The CADCHF currency pair represents the exchange rate between the Canadian Dollar and the Swiss Franc. It serves as a unique barometer for contrasting economic health and investor sentiment towards two very different economies. Canada is heavily reliant on commodity exports such as oil, positions the Canadian Dollar as a ‘commodity currency.’ Its value often reflects global economic growth trends and commodity prices. However, Switzerland’s reputation for financial stability and its role as a safe haven for capital make the Swiss Franc a ‘safety-geared, low yielding’ currency.

CADCHF Analysis

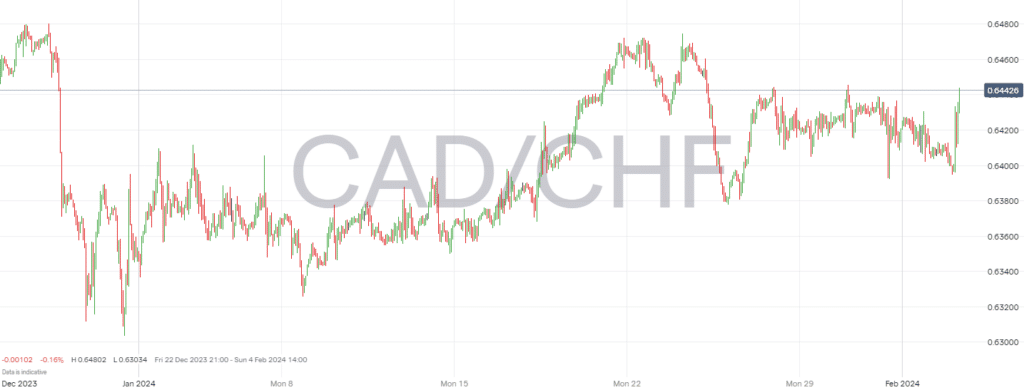

Recent analyses and market sentiment suggest a nuanced picture of the CADCHF pair. This pair is marked by its role as a carry trade vehicle. This dynamic stems from the interplay between a growth-sensitive Canadian Dollar and a risk-averse Swiss Franc. Traders and analysts keep a close eye on various indicators, including technical patterns and global economic cues, to forecast the pair’s movement.

The pair is recognized for embodying the relationship between a higher yielding, growth-linked currency (CAD) and a low yielding, safety-geared one (CHF). This relationship makes CADCHF a notable pair for carry trades. Investors borrow in a low-interest-rate currency (CHF) to fund investments in a higher-yielding one (CAD), aiming to profit from the interest differential.

However the direction of the CADCHF exchange rate can be influenced by various factors. These include changes in global economic growth projections, oil price fluctuations, and shifts in investor risk appetite. As such, the pair’s future movements will likely continue to reflect broader economic trends and policy decisions by central banks in Canada and Switzerland.

Canadian Central Bank Policy

Lets look at The Bank of Canada‘s monetary policy and it’s effects on CADCHF. Throughout 2023 and into early 2024 was characterized by a proactive stance to address inflation while supporting economic growth. In January 2023, the Bank raised its policy interest rate by 25 basis points. This shows a continued effort in quantitative tightening amidst global inflation challenges. By October 2023, the policy interest rate was kept at 5%, with the Bank continuing its quantitative tightening approach. The plan was to cool the economy enough to relieve price pressures without stopping growth.

By January 2024, the Bank of Canada upheld the overnight rate at 5%. This emphasizes the ongoing efforts to balance economic growth against inflationary pressures, which was slowly easing across most economies. Despite a global economic slowdown, the Bank projected a growth recovery in the latter half of 2024, with GDP growth forecasts at 0.8% for 2024 and an anticipation of reaching the 2% inflation target by 2025.

Swiss National Bank Policy

The Swiss National Bank (SNB) had been navigating its monetary policy amidst inflationary pressures and the global economic environment. The SNB’s strategy often revolves around the use of negative interest rates and interventions in the foreign exchange markets, including CADCHF. This prevents excessive appreciation of the Swiss Franc, which can impact inflation and economic growth. Historically the SNB has prioritized price stability while ensuring that monetary conditions support economic activity. The specific actions and outlooks for 2023 and early 2024 would likely continue to reflect these priorities. Adjustments will be made in response to changing economic conditions and inflationary trends. However, for the most current and detailed information on the SNB’s policy throughout 2023 and predictions or actions in early 2024, direct sources from the SNB or recent financial analyses would offer the latest insights.

CADCHF Comparison and Likely Behaviours

Comparatively, both central banks have focused on managing inflation while supporting economic growth. Their tools and specific approaches may differ due to their unique economic environments. The Bank of Canada’s clear pathway through rate adjustments and quantitative tightening reflects its direct approach to curbing inflation and supporting a balanced economic recovery. The SNB has its own particular challenges, including currency appreciation pressures. They normally employ a broader set of tools including negative interest rates and market interventions.

Looking into early 2024, the Bank of Canada’s policy stance suggests a careful approach to rate changes. They aim to maintain a balance between inflation management and economic growth. For the SNB, although specific early 2024 actions were not detailed here, the emphasis would likely remain on price stability and economic support. They will adjust policies as necessary to navigate the post-pandemic recovery and global economic shifts.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk