Sign up with any online broker and the chances are you will be offered access to the MT4 and MT5 trading platforms. These ever-popular dashboards allow you to research and analyse the markets, book trades, and monitor positions. Given that these dashboards are the portals traders use to access the markets, there is some benefit in understanding the differences and similarities between the two platforms. That knowledge can help you find the best fit for your trading style and help optimise returns.

Both platforms are operated by MetaQuotes Software Inc. and are provided under licence to brokers wishing to make them available to their customers. The fact that some brokers offer both platforms, and some choose to offer only one, is the first sign that there is something of a question about whether MT4 or MT5 is better. That MT4 vs MT5 debate extends to the trading community, with many investors taking a strong view on which is best. The truth is that strong opinions are entirely natural because of the different features and functionality of the MT4 and MT5 platforms. For some traders, choosing one of the platforms over another will be completely appropriate. These are the reasons why.

Trading with MT4

MT4 is the world’s most widely used retail forex trading platform. It first came to the market in 2005, and there are now estimated to be over 40m active MT4 users, with those MT4 traders accounting for approximately 32% of the global retail forex market.

The enduring appeal of MT4 is partly due to how the platform revolutionised online trading when it was first released. It offered millions of investors everything they needed to trade the financial markets, and after grabbing so much market share, many users have found little reason to move away.

The functionality and layout of the platform are so user-friendly that it sets a benchmark for other platforms that were subsequently developed, including MT5 and those of competitors. MT4 may now appear slightly dated, but how MT5 and competing platforms mimic much of the MT4 functionality highlights how much its developers got right when it was first introduced.

What is it like to trade with MT4?

The first thing you’ll notice about MT4 is the clinical aesthetics of the trading dashboard. Default settings for price charts have razor-sharp graphics, allowing those using charting techniques to annotate their monitor to identify the exact point when new trading opportunities might occur.c

To help establish if charting analysis is supported by other factors, additional indicators such as Oscillators, MACD, and Bollinger Bands can be overlaid. Incorporating these tools, which analyse historical price data to give a feeling for the market’s mood, can help establish if a particular signal can be deemed strong enough to justify entering a trade.

Despite the neat simplicity of the MT4 platform, the main trading monitor can be set to a multi-screen format so that traders can follow price moves in different markets simultaneously. Alternatively, the same instrument can be monitored over different timeframes to establish to what extent short-term price movements fit in with longer-term trends.

The list of markets to be traded is conveniently held on the left-hand sidebar. Switching from one market, such as GBPUSD to USDJPY, can be done in an instant, and additional features and tools can be brought into your trading by right-clicking on the main screen monitor. From there, you can choose to switch to one-click trading, change the screen layout, or enter limit orders.

Trade execution is done by right-clicking on the chosen price chart, with the platform having a reputation for reliability regarding orders being filled. Those orders are then displayed as active positions in the Portfolio monitor, which can be found at the base of the screen.

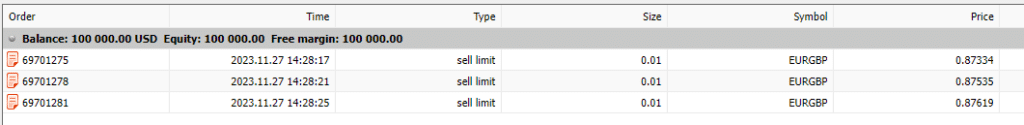

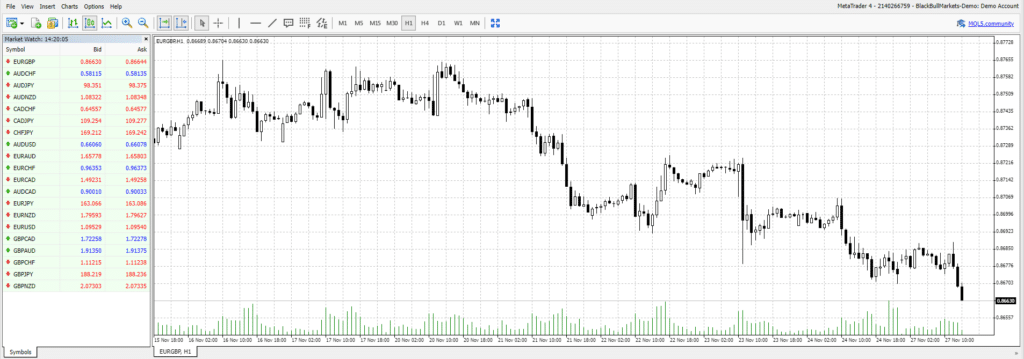

MT4 – EURGBP Price Chart

Source: BlackBull MT4 Dashboard

The best features of MT4

The fact that MT4 is extremely popular points to there being lots of features on the platform that traders like. One of the big selling points is the simplicity of the dashboard. It takes moments to set up access to the platform, and thanks to excessive user testing, the MT4 platform is so robust that MetaQuotes don’t even have to offer technical support.

The number of users is also a plus point in its own right because it has resulted in a community of MT4 traders who actively share trade ideas and crowdsource ways of getting the most out of the platform. It also means that if you’re using MT4 with one broker but want to switch to another for some other reason, maybe cheaper trading costs, then if, as is likely, that broker also supports MT4, you don’t have to learn how to use a different platform.

Trading with MT5

MT5 was introduced in 2010, leading some to mistakenly see the platform as an upgrade of MT4. There is some value in moving away from that interpretation when considering whether MT4 or MT5 is better for your style of trading. In reality, despite their many similarities both platforms set about trading different markets in different ways.

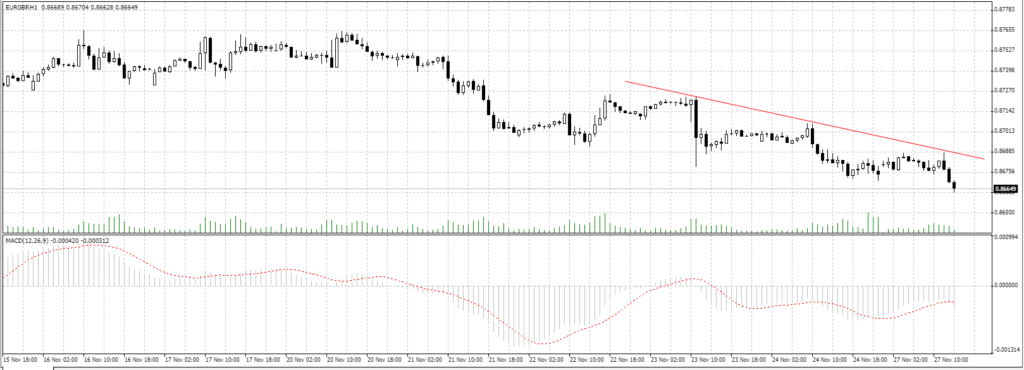

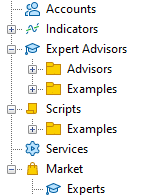

Source: MQL5

What is it like to trade with MT5?

The first noticeable difference is that the WebTrader version of MT5, for example, has a more colourful layout. It’s still possible to follow trading strategies based on charting techniques, but navigating around the dashboard reveals that MT5 has some features, such as a Depth of Market monitor, which MT4 doesn’t have and isn’t ever likely to.

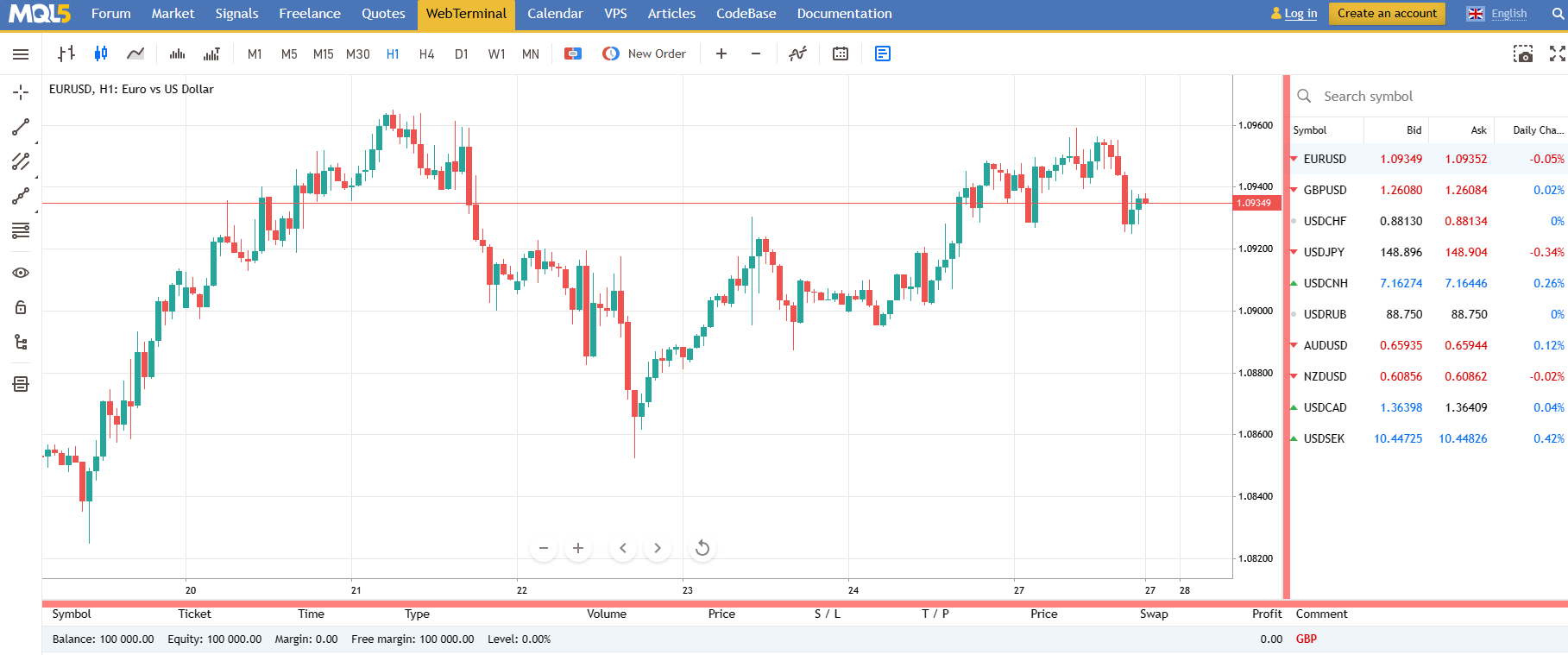

Source: BlackBull MT5 Dashboard

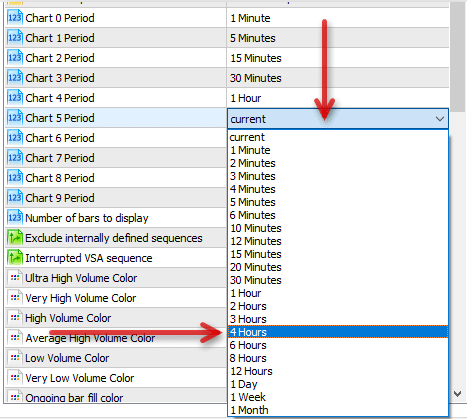

There is an extensive range of time intervals to which price charts can be set. That allows traders of short-term and long-term strategies to interrogate price data. Added to this are the 38 technical and 39 graphical indicators, which come as part of the default package, with the option to download others that members of the MQL5 community have developed.

Source: Trader Guide

Another additional feature found on MT5 is the markets in assets other than forex. It’s possible to trade using a multi-strategy approach and diversify your portfolio to include stocks, indices, commodities, futures, bonds, and options. However, it should be noted that access to those markets also depends on whether your chosen broker supports trading in them.

The best features of MT5

MT5 provides access to a greater number of markets and asset groups. It also supports traders from a more comprehensive number of jurisdictions thanks to its protocols being compliant with regulations set out by US authorities. Part of the reason for MT5 being brought into the market in the first place was to solve the issue of US citizens requiring a platform which operates on a FIFO (first in, first out) method of booking trades.

Another feature of MT5 that will appeal to some traders is the functionality of the MQL5 programming language, which is used by those looking to create their own trading algorithms. The consensus among the trading community is that MQL5, in many ways, has the edge over MQL4, the coding language used on MT4. Most importantly, MQL5 is more efficient, which means trades booked by models which use it can be executed up to 20 times faster.

What are the differences between MT4 and MT5?

The fact that MT5 came to the market several years after MT4 means it has been designed and constructed in a way which allows it to offer a range of additional features. In some instances, the improved functionality might not be significant; in others, such as being available to US traders, it can be a deal-breaker.

MT4 | MT5 | |

US Clients | No | Yes |

Programming Language | MQL4 - simpler, | MQL5 - faster and compatible |

Multiple Backtesting | No | Yes |

FIX API Access | Yes | No |

Hedging | Yes | No |

Technical Support | No | Yes |

Trading Community | Larger | Smaller |

Trading Time Frames | Fewer | More |

Reliability | Higher | Lower |

Depth of Market Monitor | No | Yes |

Economic Calendar | No | Yes |

Markets | Forex, CFDs | Forex, Futures, Stocks, |

Technical Indicators | 30 | 38 |

Graphical Objects | Fewer | More |

Pending Order Types | Fewer | More |

Order Fill Policy | Fill or Reject | Fill or Reject, Immediate |

Partial Order Fill Policy | No | Yes |

Email System | No Attachments | Allows Attachments |

Fund Transfer | No | Yes |

Netting | No | Yes |

Exchange Trading | No | Yes |

The above graphic highlights how MT5 has an edge over MT4 in many areas, the paradox being that MT4 is still much more widely used. That partly comes down to some of the differences being marginal and some irrelevant to particular traders. It is also worth factoring in the ‘feel’ of the platforms. Trying both platforms out using a Demo account offers a hands-on way to establish if the extra features of MT5 suit your trading style or if opting for the simplicity of MT4 will be more beneficial.

Which is better for Forex Trading?

Millions of traders actively use both MT4 and MT5 to gain access to the forex markets. The proof that each works effectively was provided many years ago, which means deciding which might be best for you will primarily be determined by your personal circumstances.

The intuitive and more straightforward functionality of MT4 makes it ideal for beginner forex traders. There is everything you need and nothing that you don’t. That can help when starting out and getting used to external factors such as shock news announcements leading to extreme price moves. Keeping the act of trading as simple as possible can help you focus on strategy development, risk management, and other crucial aspects.

MT5 does offer eight more indicators than MT4 as part of the default package. But as MT4’s 30 standard indicators include the most popular types, the difference is marginal. Another way of putting that difference into context is that thanks to other traders developing their own indicators, it is possible to download up to 2,000 more to MT4.

The Best MT4 Brokers

Whether you are new to trading and looking to sign up to use MT4 or are already using the platform, conducting research into the best MT4 brokers can help you secure trading terms that help you protect your returns. Online brokers have made trading much more cost-effective, but cross-referencing to ensure you secure the lowest trading fees and can access additional services like research reports will ensure you operate in the best trading environment for your purposes.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

The Best MT5 Brokers

If the additional functionality, additional markets, or the fact that MT5 is available to US clients means that it is the best option for you, the next step is to choose a reliable broker offering the platform. Many do, so there is a benefit to be gained by checking which broker is the most trustworthy and offers the most attractive terms and conditions.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Final Thoughts

An experienced trader would probably state that the primary requirement of any trading platform is that it is reliable, robust, and easy to use. MT4 and MT5 have a proven track record of meeting those core requirements, even when markets are stressed and price volatility is high. If you’re a US trader or want to gain exposure to a broader range of asset types, then MT5 is the platform to opt for. If you’re a beginner looking to specialise in forex trading, both platforms are an option; however, the more straightforward functionality and community of other traders using the platform will likely mean MT4 is a better fit for your needs.

Related Articles:

- cTrader vs MT4: What Are the Differences?

- How to Count and Calculate Pips in MT4

- How To Use Expert Advisors in MT4

- MT5 Trading Software Review

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.