- The US, UK, and Eurozone central banks will update the markets on interest rate policies.

- US inflation and UK unemployment data due on Tuesday will set the tone for the bankers’ announcements.

- Manufacturing sentiment reports round off a busy week in terms of news flow.

All eyes will be on the officers of three major central banks this week when they update the markets on interest rate policy. The US Federal Reserve, Bank of England, and European Central Bank are all due to make their monthly announcements in the coming days. Given the recent relatively high price volatility levels, any of the statements could jolt the forex markets.

US Dollar

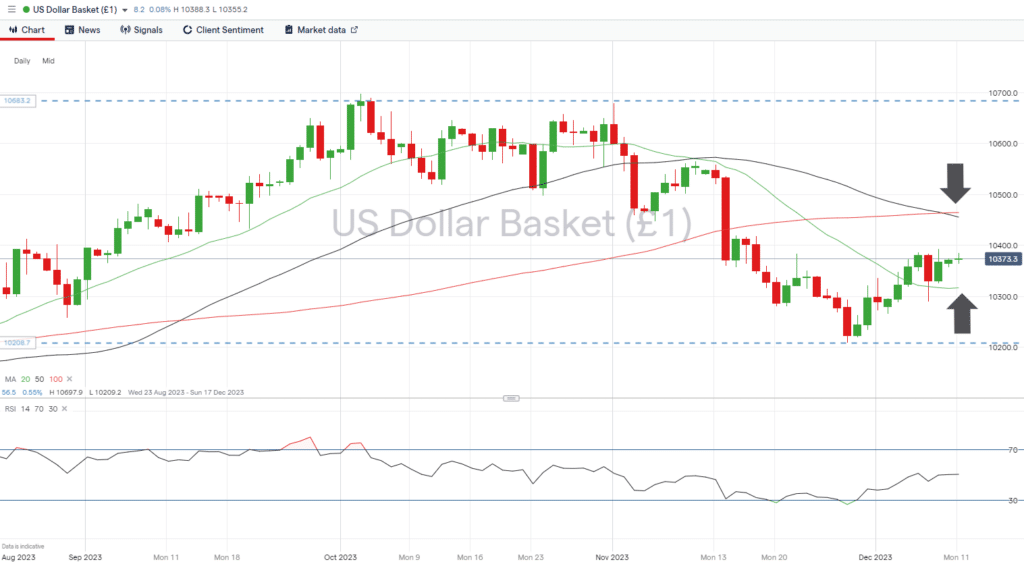

Most analysts expect the US Fed to leave rates unchanged when Jerome Powell and his team meet on Wednesday. That doesn’t mean volatility won’t pick up around the time of the announcement, with the commentary from Powell having the potential to trigger moves in the price of the US Dollar Basket Index. That index currently sits mid-range between two crucial price levels, so it has room to move before coming up against significant support and resistance. With the RSI on the Daily Price Chart currently generating a reading of 50.7, there is further confirmation that the price could post considerable upward or downward price moves before becoming overbought or oversold in that timeframe.

US Dollar Basket Index – Daily Price Chart – Mid-range and RSI at 50

Source: IG

Key number to watch: Wednesday 13th December at 7.00 pm (GMT). US Federal Open Market Committee (FOMC) rate decision: Analysts forecast rates to remain unchanged at 5.5%. Press conference and further guidance follow at 7.30 pm.

Key price levels: 102.16 – Support in the form of the 20 SMA on the Daily Price Chart, and 104.55 which marks the area where the 50 and 100 Daily SMA’s are converging.

