its 100 MA. Given the recent rally in stocks and risk assets, a potential move back to the trendline and 1.2250 is possible in the near term. However, we would expect a rejection of that level and the downtrend to continue. The most obvious target would be 1.1931.

Trade GBPUSD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.