EURUSD

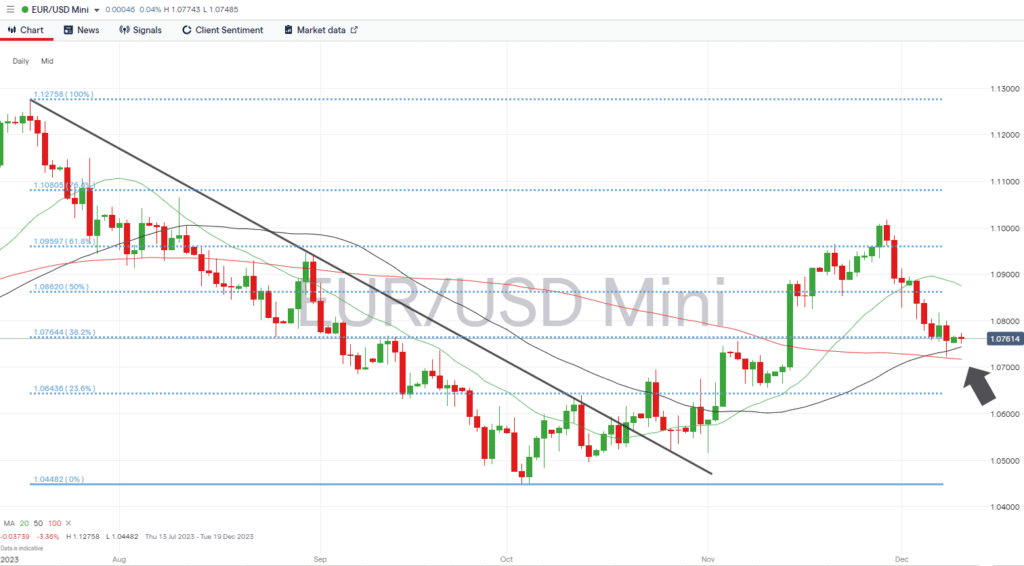

The ECB put in place a series of 10 consecutive interest rate rises between July 2022 and October 2023. While it looks set to keep rates unchanged on Thursday, some of the rhetoric out of the bank continues to be more hawkish than that of its counterparts. The German ZEW Index number is due on Tuesday, and the Germany Manufacturing PMI report is set to be released on Friday. They will offer further insights into the Eurozone’s most important economy.

Signs that the German economy could be recovering or cautionary guidance from the ECB could trigger a bounce in the value of EURUSD, which is now sitting at a key support level after last week’s slump in value. The 1.07644 price level marks the 38.2% Fibonacci retracement level of the euro price crash between July and October. Just below that sit the 50 and 100 SMAs on the Daily Price Chart which have converged in the regions of 1.07442 and 1.07175.

Daily Price Chart – EURUSD – Fib retracement and SMA support

Source: IG

Key number to watch: Wednesday 13th December 1.15 pm (GMT). European Central Bank interest rate decision. Analysts forecast the base interest rate to remain unchanged at 4.5%, but guidance from bank officers could be crucial.

Key price level: 1.07644 – support formed by the 38.2% Fib retracement.

GBPUSD

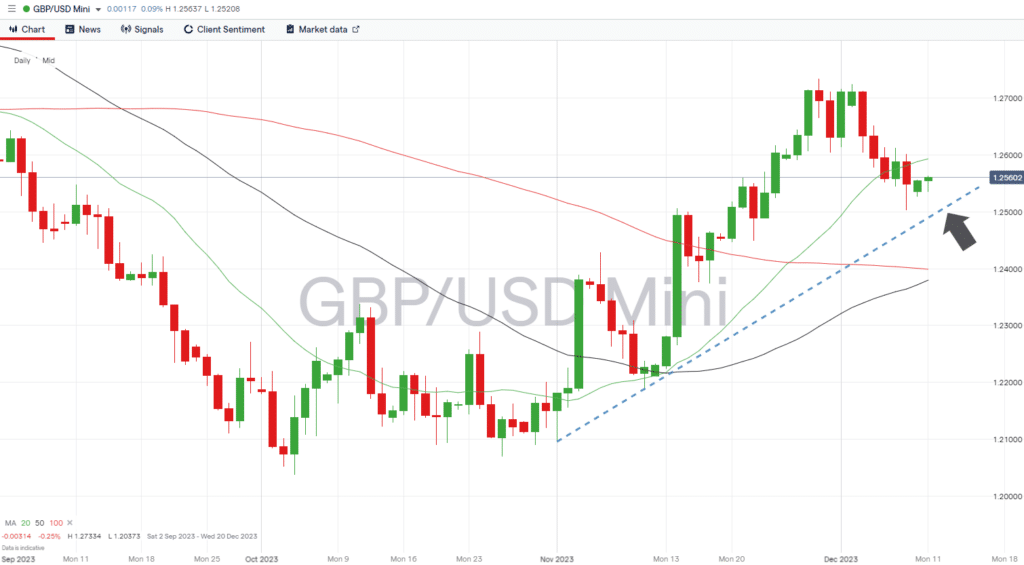

The rally in the price of sterling saw GBPUSD gain in value by more than 5.5% in October and November. That trend could be about to be tested thanks to last week’s price weakness, bringing GBPUSD close to the supporting trendline of that move.

With Bank of England governor Andrew Bailey set to announce that UK interest rates will remain unchanged at 5.25%, a break of the trendline, which sits in the region of 1.250, would open the door to further downward price moves and a test of 1.240, which is also the region of the 50 and 100 SMAs on the Daily Price Chart.

Tuesday’s unemployment report will set the tone for the bank’s announcement, which will follow on Thursday. Analysts currently forecast that both unemployment and wage levels will post a rise. Jobless numbers are expected to be 4.3%, and hourly pay rates are predicted to show an increase of 6.7% on the previous quarter. With the threat of stagflation looming over the UK economy, Governor Andrew Bailey’s decision-making looks set to be tested, and his guidance regarding the Bank’s priorities can be expected to trigger price moves in GBPUSD.

Daily Price Chart – GBPUSD – Daily Price Chart – Trendline support?

Source: IG

Key number to watch: Thursday 14th December at 12.00 pm (GMT). Bank of England interest rate decision. Analysts forecast the UK base interest rate to remain unchanged at 5.25%

Key price level: 1.2500 – Region of supporting trendline and psychologically important ’round number’ price level.

USDJPY

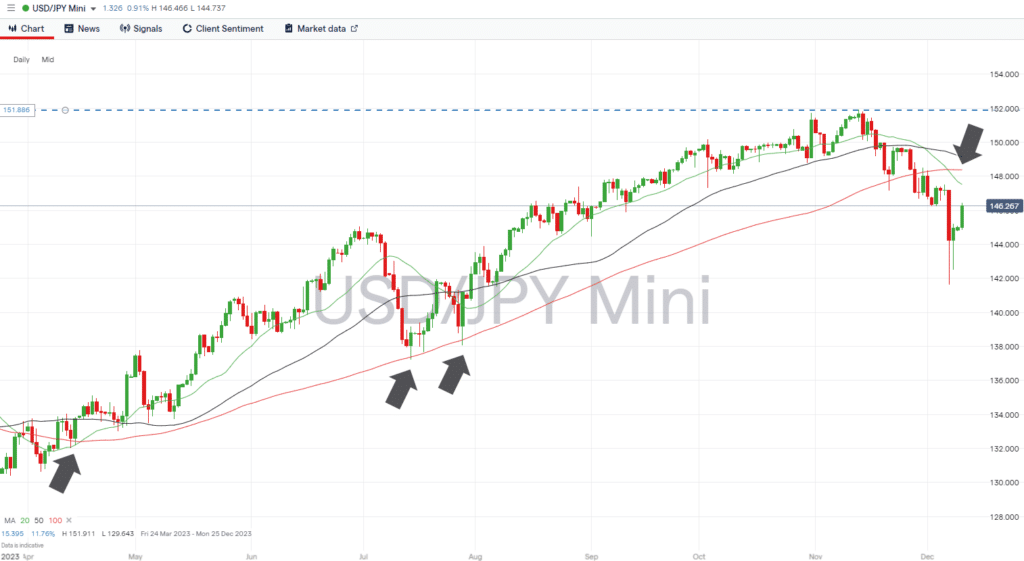

With very little Japan-specific data due out this week, price moves in USDJPY look set to be influenced by the reports due out of the US. Tuesday’s CPI inflation report isn’t the Fed’s favourite metric when considering inflationary pressures in the US economy. Still, its release just one day before the interest rate decision will ensure it influences investor thinking.

The intra-day price low of 141.62, recorded on 7th December marks a multi-month low for USDJPY. It’s been more than six months since the price of dollar-yen traded this far below the 100 SMA on the Daily Price Chart, and even though the medium-term prognosis is bearish, a short-term rally and a test of that key SMA can’t be discounted.

USDJPY – Daily Price Chart – Break of 100 SMA

Source: IG

Key number to watch: Wednesday 13th December 7.00 pm (GMT). US Federal Open Market Committee (FOMC) rate decision: Analysts forecast rates to remain unchanged at 5.5%. Press conference and further guidance will follow at 7.30 pm.

Key price level: 148.38 – Region of the 100 SMA on the Daily Price Chart.

Trade EURUSD with our top brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.